February 13, 2024

West Australian gold exploration and development company, Rox Resources Limited (“Rox” or “the Company”) (ASX: RXL), is pleased to report results from recently completed geophysical Gradient Array Induced Polarisation (GAIP) surveys at its Mt Fisher and Mt Eureka Projects in Western Australia.

- Mt Fisher greenstone belt is one of the most remote and least explored greenstone belts within the gold-prolific Yilgarn Craton

- Past drill intercepts at Mt Fisher of 9m @ 34.34 g/t Au demonstrate the high-grade potential of the belt

- Currently, limited drilling in the Mt Fisher - Mt Eureka corridor has delineated a gold Mineral Resource of 187koz Au within 100km of Strickland Metals’ Milrose Project, which was recently acquired by Northern Star for approximately A$61m.

- Rox holds a dominant tenure position over the Mt Fisher-Mt Eureka belt and has recently conducted a Gradient Array Induced Polarisation (GAIP) survey over the project area

- The geophysical surveys have identified multiple walk-up drill targets, located along strike from known gold mineralised trends that are characterised by high-sulphide content (consistent with the causative geology of GAIP anomalies).

- Rox is progressing opportunities to advance and monetise the highly-prospective Mt Fisher - Mt Eureka Project, given the Company’s priority focus on developing its flagship high- grade Youanmi Gold Project in WA

