December 13, 2023

HyTerra Ltd (ASX: HYT) (HyTerra or the Company) is pleased to advise that Sproule Incorporated ("Sproule") has completed an independent prospective source assessment of the Company's 100% owned and operated Nemaha Ridge leases in Kansas. Sproule's Independent Resource Report was completed after its extensive review of geophysical, geological and wells data in the area.

Benjamin Mee, Hyterra's Executive Director, commented: "This independent assessment of both prospective hydrogen and helium resources strengthens our confidence in our portfolio as a platform to potentially support the decarbonising of several mature industrial sectors and transport in the mid-West USA, and elsewhere. We will use this resource assessment to rank our drilling targets."

Highlights:

- Hyterra delivers maiden independent Prospective Resource estimate of hydrogen and helium within 100% held Project Nemaha leases in Kansas, USA

- P50 New Hydrogen Prospective Resource is 100.2 BCF (237,543 tonnes) with a minimum (P90) of 47.1 BCF (111,738 tonnes) and a maximum (P10) of 238.4 BCF (565,390 tonnes)*

- P50 volume of Helium Prospective Resources is 0.47 BCF with a P90 volume of 0.04 BCF and a P10 volume of 1.63 BCF

- Prospective Resources anticipated to increase a leasing of acreage in the play continues

- Assessment carried out by respected global energy consulting firm, Sproule, and will assist in ranking existing drilling prospects

- Prospective Resources areas are surrounded by mature industrial production facilities and interconnected railroads and highways

PORTFOLIO

Hyterra is focused on the early discovery and development of natural hydrogen and has established a major presence in potentially one of the world's most prolific natural hydrogen in the Mid-West of the USA.

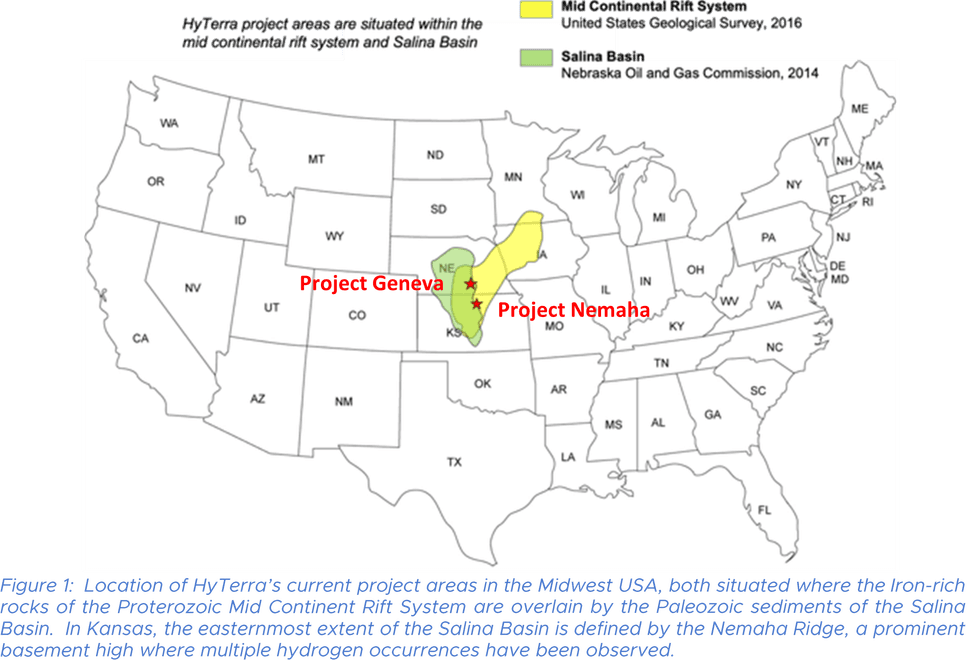

Hyterra's Project Geneva (Nebraska) and Project Nemaha (Kansas) are situated respectively on the western and eastern margins of the Mid-Continent Rift System, an iron-rich band of rocks underlying the Salina Basin widely considered to be the source of multiple historic hydrogen occurrences. In addition to a 16% working interest in the Joint Development Agreement with Natural Hydrogen Energy LLC (the Operator) for Nebraska, the Company has 100% owned and operated lease holdings at Nemaha Ridge, which now spans 9,607 net acres across Riley, Geary and Morris Counties in Kansas calibrated by a geological model and historical wells with occurrences of natural hydrogen and helium. The Company has identified multiple targets covering a diverse range of geological plays for natural hydrogen and helium exploration.

In addition to being prospective for hydrogen, the Nemaha Ridge is cored by Precambrian granites which are capable of generating helium and the elements required for a helium system are present. These are documents occurrences of helium within the play area and further along the Nemaha Ridge. These published occurrences are in the Precambrian formations penetrated in the Sue Duroche #2 well with a helium percentage of approximately 3%, and helium of approximately 0.9% reported in various tests from the Heins #1 well in Geary County1.

Click here for the full ASX Release

This article includes content from Hyterra Ltd, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

06 February

Syntholene Energy Corp. Announces $2.0 Million Non-Brokered Private Placement

Proceeds to be used to Accelerate Procurement and Component Assembly for Demonstration Facility Deployment in IcelandSyntholene Energy CORP. (TSXV: ESAF,OTC:SYNTF) (FSE: 3DD0) (OTCQB: SYNTF) (the "Company" or "Syntholene") announces that it intends to complete a non-brokered private placement of... Keep Reading...

05 February

Angkor Resources Celebrates Indigenous Community Land Titles and Advances Social Programs, Cambodia

(TheNewswire) GRANDE PRAIRIE, ALBERTA (February 5, 2026): Angkor Resources Corp. (TSXV: ANK,OTC:ANKOF) ("ANGKOR" OR "THE COMPANY") is pleased to announce that nine Indigenous community land titles have been formally granted to Indigenous communities in Ratanakiri Province, Cambodia, following a... Keep Reading...

05 February

Syntholene Energy Corp Strengthens Advisory Board with Former COO of Icelandair Jens Thordarson

Mr. Thordarson brings two decades of expertise in operations, infrastructure development, and large-scale business transformation in the aviation industrySyntholene Energy Corp. (TSXV: ESAF,OTC:SYNTF) (OTCQB: SYNTF) (FSE: 3DD0) ("Syntholene" or the "Company") announces the nomination of Jens... Keep Reading...

04 February

The Future of Aviation is Synthetic: Syntholene CEO Highlights Growing Demand for E-Fuel

The global aviation industry is entering a period of rapid transition as airlines seek low-carbon fuel alternatives that meet both performance and regulatory demands. It’s a market Syntholene Energy (TSXV:ESAF,OTCQB:SYNTF) is aiming to supply through its breakthrough synthetic fuel, or... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Equity Metals Exhibiting at the 2026 PDAC

06 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00