Pan American Silver Corp. (NASDAQ: PAAS) (TSX: PAAS) ("Pan American", or the "Company") today announced an updated mineral resource estimate for its 100% owned La Colorada Skarn deposit in Zacatecas, Mexico . The estimated indicated mineral resource totals 95.9 million tonnes containing 94.4 million ounces of silver, 2.7 million tonnes of zinc and 1.2 million tonnes of lead. In addition, the estimated inferred mineral resource now totals 147.8 million tonnes containing 132.9 million ounces of silver, 3.4 million tonnes of zinc and 1.5 million tonnes of lead. The updated mineral resource estimate is a significant increase relative to our previous mineral resource estimate released on August 4, 2020 .

The mineral resource estimate is based on a US$45 per tonne unit cut-off value and an underground sub-level cave (SLC) mining method followed by processing through a selective flotation beneficiation plant that generates zinc and lead concentrates.

"Our exploration team has done a remarkable job of delineating a large resource with notable growth potential in only four years. Our confidence in the geology has also improved, resulting in a large portion of the deposit now being classified as indicated resources," said Christopher Emerson , Pan American's Vice President Business Development and Geology. "Notably, the high-grade intersects we announced on July 21, 2022 are not included in today's mineral resource estimate, and the deposit remains open in nearly all directions for further resource expansion."

Michael Steinmann , President and CEO, said: "The prospect of an extensive polymetallic deposit located below our largest and highest-grade silver mine is very promising, and based on its size, we believe the Skarn could provide Pan American with production for many decades."

"Our next steps to advance the project involve incorporating the most recent drill results and high-grade intersects into the resource model, and continuing the development of preliminary project engineering studies. Our aim is to release an updated Technical Report on the La Colorada property in 2023 that includes a preliminary economic assessment of the Skarn deposit," added Mr. Steinmann.

Estimated Mineral Resource

| Classification | Cut-off Value (US$/tonne) | Tonnes (millions) | Zn (%) | Pb (%) | Ag (g/t) |

| Indicated | 45 | 95.9 | 2.77 | 1.28 | 31 |

| Inferred | 45 | 147.8 | 2.29 | 1.04 | 28 |

Notes:

- Estimation and reporting of mineral resources were carried out in accordance with CIM guidelines.

- Mineral resources have reasonable prospects for eventual economic extraction demonstrating sufficient spatial continuity of mineralisation constrained within a potentially mineable shape. No mineral reserves are reported at this time.

- Prices used to report mineral resources were: US$22 per ounce of silver, US$2,800 per tonne of zinc and US$2,200 per tonne of lead.

- An estimate of mineral value per tonne was calculated using metallurgical recoveries of 87.4% Ag, 88% Pb and 93% Zn with mineral concentrate qualities of 67% Pb in lead concentrate and 60% Zn in zinc concentrate, obtained from metallurgical testing. Estimates for transport, payability and refining/selling costs, based on experience and long-term views of the marketing, treatment and refining of these types of mineral concentrates, were included.

- Reasonable prospects for eventual economic extraction were assessed by determining the total in-situ tonnes and grade constrained inside volumes that are based on a bulk style sub-level caving underground mining method. The tonnes and grades are inclusive of the must-take low grade material within the volume, as per CIM best practice guidelines. No other mining dilution or mineral losses have been accounted for. A US$45 per tonne operating cost has been assumed, which includes estimates of mining, processing and G&A operating costs.

- This mineral resource estimate was prepared under the supervision of, or was reviewed by, Christopher Emerson , FAusIMM, Vice President Business Development and Geology, and Martin G. Wafforn, P.Eng., Senior Vice President Technical Services and Process Optimization, each of whom is a Qualified Person as that term is defined in National Instrument 43-101 ("NI 43-101").

- The effective date of the mineral resources estimate is September 13, 2022 .

