Several significant veins composed of sulfide and sulfosalt mineralization have been intersected

Idaho Champion Gold Mines Canada Inc. (CSE:ITKO)(OTCQB:GLDRF)(FSE:1QB1)("Idaho Champion" or the "Company") is pleased to provide an update on the 2021 exploration program at its 100% controlled Champagne Gold Project ("Champagne") near the city of Arco, Butte County, Idaho

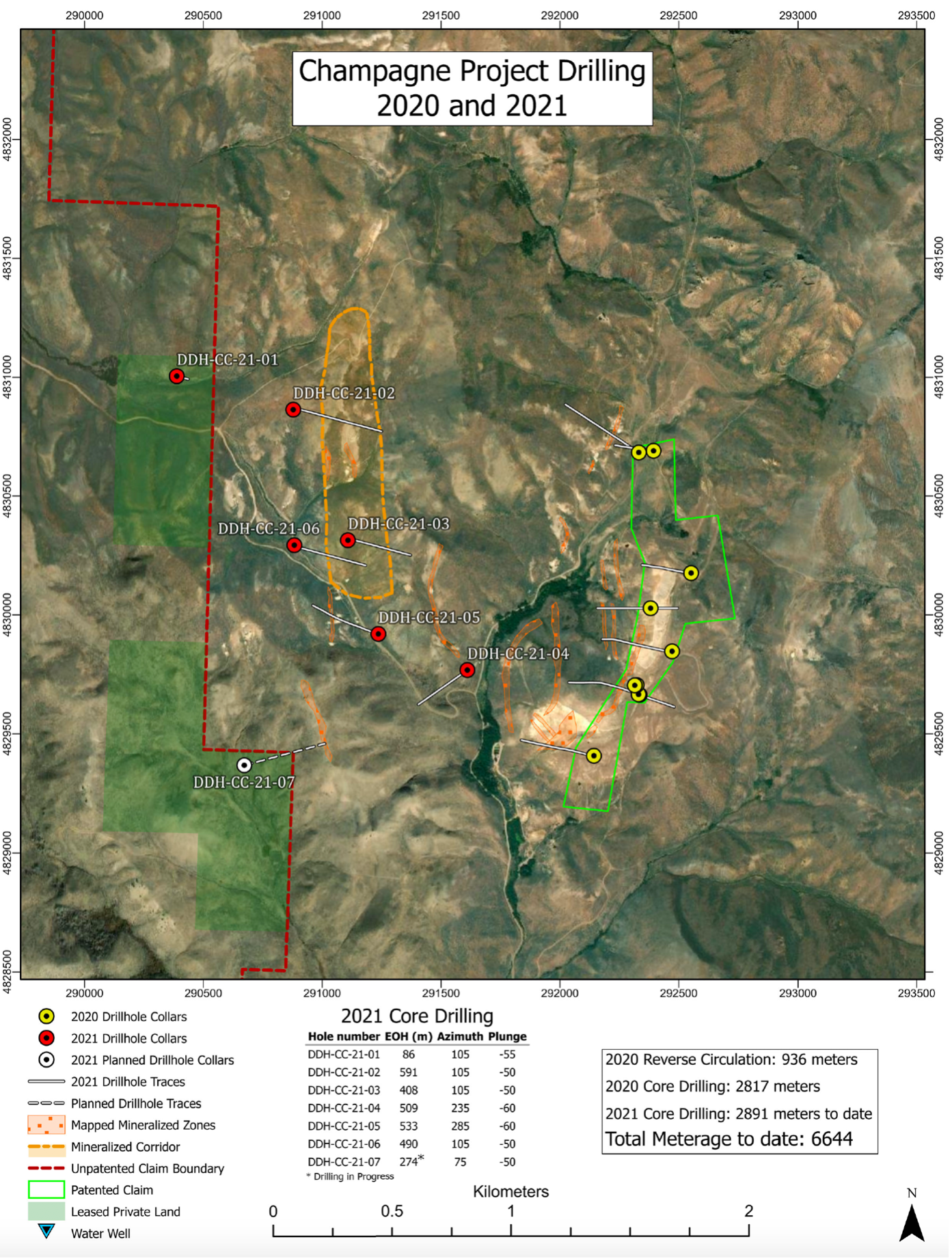

Recently announced core drilling (See press release dated July 7, 2021) has identified a new mineralized Corridor which is located on the high priority anomalous drill target area to the north-west of the past producing open pits and covers approximately 800 metres north-south and 300 metres east-west.

Drill core for holes one (1) through four (4) have been sent to the lab for assay and Champion is currently cutting and logging holes five (5) through seven (7) with a total of 2,900 metres drilled to date.

Figure 1: Drill Core from DDH-CC-21-02 showing fracture veinlets and narrow veins of sulfides

"The targets for the 2021 drill program are the displaced roots of the multiple veins of the Mine Hill polymetallic (Ag, Pb-Zn-Ag, and Cu-Ag) system and also nearby vuggy silica sheeted breccias mined for Au-Ag at the North and South Pits," commented Chief Geologist, Rob Kell. "The characteristics of the vein system and sheeted breccia are typical of high sulfidation epithermal deposits sourced from a porphyry copper intrusion at greater depth. The 2020 drilling determined that the vein system and breccias at Mine Hill were cut off at shallow depth by a detachment fault. The follow-up IP survey identified a large chargeability anomaly positioned 800 meters to the west of Mine Hill. Testing the near-surface parts of this IP anomaly is a key component of our strategy for 2021.

