(TheNewswire)

-

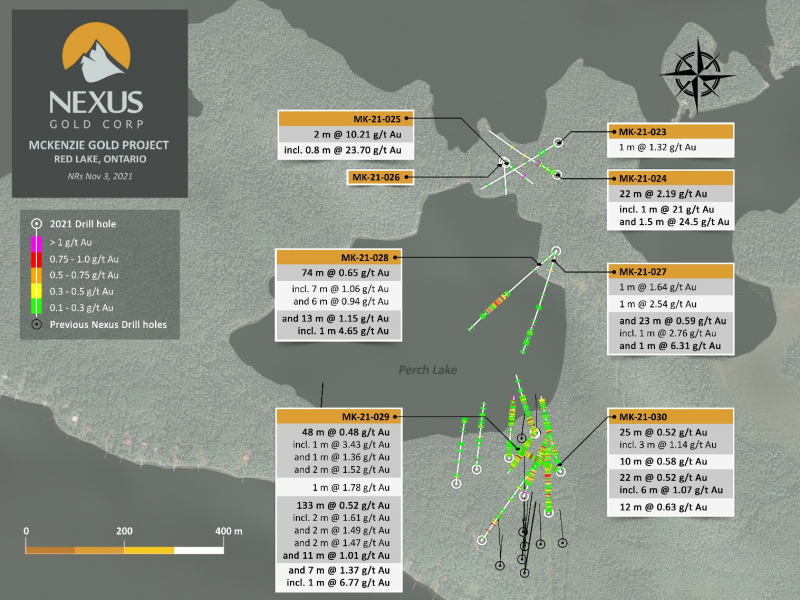

Hole MK-21-025 returns 10.21 g/t Au over 2 meters

-

Hole MK-21-028 returns 74m of 0.65 g/t Au

-

Includes 13m of 1.15 g/t Au and 7m of 1.06 g/t Au

-

Strike length now over 475 meters

Vancouver, Canada - TheNewswire - February 15, 2022 - Nexus Gold Corp. (" Nexus " or the " Company ") (TSXV:NXS ) ( OTC:NXXGF ) ( FSE:N6E) is pleased to report additional assay results from its second round of phase two diamond drilling on its 100% owned McKenzie Gold Project located at Red Lake, Ontario.

This second round of drilling, completed in December 2021, was designed to test gold anomalies occurring in and around historic trenches identified earlier in the fall by prospecting teams employed by the Company. The program was also testing the potential strike extension of mineralization identified in the first round of phase two drilling in the spring of 2021. The program consisted of eight drill holes totaling 2000 meters (full summary of the four holes received is tabled below).

Highlights from the final four holes from the December drill program include:

-

MK-21-025 returned 2 meters ("m") of 10.21 grams-per-tonne ("g/t") gold ("Au"), which includes .8m of 23.7 g/t Au

-

MK-21-028 returned 0.65 g/t Au over 74m, including 7m of 1.16 g/t Au, 6m of 0.94 g/t Au, and 13m of 1.15 g/t Au

-

MK-21-029 returned multiple intercepts, including 133m of 0.52 g/t Au, which includes 11m of 1.01 g/t Au, 7m of 1.37 g/t Au, 2m of 1.61 g/t Au among others, and 48m of 0.48 g/t Au (see table following)

Seven of the eight holes drilled in December successfully intersected gold mineralization. To date Nexus has drilled 30 holes at McKenzie, with 27 returning gold values of 1 gram-per-tonne gold or better (visit nxs.gold for a complete drill table under the McKenzie Gold Project tab). Data generated shows a mineralized trend that develops south of Perch Lake and continues in a north/north-westerly direction.

All drill holes were collared in the Dome Stock and successfully cored through granitic rock displaying zones of potassic ("K") alteration with zones of silica and sericitic alteration; sulphide mineralization consisting primarily of pyrite with lesser chalcopyrite; and occasional molybdenite and sphalerite hosted in quartz carbonate stringers and veins, which was reported occurring in both alteration styles but in greater amounts in the siliceous sericitically altered granite.