The La Colorada Skarn is a large underground mineral deposit, and a range of mining methods is being considered for its extraction. The mineral resource estimate provided in this news release considers using the bulk SLC method throughout the deposit. However, the table below is provided for comparison purposes only to highlight how the mineral resource estimate would change using potentially mineable shapes and cut-off value estimates specific to two alternative mining methods. Applying some combination of these mining methods to the mineral resource may prove economically and technically optimal, depending on geometric, geographic and geotechnical factors specific to different areas of the deposit.

Mineral Resource Estimate at Different Cut-off Values and Mining Methods

| Mining Method | Cut-off Value (US$/tonne) | Classification | Tonnes (millions) | Zn (%) | Pb (%) | Ag (g/t) | Zn (Mt) | Pb (Mt) | Ag (Moz) |

| Sub-level | 45 | Indicated | 95.9 | 2.77 | 1.28 | 31 | 2.66 | 1.23 | 94.4 |

| Inferred | 147.8 | 2.29 | 1.04 | 28 | 3.39 | 1.54 | 132.9 | ||

| Sub-level | 45 | Indicated | 101.5 | 2.66 | 1.22 | 30 | 2.70 | 1.24 | 96.3 |

| Inferred | 153.2 | 2.03 | 0.88 | 25 | 3.12 | 1.34 | 125.1 | ||

| 65 | Indicated | 67.3 | 3.08 | 1.46 | 33 | 2.07 | 0.98 | 72.1 | |

| Inferred | 60.8 | 2.59 | 1.13 | 30 | 1.60 | 0.68 | 59.8 | ||

| Long-hole | 60 | Indicated | 65.4 | 3.39 | 1.62 | 36 | 2.22 | 1.06 | 75.6 |

| Inferred | 113.8 | 2.91 | 1.32 | 34 | 3.31 | 1.50 | 124.6 | ||

| 70 | Indicated | 56.3 | 3.62 | 1.76 | 38 | 2.03 | 0.99 | 68.0 | |

| Inferred | 88.5 | 3.17 | 1.46 | 37 | 2.80 | 1.29 | 104.5 |

Notes:

- Prices used to report mineral resources were: US$22 per ounce of silver, US$2,800 per tonne of zinc and US$2,200 per tonne of lead.

- An estimate of mineral value per tonne was calculated using metallurgical recoveries of 87.4% Ag, 88% Pb and 93% Zn with mineral concentrate qualities of 67% Pb in lead concentrate and 60% Zn in zinc concentrate, obtained from metallurgical testing. Estimates for transport, payability and refining/selling costs, based on experience and long-term views of the marketing, treating and refining of these types of mineral concentrates, were included.

- This table has been included to reflect the sensitivity of the mineral resource to mining method, potential mineable shapes and costs rather than applying variable cut-off values within a non-selective mining shape.

- The inventories in the table are for sensitivity comparisons to the SLC mineral resource estimate stated above; they do not represent mineral resource estimates in themselves.

- All inventories are in-situ tonnes and metal contents.

Mineral Resource Highlights:

- The current mineral resource estimate is based on 190,000 metres of drilling to a drill cut-off date of April 30, 2022 . An additional 44,000 metres of drilling has been completed since the resource cut-off date. The extensions and high-grade results that were reported in our news release dated July 21, 2022 have not been included in this mineral resource estimate.

- The initial discovery of the La Colorada Skarn deposit was announced on October 23, 2018 , and a total of 234,000 metres of exploration drilling has been completed on the deposit to date.

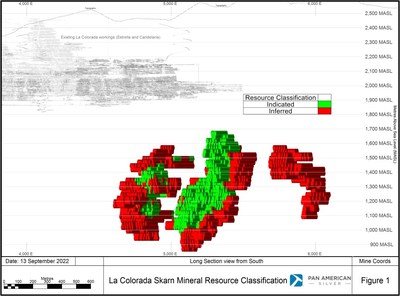

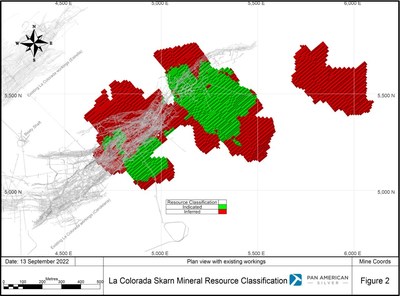

- The polymetallic skarn mineralisation is concentrated in three zones, which cover an area of 1,500 metres by 1,100 metres laterally, and a depth of between 600 metres and 1,900 metres below surface. The deposit is oriented in a north-northwest to south-southeast direction and is below the currently active Candelaria mine workings. See Figures 1 and 2 that accompany this news release.