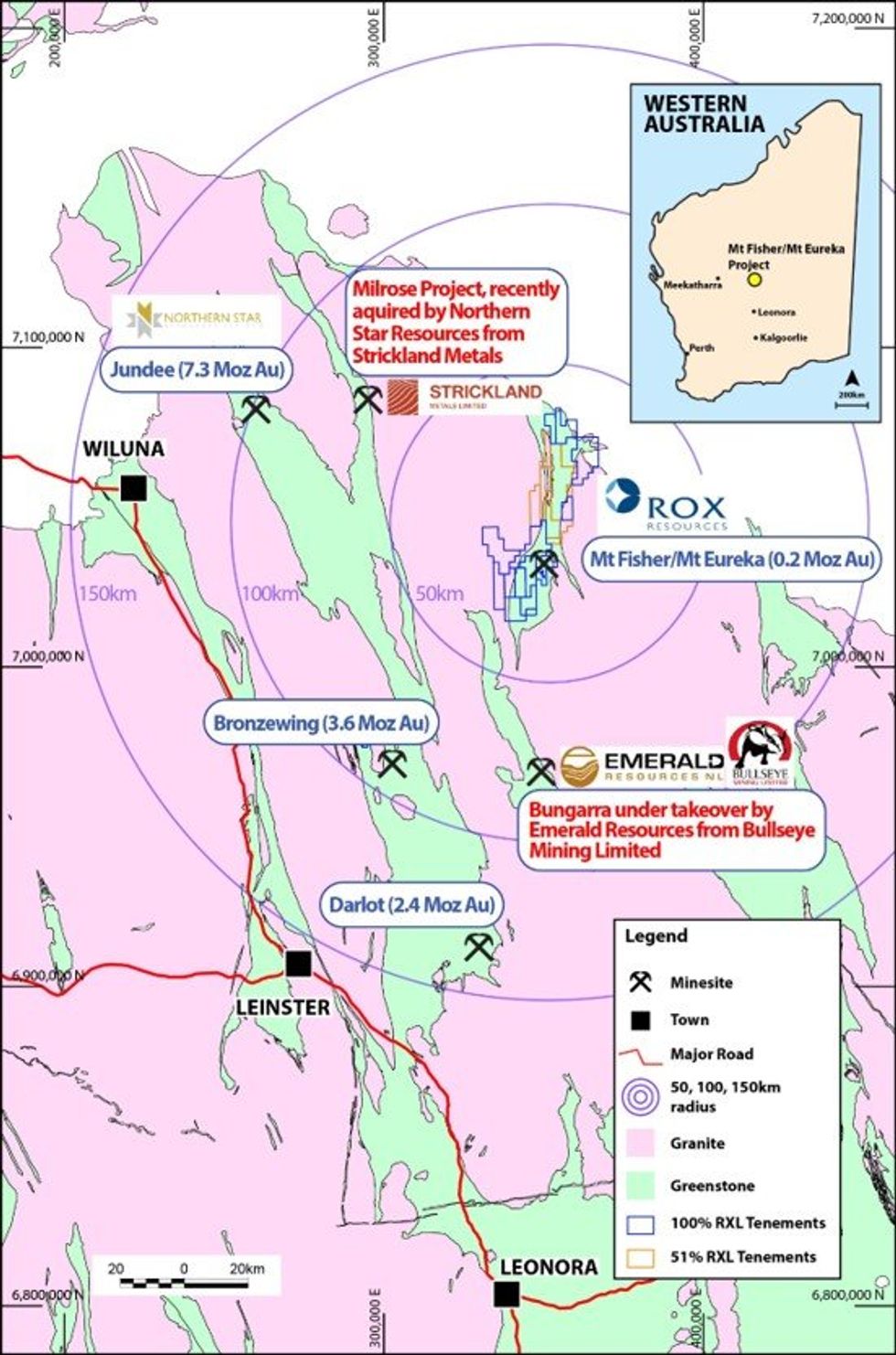

The 100% Rox Resources owned Mt Fisher Gold Project and the 51% gold rights (rights to earn uo to 75%) Mt Eureka Gold Project are located in the Northern Goldfields, with a gold Mineral Resource of 187koz Au defined within a 1,150km2 tenement package that is highly prospective for gold and nickel mineralisation.

Managing Director Comments

Rox Resources’ Managing Director, Mr Robert Ryan, said:

“The geophysical surveys conducted recently at Mt Fisher and Mt Eureka have highlighted a number of walk- up drill targets. The surveys have detected potential sulphide-bearing structures, which could host gold mineralisation as seen elsewhere in the tenement package.

"The 1,150km2 tenement package represents a district-scale exploration opportunity for both gold and nickel sulphides, that Rox will continue to advance in order to generate value for our shareholders.”

The 100% Rox Resources owned Mt Fisher Gold Project and the 51% gold rights (rights to earn uo to 75%) Mt Eureka Gold Project are both located in the Northern Goldfields, approximately 500km north of Kalgoorlie (120km east of Wiluna) (Figure 1).

The Projects are at an advanced exploration stage with an existing gold Mineral Resource of 187koz Au defined at Mt Fisher - Mt Eureka and significant exploration upside identified across the broader 1,150km2 tenement package.

