TSX.V: OZ | OTCQB: OZBKF | FSE: S600

Outback Goldfields Corp . (the " Company " or " Outback ") (TSXV: OZ) (OTCQB: OZBKF) is pleased to announce that it has entered into a letter of intent dated February 16, 2024 (the Letter of Intent ") with S2 Resources Ltd. (" S2 ") to acquire all of S2's highly prospective portfolio of gold projects in Finland (the " S2 Finnish Projects "), by way of an acquisition (the " Transaction ") of S2's wholly-owned Finnish subsidiary, Sakumpu Exploration Oy (the " S2 Subsidiary "). On March 1, 2024 Outback notified S2 that it was satisfied with the results of its due diligence investigation, and the parties are now committed to proceeding with the Transaction subject to the terms and conditions set out in the Letter of Intent. Depending on the price and size of the Offering (as defined below), the Transaction may constitute a "Reverse Takeover" of Outback in accordance with Policy 5.2 Changes of Business and Reverse Takeover s of the TSX Venture Exchange (the " TSXV ").

In addition, Outback will grant S2 an option (the " Joint Venture Earn-In ") to earn an interest in Outback's Glenfine, Silver Spoon, Ballarat West and Yeungroon gold projects, located in the Victorian Goldfields, Australia (the " Outback Australian Projects "). The Outback Australian Projects are expected to have exploration synergies with S2's gold projects also located in the Victorian Goldfields, near the Fosterville gold mine.

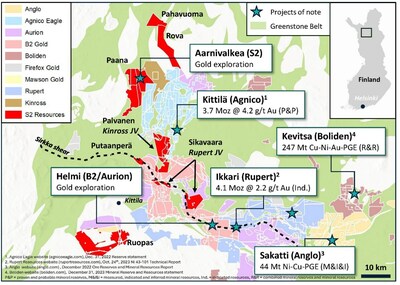

"This is a transformative acquisition for Outback, providing our company with a world-class portfolio of projects in a highly prospective jurisdiction," commented Chris Donaldson , CEO of Outback. "The Central Lapland Greenstone Belt of Northern Finland is an emerging gold camp and is host to several recent gold discoveries including Europe's largest primary gold mine, Agnico Eagle's Kittilä Mine, which produces over 200koz gold per annum. We look forward to working with S2 on completing this transaction and focusing our technical team solely on making gold discoveries in Finland ."

Mark Bennett , Executive Chairman of S2 stated, "We are very pleased to partner with Outback to create a new Canadian-listed company focused on exploring S2's portfolio of highly prospective gold projects in Finland . S2 has had significant early-stage exploration success at these projects in a short period of time. This transaction will further solidify S2 as a leading explorer in the Greater Fosterville area, allowing Outback to solely focus on advancing exploration in Finland ."

Concurrent with the Transaction, Outback intends to complete a financing to raise gross proceeds of C$5 million (the " Offering ").

Transaction Highlights:

- Creation of a new Canadian-listed Finnish exploration company: Canadian-listed explorers are leading the exploration frontier in Finland with Rupert Resources Ltd., Aurion Resources Ltd., and FireFox Corp. boasting a combined market capitalization of approximately C$700 million .

- Large land position in a premier district: The S2 Finnish Projects comprise an over 35,000-hectare land package in Northern Finland's Central Lapland Greenstone Belt, which is host to world class gold and nickel-copper-cobalt-PGE deposits, including Agnico Eagle's 3.7 million ounce Kittilä gold mine 1 , Rupert's 4.1 million ounce Ikkari gold deposit 2 , Boliden's 247 million tonne Kevitsa copper-nickel-gold-PGE mine 3 and Anglo American's 44 million tonne Sakatti nickel-copper–PGE deposit 4 .

- Strategic partnerships in Finland : Senior gold producer Kinross Gold and marquee explorer Rupert Resources are currently funding approximately C$14 million of exploration work pursuant to farm into agreements on 12,000 hectares of regional ground, while Outback will maintain 100% ownership of the Paana, Ruopas, Putaanperä, Rova and Pahavuoma projects.

- Defined high-grade gold target : The Aarnivalkea West discovery on the Paana project represents an open-ended, 1.3 km striking zone of near-surface, orogenic gold mineralization. This target will be a priority area for future exploration programs conducted by Outback.

- Strong balance sheet to execute growth: Concurrent C$5 million financing will fund Outback to advance drill-ready targets.

- Experienced leadership team: The board and management team of Outback have decades of experience, with a demonstrated track record of exploration and the support of Inventa Capital Corp., a Vancouver -based merchant bank founded in 2017 with the goal of discovering and funding opportunities in the resource sector.

- Continued exposure to Victorian Goldfields: S2 is a proven successful explorer and controls one of the largest landholdings in the greater Fosterville area, making S2 well placed to move the Outback Australian Projects forward. Outback will retain minority interests in the Outback Australian Projects.