- The geological model used for the resource estimate is based on 235 diamond drillholes with drill spacing ranging from 50 metres to 80 metres. The mineral resource classification has been based on geological criteria, estimation confidence and density of data for the indicated and inferred mineral resource categories.

- Geological interpretation, resource modeling and mineral resource estimation were carried out using Leapfrog Geo and Datamine software. The block model and mineral resource estimation methodology were validated by third party consultants. Deswik mine planning software was used to define the SLC mining shapes, in particular the "Deswik.Caving" and "Pseudoflow" functions were integral in defining the constraining shapes. Deswik.Caving utilizes PGCA (Power Geotechnical Cellular Automata) particle-based flow modelling techniques and software.

- Comminution, selective flotation (rougher, cleaners, kinetics and locked cycle tests), mineralogical analysis, sedimentation and filtration testing have shown the mineral to be amenable to conventional crushing, grinding, flotation, thickening and filtration unit processing. The projected Zn and Pb contents of the flotation concentrates that could be produced are expected to be readily marketable. Further geo-metallurgical sample collection and testing is in progress, as the deposit size continues to expand and as mining methods are being considered that affect the expected plant head grade, and therefore potentially impact metallurgical recovery and concentrate quality estimates.

- The SLC mining method was chosen to develop mining shapes that constrain the mineral resource volume. The reported mineral resource is the in-situ tonnage and metals contained within a mining shape developed at a $45 per tonne operating cost, and honours practical cavability geometry and layouts that are at a suitable level of detail for mineral resource estimation purposes. The mineral resource inventory does not have mining recovery or dilution factors applied beyond the mining shape.

- Geotechnical drilling, laboratory testing and studies have been conducted with the assistance of internal and third-party geotechnical experts to make an initial positive caveability assessment in support of the SLC mining method.

- The Qualified Persons, as identified in the "General Notes with Respect to Technical Information" section below, are satisfied that applying SLC parameters is practical and satisfies the test of reasonable prospects of eventual economic extraction. It is acknowledged that additional resource definition drilling, geotechnical studies and metallurgical testing may change the mining approach as the project progresses and further extents of the mineralisation are defined.

General Notes with Respect to Technical Information

A total of 235 diamond drillholes with a total length of 190,000 metres were used in the geological interpretation and resource estimate. Several old historic drillholes were included in the modeling. Drilling of the La Colorada Skarn deposit has been completed from both surface and underground drill platforms.

All drill hole samples used in the mineral resource have been previously reported in news releases dated October 23, 2018 , February 21, 2019 , May 8, 2019 , August 1, 2019 , October 30 , 2019, February 13, 2020 , August 4, 2020 , May 12, 2021 , November 10, 2021 , February 24, 2022 , and May 9, 2022 .

The drill hole samples were prepared by the internal La Colorada mine laboratory, SGS of Durango, Activation Laboratories Ltd ("Actlabs") of Zacatecas , Bureau Veritas of Hermosillo and ALS Global, Mexico. Pan American implements a quality assurance and quality control ("QAQC") program, including the submission of certified standards, blanks, and duplicate samples to the laboratories.

Actlabs, SGS and ALS Global all used fire assay with gravimetric finish for gold, and acid digestion with ICP finish for silver, lead, zinc, and copper. Samples delivered to ALS Global were prepared in Zacatecas, Mexico laboratory and sent to Vancouver, BC laboratory for assay. Bureau Veritas used fire assay with gravimetric finish for gold and by acid digestion with ICP finish for silver, lead, zinc, and copper in their Vancouver, Canada laboratory. The La Colorada mine laboratory, which is operated by our employees, used fire assay with gravimetric finish for gold and silver, and acid digestion with atomic absorption finish for lead, zinc, and copper.

