Outback Goldfields Corp . (the " Company " or "Outback") (TSXV: OZ) is pleased to provide an update on exploration activities at its Yeungroon property, central Victoria, Australia .

"We are excited to resume our exploration program at our Yeungroon property, located in the heart of the Victorian Goldfields. Results from exploration on the property to date indicate that the Golden Jacket mine is part of a much larger system that we now know extends along strike well beyond the limits of historical mining," commented Chris Donaldson , CEO.

"Our multi-rig program has consisted of shallow diamond drilling peripheral to the historical Golden Jacket mine as well as widely-spaced and grid-based RAB holes along strike to the south. An air core drill rig is being mobilised to the property to follow up on prospective targets to the south as well as investigating new targets northwest and northeast of the Golden Jacket mine."

Highlights

- Exploration is ongoing across the Yeungroon Gold Property: A combination of grid-based RAB and focused diamond drilling has confirmed the presence of an open-ended, reef-hosted gold system at Golden Jacket.

- Just beginning to "scratch the surface" along the Golden Jacket fault: Only 1 kilometer of the +30 kilometers of prospective strike length has been investigated with the RAB drill and follow-up targets are already defined.

- Significant air-core drill program to commence with two primary objectives :

- Expand and test at depth the 600 meter long, open-ended, near-surface arsenic anomaly south of the Golden Jacket mine.

- Test numerous priority geophysical targets located northeast of the Golden Jacket mine.

Golden Jacket Drill Program

The Golden Jacket mine is associated with the property-scale, northwest-trending Golden Jacket fault, which transects the property for over 30 kilometres of strike length. Historical small-scale production from the Golden Jacket mine was reportedly 1,400 ounces of gold at approximately 250 grams per tonne 1 .

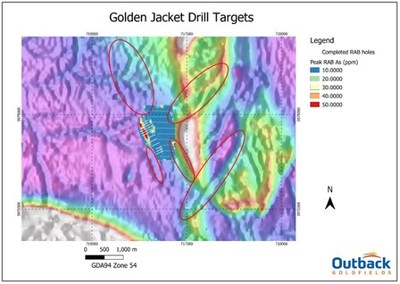

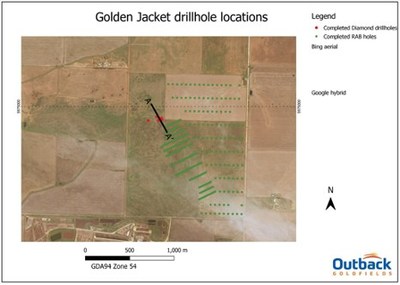

Air-core drilling will focus on testing the northwestern extent of the reef-hosted gold system along strike from the Golden Jacket mine, as well as testing numerous geophysical targets to the northeast (Figure 2). The air-core drill program is designed to build on encouraging results from a large grid-based, top of bedrock sampling rotary air-blast (RAB) drill program, and a short diamond drill program (Figure 1). Similar to RAB drilling, the air-core drill rig is used to sample and map the "top of bedrock" below cover.

The Golden Jacket drill program is being completed in two parts:

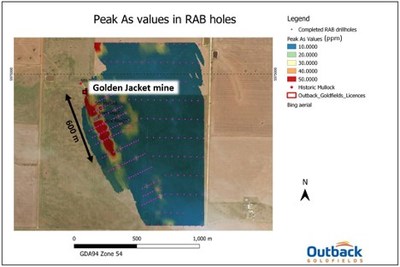

1. The first phase of the program utilised a RAB drill to complete a tight grid of holes, on 20-metre centres, peripheral to, and along strike to the southeast from the Golden Jacket mine. Grid lines were northeast-oriented and spaced 60 to 120 metres apart (Figure 1). Additional wider-spaced holes, east of Golden Jacket were also completed (Figure 1). 279 holes have been completed to date.

Top of bedrock samples were analyzed using a tailored portable Xray fluorescence spectrometer (pXRF) workflow to measure elemental concentrations from prepared sample mounts as well as QA/QC samples in the field. Samples were prepared and analyzed daily. Preliminary pXRF data highlight a broad, 600 meter long, northwest-trending, high-arsenic anomaly. This anomaly is along strike from the Golden Jacket mine to the southeast (Figure 1). The relationship between gold mineralization and disseminated arsenopyrite and high-arsenic contents in host rocks peripheral to gold-bearing quartz reefs is well established throughout the Victorian Goldfields (e.g., Arne et al., 2008) and has been used to focus exploration and vector to high-grade mineralization.