About the S2 Finnish Projects

The S2 Finnish Projects comprise over 35,000 hectares in the prospective Central Lapland Greenstone Belt (" CLGB ") of northern Finland via a mix of granted exploration licences, exploration licence applications and exploration reservations. The key projects, owned 100% by S2, include Paana, Rova, Putaanperä, Ruopas, and Pahavuoma (Figure 1). Collectively, these projects areas have not been extensively explored in the past, despite the CLGB hosting "world-class" gold and nickel-copper-cobalt-PGE deposits.

Paana Project

The Aarnivalkea West target, on the Paana Project, located approximately 24 km northwest of Agnico's Kittilä mine (Figure 1), was initially defined via reconnaissance geochemical surveys, follow-up base of till (BoT) drilling and shallow scout diamond drilling from 2018 to 2019. The approximately 1.3 km long, north-south trending strong muti-element (Au-Sb-As) geochemical anomaly was later investigated with deeper diamond drilling (> 100m ) on ~100 to 250 metre centers in 2020 and 2021. The focus of these programs, totalling 5,200 metres, was on investigating the strike and down-dip extent of vein-hosted orogenic gold mineralization.

Most of the deeper holes intersected zones of broad and/or high-grade gold mineralisation, highlighted by intervals such as:

- 65.4 metres at 1.5 g/t Au including 6.8 meters at 11.8 g/t Au from 164.5 metres down hole (FAVD62) 5

- 55.5 metres at 1.6 g/t Au including 20.4 metres at 4.0 g/t Au from 158.0 metres down hole (FAVD64) 5

- 79.6 metres at 0.76 g/t Au including 16.8 metres at 2.7 g/t Au from 123.0 metres and 48.0 metres at 0.96 g/t Au including 7.9 metres at 3.98 g/t Au from 214 metres down hole (FAVD71) 6

- 30.5 metres at 1.9 g/t Au including 9.5 metres at 5.2 g/t Au from 32.2 metres down hole (FAVD40) 7

Mineralisation at Aarnivalkea West is associated with intense albite-sericite-carbonate alteration, with abundant disseminated sulfide and multi-generational deformed quartz veins. Gold mineralisation at the Aarnivalkea West target is open at depth, down-dip to the east, and along strike to the north and south. Outback's preliminary focus at Aarnivalkea West, will be aimed at targeting structural and lithological controls on higher-grade zones as well as investigating the down-dip and strike-extent of near-surface mineralization with an initial approximately 3,000 metre drill program.

Reconnaissance scout drilling was also conducted at the Aarnivalkea East target in 2021, 2.4 km east of Aarnivalkea West, to test a multi-element (Au-As-Sb) base of till (BoT) anomaly. Thirteen wide spaced, shallow holes (average 100 metres depth) confirmed the presence of a strongly altered and deformed shear zone with multiple zones of local gold mineralisation highlighted by an intercept of 3.7 metres at 0.86 g/t gold from 85.0 metres in hole FPAD0005 8 . Similar to Aarnivalkea West, the East target warrants systematic and deeper follow-up drill testing.

Complimentary Projects

Soil sampling across other prospective projects north of Paana (e.g., Rova and Pahasvuoma projects, Figure 1) has previously returned broad multi-element (Au-Cu-Sb-As-Ag) geochemical anomalies 9 . These targets are considered prospective for orogenic gold mineralization. Surface geochemistry at the Putaanperä project, approximately 40 km northeast of Rupert Resources Ikkari gold discovery (Figure 1), reveals a broad Au-Ag-As-Cu anomaly 9 spatially associated with the regionally important Sirkka shear zone. These results suggest strong prospectivity for orogenic gold mineralization across the Putaanperä project.

The Ruopas project, 60 km south of Paana and the Aarnivakea gold prospects (Figure 1), was previously explored for the presence of magmatic nickel-copper-PGE mineralization via ground electromagnetic surveys.

Partnerships with Majors

In June 2021 , S2 entered into a farm-in option agreement with Kinross Gold Corporation (K:TSX) (" Kinross ") on a 56 square kilometre area prospective for gold mineralisation. Under the agreement, Kinross can spend up to USD$6.5 million (approximately C$9 million ) to earn a 70% interest in the Palvanen/Mesi blocks, with a minimum expenditure requirement of USD$3.5 million (approximately C$5 million ) over the first three years. Outback would retain a 30% interest in these blocks if Kinross successfully completes the earn-in.

In August 2021 , S2 entered into another farm-in option agreement on two exploration licence applications covering an area of 37 square kilometres with Rupert Resources Ltd. (RUP:V) (" Rupert "). Under this agreement, Rupert can spend up to EUR3.4 million (approximately C$5 million ) to earn a 70% interest in the Sikavaara East and Sikavaara West licences, with an initial expenditure requirement of EUR1.2 million (approximately C$1.75 million ) over the first three years (see S2's annual report for the year ended June 30, 2022 ). Outback would retain a 30% interest in these blocks if Rupert successfully completes the earn-in.