The results of the QAQC samples submitted to SGS, Actlabs, Bureau Veritas, ALS Global and the La Colorada mine laboratory all demonstrate acceptable accuracy and precision.

The Qualified Persons are of the opinion that the sample preparation, analytical, and security procedures followed for the samples are sufficient and reliable for the purpose of mineral resource and mineral reserve estimates. Pan American is not aware of any drilling, sampling, recovery or other factors that could materially affect the accuracy or reliability of the data reported herein.

Mineral reserves and mineral resources are as defined by the Canadian Institute of Mining, Metallurgy and Petroleum ("CIM").

Pan American reports mineral resources and mineral reserves separately. Reported mineral resources do not include amounts identified as mineral reserves. Mineral resources that are not mineral reserves have no demonstrated economic viability. No mineral reserves have yet been estimated for the La Colorada Skarn deposit.

The Qualified Persons do not expect these mineral resource estimates to be materially affected by any known legal, political, environmental or other risks.

See the Company's Annual Information Form dated February 23, 2022 , available at www.sedar.com for further information concerning QAQC and data verification matters, the key assumptions, parametres and methods used by the Company to estimate mineral reserves and mineral resources, and for a detailed description of known legal, political, environmental, and other risks that could materially affect the Company's business and the potential development of the Company's mineral reserves and resources.

Technical information contained in this news release with respect to Pan American has been reviewed and approved by Christopher Emerson , FAusIMM, Vice President Business Development and Geology, and Martin Wafforn, P.Eng., Senior Vice President Technical Services and Process Optimization, each of whom is a Qualified Person for the purposes of NI 43-101.

Pan American Silver Corp. is authorized by The Association of Professional Engineers and Geoscientists of the Province of British Columbia to engage in Reserved Practice under Permit to Practice number 1001470.

About Pan American Silver

Pan American owns and operates silver and gold mines located in Mexico , Peru , Canada , Argentina and Bolivia . We also own the Escobal mine in Guatemala that is currently not operating. Pan American provides enhanced exposure to silver through a large base of silver reserves and resources, as well as major catalysts to grow silver production. We have a 28-year history of operating in Latin America , earning an industry-leading reputation for sustainability performance, operational excellence and prudent financial management. We are headquartered in Vancouver, B.C. and our shares trade on NASDAQ and the Toronto Stock Exchange under the symbol "PAAS".

Learn more at panamericansilver.com.

Cautionary Note Regarding Forward-Looking Statements and Information

Certain of the statements and information in this news release constitute "forward-looking statements" within the meaning of the United States Private Securities Litigation Reform Act of 1995 and "forward-looking information" within the meaning of applicable Canadian provincial securities laws. All statements, other than statements of historical fact, are forward-looking statements or information. Forward-looking statements or information in this news release relate to, among other things: estimates mineral resources; the expectation of the Company to complete a technical report, including preliminary economic assessment relating to the La Colorada Skarn mineral resources in 2023, and the timing and results of any such assessment; the prospects of any future production from the La Colorada Skarn deposit; the extent of, and success related to any future exploration or development programs with respect to the La Colorada Skarn; expectations with respect to future anticipated size of the La Colorada Skarn deposit; the selection of the ultimate mining method, if any, and in particular, whether the SLC mining method will be utilized or used in combination with other mining methods; expectations that legal, political, environmental, or other risks or issues will not materially affect estimates of mineral resources.