The following table includes results from the final four holes drilled in December 2021:

| DRILL HOLE | UTM_E | UTM_N | ELEV (m) | AZIMUTH | DIP | FROM | TO | LENGTH | Au g/t |

| MK-21-023 | 437725 | 5653016 | 366 | 240 | -45 | 107 | 108 | 1 | 1.32 |

| MK-21-025 | 437608 | 5652926 | 362 | 130 | -45 | 66 | 68 | 2 | 10.21 |

| Includes | 66 | 67 | .8 | 23.70 | |||||

| MK-21-028 | 437718 | 5652729 | 360 | 230 | -45 | 203 | 276 | 74 | 0.65 |

| Includes | 207 | 214 | 7 | 1.06 | |||||

| And | 220 | 226 | 6 | 0.94 | |||||

| And | 260 | 273 | 13 | 1.15 | |||||

| Includes | 272 | 273 | 1 | 4.65 | |||||

| MK-21-029 | 437725 | 5652342 | 380 | 290 | -70 | 40 | 88 | 48 | 0.48 |

| Includes | 47 | 48 | 1 | 3.43 | |||||

| And | 53 | 54 | 1 | 1.36 | |||||

| And | 58 | 60 | 2 | 1.52 | |||||

| And | 80 | 81 | 1 | 1.00 | |||||

| 115 | 116 | 1 | 1.78 | ||||||

| 132 | 265 | 133 | 0.52 | ||||||

| Includes | 141 | 142 | 1 | 2.57 | |||||

| And | 163 | 165 | 2 | 1.61 | |||||

| And | 168 | 170 | 2 | 1.49 | |||||

| And | 178 | 180 | 2 | 1.47 | |||||

| And | 200 | 211 | 11 | 1.01 | |||||

| And | 227 | 228 | 1 | 1.82 | |||||

| And | 231 | 232 | 1 | 2.67 | |||||

| And | 243 | 250 | 7 | 1.37 | |||||

| Includes | 243 | 244 | 1 | 6.77 | |||||

| And | 264 | 265 | 1 | 1.59 |

"This round of drilling has shown that the longer gold intercepts hosted in the silicious and sericitic altered granite is trending to the north west, towards the historic Trench 3 found in our recent prospecting program," said VP Exploration, Warren Robb. "We clipped this zone in hole 27 but clearly intersected it in hole 28 adding an addition 50 meters to this zone's strike extent. The drilling north of Perch Lake has intersected a higher grading quartz vein which was intersected by holes 24 and 25 and we have traced it now for 50 meters," continued Mr. Robb.

"The drilling we've done so far at McKenzie has resulted in the discovery of a well mineralized gold system, combining higher grade gold in quartz veins with lengthy, near 1-gram intercepts that permeate out into the intrusives," said President and CEO, Alex Klenman. "The vast majority of the holes we've drilled have returned positive results. We've established almost 500 meters of strike length. We are now planning a follow up drill program to pursue the mineralization to the north west and extend the known strike," continued Mr. Klenman.

Initial holes from the December drill program, previously reported (NR dated February 9, 2022):

