(TheNewswire)

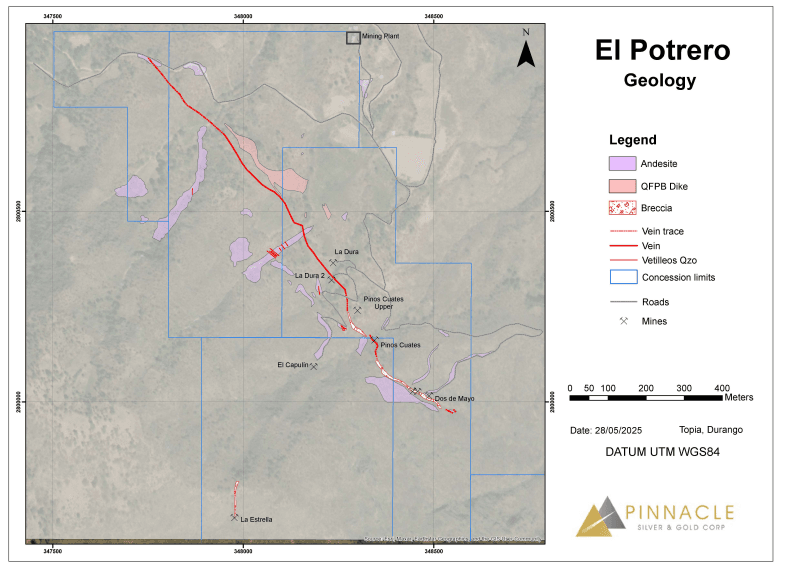

VANCOUVER, BRITISH COLUMBIA, November 12, 2025 TheNewswire - (TSXV: PINN,OTC:NRGOF, OTC: PSGCF, Frankfurt: P9J) Pinnacle Silver and Gold Corp. (" Pinnacle " or the " Company ") is pleased to provide sampling results from the historic La Dura mine at the high-grade El Potrero gold-silver project in Durango, Mexico. The identification of another zone of gold-silver extends the mineralized strike length along the Dos de Mayo vein structure to almost 500 metres, with significant gaps between the three principal mines that will have to be drill-tested ( see map below ), thereby increasing the potential. The Dos de Mayo vein has never been previously drilled.

The La Dura mine consists of a main adit that follows the vein for approximately 60 metres along strike to the northwest of the portal and two smaller adits about 10 metres above and to the southeast of the main adit. These two smaller adits, one of which is consistently mineralized, are collectively called La Dura 2. There has been less underground development at La Dura than at either of the Pinos Cuates or Dos de Mayo mines and channel sampling comprises only 146 of the 722 samples taken underground to date on the project. Of those 146 samples, 40 were taken from the two small adits. The mineralized zone identified was sampled by six composite channels along an exposed 12 metre strike length, and has an average width of 1.3 metres and average grades of 1.98 g/t Au and 98 g/t Ag, with individual grades up to 4.51 g/t Au and 269 g/t Ag over 0.5 metres. Very fine visible gold was observed in places. Given that only 12 metres of the mineralized zone is exposed, there is significant potential to expand this with additional mine development and drilling.

"The discovery of this third zone of gold-silver mineralization along the Dos de Mayo vein is further evidence of the repeatability of these zones along strike ," stated Robert Archer, Pinnacle's President & CEO. "It appears that the main La Dura adit was developed in the wrong direction at that particular elevation, as it returned only anomalous grades, and the mineralization exposed at La Dura 2 was likely discovered later as it has not been developed any further than this small exposure. As we know that there is some grade variability within the system, the 12 metre strike length and slightly lower grades than we have seen at the other mines suggests only that this exposure has just scratched the surface of this zone, and additional work will be needed to determine the ultimate extent of the mineralization. These preliminary grades at La Dura 2 are still comparable to other low-sulphidation epithermal systems in Mexico and serve to underscore the high-grade nature of the gold-silver mineralization defined to date on the project."

There is approximately 150 metres between La Dura and the Pinos Cuates mine, where Pinnacle sampling returned up to 85 g/t Au and 520 g/t Ag over 0.5 metres (see Pinnacle news release of July 22, 2025 ), that will be drill tested for additional mineralized zones. There also remains approximately 120 metres of untested strike potential between Pinos Cuates and the Dos de Mayo mine to the southwest plus more than 1,000 metres to the northwest of La Dura. All of this is being groomed for drill-testing once surface permits are in place.

