Goldplay Mining Inc. (TSXV:AUC)(FRA:9FY), (the "Company" or "Goldplay"),is pleased to announce that it has signed a definitive agreement the "Agreement" to acquire up to 100% equity interest in a private Portuguese company Indice Crucial Lda ("Indice Crucial") that holds exploration rights on several past producing copper and gold projects as well as other advanced gold exploration applications in Portugal

Under the terms of the Agreement, Goldplay will acquire up to a 100% equity interest in Indice Crucial by making the following cash and share payments:

Timing | Cash in Euro | Goldplay Shares | Ownership |

Upon Signing | 100,000 | 100,000 | 20% |

Within 2 Years | 150,000 | 500,000 | 50% |

Within 4 Years | 100,000 | 750,000 | 85% |

Goldplay, can acquire the remaining 15% equity interest, for a total of 100%, at any time, for 2M Euro. There are no additional contractual spend commitments and there are no NSR being granted on the projects. The Agreement is subject to acceptance by the TSX Venture Exchange.

Barrancos Copper-Gold Properties

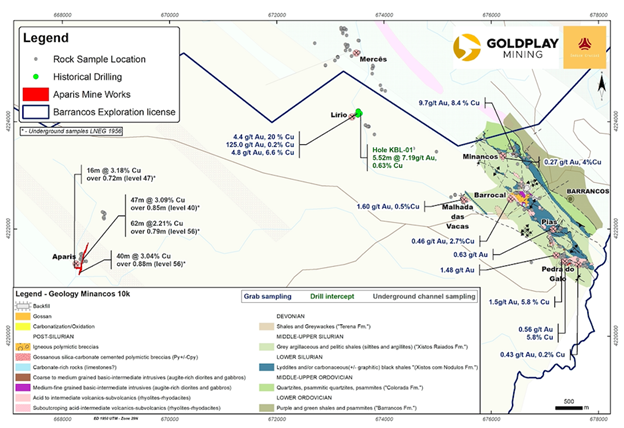

The Barrancos properties ("Barrancos") are located in south Central Portugal, near the Spanish border and cover an area of 74 square kilometers. Exploration rights were secured by Indice directly form the Portuguese Government Mining division in 2020. The exploration licence, allows the exploration work on Barrancos to be undertaken (including drilling) for a period of up to 5 years. Barrancos includes several past producing gold and copper mines, including two more advanced drill ready copper and gold projects as follows.

1. Aparis Copper Mine

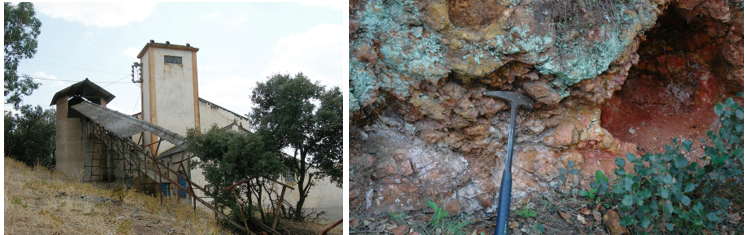

The Aparis Copper Mine ("Aparis") is a past producing underground copper mine that produced until 1975 when copper averaged just $0.55 per pound. The plant buildings and flotation mill remain on site.

The mine contains an extensive vein system. The system extends for over 3 km along strike and remains open for exploration. Historical underground results include:

- 47 metres averaging 3.09% Cu

- 40 metres averaging 3.04% Cu

- 62 metres averaging 2.21% Cu

The historic mine has been developed to a depth of just 150m and produced copper concentrate averaging up to 35% Cu. Along with Aparis, the area includes multiple other small scale copper and gold showing that deserve further investigation and modern exploration.

The planned drilling and exploration work will be focused on expanding and better defining the mineralization for a wider copper zones within the Aparis shear zone that currently averages more than 10m in true thickness.

2. The Lírio Gold Project

The Lirio Gold Project ("Lirio") is a very prospective and under explored gold system which has indications of being an extensive volcanic breccia gold system based on historical drilling, detailed surface sampling and the general geology of the area.

Historical sampling at Lirio have returned results of:

- up to 125g/t Au from chip samples and up to 7.7g/t Au from channel samples

- drill hole KBL-01 intersected 7.19 g/t Au and 0.63% Cu over 5.52 metres, including 17.8 g/t Au and 0.25% Cu over 2.03 metres

A very limited drilling campaign was carried out in 2008 by the Rio Narcea/Kernow joint venture, that intersected the mineralized zone below the main zone of the shallow underground workings.