| DRILL HOLE | UTM_E | UTM_N | ELEV (m) | AZIMUTH | DIP | FROM | TO | LENGTH | Au g/t |

| MK-21-024 | 437725 | 5652960 | 360 | 300 | -45 | 54 | 76 | 22 | 2.19 |

| includes | 65 | 66 | 1 | 21.00 | |||||

| and | 70.5 | 72 | 1.5 | 24.50 | |||||

| MK-21-026 | 437608 | 5652980 | 362 | 190 | -50 | NSR | |||

| MK-21-027 | 437718 | 5652792 | 360 | 195 | -45 | 13 | 14 | 1 | 1.64 |

| 234 | 235 | 1 | 2.54 | ||||||

| 247 | 270 | 23 | 0.59 | ||||||

| includes | 234 | 265 | 1 | 2.76 | |||||

| and | 269 | 270 | 1 | 6.31 | |||||

| MK-21-030 | 437725 | 5652342 | 380 | 350 | -50 | 75 | 100 | 25 | 0.52 |

| includes | 76 | 77 | 1 | 1.84 | |||||

| 90 | 91 | 1 | 1.14 | ||||||

| 97 | 100 | 3 | 1.41 | ||||||

| 107 | 117 | 10 | 0.58 | ||||||

| Includes | 111 | 112 | 1 | 3.57 | |||||

| 135 | 136 | 1 | 1.75 | ||||||

| 153 | 154 | 1 | 1.12 | ||||||

| 165 | 187 | 22 | 0.52 | ||||||

| Includes | 173 | 179 | 6 | 1.07 | |||||

| 251 | 263 | 12 | 0.63 | ||||||

| Includes | 253 | 259 | 6 | 1.17 | |||||

| Includes | 256 | 258 | 2 | 2.41 |

Drill core is logged and sampled in a secure core storage facility located in Red Lake, Ontario. Core samples from the program are cut in half, using a diamond cutting saw, and are sent to Activation Laboratories in Ontario, an accredited independent mineral analysis laboratory, for analysis. All samples are analyzed for gold using standard Fire Assay-AA techniques. Certified gold reference standards, blanks and field duplicates are routinely inserted into the sample stream, as part of Nexus's quality control/quality assurance program (QA/QC).

Drilling at McKenzie Gold Project

This 2000-meter drill program commenced with the first hole being drilled to test the northern extent of gold mineralization identified by earlier drilling conducted by the Company in April 2021 which included holes MK-21-018 and MK-21-019, both of which returned significant gold intercepts (see Company news releases dated May 25 and June 1, 2021), and to test gold mineralization recently identified during a fall targeting and prospecting program conducted north of Perch Lake.

Selective grab samples obtained during the fall program returned gold assays of ^13.40 grams-per-tonne ("g/t") gold ("Au"), 7.70 g/t Au, 6.83 g/t Au, 3.54 g/t Au, and 3.51 g/t Au, respectively, confirming mineralization in this new area.

Three historical trenches and a new showing were also identified during the prospecting program (see image 1). The trenches are comprised of quartz veins containing clots and patches of semi massive chalcopyrite, pyrite and molybdenite. The veins are hosted in granite which displays strong pervasive silica flooding. Local discrete shearing in both trenches trend at approximate attitudes of 330° and dip 70° to 80° to the east, displaying similar trends and lithologies established in the Company's previous drill campaigns.

This second round of diamond drilling was planned to expand on the results obtained in the Company's previous drill programs. These programs outlined a broad zone of gold mineralization in the St. Paul's Bay area, located in the southernmost section of the claim block below Perch Lake.

Significant results from these drill programs include:

-

MK-20-RC-006: 2.75m of 13.25 grams-per-tonne ("g/t") gold ("Au") , including 1m of 36.20 g/t Au (68.75m to 70.5m)

-

MK-20-RC-008: 55.5m of 1 g/t Au (67.5m to 123m), including 16m of 1.42 g/t Au, 6m of 2.37 g/t Au, and 9m of 1.14 g/t Au

-

MK-21-DD-018: 56m of 1.01 g/t Au (13m to 69m), including 21.5m of 1.84 g/t Au, 10m of 3.30 g/t Au, and 1m of 23.1 g/t Au. Other intercepts included 37.6m of 2.78 g/t Au (77m to 115m), including 24.7m of 4.05 g/t Au, 14m of 7.01 g/t Au, and 1m of 94.2 g/t Au.

-

Th e entire length of MK-21-DD-018 averaged .99 g/t Au over 198m

-

MK-21-DD-019: 136m of 1.25 g/t Au (148m to 285m), including 44.9m of 3.00 g/t Au, 15.5m of 5.25 g/t Au, 29.4m of 1.82 g/t Au, and 6m of 5.45 g/t Au. High-grade intercepts included 1m of 59.8 g/t Au, 1m of 15.5 g/t Au, and 1m of 26.7 g/t Au.

-

Hole MK-21-DD-19 ended in mineralization at 285 meters, with an average grade of the hole returning .74 g/t Au over 283.4m

See Company news releases, September 3, 2020, May 25, 2021, and June 1, 2021, for more details on previous diamond drill programs.

All reported holes were drilled entirely in a granitic rock of the Dome stock and displayed patchy moderate-to-strong silica alteration. Silica altered intervals are typically associated with high density micro-fracturing and increased molybdenite and chalcopyrite mineralization. Fine-grained fluorescent scheelite was also observed. The granite was strongly magnetic, containing 2-3% fine-grained disseminated magnetite.

