November 27, 2024

New Murchison Gold Limited (ASX: NMG) (“NMG” or the “Company”) is pleased to announce an updated Mineral Resource Estimate (MRE), reported in accordance with the JORC Code, for the Crown Prince Deposit (Crown Prince) at the Company’s flagship Garden Gully Gold Project (Garden Gully) near Meekatharra, Western Australia.

HIGHLIGHTS

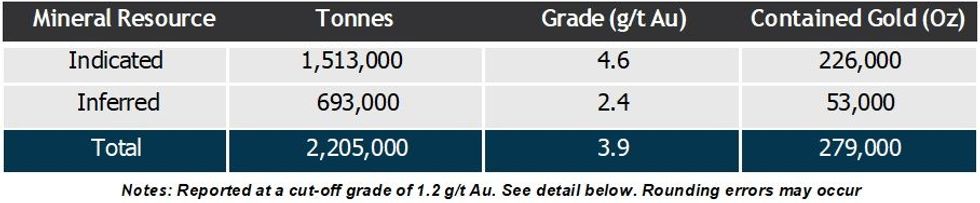

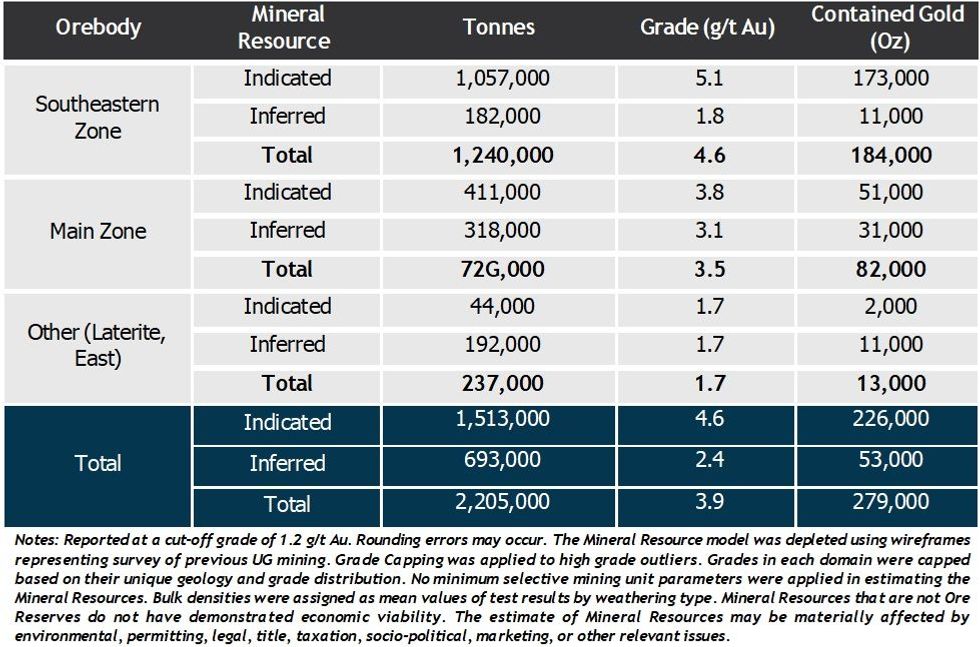

- Mineral Resource Estimate substantially increased for the Crown Prince Deposit at Garden Gully with a 3G% increase in the Indicated classification estimate to 226koz at 4.6 g/t Au.

- The total Mineral Resource has grown by 16% from the February 2024 estimate, to 27Gkoz at 3.G g/t/Au.

- With 81% (up from 68%) of gold ounces in the Indicated Mineral Resource classification, there is now a strong understanding of the Crown Prince deposits, reflecting enhanced drill density, in some places to 15 m x 15 m grid.

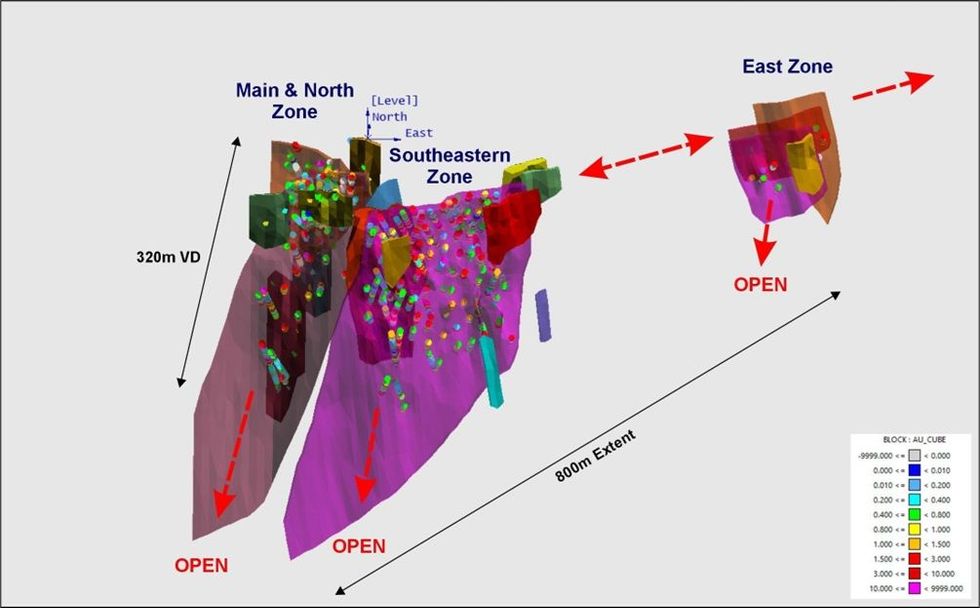

- Mineral Resources are shallow and delineated from surface. Gold mineralisation is open at depth and will be followed up with deeper drilling as the project progresses.

