March 24, 2024

Premier1 Lithium Limited (ASX:PLC) (“Premier1” or the “Company”) is pleased to announce the commencement of fieldwork at the Montague lithium project. Premier1 has the rights to earn up to 80% of the lithium rights on the project in a farm-in announced on 5 May 2023 with Gateway Mining (ASX:GML).

HIGHLIGHTS

- Field program commenced at Montague lithium project

- Areas of interest defined using fractionation vectoring of previously mapped pegmatites

- Extensive new pegmatites mapped in first phase

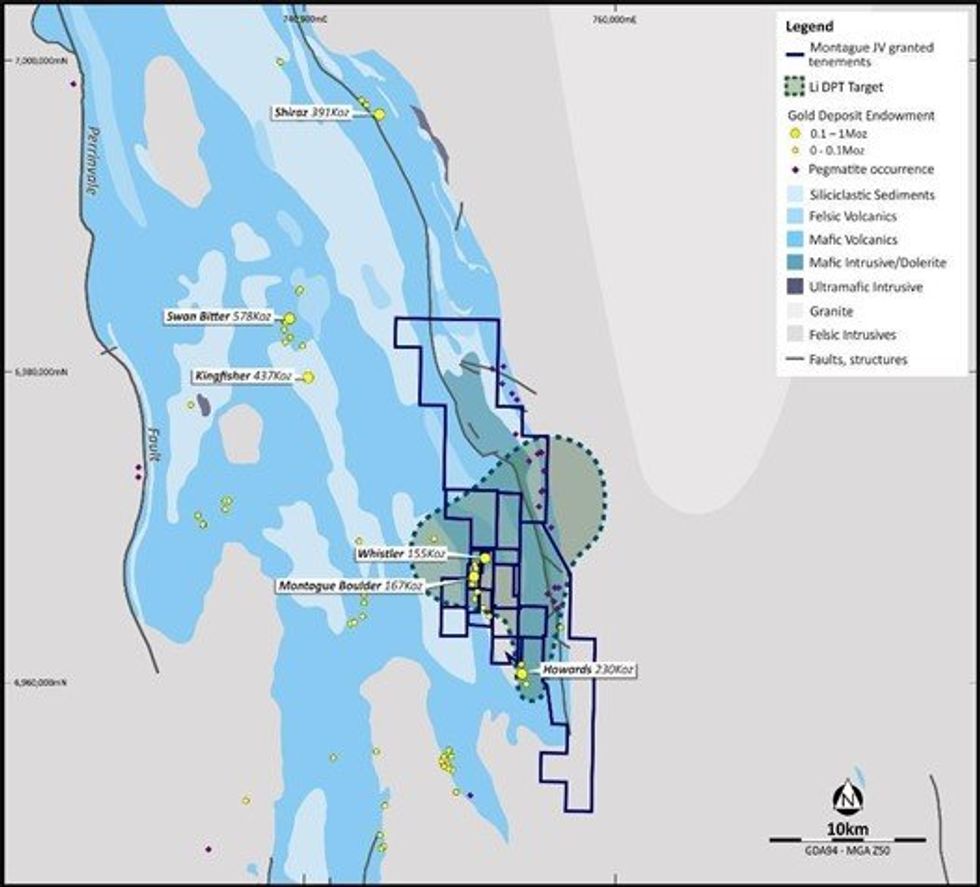

The Montague Project is located approximately 70km north of Sandstone within the Gum Creek Greenstone Belt. The greenstone belt is dominated by a sequence of metamorphosed basalts and volcano-sedimentary rocks that are centred around the Montague granodiorite dome and bounded by monzogranitic to granodioritic intrusions to the east. A major NNW-SSE striking shear zone crosscuts the greenstone belt. Transported regolith and cover mask a significant portion of the area west of the shear zone.

The Montague project was previously recognised as a large target predicted by SensOre’s machine learning system. The target identified previously unrecognised lithium potential within a greenstone belt with no previous lithium exploration. Historical data reviewed prior to acquisition did show that the Geological Survey of Western Australia (GSWA) had mapped several pegmatites in the area.

