North Bay Resources, Inc. (the " Company " or " North Bay ") (OTC: NBRI) is pleased to announce final acceptance and settlement of the Company's first gold concentrate sale from a test shipment of ore from the Company's Fran Gold Project processed at the Company's Bishop Gold Mill. All Refinery requirements have been met and comparison of assays between the Company's assay and in-house assay, for settlement of the gold, silver, and moisture content have been agreed. The Company utilizes ALS Geochemistry, Reno, NV, for concentrate assay and the Refinery, Just Refiners, Reno NV, utilizes their in-house laboratory. The concentrate represents approximately 10 tons of gross ore processed inclusive of moisture content. The recovery is from initial operations of the gravity only circuit with the flotation circuit to be brought on-line this month. The Company currently has an additional test shipment in process and has recently completed a 3 rd gold concentrate shipment.

Refinery Settlement

| LBS. (WET) | 281 | ||

| MOISTURE | 18.22 | % | |

| LBS (DRY) | 230 | ||

| DST | 0.115 | ||

| Au oz/dst | 12.181 | ||

| Ag oz/dst | 5.719 | ||

| Au: | 1.401 oz | ||

| Ag: | 0.658 oz | ||

| Metal Price Aptil 2, 2025 | |||

| Au | $ | 3,119.75 | |

| Ag | $ | 33.87 | |

| Total Value | $ | 4,172.29 | |

| Net Payment | $ | 3,981.83 | |

Bishop Gold Mill Operations

The net value paid on the recent gold sale is equivalent to approximately $400 per ton. Further optimization of the gravity circuit along with the implementation of the flotation circuit are expected to increase recovery by up to 100% generating greater than 90% total recovery and a commensurate increase in value per ton to $800. In addition, ore control and head grade monitoring will be implemented as shipment sizes increase to give greater predictability and mass balance control at the Mill. Transportation costs for the recent 120 ton shipment from Fran was approximately $300 per ton which is expected to decrease to $200 per ton for all future shipments as a result of the recent opening of a new rail siding proximate to Fran. The siding was designed for ore on-loading from the nearby recently opened Blackwater Gold Mine and became operational on March 31, 2025. Milling costs are nominal at this time due to the low volume of ore being processed during optimization and ramp up. Direct operating cost is projected at $35 per ton or $3,500 per operating day at the rated mill capacity of 100 tons per day. Tariffs are expected to be $25 per ton or less due to the low value of the raw ore. Based on recent data, previous MET studies and head grade assays, target economics for the Mill is revenue of $800 per ton and costs of $300 per ton.

Seventy-five tons of ore is currently stockpiled at the Bishop Gold Mill. The ore will continue to be processed as part of optimization and ramp-up with additional shipments to follow. There is approximately 5,000 tons of stockpiled ore at the Project site. The main focus of optimization is now the flotation circuit. The Company has all necessary re-agents and has tested the mechanical aspects of the flotation circuit. The selective testing of the titration controls for frother and reagents is now underway. The implementation of the flotation circuit is expected to increase recovery by up to 100% from the current gravity only recovery, with overall recovery expected to reach 90%+. Independent metallurgical testing has resulted in a total recovery, inclusive of gravity and flotation circuits, of 97%. In addition, the Company has begun start-up of its concentrate drying circuit to reduce moisture content prior to refinery shipment.

