October 30, 2024

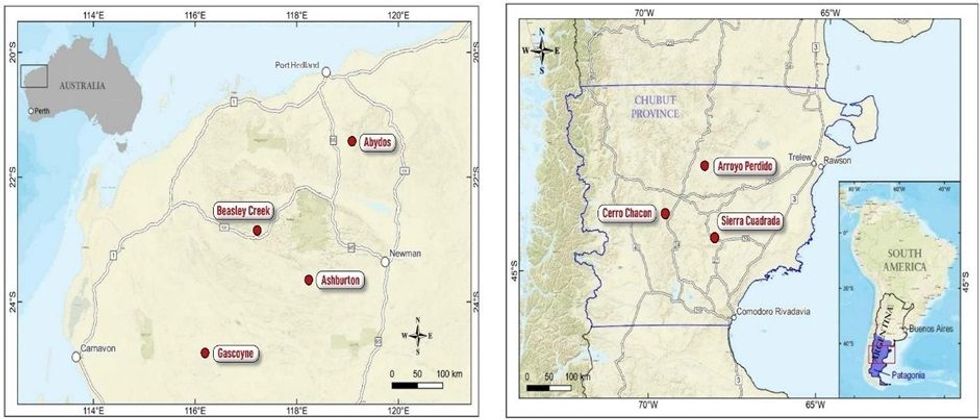

Piche Resources Limited (ASX: PR2) (“Piche” or the “Company”), holds an extensive tenement portfolio in Australia and Argentina with the focus being uranium and gold. In Western Australia, the Company has commenced drilling on its Proterozoic unconformity style uranium project, whilst in Argentina, field programmes are well underway on the Sierra Cuadrada sandstone hosted uranium project and the Cerro Chacon low sulphidation epithermal gold project (Figure 1).

Key Highlights

- Reverse Circulation drilling commenced on the Ashburton Proterozoic unconformity uranium project in Western Australia. 7 drill holes were completed in the September Quarter for a total advance of 1028m.

- Equivalent U3O8 concentrations from this phase of Ashburton reverse circulation drilling have been calculated from downhole gamma surveys, and include:

- ARC001 6.98m @ 1,617 ppm eU3O8 from 101.84 meters

- ARC002 4.36m @ 2,205 ppm eU3O8 from 109.89 meters

- ARC003 3.96m @ 1,516 ppm eU3O8 from 86.89 meters

- ARC004 6.02m @ 801 ppm eU3O8 from 83.55 meters

- ARC006 3.45m @ 5,129 ppm eU3O8 from 137.62 meters incl 0.34m @ 16,050 ppm eU3O8 from 139.11 meters

- ARC007 1.30m @ 503ppm eU3O8 from 123.37 meters

- Drilling on the Ashburton Project is ongoing with RC and Diamond drilling during the December Quarter

- Two geophysical surveys (IP and magnetics) have been completed at Cerro Chacon in Argentina and the Company is awaiting the final interpretation.

- Auger drilling at Sierra Cuadrada highlights extensive areas of near surface uranium mineralisation: the largest being 6km long and 3km wide and remains open.

- Mineralisation varies in thickness from 0.5m to 4m, with an average thickness 1.5m.

- Multiple areas are being evaluated to identifying priority areas for follow up trenching, mapping and determination.

- An additional 39 tenement applications for uranium exploration have been lodged in Argentina totalling 1785km2. Tenements are located in the provinces of Rio Negro and Chubut. Tenements are prospective for sandstone hosted uranium mineralisation and include both hard rock and in-situ recovery targets.

- The Company has established an experienced in country team with the appointment of country manager, project managers and geologists for both gold and uranium.

Australia – Uranium - Ashburton Project

A reverse circulation drilling programme commenced on the Ashburton uranium project during the September Quarter. A total of 7 drill holes were completed during the quarter for a total advance of 1028m. The reverse circulation drilling is ongoing, and a diamond drilling programme will also commence early in the December Quarter.