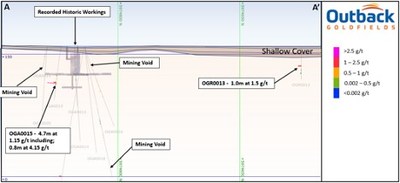

Select samples from RAB holes with elevated arsenic contents were also submitted for fire assay analyses. Hole OGR013, located 300 meters south of the Golden Jacket mine, intersected 1 meter of 1.5 g/t gold from 22 meters down hole (Figure 4), which suggests the gold system extends southerly beyond areas of historical mining.

The northwest-extent of the anomaly, as well as interpreted northeast offsets and multiple additional targets, will be investigated with the air-core rig during the current program (Figure 2).

2. Nine diamond drill holes for 1,025 metres have so far been completed at the Golden Jacket mine and, based on the presence of sulfide-bearing quartz reefs and preliminary assay data, more holes are planned. The purpose of the drilling was to investigate the structural setting and geochemical footprints of high-grade gold mineralization along strike and below the historic Golden Jacket mine (see news release dated August 25 th , 2021). The drill holes to date have covered a northwest-trending strike extent of 100 metres and have tested down to 115 metres depth (Figure 4).

Of the nine completed holes, four were terminated short of their target depth due to the presence of historical mine workings and voids (Figure 4). This suggests that historical underground developments are more widespread than government records indicate. Hole OGA0015, however, intersected 4.7 meters of 1.15 g/t gold including 0.7 meters of 4.01 g/t gold below the upper level of modelled workings (Figure 4). Gold mineralization in this area is associated with arsenopyrite-bearing quartz veins within broad zones of disseminated arsenopyrite hosted in deformed sedimentary rocks.

Updated modelling of all intersected quartz-reefs and the location of newly identified mining voids has led to the creation of new drill targets. These targets, both along strike and down-dip of the Golden Jacket system, will be ranked and prioritised together with results from the upcoming air-core program.

Table 1. Gold assay results – Golden Jacket Drilling

| Drillhole | From | To | Interval | Gold |

| | | | | |

| OGA0015 | 53.8 | 58.5 | 4.7 | 1.15 |

| inc | 54.6 | 55.4 | 0.8 | 1.33 |

| inc | 56.2 | 56.9 | 0.8 | 4.01 |

| | | | | |

| OGA0013 | No significant intervals | | ||

| OGA0014 | Mining Void | | ||

| OGA0016 | Mining Void | | ||

| OGA0017 | No significant intervals | | ||

| OGA0018 | Mining Void | | ||

| OGA0019 | Mining Void | | ||

| OGA0020 | No significant intervals | | ||

| OGA0021 | No significant intervals | | ||

| 1. | Calculations are uncut and length-weighted using a 0.10 g/t gold cut-off with no internal dilution. |

| 2. | Intervals are downhole lengths. True widths are approximately 50% for holes OGA0015. No true width could be estimated for RAB |

| 3. | DDH holes OGA0014, 0016, 0018, and 0019 intersected mining voids |

Table 2. Collar Locations for diamond drill holes

| Drill hole | *East | North (m) | RL | Dip | Azimuth | Total |

| OGA0013 | 716277 | 5974853 | 160 | -55 | 265 | 90.6 |

| OGA0014 | 716278 | 5974853 | 160 | -62 | 265 | 110.3 |

| OGA0015 | 716271 | 5974870 | 160 | -55 | 258 | 81.7 |

| OGA0016 | 716236 | 5974841 | 160 | -55 | 120 | 120.6 |

| OGA0017 | 716236 | 5974841 | 160 | -70 | 120 | 126.7 |

| OGA0018 | 716236 | 5974841 | 160 | -80 | 109 | 122.8 |

| OGA0019 | 716219 | 5974887 | 160 | -55 | 75 | 35.1 |

| OGA0020 | 716219 | 5974887 | 160 | -77 | 75 | 90.0 |

| OGA0021 | 716123 | 5974842 | 158 | -55 | 75 | 246.6 |

| *GDA94 Zone 54 |

Yeungroon Project

The 698 km 2 Yeungroon property is transected by the north-trending, crustal-scale Avoca fault, which separates the western Stawell zone from the Eastern Bendigo zone. The western side of the Yeungroon property contains the historic Golden Jacket hard-rock reef mine associated with the regional-scale, northwest-trending Golden Jacket fault. Historical mining records indicate the Golden Jacket mine produced quartz-rich ore with grades of up to 250 grams per tonne gold (Bibby and More, 1998), however, the vertical and lateral extent of mineralization remains unknown.