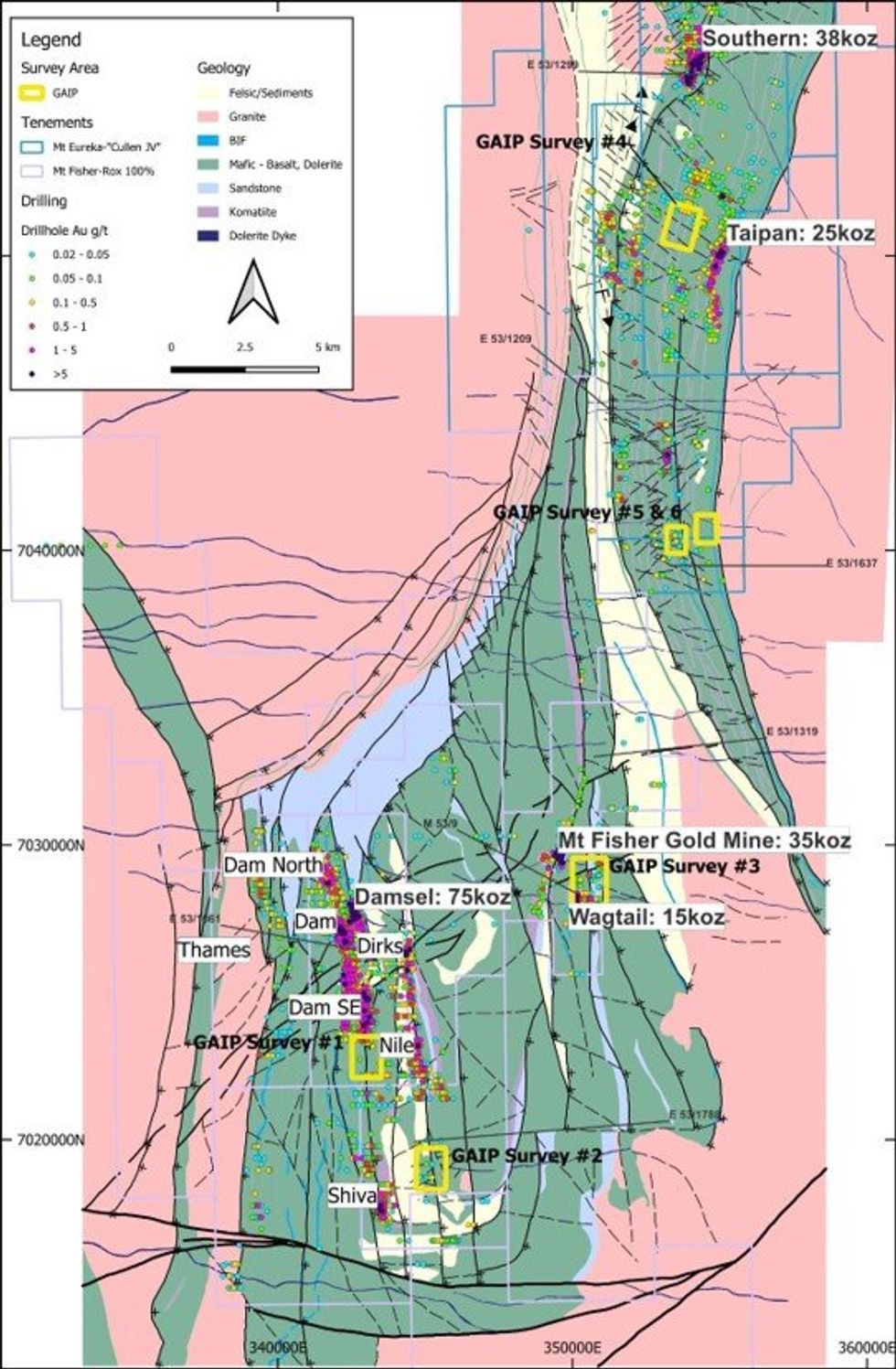

Rox has completed six Gradient Array Induced Polarisation (GAIP) geophysical surveys at the Mt Fisher and Mt Eureka Projects (Figure 2).

Each of the GAIP surveys were designed to advance the project exploration pipeline by defining potential sulphide-rich chargeability anomalies that represent drill-ready targets along the known gold mineralised trends.

The GAIP survey technique works particulary well at Mt Fisher and Mt Eureka due to the moderate percentages of disseminated sulphide, generally present as pyrite at the known gold deposits and along the mineralised trends within the project areas.

GAIP surveys are also able to cost effectively cover large strike lengths of mineralised trends to identify drill- ready targets for potential gold mineralisation associated with rich zones of disseminated sulphides.

GAIP survey #1 was completed on E53/1061 within the Damsel Project area (Figure 3), with the survey located at the southern end of the Damsel-Dam gold mineralised trend that hosts the underdrilled Damsel deposit containing 75koz Au, that was last drilled by Rox in December 2021 and July 2022 returning the following drilling results:

- 18m @ 6.99g/t Au from 69m, including 10m @ 10.27g/t Au from 74m;

- 11m @ 2.7g/t Au from 40m, including 4m @ 6.0g/t Au from 45m;

- 5m @ 3.18 g/t Au from 37m and 2m @ 4.64 g/t Au from 70m;

- 8m @ 2.55 g/t Au from 53m, including 5m @ 3.17 g/t Au from 53m; and

- 6m @ 2.84 g/t Au from 142m.

Click here for the full ASX Release

This article includes content from Rox Resources Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

4h

Adrian Day: Gold Dips Bought Quickly, Price Run Not Over Yet

Adrian Day, president of Adrian Day Asset Management, shares his latest thoughts on what's moving the gold price, emphasizing that its bull run isn't over yet. "It's monetary factors that are driving gold — that's what's fundamentally driving gold," he said. "Monetary factors, lack of trust in... Keep Reading...

4h

Brien Lundin: Gold, Silver Stock Run Just Starting, Get in Now

Brien Lundin, editor of Gold Newsletter and New Orleans Investment Conference host, shares his stock-picking strategy at a time when high metals prices are beginning to lift all boats. In his view, gold and silver equities may still only be in the second inning. Don't forget to follow us... Keep Reading...

8h

Venezuela Gold Set for US Market in Brokered Deal

A new US-Venezuela gold deal could soon channel hundreds of kilograms of bullion from the South American nation into American refineries.Venezuela’s state-owned mining company, Minerven, has agreed to sell between 650 and 1,000 kilograms of gold dore bars to commodities trading house Trafigura... Keep Reading...

05 March

Rick Rule: Gold Price During War, Silver Strategy, Oil Stock Game Plan

Rick Rule, proprietor at Rule Investment Media, shares updates on his current strategy in the resource space, mentioning gold, silver, oil and agriculture. He also reminds investors to pay more attention to gold's underlying drivers than to current events.Click here to register for the Rule... Keep Reading...

05 March

Lobo Tiggre: Gold, Oil in Times of War, Plus My Shopping List Now

Lobo Tiggre of IndependentSpeculator.com shares his thoughts on how gold, silver and oil could be impacted by the developing situation in the Middle East. He cautioned investors not to chase these commodities if prices run. Don't forget to follow us @INN_Resource for real-time updates!Securities... Keep Reading...

05 March

TomaGold: New High-grade Deep Discovery at Berrigan Mine

TomaGold (TSXV:LOT) President, CEO and Director David Grondin said the company is focusing on its flagship Berrigan mine in Chibougamau, Québec, following a large, significant discovery at depth.Berrigan is 4 kilometers northwest of the city of Chibougamau and has existed for about 50 years.... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00