July 16, 2024

Labyrinth Resources Limited (‘LRL’) is pleased to announce that LRL set to acquire Vivien Project and 100% of Comet Vale.

- Labyrinth Resources Limited (“Labyrinth” or “the Company”) has signed:

- a binding option agreement with Sand Queen Gold Mines Pty Ltd (“Sand Queen”) whereby Labyrinth has been granted a 12-month option (commencing on completion of the Distilled Acquisition) to acquire Sand Queen’s 49% interest in Comet Vale for $3m in cash (“Comet Vale Option”); and

- a binding share sale agreement to acquire 100% of Distilled Analytics Pty Ltd (“Distilled”) which owns the Vivien Gold Project (“Vivien”) located 6km from the Agnew Gold Mine (“Distilled Acquisition”), together, (“the Transactions”).

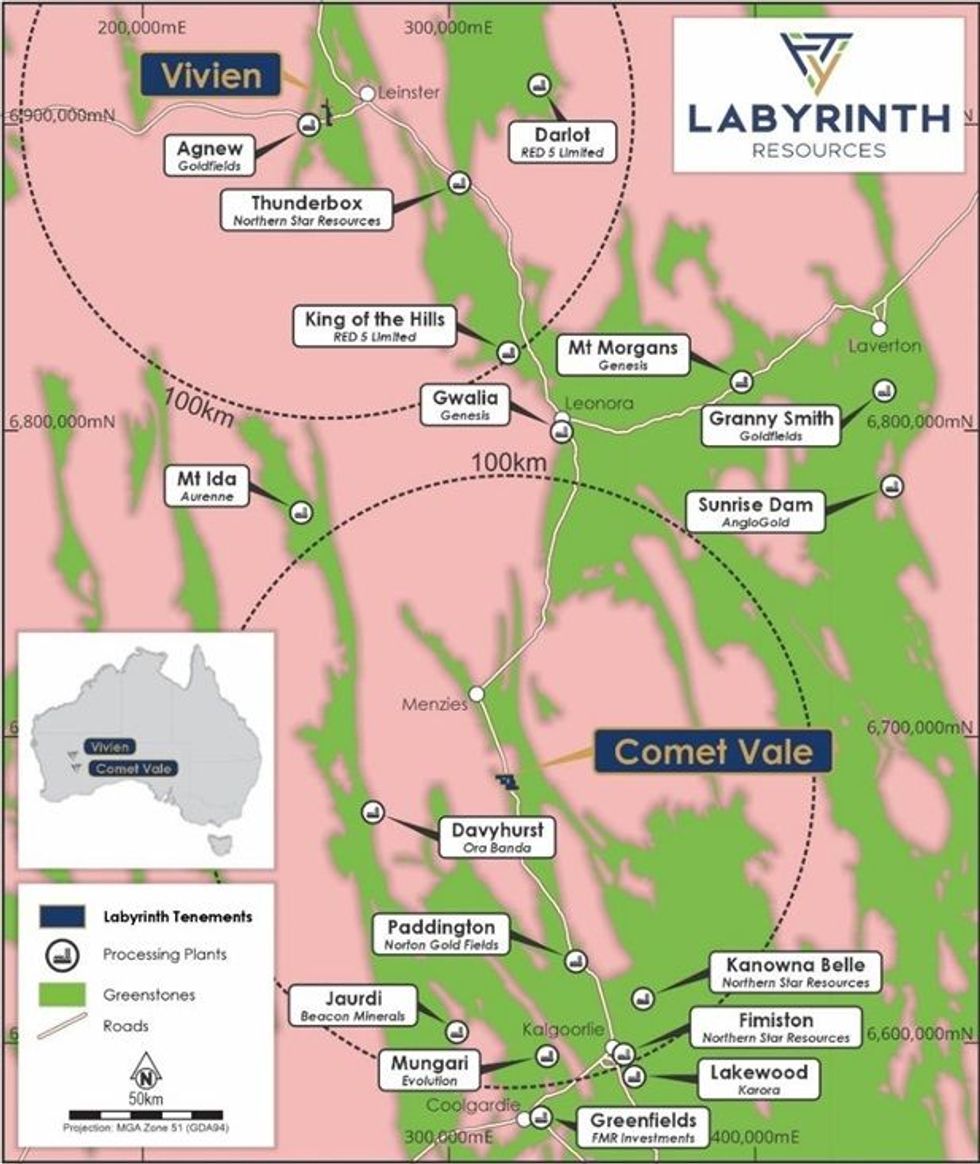

- The Transactions are consistent with the Company’s strategy to consolidate and grow underexplored high grade gold mines across the Menzies, Leonora and Leinster corridor that are close to infrastructure.

- Exercise of the Comet Vale Option will allow the Company to increase its existing controlling interest in Comet Vale from 51% to 100%.

- The Company’s Comet Vale gold project (on granted mining leases) is located 32km south of Menzies next to the Goldfields highway. The Company released an updated Mineral Resource of 96koz at 4.8g/t Au (100% basis) on 11 April 2023.1

- Vivien, previously owned and operated by Ramelius Resources Limited (ASX: RMS) (“Ramelius”), will provide Labyrinth a near-term opportunity to define a JORC mineral resource across the Vivien Main Pit and Vivien Gem Prospect from the existing project drill database.

- The Vendors of Distilled amongst others include Alex Hewlett and Kelvin Flynn. Alex and Kelvin have a strong track record, with one or both being involved in driving value creation at Red Dirt Metals Limited (now Delta Lithium), Spectrum Metals Limited, Mineral Resources Limited, Silver Lake Resources Limited and Wildcat Resources Limited.