The eastern side of the project is underlain by Ordovician rocks of the Castlemaine group and comprises the northern extent of the Wedderburn Goldfield, where numerous small-scale, historical alluvial and hard-rock mines are located.

Community Engagement

Outback recognises the importance of open and honest community engagement in all our exploration activities. We approach all our exploration activities in a sustainable manner and ensure our activities comply with the Victorian Code of Practice for Mineral Exploration. As such, community consultation with local landowners has commenced and is ongoing.

Quality Assurance and Quality Control

All sample assay results have been monitored through Outback's quality assurance / quality control (QA/QC) program. Drill core was sawn in half at Outback's core logging and processing facility in Ballarat, VIC. RAB samples were collected in the field. Half the drill core and RAB chips were sampled and shipped in sealed and secure bags to the Gekko Assay Laboratory in Ballarat, VIC. Samples were prepared using standard preparation procedures (dry, crush and pulverise at 75 micron mesh). Gold was analyzed by fire assay on a 30 gram sample with an AAS finish (atomic absorption spectroscopy). Gekko Assay Laboratory is accredited for compliance with ISO/IEC 17025 Testing by National Association of Testing Authorities, Australia (NATA)

In addition to Gekko Assay Laboratory QA/QC protocols, Outback implements an internal QA/QC program that includes the insertion of standards and blanks into the sample stream.

National Instrument 43-101 Disclosure

This news release has been approved by Mr. Matthew Hernan (FAusIMM, MAIG) an independent consultant and "Qualified Person" as defined in National Instrument 43-101, Standards of Disclosure for Mineral Projects of the Canadian Securities Administrators. He supervised the drill program and verified the data disclosed, including sampling, analytical and QA/QC data, underlying the technical information in this news release.

Some data disclosed in this News Release relating to sampling and drilling results is historical in nature. Neither the Company nor a qualified person has yet verified this data and therefore investors should not place undue reliance on such data. In some cases, the data may be unverifiable due to lack of drill core. Mineralization hosted on adjacent and/or nearby and/or geologically similar properties is not necessarily indicative of mineralization hosted on the Company's property.

References

Bibby, L.M., and Moore, D.H., 1998, Charlton 1:100,000 map area geological report, Geological Survey of Victoria Report 116, 95 p.

Arne, D.C., House, E., and Lisitsin, V., 2008, Lithogeochemical haloes surrounding central Victorian gold deposits: Part 1 – Primary alteration, Geoscience Victoria Gold Undercover Report 4, 95 p.

About Outback Goldfields Corp.:

Outback Goldfields Corp. is a well financed exploration mining company that is actively exploring its package of highly prospective gold projects located around the Fosterville Gold Mine in Victoria . The goldfields of Victoria are home to some of the highest grade and lowest cost mining in the world.

~signed

Chris Donaldson , CEO and Director

CAUTIONARY NOTE REGARDING FORWARD LOOKING STATEMENTS

This news release includes certain "forward-looking statements" and "forward-looking information" under applicable Canadian securities legislation that are not historical facts. Forward-looking statements involve risks, uncertainties, and other factors that could cause actual results, performance, prospects, and opportunities to differ materially from those expressed or implied by such forward-looking statements. Forward-looking statements in this news release include, but are not limited to, statements with respect to: the Company's business and prospects; the Company's objectives, goals or future plans; resumption of trading in the Company's common shares; and the business, operations, management and capitalization of the Company. Forward-looking statements are necessarily based on a number of estimates and assumptions that, while considered reasonable, are subject to known and unknown risks, uncertainties and other factors which may cause actual results and future events to differ materially from those expressed or implied by such forward-looking statements. Such factors include, but are not limited to: general business, economic and social uncertainties; litigation, legislative, environmental and other judicial, regulatory, political and competitive developments; delay or failure to receive board, shareholder or regulatory approvals; those additional risks set out in the Company's public documents filed on SEDAR at www.sedar.com ; and other matters discussed in this news release. Accordingly, the forward-looking statements discussed in this release, including the resumption of trading, may not occur and could differ materially as a result of these known and unknown risk factors and uncertainties affecting the companies. Although the Company believes that the assumptions and factors used in preparing the forward-looking statements are reasonable, undue reliance should not be placed on these statements, which only apply as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all. Except where required by law, the Company disclaims any intention or obligation to update or revise any forward-looking statement, whether as a result of new information, future events, or otherwise.

SOURCE Outback Goldfields Corp.

![]() View original content to download multimedia: https://www.newswire.ca/en/releases/archive/January2022/25/c9764.html

View original content to download multimedia: https://www.newswire.ca/en/releases/archive/January2022/25/c9764.html