These forward-looking statements and information reflect the Company's current views with respect to future events and are necessarily based upon a number of assumptions that, while considered reasonable by the Company, are inherently subject to significant operational, business, economic and regulatory uncertainties and contingencies. These assumptions include: the accuracy of our mineral reserve and mineral resource estimates and the assumptions upon which they are based, including operating costs and mining methods; ore grades and recoveries are as anticipated; prices for lead, zinc, silver, gold, and other metals remaining as estimated; our continued ownership and rights to the La Colorada surface properties and mineral concessions; currency exchange rates remaining as estimated; capital, decommissioning and reclamation estimates; prices for energy inputs, labour, materials, supplies and services (including transportation); all necessary permits, licenses and regulatory approvals for our operations are received in a timely manner; our ability to comply with environmental, health and safety laws; and that the COVID-19 pandemic, or other pandemics, do not materially impact underlying assumptions used in estimating mineral reserves and mineral resources, such as prices, the costs and availability of necessary labour, energy, supplies, materials and services, and exchange rates, among other things. The foregoing list of assumptions is not exhaustive.

The Company cautions the reader that forward-looking statements and information involve known and unknown risks, uncertainties and other factors that may cause actual results and developments to differ materially from those expressed or implied by such forward-looking statements or information contained in this news release and the Company has made assumptions and estimates based on or related to many of these factors. Such factors include, without limitation: fluctuations in lead, zinc, silver, gold and other metal prices; fluctuations in prices for energy inputs, labour, materials, supplies and services (including transportation); fluctuations in currency markets (such as the Canadian dollar, Peruvian sol, Mexican peso, Argentine peso and Bolivian boliviano versus the U.S. dollar); operational risks and hazards inherent with the business of mining (including environmental accidents and hazards, industrial accidents, equipment breakdown, unusual or unexpected geological or structural formations, cave-ins, flooding and severe weather); employee relations; our ability to obtain all necessary permits, licenses and regulatory approvals in a timely manner; changes in laws, regulations and government practices in the jurisdictions where we operate, including environmental, export and import laws and regulations; legal restrictions relating to mining, including in Guatemala ; risks relating to expropriation; diminishing quantities or grades of mineral reserves as properties are mined; increased competition in the mining industry for equipment and qualified personnel; relationships with, and claims by, local communities and indigenous populations, including with respect to the ongoing Agrarian Court and SEDATU processes related to La Colorada (as previously disclosed in our most recent Annual Information Form), where certain individuals have asserted community rights and land ownership over a portion of the La Colorada mine's surface lands and have also initiated a process before SEDATU to declare such lands as national property. In 2019, we filed an amparo against the SEDATU process but our amparo challenge was dismissed in October 2021 , primarily on the basis that no final declaration of national lands had yet been made by SEDATU that would affect our property rights. Our appeal of the amparo resolution was recently dismissed in early September 2022 . We will continue to oppose the SEDATU process and the claims in the Agrarian Court. The Agrarian Court and SEDATU processes are not related to our mineral concessions. While we believe that we hold proper title to the surface lands in question, if a declaration of national property was made by SEDATU or if the Agrarian Court determined that certain individuals had community rights on our surface properties and as a result we are unable to maintain, or maintain access to, those surface rights, there could be material adverse impacts on the La Colorada mine's future operations. In addition to the forgoing risks, readers should also refer to those risk factors identified under the caption "Risks Related to Pan American's Business" in the Company's most recent form 40-F and Annual Information Form filed with the United States Securities and Exchange Commission and Canadian provincial securities regulatory authorities, respectively. Although the Company has attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause results not to be as anticipated, estimated, described or intended. Investors are cautioned against undue reliance on forward-looking statements or information. Forward-looking statements and information are designed to help readers understand management's current views of our near and longer term prospects and may not be appropriate for other purposes. The Company does not intend, nor does it assume any obligation to update or revise forward-looking statements or information, whether as a result of new information, changes in assumptions, future events or otherwise, except to the extent required by applicable law.