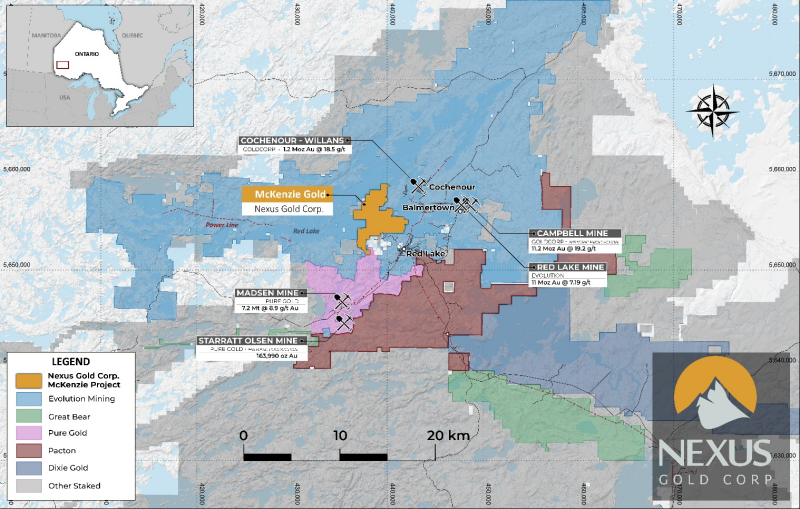

Figure 2: McKenzie Gold Project, Red Lake, Ontario, with nearby advanced prospects, producers, and past producers

About the McKenzie Gold Project

The 100%-owned McKenzie Gold Project is an approximately 1,400-hectare gold exploration project located in the heart of the historic Red Lake gold camp, in western Ontario, Canada. Areas of high-grade gold mineralization have been established within the northern portion of the claim block (McKenzie Island), with significant gold values having been drilled along a 600-meter strike in the southern portion of the property (St. Paul's Bay area).

Significant results from the Company's initial drill program in August 2020 include hole MK-20-006 which returned 2.75 meters of 13.25 g/t Au, including 1m of 36.2 g/t Au; hole MK-20-007 which returned 117.4m of 0.33 g/t Aum including 9.4m of 1.26 g/t Au, and 1.5m of 4.64 g/t Au; and hole MK-20-007, which returned 117.5m of .62 g/t Au, including 55.5m of 1.00 g/t Au, which included 16m of 1.42 g/t Au (including 6m of 2.37 g/t Au and 2m of 4.28 g/t Au), and 9m of 1.14 g/t Au. See the Company website – www.nxs.gold – for the complete McKenzie project drill table.

Results from the Company's initial summer 2020 drill program returned values similar to historic drilling in the area, which have been typically higher-grade intercepts over narrow widths (i.e., 0.5m to 1m of > 5 g/t Au). In addition, holes 007 and 008 identified a second style of gold mineralization on the McKenzie property. These lengthy (> 100m) disseminated, sub and near one-gram gold intercepts more closely resemble the type of mineralization being explored at the Hasaga Project, located approximately 5kms to the south-east of the McKenzie project ground.

The Hasaga property is host to the past-producing Hasaga and Gold Shore Mines and is strategically located proximal to the Balmer-Confederation regional unconformity, recognized as an important geologic feature at the multi-million ounce past and currently producing Red Lake area mines. The deposits on the Hasaga Project are estimated as hosting an Indicated mineral resource of 42.294 million tonnes at a grade of 0.83 g/t gold representing 1,123,900 ounces of gold (Indicated)*.

Nexus Amends Dorset Option Agreement

Nexus Gold Corp. (the "Company") is pleased to announce that it has reached an agreement (the "Amended Agreement") with Leocor Gold Inc. ("Leocor") (CSE: LECR), dated February 8, 2022, pursuant to which it has agreed to amend the terms by which Leocor can acquire the Dorset Gold Project (the "Project") located in the Province of Newfoundland. The Amended Agreement replaces the existing property option agreement (the "Option Agreement") entered into between the Company and Leocor, dated April 22, 2020.

Under the terms of the Amended Agreement, Leocor will continue to hold a right to acquire up to a one-hundred percent interest in the Project. Consideration for the acquisition will now consist of the following:

| Deadline | Cash Payment | Common Shares |

| Initial | $100,000 (Paid) | Nil |

| Year 1 | $50,000 (Paid) | Nil |

| February 28, 2022 | $200,000 | 333,333 |

| February 28, 2023 | $200,000 | 333,333 |

| February 28, 2024 | Nil | 333,334 |

| Total | $550,000 | 1,000,000 |

Leocor will also assume responsibility for a two percent net smelter returns royalty on the Project, currently held by United Gold Inc. and Margaret Duffitt. All common shares of Leocor issued to the Company will be subject to statutory restrictions on resale for a period of four-months-and-one-day following issuance in accordance with applicable securities laws.