The September Quarter drilling programme was undertaken at, and along strike of the Angelo A prospect where no exploration activities have been carried out in the last 40 years. The drilling programme was planned to confirm the results from previous exploration by drilling several twin holes, to test a revised model for the control of the uranium mineralisation and explore for extensions to the mineralisation identified between 1973 and 1984.

Results from the first seven reverse circulation drill holes completed have been received and six of those have returned significant high grade uranium mineralisation.

Drilling is targeting Proterozoic unconformity style uranium mineralisation, similar to that seen in two of the most significant uranium jurisdictions in the world: the Pine Creek Geosyncline in Australia and the Athabasca Basin in Canada.

Drilling was preceded by a detailed heritage clearance survey.

Click here for the full ASX Release

This article includes content from Piche Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

silver investinguranium investingasx stocksasx:pr2gold explorationgold investinggold stockscopper investing

PR2:AU

Sign up to get your FREE

Piche Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

30 July 2025

Piche Resources

Targeting globally significant uranium and gold discoveries in Australia and Argentina

Targeting globally significant uranium and gold discoveries in Australia and Argentina Keep Reading...

25 February

Board Changes

Piche Resources (PR2:AU) has announced Board ChangesDownload the PDF here. Keep Reading...

29 January

Quarterly Activities/Appendix 5B Cash Flow Report

Piche Resources (PR2:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

04 December 2025

Commences Maiden RC Drilling at Cerro Chacon Gold Project

Piche Resources (PR2:AU) has announced Commences Maiden RC Drilling at Cerro Chacon Gold ProjectDownload the PDF here. Keep Reading...

06 November 2025

Reinstatement to Quotation

Piche Resources (PR2:AU) has announced Reinstatement to QuotationDownload the PDF here. Keep Reading...

06 November 2025

$2million placement to advance Argentine exploration

Piche Resources (PR2:AU) has announced $2million placement to advance Argentine explorationDownload the PDF here. Keep Reading...

06 March

Adrian Day: Gold Dips Bought Quickly, Price Run Not Over Yet

Adrian Day, president of Adrian Day Asset Management, shares his latest thoughts on what's moving the gold price, emphasizing that its bull run isn't over yet. "It's monetary factors that are driving gold — that's what's fundamentally driving gold," he said. "Monetary factors, lack of trust in... Keep Reading...

06 March

Brien Lundin: Gold, Silver Stock Run Just Starting, Get in Now

Brien Lundin, editor of Gold Newsletter and New Orleans Investment Conference host, shares his stock-picking strategy at a time when high metals prices are beginning to lift all boats. In his view, gold and silver equities may still only be in the second inning. Don't forget to follow us... Keep Reading...

06 March

Venezuela Gold Set for US Market in Brokered Deal

A new US-Venezuela gold deal could soon channel hundreds of kilograms of bullion from the South American nation into American refineries.Venezuela’s state-owned mining company, Minerven, has agreed to sell between 650 and 1,000 kilograms of gold dore bars to commodities trading house Trafigura... Keep Reading...

05 March

Rick Rule: Gold Price During War, Silver Strategy, Oil Stock Game Plan

Rick Rule, proprietor at Rule Investment Media, shares updates on his current strategy in the resource space, mentioning gold, silver, oil and agriculture. He also reminds investors to pay more attention to gold's underlying drivers than to current events.Click here to register for the Rule... Keep Reading...

05 March

Lobo Tiggre: Gold, Oil in Times of War, Plus My Shopping List Now

Lobo Tiggre of IndependentSpeculator.com shares his thoughts on how gold, silver and oil could be impacted by the developing situation in the Middle East. He cautioned investors not to chase these commodities if prices run. Don't forget to follow us @INN_Resource for real-time updates!Securities... Keep Reading...

05 March

TomaGold: New High-grade Deep Discovery at Berrigan Mine

TomaGold (TSXV:LOT) President, CEO and Director David Grondin said the company is focusing on its flagship Berrigan mine in Chibougamau, Québec, following a large, significant discovery at depth.Berrigan is 4 kilometers northwest of the city of Chibougamau and has existed for about 50 years.... Keep Reading...

Latest News

Sign up to get your FREE

Piche Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00