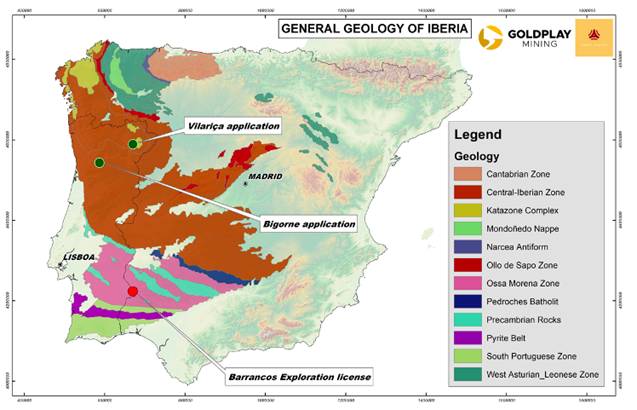

Bigorne Gold Exploration Application

The Bigorne Gold Exploration Application ("Bigorne") is an exploration/concession application made by Indice directly with the Portuguese Government Mining Division. Bigorne is situated in northern-central part of Portugal and covers an area of 24 km2. The main prospect includes a wide sheeted vein system, oriented N-S to NNE-SSW, hosted in Variscan granites from a suite of syn-to pos-tectonic intrusions.

A total of 15 historical holes have been drilled in several sections of the shear corridor with an indication of a bulk mineable potential as suggested by some of the best intercepts including:

- 40.2m grading 1.10 g/t Au from 35m, Including 10m grading 2 g/t Au in hole BI-1;

- 13m grading 1.66 g/t Au from 53m, including 6m grading 2.32 g/t Au in hole BI-3;

- 27m grading 1.0 g/t Au from 36m, including 5m grading 1.53 g/t Au in hole BI-4 and

- 13m grading 1.61 g/t including 4m grading 2.48 g/t Au from 39m in hole BI-5.

Vilariça Gold Exploration Application

The Vlarica Gold Exploration Application ("Vilarica") is an exploration/concession application made by Indice directly with the Portuguese Government Mining Division. The project covers a total of 178 km2 is situated approximately 200 km east of Porto and 450 Km northeast of Lisbon. The area is covered by an alloctonous sequence of metasediments and metavolcanics that have been extensively intruded by Variscan granites. These are in contact with a mafic/ultramafic complex in the NE.

Numerous vein and disseminated type showings and small diggings for Gold, Silver, Lead and Zinc occur thoroughly associated with intrusion/volcanic activity together with Tin and Tungsten respectively in greisen and skarn deposits. All these are spatially related with deep-seated post-Variscan structures with the Vilariça fault interpreted to represent the main structural feature. This area is adjacent to a gold mining district including Latadas and Freixeda mine areas located only a few kilometers to the west of the permitted mine owned by the Minaport group.

Catalin Kilofliski, Goldplay Mining President & CEO stated: "I am very pleased that in just two months from our initial listing on TSXV, our ambitious growth objectives are starting to materialize. Today's acquisition in Portugal, marks an important and concrete step forward in Company's growth plans. With the exploration plans on the Scottie West Project finalized and the BC fieldwork expected to begin in August, led by our BC based Exploration Manager, Andrew Wilkins, we are also looking forward to begin the exploration work in Portugal led by our Portugal based Exploration manager Jose Mario Castelo Branco this summer."

Qualified Person

The scientific and technical information in this news release has been reviewed and approved by Mr. Jose Mario Castelo Branco, Golplay's Portugal Exploration Manager and Qualified Person within the context of Canadian Securities Administrators' National Instrument 43-101; Standards of Disclosure for Mineral Projects.

About Goldplay Mining

Goldplay Mining is a newly listed Canadian public company which is focused on exploring and advancing gold-copper projects located in top mining jurisdictions with potential for world class mineral discovery.

On behalf of the Board of Directors

"Catalin Kilofliski"

Catalin Kilofliski

President, CEO & Director

For further information please contact:

Goldplay Mining Inc.

Mr. Catalin Kilofliski, President & CEO

Suite 650 - 1021 West Hastings Street

Vancouver, BC V6E 0C3

T: (604) 655-1420

E: catalin@goldplaymining.ca

www.goldplaymining.ca

Forward Looking Information

This news release contains "forward-looking information" within the meaning of applicable securities laws relating to the potential listing of the company on a stock exchange, and other associated matters. Generally forward-looking statements can be identified by the use of terminology such as "anticipate", "will", "expect", "may", "continue", "could", "estimate", "forecast", "plan", "potential" and similar expressions. Although the Company believes current conditions and expected future developments and other factors that have been considered are appropriate and that the expectations reflected in this forward-looking information are reasonable, undue reliance should not be placed on them because the Company can give no assurance that they will prove to be correct or enduring. Readers are cautioned to not place undue reliance on forward-looking information. The statements in this press release are made as of the date of this release. Except as required by law, the Company does not undertake any obligation to update publicly or to revise any forward-looking statements that are contained or incorporated in this press release. All forward-looking statements contained in this press release are expressly qualified by this cautionary statement.

SOURCE: Goldplay Mining Inc.

View source version on accesswire.com:

https://www.accesswire.com/652793/Goldplay-Strengthens-Portuguese-Portfolio-Signs-Definitive-Agreement-To-Acquire-Past-Producing-Copper-Mine-and-Highly-Prospective-Gold-Projects