Alex Klenman is a director and senior officer of both the Company and Leocor, however the Amended Agreement and the Option Agreement are not considered related party transactions within the meaning of Multilateral Instrument 61-101, Protection of Minority Security Holders in Special Transactions . The Company and Leocor are considered to be "non-arms' length parties" under the policies of the TSX Venture Exchange, and as a result the Amended Agreement is subject to review by the TSX Venture Exchange.

The Amended Agreement and the Option Agreement have been reviewed and approved by the independent directors of each of the Company and Leocor, but the acquisition of any interest in the Project by Leocor, under the terms of the Amended Agreement, remains subject to the approval of the TSX Venture Exchange.

Nexus Appoints Brian Shin to the Board of Directors

The Company is also please to announce the appointment of Mr. Brian Shin as a Director of the Company effective immediately.

Mr. Shin specializes in providing financial reporting, corporate finance, auditing, corporate strategy, risk management and other accounting services to both public and private companies in various industries. He holds the professional designation of Chartered Professional Accountant (CPA) in B.C. and Canada and Certified Management Consultant (CMC). Mr. Shin has had extensive experience as a consultant, controller and auditor for numerous publicly traded and private corporations in several industries in multiple countries such as Canada, Hong Kong and South Korea.

Alex Klenman, President and CEO of Nexus Gold states, "On behalf of Nexus Gold's Board of Directors, I am very pleased to welcome Brian Shin to the Company. We are confident that Brian's experience and perspective will be of great value to Nexus Gold as the Company grows."

* Reported lengths are intercepts and are not true widths

^ Grab samples are selected samples and are not necessarily representative of mineralization hosted on the property. All samples were sent to Activation Laboratories in Ontario, an accredited mineral analysis laboratory, for analysis.

Drill core is logged and sampled in a secure core storage facility located in Red Lake Ontario. Core samples from the program are cut in half, using a diamond cutting saw, and are sent to Activation Laboratories in Ontario, an accredited mineral analysis laboratory, for analysis. All samples are analyzed for gold using standard Fire Assay-AA techniques. Certified gold reference standards, blanks and field duplicates are routinely inserted into the sample stream, as part of Nexus's quality control/quality assurance program (QA/QC). No QA/QC issues were noted with the results reported herein.

* NI 43-101 Technical Report, Hasaga Project, Red Lake Mining District, Ontario, Canada, NTS Map Sheets 52K/13 and 52N/04 by Vincent Jourdain (Ph.D., P.Eng.), John Langton (M.Sc., P. Geo.) & Abderrazak Ladidi (P.Geo.) , February 24 th , 2017.

Warren Robb P.Geo., Vice President, Exploration, is the designated Qualified Person and has reviewed and approved the technical information contained in this release. Any historic drill and sample data contained in this release was verified by the QP by comparing reported assay data with Certificates of Analysis documented. The QP has verified mineral showings and areas of select sampling and the collars of reported historic drill hole locations. It is the QP's opinion that the data as presented is adequate and can be relied upon for use in this press release.

About the Company

Nexus Gold is a Canadian-based gold exploration and development company with an extensive portfolio of projects in Canada and West Africa. The Company's primary focus is on its 100%-owned, 98-sq km Dakouli 2 Gold Concession in Burkina Faso, West Africa, and the approximately 1400-ha McKenzie Gold Project, located in Red Lake, Ontario. The Company is focusing on the development of its core assets while seeking joint-venture, earn-in, and strategic partnerships for other projects in its portfolio.

For more information, please visit nxs.gold

On behalf of the Board of Directors of

Nexus Gold CORP.

Alex Klenman

President & CEO

604-558-1920

info@nexusgoldcorp.com

www.nexusgoldcorp.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. This news release may contain forward-looking statements. These statements are based on current expectations and assumptions that are subject to risks and uncertainties. Actual results could differ materially because of factors discussed in the management discussion and analysis section of our interim and most recent annual financial statement or other reports and filings with the TSX Venture Exchange and applicable Canadian securities regulations. We do not assume any obligation to update any forward-looking statements, except as required by applicable laws.

Copyright (c) 2022 TheNewswire - All rights reserved.