Cautionary Note to US Investors Regarding References to Mineral Reserves and Mineral Resources

Unless otherwise indicated, all mineral resource estimates included in this news release have been prepared and disclosed in accordance with Canadian National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101") and the Canadian Institute of Mining, Metallurgy and Petroleum classification system. NI 43-101 is a rule developed by the Canadian Securities Administrators that establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. Canadian standards, including NI 43-101, differ significantly from the requirements of the United States Securities and Exchange Commission (the "SEC"), and mineral reserve and resource information included herein may not be comparable to similar information disclosed by U.S. companies. In particular, and without limiting the generality of the foregoing, this news release uses the terms "measured mineral resources," "indicated mineral resources" and "inferred mineral resources" as defined under Canadian regulations. The requirements of NI 43-101 for the identification of "reserves" are also not the same as those of the SEC, and mineral reserves reported by Pan American in compliance with NI 43-101 may not qualify as "mineral reserves" under SEC standards. In addition, disclosure of "contained ounces" in a mineral resource is permitted disclosure under Canadian regulations. Accordingly, information concerning mineral deposits set forth in this news release may not be comparable with information made public by companies that report in accordance with U.S. standards.

The SEC has adopted amendments to its disclosure rules to modernize the mineral property disclosure requirements for issuers whose securities are registered with the SEC under the U.S. Securities Exchange Act of 1934, as amended. These amendments became effective February 25, 2019 (the "SEC Modernization Rules") with compliance required for the first fiscal year beginning on or after January 1, 2021 . Under the SEC Modernization Rules, the historical property disclosure requirements for mining registrants included in Industry Guide 7 under the U.S. Securities Act of 1933, as amended, were rescinded and replaced with disclosure requirements in subpart 1300 of SEC Regulation S-K. As a result of the adoption of the SEC Modernization Rules, the SEC now recognizes estimates of "measured mineral resources", "indicated mineral resources" and "inferred mineral resources." In addition, the SEC has amended its definitions of "proven mineral reserves" and "probable mineral reserves" to be substantially similar to the corresponding standards under NI 43-101. While the above terms are "substantially similar" to the standards under NI 43-101, there are differences in the definitions under the SEC Modernization Rules. As a foreign private issuer that is eligible to file reports with the SEC pursuant to the multi-jurisdictional disclosure system (the "MJDS"), Pan American is not required to provide disclosure on its mineral properties under the SEC Modernization Rules and will continue to provide disclosure under NI 43-101. Accordingly, there is no assurance any mineral reserves or mineral resources that Pan American may report as "proven mineral reserves", "probable mineral reserves", "measured mineral resources", "indicated mineral resources" and "inferred mineral resources" under NI 43-101 would be the same had Pan American prepared the mineral reserve or resource estimates under the standards adopted under the SEC Modernization Rules. If Pan American ceases to be a foreign private issuer or loses its eligibility to file its annual report on Form 40-F pursuant to the MJDS, then Pan American will be subject to the SEC Modernization Rules, which differ from the requirements of NI 43-101.

U.S. investors should not assume that any part or all of an "inferred mineral resource", a "measured mineral resource" or an "indicated mineral resource" will ever be converted into a higher category of mineral resources or into mineral reserves or that it will ever be economically or legally mineable. Mineralization described using these terms has a greater amount of uncertainty as to its existence and feasibility than mineralization that has been characterized as a mineral reserve. Further, "inferred mineral resources" have an even greater amount of uncertainty as to their existence and as to whether they can be mined legally or economically. Therefore, U.S. investors are also cautioned not to assume that all or any part of "inferred mineral resources" exist. Under Canadian securities laws, estimates of "inferred mineral resources" may not form the basis of feasibility or pre-feasibility studies, except in rare cases.

![]() View original content to download multimedia: https://www.prnewswire.com/news-releases/pan-american-silver-reports-large-increase-to-the-mineral-resource-estimate-for-its-la-colorada-skarn-deposit-301624779.html

View original content to download multimedia: https://www.prnewswire.com/news-releases/pan-american-silver-reports-large-increase-to-the-mineral-resource-estimate-for-its-la-colorada-skarn-deposit-301624779.html

SOURCE Pan American Silver Corp.

![]() View original content to download multimedia: https://www.newswire.ca/en/releases/archive/September2022/14/c9122.html

View original content to download multimedia: https://www.newswire.ca/en/releases/archive/September2022/14/c9122.html