Fran Gold Project

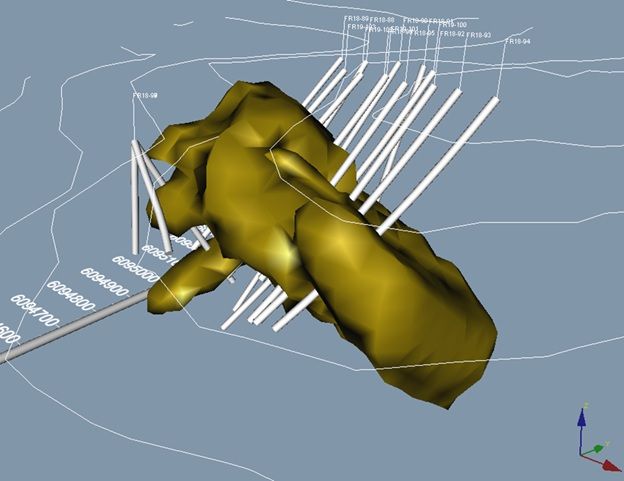

Recent data re-compilation has resulted in the discovery of a bulk tonnage gold deposit at Fran ( see Press Release dated April 1, 2025 ). Re-calculation utilizing a 3D Model originally created at the time of the 2018-2019 drilling has provided for an initial volumetric model of the deposit. The model represents less than half of the known deposit and utilizes a very small portion of the 104 drill holes. Never-the-less a number of significant features can be noted including the general strike and orientation as well as continuation of the deposit to a significant extent at depth and to the East in addition to being open to a limited extent to the West and potential for a smaller parallel system to the South. The deposit model also shows the near surface aspect of the deposit which has been verified by extensive surface trenching.

Fran Gold 3D Model DDH 2018-2019

Approximately half of the 104 historic diamond drill holes have been re-analyzed to date.

Significant Drill Intercepts

| Hole ID | From (m) | To (m) | Width (m) | Grade g/t |

| 2006-43 | 153.0 | 193.2 | 40.2 | 0.7 |

| 2006-47 | 35.1 | 81.6 | 46.5 | 1.3 |

| 2006-49 | 104.1 | 119.3 | 15.1 | 2.7 |

| 2006-50A | 44.3 | 118.1 | 73.8 | 0.7 |

| 2006-51 | 66.1 | 85.4 | 19.3 | 0.7 |

| 2006-53 | 79.8 | 92.9 | 13.1 | 1.6 |

| 2006-55 | 27.9 | 100.5 | 72.5 | 1.8 |

| 2006-56 | 90.5 | 116.5 | 26.1 | 1.2 |

| 2006-58 | 61.4 | 157.4 | 96.0 | 0.3 |

| 2006-59 | 21.8 | 74.1 | 52.3 | 0.6 |

| 2006-60 | 90.5 | 131.5 | 41.0 | 0.7 |

| 2006-61 | 9.1 | 58.8 | 49.6 | 0.6 |

| 2006-62 | 79.9 | 150.3 | 70.5 | 0.5 |

| 2007-68 | 127.1 | 147.1 | 20.0 | 0.8 |

| 2007-69 | 171.3 | 197.8 | 26.6 | 0.5 |

| 2007-70 | 131.1 | 246.0 | 114.9 | 0.7 |

| 2007-71 | 32.9 | 116.9 | 84.0 | 0.9 |

| 2007-72 | 78.9 | 106.9 | 28.0 | 0.3 |

| 2007-73 | 180.6 | 194.2 | 13.6 | 0.4 |

| 2007-74 | 111.9 | 269.8 | 157.9 | 0.6 |

| incl. | 111.9 | 188.0 | 76.1 | 1.1 |

| 2007-75 | 49.0 | 124.5 | 75.5 | 0.8 |

| 2007-76 | 133.2 | 169.8 | 36.6 | 0.9 |

| 2018-91 | 249.4 | 296.0 | 46.6 | 0.4 |

| 2018-94 | 222.0 | 339.2 | 117.2 | 0.6 |

| 2018-95 | 202.7 | 309.0 | 106.3 | 1.0 |

| 2018-96 | 134.7 | 284.0 | 149.3 | 0.9 |

| 2018-103 | 105.7 | 178.6 | 72.9 | 1.4 |

Past exploration and development, including over 18,000m (55,000ft.) of diamond drilling, has shown large intercepts of mixed vein and disseminated gold. The deposit area has been identified to be in excess of 1000m x 100m x 300m within a known strike length of 1700m. The Fran Gold Project is next to Centerra Gold's Mt. Milligan Project, with Reserves of 264Mt grading 0.3 gram per tonne gold and 0.2% copper and proximate to Artemis Gold's Blackwater Mine, with Proven and Probable Reserves of 334Mt grading 0.8 grams per tonne gold. Both Mt. Milligan and the Blackwater Mine are two of the largest new copper/gold and gold mines respectively, in North America.

On behalf of the Board of Directors of

North Bay ResourceS INC.

Jared Lazerson

CEO

X: @NorthBayRes

YouTube: North Bay Resources - YouTube

LinkedIn: North Bay Resources Inc | LinkedIn

This news release may contain certain "Forward-Looking Statements" within the meaning of the United States Private Securities Litigation Reform Act of 1995 and applicable Canadian securities laws.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/d6d8dbf3-98a1-4857-9932-7a187b9838b1