- Crown Prince’s mineralisation is mostly situated within a 300 m x 380 m area. The Mineral Resource Estimate, beneath the mineralised cap rock, shows an average of 1,538 oz of gold per vertical metre between 10 m and 150 m depth.

- The structural corridor, which hosts the Crown Prince deposits, is open to the south and is relatively untested. To the north, recent passive seismic delineated a wide and thick paleochannel (up to 60 m depth). The northern area below the paleochannel may be better explored from underground or base of open pit positions.

- Crown Prince is strategically located in the heart of the prolific Murchison gold district, with close proximity to numerous operating gold mines, processing facilities and other key infrastructure.

- NMG is close to announcing a detailed Feasibility Study (environmental, social, mining, metallurgy, geotechnical, hydrogeological) to support a robust value proposition for mining Crown Prince

Alex Passmore, NMG’s CEO commented: “Following a busy year of exploration and development work in 2024, the Company is delighted to report an increased Crown Prince Mineral Resource Estimate from the additional drilling undertaken.

With increased drilling density, the understanding of the Crown Prince deposit is at a strong confidence level with 81% of the ounces (i.e., 22C,000 oz) now reporting to the Indicated Mineral Resource classification. Pleasingly, the average ounce per vertical metre endowment sits at 1,538 within key areas of our conceptual open pit development.

This resource underpins the detailed feasibility study work which is well advanced to confirm the mining, metallurgical, geotechnical, economic and environmental parameters to develop the Crown Prince Gold Project.

Initial economic optimisation modelling of the Crown Prince resource confirms that there is sufficient grade and tonnage to sustain an open pit mining operation.”

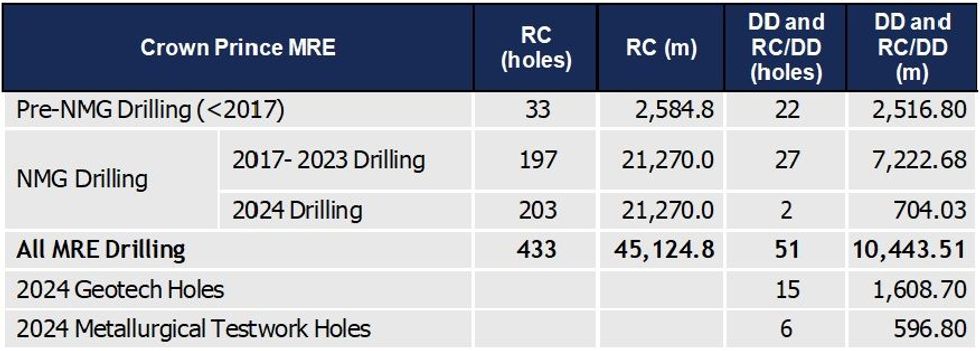

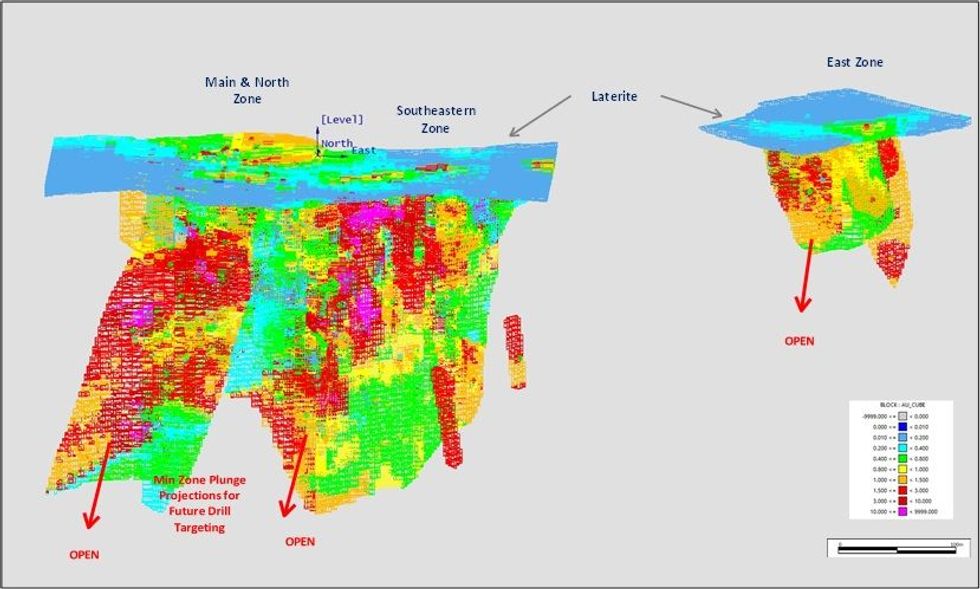

This MRE (Table 1, Figure 1) was prepared by Cube Consulting, an independent consultant, using geological and mineralisation interpretations prepared by NMG using all available reverse circulation and diamond drillhole data. The updated Crown Prince MRE incorporates all drilling completed and assayed up to October 2024. Over the course of 2024, NMG’s exploration team completed 21,974 m of reverse circulation and diamond drilling within the Crown Prince area.