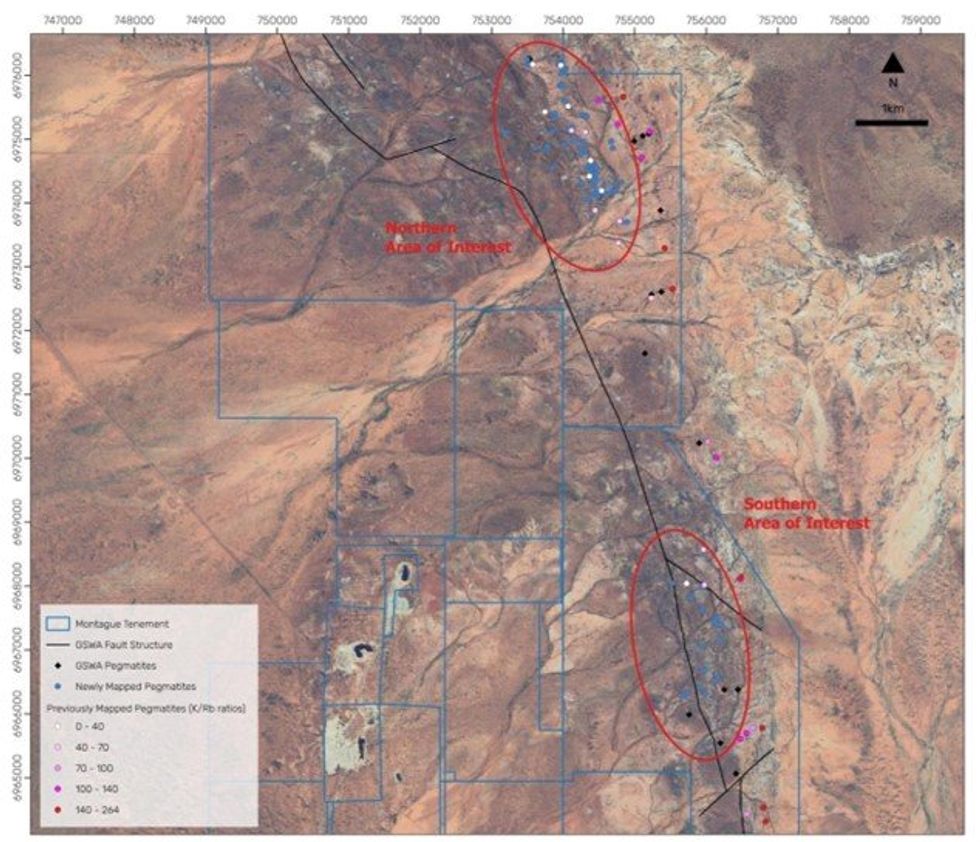

Recent fieldwork by Premier1 has identified abundant new pegmatites along a mafic-ultramafic and siliclastic sequence of the greenstone belt up to 1km west of the main granite contact to the east. Potassium-Rubidium (K/Rb) ratios defined at least two areas of interest that showed high fractionation of below 40 that indicate prospectivity for Lithium-Caesium-Tantalum (LCT) pegmatites.

The recently commenced first phase of field mapping and sampling has identified numerous newly mapped pegmatites in these two areas of interest. Occasionally, green mica has been identified and a first set of samples has been sent to the lab. Feldspar samples were taken of all newly mapped pegmatites to determine fractionation trends for further target vectoring and identification of potential drill targets for H2 2024.

Richard Taylor, CEO of Premier1, commented:

“While we wait for assays from our first phase drilling at Abbotts North, the team has quickly mobilised to Montague which is showing considerable prospectivity based on initial surface mapping of pegmatites. Montague is shaping up to be every bit as exciting as the other projects in our portfolio.”

This release was approved by the CEO.

Click here for the full ASX Release

This article includes content from Premier1 Lithium, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

PLC:AU

The Conversation (0)

05 June 2024

Premier1 Lithium

AI-based and data-driven approach to lithium exploration in Western Australia

AI-based and data-driven approach to lithium exploration in Western Australia Keep Reading...

27 February

UK Enters Commercial Lithium Production with Geothermal Plant Launch

The UK has entered commercial lithium production for the first time as Geothermal Engineering Ltd (GEL) began operations in its plant at Cornwall, anchoring the government's hopes of a domestic battery metals supply chain.The Redruth-based facility marks the country’s first commercial-scale... Keep Reading...

26 February

Zimbabwe Imposes Immediate Ban on Raw Mineral and Lithium Exports

Zimbabwe has imposed an immediate ban on exports of all raw minerals and lithium concentrates, halting shipments already in transit as the government tightens control over the country’s mining sector.Mines and Mining Development Minister Polite Kambamura announced Wednesday that the suspension... Keep Reading...

19 February

Top Australian Mining Stocks This Week: Lithium Valley Results Boost Gold Mountain

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.Mining giant BHP (ASX:BHP,NYSE:BHP,LSE:BHP) reported strong half-year copper results, saying that its copper operations accounted for... Keep Reading...

17 February

Howard Klein Doubles Down on Strategic Lithium Reserve as Project Vault Takes Shape

Before the Trump administration revealed plans for Project Vault, Howard Klein, co-founder and partner at RK Equity, proposed the idea of a strategic lithium reserve. “The goal of a strategic lithium reserve is to stabilize prices and allow the industry to develop,” he told the Investing News... Keep Reading...

17 February

Sigma Lithium Makes New Lithium Fines Sale, Unlocks US$96 Million Credit Facility

Sigma Lithium (TSXV:SGML,NASDAQ:SGML) has secured another large-scale sale of high-purity lithium fines and activated a production-backed revolving credit facility as it ramps up operations in Brazil.The lithium producer announced it has agreed to sell 150,000 metric tons (MT) of high-purity... Keep Reading...

12 February

Albemarle Lifts Lithium Demand Forecast as Energy Storage Surges

Albemarle (NYSE:ALB) is raising its long-term lithium demand outlook after a breakout year for stationary energy storage, underscoring a shift in the battery materials market that is no longer driven solely by electric vehicles.The US-based lithium major reported fourth quarter 2025 net sales of... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Obonga Project: Wishbone VMS Update

27 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00