- NORTH AMERICA EDITIONAustraliaNorth AmericaWorld

November 01, 2024

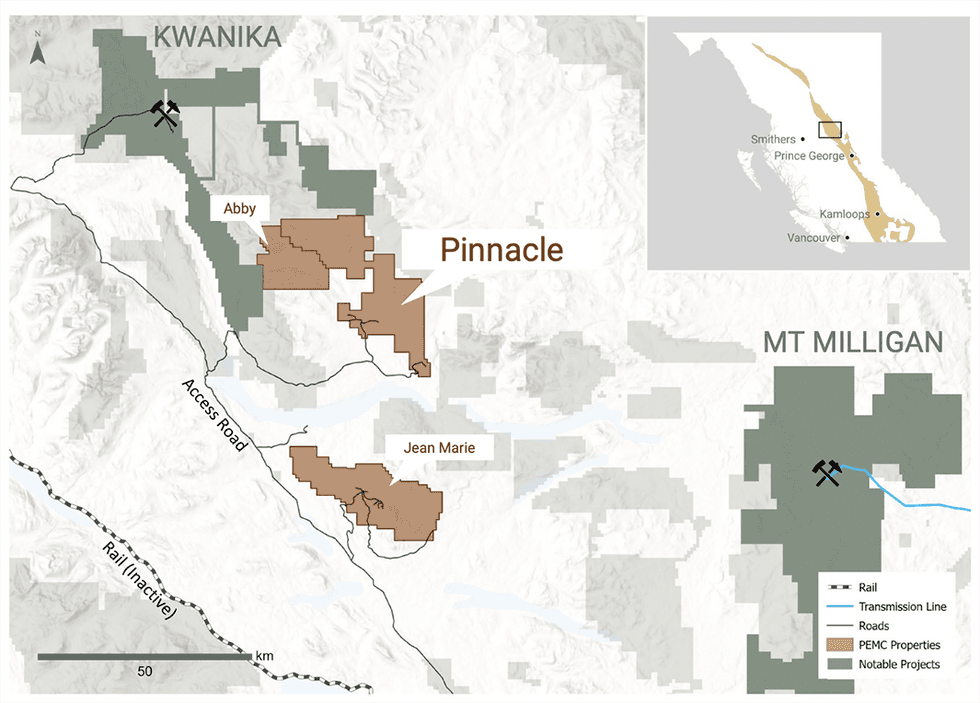

Pinnacle Silver and Gold (TSXV:PINN) stands out as a promising precious metals explorer with its strategic focus on high-potential projects in North and South America. The company presents a compelling investment opportunity in the precious metals sector as it continues to advance its existing projects and pursue new opportunities, offering investors an attractive entry point into the dynamic world of silver and gold exploration.

The company is strategically positioned to capitalize on the growing demand for these valuable resources driven by several key factors including a robust pipeline of projects at various stages of exploration and development and effective capital management practices.

El Potrero lies within 35 km of four operating mines, including the 4,000 tons-per-day (tpd) Ciénega mine by Fresnillo, Luca Mining’s 1,000 tpd Tahuehueto mine, and the 250 tpd Topia mine owned by Guanajuato Silver. The El Potrero property had undergone small-scale production from 1989 to 1990 and contains a 100 tpd plant that can be refurbished/rebuilt at relatively low cost.

Company Highlights

- Pinnacle Silver and Gold is a Canada-based exploration and development company dedicated to building long-term shareholder value with its silver- and gold-focused assets in North and South America.

- The company has built an asset portfolio entirely within mining-friendly jurisdictions with clear legal requirements and regulations that provide confidence in the future of each project.

- Both the Argosy Gold Mine and North Birch Project are located in the Red Lake District in Northwestern Ontario, a region famous for gold production.

- The company's expansion to Mexico, through a recent agreement, gives it access to the prolific and resource-rich Sierra Madre Trend and further diversifies its portfolio of high-grade assets.

- The company is led by an impressive management team with decades of experience managing mining companies that operate in the Americas.

This Pinnacle Silver and Gold profile is part of a paid investor education campaign.*

Click here to connect with Pinnacle Silver and Gold (TSXV:PINN) to receive an Investor Presentation

PINN:CC

Sign up to get your FREE

Pinnacle Silver and Gold Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

21 October

Pinnacle Silver and Gold

District-scale silver-gold exploration and development in the Americas

District-scale silver-gold exploration and development in the Americas Keep Reading...