- Following completion of the Transactions and Equity Raising at full participation, Mr Hewlett and Mr Flynn are expected to emerge with voting power in Labyrinth of approximately 12.3% and 10.2% respectively.

- Firm commitments received via a two tranche placement to raise $2.0 million in support of the Transactions and to fund high priority work programs.

- Existing Labyrinth shareholders will have the opportunity to participate in a 1-for-1.9813 non-renounceable Entitlement Offer raising up to an additional ~$2.0m.

§ The proceeds of the two tranche placement (“Placement”) and entitlement offer

(“Entitlement Offer”) (together, the “Equity Raising”) will be used to advance exploration at both Comet Vale and Vivien with the aim of growing a significant and high-grade resource inventory.

- Following completion of the Transactions and Equity Raising at full participation, Labyrinth will emerge with a pro-forma undiluted market capitalisation of ~$13.7m and pro-forma cash holdings of approximately $4.0m (before transaction costs and the exercise of the Comet Vale Option).

- Post the Transactions, the Company will re-assess strategic options (including a potential sale) for its 100% owned Labyrinth Project in Canada which currently contains a JORC compliant resource of 3Mt @ 5g/t Au for 500koz2. This will include leveraging the geological skill set of the Company to further evaluate the prospectivity of the deposit at depth and along strike.

- The Company has obtained in-principle confirmation from the ASX that Listing Rules 11.1.2 and 11.1.3 do not apply to the Transactions.

Overview

The Comet Vale Option and Distilled Acquisition align with the Company’s strategy to consolidate and grow underexplored high grade gold mines across the Menzies, Leonora and Leinster corridor that are close to infrastructure.

Historical underground production from the Vivien leases between 1902 and 1911 totalled 76,000oz at an average grade of 12.4 g/t Au. The Vivien open pit was mined between 1997 and 1998 and produced 410,000 tonnes at 2.70 g/t Au for 35,600oz.3

Ramelius ceased mining at Vivien in early 2023, with the last ore load coming to surface on 11 January 2023. Gold production for Vivien over the period of Ramelius’ operatorship (2015-2023) was 1.5Mt at 5.68g/t Au for 260koz4 processed through its Mt Magnet Mill situated 296km west of Vivien. Vivien was acquired by Ramelius in 2013 from Gold Fields at a cost of $10 million and, over its life, generated net cash flows of $130 million for Ramelius.5

Vivien comprises five Mining Licences (M36/111, M36/292, M36/34, M36/61 and M36/64) and one Prospecting Licence (P36/1890) with an area of 20.4km².

The wider Vivien project provides a commercially compelling brownfield gold exploration opportunity with six (6) priority drill targets based on historical gold intercepts that were not prioritised by Ramelius as part of its mining focussed activities at Vivien.

Vivien provides Labyrinth a near-term opportunity to define a JORC mineral resource across the Vivien Main Pit and Vivien Gem Prospect from the existing project drill database. There are also five (5) separate gold processing mills within 100km of Vivien that potentially provide a lower commercial threshold to profitable gold production.

Click here for the full ASX Release

This article includes content from Labyrinth Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

LRL:AU

The Conversation (0)

31 August 2023

Labyrinth Resources

Developing underexplored gold assets in the prolific Canadian Abitibi Gold Belt and the Yilgarn Craton of Western Australia.

Developing underexplored gold assets in the prolific Canadian Abitibi Gold Belt and the Yilgarn Craton of Western Australia. Keep Reading...

22h

Adrian Day: Gold Dips Bought Quickly, Price Run Not Over Yet

Adrian Day, president of Adrian Day Asset Management, shares his latest thoughts on what's moving the gold price, emphasizing that its bull run isn't over yet. "It's monetary factors that are driving gold — that's what's fundamentally driving gold," he said. "Monetary factors, lack of trust in... Keep Reading...

22h

Brien Lundin: Gold, Silver Stock Run Just Starting, Get in Now

Brien Lundin, editor of Gold Newsletter and New Orleans Investment Conference host, shares his stock-picking strategy at a time when high metals prices are beginning to lift all boats. In his view, gold and silver equities may still only be in the second inning. Don't forget to follow us... Keep Reading...

06 March

Venezuela Gold Set for US Market in Brokered Deal

A new US-Venezuela gold deal could soon channel hundreds of kilograms of bullion from the South American nation into American refineries.Venezuela’s state-owned mining company, Minerven, has agreed to sell between 650 and 1,000 kilograms of gold dore bars to commodities trading house Trafigura... Keep Reading...

05 March

Rick Rule: Gold Price During War, Silver Strategy, Oil Stock Game Plan

Rick Rule, proprietor at Rule Investment Media, shares updates on his current strategy in the resource space, mentioning gold, silver, oil and agriculture. He also reminds investors to pay more attention to gold's underlying drivers than to current events.Click here to register for the Rule... Keep Reading...

05 March

Lobo Tiggre: Gold, Oil in Times of War, Plus My Shopping List Now

Lobo Tiggre of IndependentSpeculator.com shares his thoughts on how gold, silver and oil could be impacted by the developing situation in the Middle East. He cautioned investors not to chase these commodities if prices run. Don't forget to follow us @INN_Resource for real-time updates!Securities... Keep Reading...

05 March

TomaGold: New High-grade Deep Discovery at Berrigan Mine

TomaGold (TSXV:LOT) President, CEO and Director David Grondin said the company is focusing on its flagship Berrigan mine in Chibougamau, Québec, following a large, significant discovery at depth.Berrigan is 4 kilometers northwest of the city of Chibougamau and has existed for about 50 years.... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00