Surface and underground mapping and sampling is now focused on a north-south trending vein called La Estrella, approximately 500 metres to the southwest of the Dos de Mayo trend and at least 100 metres along strike (see map above). It is presently unclear as to the reason for, or significance of, the north-south trend compared to the northwest-southeast Dos de Mayo trend. The intersection of two structural trends is often the locus of significant mineralization in these types of vein systems.

QA/QC

The technical results contained in this news release have been reported in accordance with National Instrument 43-101 Standards of Disclosure for Mineral Projects ("NI 43-101"). Pinnacle has implemented industry standard practices for sample preparation, security and analysis given the stage of the Project. This has included common industry QA/QC procedures to monitor the quality of the assay database, including inserting certified reference material samples and blank samples into sample batches on a predetermined frequency basis.

Systematic chip channel sampling was completed across exposed mineralized structures using a hammer and maul. The protocol for sample lengths established that they were not longer than two metres or shorter than 0.3 metres. The veins tend to be steeply dipping to vertical, and so these samples are reasonably close to representing the true widths of the structures. Samples were collected along the structural strike or oblique to the main structural trend. Grab samples, by their nature, are only considered as indicative of local mineralization and should not be considered as representative.

All samples were bagged in pre-numbered plastic bags; each bag had a numbered tag inside and were tied off with adhesive tape and then bulk bagged in rice bags in batches not to exceed 40 kg. They were then numbered, and batch bags were tied off with plastic ties and delivered directly to the SGS laboratory facility in Durango, Mexico for preparation and analysis. The lab is accredited to ISO/IEC 17025:2017. All Samples were delivered in person by the contract geologist who conducted the sampling under the supervision of the QP.

SGS sample preparation code G_PRP89 including weight determination, crushing, drying, splitting, and pulverizing was used following industry best practices where all samples were crushed to 75% less than 2 mm, riffle split off 250 g, pulverized split to >85% passing 75 microns (μm). All samples were analyzed for gold using code GA_FAA30V5 with a Fire Assay determination on 30g samples with an Atomic Absorption Spectography finish. An ICP-OES analysis package (Inductively Coupled Plasma - Optical Emission Spectrometry) including 33 elements and 4-acid digestion was performed (code GE_ICP40Q12) to determine Ag, Zn, Pb, Cu and other elements.

Qualified Person

Mr. Jorge Ortega, P. Geo, a Qualified Person as defined by National Instrument 43-101, and the author of the NI 43-101 Technical Report for the Potrero Project, has reviewed, verified and approved for disclosure the technical information contained in this news release.

About the Potrero Property

El Potrero is located in the prolific Sierra Madre Occidental of western Mexico and lies within 35 kilometres of four operating mines, including the 4,000 tonnes per day (tpd) Ciénega Mine (Fresnillo), the 1,000 tpd Tahuehueto Mine (Luca Mining) and the 250 tpd Topia Mine (Guanajuato Silver).

High-grade gold-silver mineralization occurs in a low sulphidation epithermal breccia vein system hosted within andesites of the Lower Volcanic Series and has three historic mines along a 500 metre strike length. The property has been in private hands for almost 40 years and has never been systematically explored by modern methods, leaving significant exploration potential.

A previously operational 100 tpd plant on site can be refurbished / rebuilt and historic underground mine workings rehabilitated at relatively low cost in order to achieve near-term production once permits are in place. The property is road accessible with a power line within three kilometres.

Pinnacle will earn an initial 50% interest immediately upon commencing production. The goal would then be to generate sufficient cash flow with which to further develop the project and increase the Company's ownership to 100% subject to a 2% NSR. If successful, this approach would be less dilutive for shareholders than relying on the equity markets to finance the growth of the Company.

About Pinnacle Silver and Gold Corp.

Pinnacle is focused on the development of precious metals projects in the Americas. The high-grade Potrero gold-silver project in Mexico's Sierra Madre Belt hosts an underexplored low-sulphidation epithermal vein system and provides the potential for near-term production . In the prolific Red Lake District of northwestern Ontario, the Company owns a 100% interest in the past-producing, high-grade Argosy Gold Mine and the adjacent North Birch Project with an eight-kilometre-long target horizon . With a seasoned, highly successful management team and quality projects, Pinnacle Silver and Gold is committed to building long -term , sustainable value for shareholders.

Signed: "Robert A. Archer"

President & CEO

For further information contact :

Email: info@pinnaclesilverandgold.com

Tel.: +1 (877) 271-5886 ext. 110

Website: www.pinnaclesilverandgold.com

Neither the TSX Venture Exchange nor the Investment Industry Regulatory Organization of Canada accepts responsibility for the adequacy or accuracy of this release .

Copyright (c) 2025 TheNewswire - All rights reserved.