28 October

Pinnacle Receives Positive Results from Preliminary Metallurgical Tests at El Potrero with Average of 95.09% Gold Recovery

(TheNewswire) VANCOUVER, BRITISH COLUMBIA, October 28, 2025 TheNewswire - (TSXV: PINN,OTC:NRGOF, OTC: PSGCF, Frankfurt: P9J) Pinnacle Silver and Gold Corp. (" Pinnacle " or the " Company ") is pleased to announce positive results from the preliminary scoping metallurgical tests for the... Keep Reading...

21 October

Pinnacle Strengthens Mexican Management Team

(TheNewswire) VANCOUVER, BRITISH COLUMBIA, October 21, 2025 TheNewswire - (TSXV: PINN,OTC:NRGOF, OTC: PSGCF, Frankfurt: P9J) Pinnacle Silver and Gold Corp. (" Pinnacle " or the " Company ") is pleased to announce the appointment of Carlos Castro Villalobos as Project Manager for the high-grade... Keep Reading...

24 September

Pinnacle Delineates New Vein at El Potrero as Robust Epithermal System Takes Shape

(TheNewswire) VANCOUVER, BRITISH COLUMBIA, September 24, 2025 TheNewswire - (TSXV: PINN,OTC:NRGOF, OTC: PSGCF, Frankfurt: P9J) Pinnacle Silver and Gold Corp. (" Pinnacle " or the " Company ") is pleased to announce that continuing surface mapping and sampling, in conjunction with the previously... Keep Reading...

09 September

Pinnacle Defines High-Grade Gold-Silver Mineralization in Dos de Mayo Mine at El Potrero

(TheNewswire) VANCOUVER, BRITISH COLUMBIA TheNewswire - September 09, 2025 (TSXV: PINN,OTC:NRGOF, OTC: PSGCF, Frankfurt: P9J) Pinnacle Silver and Gold Corp. (" Pinnacle " or the " Company ") is pleased to announce that systematic underground channel sampling in the historic Dos de Mayo mine at... Keep Reading...

07 August

Pinnacle Closes Oversubscribed Non-Brokered Private Placement

(TheNewswire) VANCOUVER, BRITISH COLUMBIA, August 7, 2025 TheNewswire - (TSXV: PINN,OTC:NRGOF, OTC: PSGCF, Frankfurt: P9J) Pinnacle Silver and Gold Corp. (" Pinnacle " or the " Company ") is pleased to announce that, further to Company news releases of July 14 and 25, 2025, it has closed its... Keep Reading...

07 November

Top 5 Canadian Mining Stocks This Week: Quarterback Resources Scores with 160 Percent Gain

Welcome to the Investing News Network's weekly look at the best-performing Canadian mining stocks on the TSX, TSXV and CSE, starting with a round-up of Canadian and US news impacting the resource sector.Statistics Canada released October’s job numbers on Friday (November 7). The data showed a... Keep Reading...

07 November

Goldgroup Files Updated Technical Report on Cerro Prieto Project

Goldgroup Mining Inc. ("Goldgroup" or the "Company") (TSXV:GGA)(OTCQX:GGAZF) is pleased to announce that it has filed an updated NI 43-101 technical report on the Cerro Prieto gold project located in Sonora State, Mexico. The report is entitled "Cerro Prieto Project, Heap Leach Project,... Keep Reading...

06 November

Adrian Day: Gold Far from Top, Two Triggers for Next Price Move

Adrian Day, president of Adrian Day Asset Management, shares his thoughts on gold's price pullback, saying he currently sees no evidence of a top. "It's perfectly normal in middle of a bull market to have a significant correction. This really isn't even a correction yet, let's not forget that.... Keep Reading...

06 November

Rick Rule: Gold Strategy, Oil Stocks I Own, "Sure Money" in Uranium

Rick Rule, proprietor at Rule Investment Media, recently sold 25 percent of his junior gold stocks, redeploying the funds into physical gold, as well as Franco-Nevada (TSX:FNV,NYSE:FNV), Wheaton Precious Metals (TSX:WPM,NYSE:WPM) and Agnico Eagle Mines (TSX:AEM,NYSE:AEM). In addition to those... Keep Reading...

Latest News

Sign up to get your FREE

Pinnacle Silver and Gold Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Latest Press Releases

E-Power Announces Results of Annual Meeting

07 November

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00