In June 2023 , Kinross exercised its right of first refusal, under the terms of its farm-in agreement with S2, on the Paana East and Paan Silas licences, demonstrating the level of interest in this region.

A press release with further information in respect of the S2 Subsidiary and the S2 Finnish Projects, including significant financial information, will follow in accordance with the policies of the TSXV.

Summary of the Transaction

The Letter of Intent contemplates that Outback and S2 will negotiate and enter into a definitive agreement in respect of the Transaction (the " Definitive Agreement ") pursuant to which Outback will acquire S2's Finnish portfolio for total consideration of C$7,000,000 , comprised of a C$1,500,000 cash payment and the issuance of C$5,500,000 in common shares of Outback (the " Consideration Shares "). The deemed issuance price of the Consideration Shares will be equal to the issuance price of any common shares issued pursuant to the Offering (as defined below). Pursuant to the Letter of Intent, the Transaction is expected to be carried out by way of a share purchase agreement whereby Outback will acquire all of the issued and outstanding shares of the S2 Subsidiary. The final structure and terms of the Transaction will be governed by the terms of the Definitive Agreement, which is expected to be entered into on or around April 6, 2024 . Upon completion of the Transaction Outback expects to be listed as a Tier 2 Mining Issuer on the TSXV.

In connection with the Transaction, Outback intends to complete a non-brokered private placement for minimum gross proceeds of C$5 million (the " Offering "). Details of the Offering will be announced at a later date. Finder's fees may be paid in connection with the Offering within the limits permitted by the policies of the TSXV.

The completion of the Transaction remains subject to a number of terms and conditions, among other standard conditions for a transaction of this nature, including, among other things: (i) the negotiation and execution of the Definitive Agreement; (ii) completion of the Offering; (iii) approval of the shareholders of Outback and, if required, the shareholders of S2; (iv) the preparation of a NI 43-101 compliant technical report for each of the material S2 Finnish Projects that is acceptable to the TSXV and Outback; (v) the receipt of all required regulatory, stock exchanges (including the TSXV), creditor, court, security holder and other approvals, consents, permits, waivers, exemptions and orders; and (vi) if required by the TSXV, delivery of a sponsor report. There can be no assurance that all of the necessary regulatory and shareholder approvals will be obtained or that all conditions of closing will be met.

Summary of Proposed Principals

Upon completion of the Transaction, S2 will be granted the right to appoint one member to the board of directors of Outback (the " S2 Nominee "). S2 has not yet identified any potential S2 Nominee. Other than the appointment of a potential S2 Nominee, the directors and officers of Outback are not expected to change.

In addition, it is expected that S2 will become an Insider of Outback upon completion of the Transaction and the Offering. S2, an Australian entity, is a public company listed on the Australian Securities Exchange under the symbol "S2R".

Sponsorship of Transaction

Sponsorship of the Transaction may be required by the TSXV unless an exemption or waiver from this requirement is obtained in accordance with the policies of the TSXV. Neither Outback nor S2 has yet engaged a sponsor in connection with the Transaction. The parties intend to apply for an exemption from the TSXV's sponsorship requirement. Additional information on sponsorship arrangements will be provided once available.

Joint Venture Earn-In – Outback Australian Projects

In addition, Outback and S2 have entered into a separate binding letter of intent with respect to the Joint Venture Earn-In, pursuant to which S2 may, over a 48 month period, earn (i) an 80% joint venture interest in the Outback Australian Projects by incurring A$1,200,000 of exploration expenditures; and (ii) a 51% joint venture interest in the Glenfine project by incurring exploration expenditures of A$200,000 . Outback will retain a 2% royalty interest in the Australian Projects, subject to a buydown provision. The Joint Venture Earn-In is subject to various conditions and the parties intend to enter into a definitive agreement to govern the Joint Venture Earn-In.

Other Information relating to the Transaction

The Transaction is not a "related party transaction" as such term is defined by Multilateral Instrument 61-101 – Protection of Minority Security Holders in Special Transactions and is not subject to Policy 5.9 – Protection of Minority Security Holders in Special Transactions of the TSXV. In addition, the Transaction will constitute an "Arm's Length Transaction" (as such term is defined in the policies of the TSXV).

No finder's fees are expected to be payable in connection with the Transaction.

If required under TSXV policies, Outback will obtain shareholder approval for the Transaction.

In accordance with the policies of the TSXV, trading of the common shares of Outback has been halted as a result of this announcement and will not resume trading until such time as the TSXV determines, which, depending on the policies of the TSXV, may not occur until completion of the Transaction.

