Northern Lights Resources Corp. ("Northern Lights" or the "Company") (CSE:NLR)(OTCQB:NLRCF) is pleased to announce a significant expansion to the claim base and the commencement of exploration work at the Medicine Springs Project located in Elko County, Nevada, that the Company is exploring in joint venture with Reyna Silver Corp. ("Reyna Silver"), (TSX.V:RSVL

Under the terms of the Medicine Springs Option and Joint Venture Agreement, announced October 5, 2021, Reyna Silver will earn a 75% interest in the Medicine Springs Project ("Medicine Springs" or the "JV Project") by fulfilling various commitments including completing exploration work commitments totalling US$2.4 million. Reyna may acquire an additional 5% in Medicine Springs by paying Northern Lights US$1.0 million. Under the terms of the Joint Venture, Reyna Silver is responsible for the first US$4.0 million of exploration expenditures, then both Reyna Silver and Northern Lights will contribute to expenditures on a pro-rata equity basis.

In early May, Reyna Silver CEO Jorge Ramiro Monroy, Dr. Peter Megaw and NLR geologist, Dr. Bill Tafuri spent several days at the Medicine Springs site finalizing the 2021 exploration plan for the project. Please see the the link to a presentation by Dr Peter Megaw while on site at Medicine Springs ("Peter Megaw - Medicine Springs").

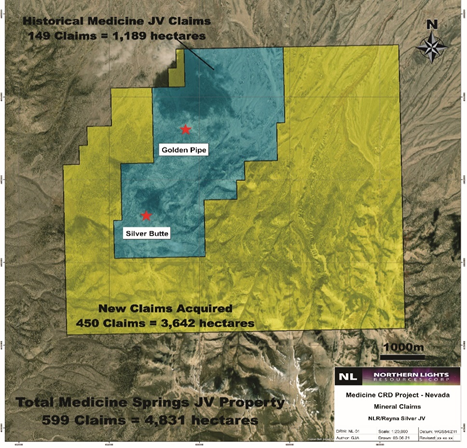

To capture the total limits of the recognized mineralization and alteration system observed at Medicine Springs, Reyna Silver has aggressively staked additional mineral claims contiguous with the original Medicine Springs 1,189 hectare (149 claims) project claim boundaries. A total of 450 new unpatented Federal mineral claims have been added to the JV Project area increasing the total land position to 4,831 hectares (599 claims), an increase of over 300%. (Under the terms of the joint venture with Reyna Silver, any land acquired within a 5-mile radius of the original Medicine Springs mineral claims is included within the JV Project area.) See Figure 1 - Medicine Springs Joint Venture Mineral Claims.

The 2021 exploration plan for the JV Project includes:

- The orientation sampling phase is complete (assays pending)

- A property wide Lidar-like survey is being flown this week. This will facilitate mapping and identify target areas for sampling.

- A systematic property-wide mapping and selective jasperoid sampling program to determine the limits of the alteration system and where its center (or centers) are located.

- Potential additional Magnetic and NSAMT geophysics for drill targeting.

The exploration program builds on geological studies completed by Northern Lights and indicates that there are several mineralization centers in the district developed along strong NE-SW structures reflected by topography and marked by Carbonate Replacement Deposit ("CRD") style jasperoid alteration. Reyna interprets the known mineralization and alteration as "leakage" from more concentrated mineralization at depth and intends to trace the system to depth by outlining and following the system's structural "plumbing" network.

"Jasperoids are an important alteration style marking the limits of major CRD systems, so finding them well outside of our initial Medicine Springs property package means the system is larger than we thought and triggered tripling our property holdings--we are comfortable we now cover the whole thing", stated Dr. Peter Megaw, Technical Advisor to Reyna Silver. "We look forward to defining drill targets quickly by building on Northern Lights excellent work through our expanded district-scale mapping and sampling approach".

Northern Lights CEO, Jason Bahnsen, commented "We are delighted to work with the excellent team at Reyna Silver to build on the 2+ years of exploration work completed by Northern Lights which led to the identification of CRD mineralization on the project. The recent staking has inceased the project size by over 300%, creating a district scale project with significant potential."

Figure 1 - Medicine Springs Joint Venture Mineral Claims(For enhanced image click here)

The scientific and technical data contained in this news release was reviewed and approved by Gary Artmont (Fellow Member AUSIMM #312718), Head of Geology and qualified person to Northern Lights Resources, who is responsible for ensuring that the geologic information provided in this news release is accurate and who acts as a "qualified person" under National Instrument 43-101 Standards of Disclosure for Mineral Projects.

For further information, please contact:

Albert Timcke, Executive Chairman and President

Email: rtimcke@northernlightsresources.com

Tel: +1 604 608 6163

Jason Bahnsen, Chief Executive Officer

Email: Jason@northernlightsresources.com

Tel: +1 604 608 6163

Shawn Balaghi, Investor Relations

Email: shawn@northernlightsresources.com

Tel: +1 604 773 0242

About Northern Lights Resources Corp.

Northern Lights Resources Corp is a growth-oriented exploration and development company that is advancing two projects: The 100% owned, Secret Pass Gold Project located in Arizona; and the Medicine Springs silver-zinc-lead Project located in Elko County Nevada where Northern Lights are in joint venture with Reyna Silver Corp (TSX.V "RSLV"), (25% Northern Lights / 75% Reyna Silver).

Northern Lights Resources trades under the ticker of "NLR" on the CSE exchange and "NLRCF" on the OTCQB exchange. This and other Northern Lights Resources news releases can be viewed at www.sedar.com and www.northernlightsresources.com.

About Reyna Silver

Reyna Silver Corp. is a silver exploration company with a robust portfolio of silver assets in Mexico and the US. The Company was built around the Guigui and Batopilas Projects, which formed part of MAG Silver's original IPO portfolio. It is also actively exploring the Medicine Springs project in Nevada, another CRD target and the La Reyna Project in Chihuahua, an epithermal vein project in the historic Cusihuriachic district. Reyna's strategy centers around leveraging its expertise in Mexico and elsewhere to explore projects that have the potential for high-grade, district-scale discoveries.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION: This news release includes certain "forward-looking statements" under applicable Canadian securities legislation. Forward-looking statements include, but are not limited to, statements with respect to: the terms and conditions of the proposed private placement; use of funds; the business and operations of the Company after the proposed closing of the Offering. Forward-looking statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable, are subject to known and unknown risks, uncertainties, and other factors which may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking statements. Such factors include, but are not limited to: general business, economic, competitive, political and social uncertainties; delay or failure to receive board, shareholder or regulatory approvals; and the uncertainties surrounding the mineral exploration industry. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward looking statements. The Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

SOURCE: Northern Lights Resources Corp.

View source version on accesswire.com:

https://www.accesswire.com/650970/Medicine-Springs-JV--Project-Expansion-and-Exploration-Update