Figure 2: 2020 and 2021 drilling locations and mineralized corridors

Drill Program Update

Drill holes DDH-CC-21-02, 03, and 06 intercepted a corridor of moderately to strongly altered andesitic volcanics and tuffaceous rocks, dominantly clay- and/or quartz-sericite-pyrite (QSP) alteration. Quartz-latite porphyry dikes also crosscut the volcanic rocks. Thick sections host disseminated sulfides in intervals up to 300 metres in total width. Hydrothermal alteration is seen to increase in intensity with depth. In total, this corridor of alteration, veining, and brecciation extends for over 800m in a north-south direction and is up to 300m wide.

These holes also encountered intervals of fracture veinlets and narrow veins of pyrite, galena, sphalerite, chalcopyrite, and dark grey sulfosalts that crosscut the volcanic rocks and the porphyry dikes. DDH-CC-21-03 passed through a more significant vein, possibly the St. Louis Vein at 63 metres depth, which consists of subequal amounts of pyrite and sulfosalts (See Figure 3). Deeper parts of the vein systems appear to be zoned towards silver-copper rather than lead-zinc minerals. While assays are pending, semi-quantitative analysis by field-portable X-ray fluorescence (XRF) indicated that the veins are enriched in silver, lead, zinc, and copper.

Figure 3: 2021 Drilling DDH-21-03 showing a vein with pyrite and sulfosalt minerals

Drilling has confirmed that alteration and veining do continue into the rocks that underly the caldera and volcanic rocks. Several narrow (but significant) veins composed entirely of sulfide and sulfosalt mineralization were also intersected in the hornfelsed "basement" siliciclastic sedimentary rocks. Hornfels alteration is formed by contact metamorphism from higher temperature rocks, which could indicate the presence of more porphyritic rocks at depth. The sedimentary basement rocks in this area are known as the Mississippian McGowan Creek Formation.

About the Champagne Project

The Champagne Mine* was operated by Bema Gold as a heap leach operation on an epithermal gold-silver system that occurs in volcanic rocks. Bema Gold drilled 72 shallow reverse circulation holes on the project, which complement drilling and trenching from other previous operators. The property has had no deep drilling or significant modern exploration since the mine closure in early 1992.

The Champagne Deposit contains epigenetic style gold and silver mineralization that occurs in strongly altered Tertiary volcanic tuffs and flows of acid to intermediate composition. Champagne has a near surface cap of gold-silver mineralization emplaced by deep-seated structures that acted as conduits for precious metal rich hydrothermal fluids. Higher grade zones in the Champagne Deposit appear to be related to such feeder zones.

* The Company cautions that the information about the past-producing mine may not be indicative of mineralization on Champion's property, and if mineralization does occur, that it will occur in sufficient quantity or grade that would result in an economic extraction scenario. The historic data were simply used to evaluate the prospective nature of the property. The Company has not yet conducted sufficient exploration to ascertain if a mineral resource is present on the property.

Qualified Person

The technical information in this press release has been reviewed and approved by Peter Karelse P.Geo., a consultant to the Company, who is a Qualified Person as defined by NI 43-101. Mr. Karelse has more than 30 years of experience in exploration and development.

About Idaho Champion Gold Mines Inc.

Idaho Champion is a discovery-focused gold exploration company that is committed to advancing its 100%-owned highly prospective mineral properties located in Idaho, United States. The Company's shares trade on the CSE under the trading symbol "ITKO", on the OTCQB under the trading symbol "GLDRF", and on the Frankfurt Stock Exchange under the symbol "1QB1". Idaho Champion is vested in Idaho with the Baner Project in Idaho County, the Champagne Project located in Butte County near Arco, and four cobalt properties in Lemhi County in the Idaho Cobalt Belt. Idaho Champion strives to be a responsible environmental steward, stakeholder and a contributing citizen to the local communities where it operates. Idaho Champion takes its social license seriously, employing local community members and service providers at its operations whenever possible.

ON BEHALF OF THE BOARD

"Jonathan Buick"

Jonathan Buick, President and CEO

For further information, please visit the Company's SEDAR profile at www.sedar.com or the Company's corporate website at www.idahochamp.com.

For further information please contact:

Nicholas Konkin, Marketing and Communications

Phone: (416) 567- 9087

Email: nkonkin@idahochamp.com

THIS PRESS RELEASE DOES NOT CONSTITUTE AN OFFER TO SELL OR THE SOLICITATION OF AN OFFER TO BUY ANY SECURITIES IN ANY JURISDICTION, NOR SHALL THERE BE ANY OFFER, SALE, OR SOLICITATION OF SECURITIES IN ANY STATE IN THE UNITED STATES IN WHICH SUCH OFFER, SALE, OR SOLICITATION WOULD BE UNLAWFUL.

Cautionary Statements

Neither the Canadian Securities Exchange nor its regulation services provider has reviewed or accepted responsibility for the adequacy or accuracy of this press release This press release may include forward-looking information within the meaning of Canadian securities legislation, concerning the business of the Company. Forward-looking information is based on certain key expectations and assumptions made by the management of the Company, including suggested strike extension. Although the Company believes that the expectations and assumptions on which such forward-looking information is based on are reasonable, undue reliance should not be placed on the forward-looking information because the Company can give no assurance that they will prove to be correct. Forward-looking statements contained in this press release are made as of the date of this press release. The Company disclaims any intent or obligation to update publicly any forward-looking information, whether as a result of new information, future events or results or otherwise, other than as required by applicable securities laws.

SOURCE: Idaho Champion Gold Mines Canada Inc.

View source version on accesswire.com:

https://www.accesswire.com/664111/Idaho-Champion-Gold-Defines-New-Mineralized-Corridor-Through-Drilling-at-Champagne-Project