Additional information concerning the Transaction, the S2 Subsidiary, the S2 Finnish Projects and the Offering will be provided once determined in subsequent news releases and in the disclosure documents to be prepared by Outback in connection with the Transaction. Such documents will be available in due course under Outback's SEDAR+ profile at www.sedarplus.ca .

Advisors and Counsel

Agentis Capital Mining Partners is acting as financial advisor to Outback. Forooghian + Company Law Corporation is acting as legal counsel to Outback.

Technical Disclosure

The disclosure of technical or scientific information in this press release has been reviewed and approved by Dr. Christopher Leslie , P.Geo., a Qualified Person as defined under the terms of National Instrument 43-101.

The reader is cautioned that the historical drill results are based on prior data and reports prepared by S2. The reader is cautioned not to treat them, or any part of them, as current and that a qualified person has not done sufficient work to verify the results and that they may not form a reliable guide to future results. The Company considers these historical results relevant as it is using this data as a guide to plan exploration programs. No independent QA/QC protocols are known for these drilling activities and as such analytical results may be unreliable. The Company's future exploration work will include verification of the historical data through drilling.

Mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on the S2 Finnish Projects.

References

1. Agnico Eagle website (agnicoeagle.com), December 31, 2022 Reserve statement.

2. Rupert Resources website (rupertresources.com), October 24, 2023 NI 43-101 Technical Report.

3. Boliden website (boliden.com), December 31, 2023 Mineral Reserve and Resources statement.

4. Anglo website (anglo.com), December 2022 Ore Reserves and Mineral Resources Report.

5. Data reported in S2 Resources July 19, 2021 news release (s2resources.com.au).

6. Data reported in S2 Resources October 11, 2021 news release (s2resources.com.au).

7. Data reported in S2 Resources September 26, 2019 news releases (s2resources.com.au).

8. Data reported in S2 Resources Annual Report 2021 (s2resources.com.au).

9. Data reported in S2 Resources October 24, 2018 news release (s2resources.com.au).

About Outback

Outback is an exploration mining company that is actively exploring its package of highly prospective gold projects. Outback is backed by Inventa Capital Corp., a Vancouver -based merchant bank founded in 2017 with the goal of discovering and funding opportunities in the resource sector.

Completion of the Transaction is subject to a number of conditions, including but not limited to, TSXV acceptance and if applicable, disinterested shareholder approval. Where applicable, the Transaction cannot close until the required shareholder approval is obtained. There can be no assurance that the Transaction will be completed as proposed or at all.

Investors are cautioned that, except as disclosed in the management information circular or filing statement to be prepared in connection with the Transaction, any information released or received with respect to the Transaction may not be accurate or complete and should not be relied upon. Trading in the securities of Outback should be considered highly speculative.

The TSXV has in no way passed upon the merits of the proposed transaction and has neither approved nor disapproved the contents of this news release.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward Looking Statements

This news release contains forward-looking statements or forward-looking information relating to the future operations of the Company and other statements that are not historical facts. Forward-looking statements in this news release include but are not limited to: obtaining the necessary approvals required for the Transaction and the Offering; completion of the Transaction and the Offering and the timing thereof; final terms of the Transaction and Offering; the benefits of the Transaction and the Offering; and exploration activities.

Forward-looking statements are based on the reasonable assumptions, estimates, analyses and opinions of management made in light of its experience and its perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances at the date that such statements are made, but which may prove to be incorrect. Management believes that the assumptions and expectations reflected in such forward-looking statements are reasonable. Assumptions have been made regarding, among other things: the benefits of the Transaction and the Offering; the Company's ability to carry on exploration and development activities; the timely receipt of required approvals; the price of metals; the integration of assets acquired by the Company; and the Company's ability to obtain financing as and when required and on reasonable terms. Readers are cautioned that the foregoing list is not exhaustive of all factors and assumptions which may have been used.

Forward-looking statements are subject to known and unknown risks, uncertainties and other factors that may cause actual results to be materially different from those expressed or implied by such forward-looking statements. Such risks, uncertainties and other factors include but are not limited to: the Company's early stage of development; the fluctuation of the price of metals; the availability of additional funding as and when required; the speculative nature of mineral exploration and development; the timing and ability to maintain and, where necessary, obtain necessary permits and licenses; the uncertainty in geologic, hydrological, metallurgical and geotechnical studies and opinions; infrastructure risks, including access to water and power; environmental risks and hazards; risks associated with negative operating cash flow; and risks associated with dilution. For a further discussion of risks relevant to the Company, see the Company's other public disclosure documents.

Although management has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. There is no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such forward-looking statements. Accordingly, readers should not place undue reliance on forward-looking statements. The Company does not undertake to update any forward-looking statements, except as, and to the extent required by, applicable securities laws.

SOURCE Outback Goldfields Corp.

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/March2024/01/c4171.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/March2024/01/c4171.html