Following the discovery of the south eastern zone (SEZ) of mineralisation at Crown Prince in 2022, follow up exploration in 2023 and 2024 successfully added resource inventory via infill and extensional drilling.

Multiple phases of drilling were undertaken in 2024 (Table 2) with resulting assays now incorporated into the resource model supporting the November 2024 estimate for Crown Prince.

Mineralisation envelopes at the Main and Northern Zones were also better defined for this model. Additionally, new high-grade lodes were discovered in the Northern Zone contributing to the uplift seen in this updated MRE.

The Crown Prince deposit is hosted within quartz-carbonate veins within altered and sheared mafic units. In the weathered profile, primary mineralisation (fresh rock) has in places been enriched with a supergene overprint. Notably, primary mineralisation persists at depth and remains open (Figure 2). Further drilling will be undertaken to test for extensions.

Material Information Summary – Mineral Resources

Information required by ASX Listing Rule 5.8.1 (summary of technical information pertaining to the Mineral Resource Estimate) is detailed in the following sections.

Click here for the full ASX Release

This article includes content from New Murchison Gold Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

NMG:AU

The Conversation (0)

02 April 2025

New Murchison Gold Limited

Advanced gold exploration company with a path to production

Advanced gold exploration company with a path to production Keep Reading...

20 June 2025

Trading Halt

New Murchison Gold Limited (NMG:AU) has announced Trading HaltDownload the PDF here. Keep Reading...

12 June 2025

Further High-Grade Gold Intersections at Crown Prince

New Murchison Gold Limited (NMG:AU) has announced Further High-Grade Gold Intersections at Crown PrinceDownload the PDF here. Keep Reading...

27 May 2025

Grade Control Drilling Results

New Murchison Gold Limited (NMG:AU) has announced Grade Control Drilling ResultsDownload the PDF here. Keep Reading...

12 May 2025

High-Grade Gold Intercepts within Caprock Drilling

New Murchison Gold Limited (NMG:AU) has announced High-Grade Gold Intercepts within Caprock DrillingDownload the PDF here. Keep Reading...

30 April 2025

Second Quarter Activities and Cashflow Report

New Murchison Gold Limited (NMG:AU) has announced Second Quarter Activities and Cashflow ReportDownload the PDF here. Keep Reading...

27 February

Lahontan Gold Eyes Resource Update as Production Nears

Lahontan Gold (TSXV: LG,OTCQB:LGCXF) is drawing investor attention as it advances toward renewed production at its historic Santa Fe Mine in Nevada. A revised mineral resource estimate is expected soon, offering a potential catalyst, according to a recent report by News Financial.... Keep Reading...

27 February

Peruvian Metals Invites Shareholders and Investment Community to Visit Them at Booth 2624B at PDAC 2026 in Toronto, March 3-4

Peruvian Metals Corp (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals" or the "Company") is pleased to invite investors and shareholders to Booth #2624B at the Prospectors & Developers Association of Canada's (PDAC) Convention at the Metro Toronto Convention Centre (MTCC) from Tuesday,... Keep Reading...

27 February

OTC Markets Group Welcomes RUA GOLD INC. to OTCQX

OTC Markets Group Inc. (OTCQX: OTCM), operator of regulated markets for trading 12,000 U.S. and international securities, today announced Rua Gold INC. (TSX: RUA,OTC:NZAUF; OTCQX: NZAUF), an exploration company, has qualified to trade on the OTCQX® Best Market. Rua Gold INC. upgraded to OTCQX... Keep Reading...

27 February

RUA GOLD Begins Trading on the OTCQX Best Market in the United States

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZ: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce that that its common shares have begun trading today on the OTCQX® Best Market under the symbol 'NZAUF'. U.S. investors can find current financial disclosure and Real-Time Level 2... Keep Reading...

27 February

American Eagle Expands South Zone 750 Metres to the East and Further Demonstrates Continuity Within High-Grade Core, Intersecting 618 Metres of 0.77% CuEq from Surface

Highlights: 618 m of 0.77% CuEq from surface in NAK25-80, linking high grade, at-surface gold rich mineralization to high-grade core at depth. Continuity from surface to depth: NAK25-80 builds on prior long-intervals, including NAK25-78: 802 m of 0.71% CuEq from surface, and strengthens... Keep Reading...

26 February

Pause in Trading

Zeus Resources Limited (ZEU:AU) has announced Pause in TradingDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00