December 06, 2023

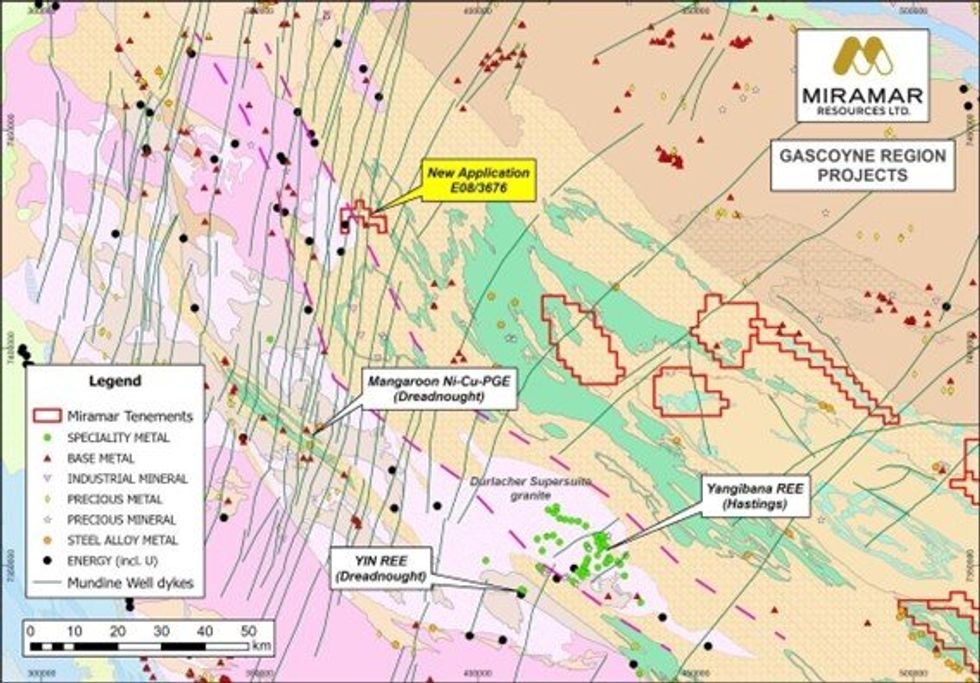

Miramar Resources Limited (ASX:M2R, “Miramar” or “the Company”) is pleased to advise that the Company has submitted an Exploration Licence Application over copper and uranium occurrences in the northern Gascoyne Region of WA.

- Application over copper and uranium occurrences in northern Gascoyne

- Tenement application covers

- Durlacher Supersuite granite – host to Yangibana and YIN REE deposits

- Historic high-grade Joy Helen Cu-Pb-Ag mine

Exploration Licence Application, E08/3676, covers part of an outcropping “Durlacher Supersuite” granite, the same unit that hosts the Yangibana (Hastings) and YIN (Dreadnought) REE deposits (Figure 1).

The tenement application also covers numerous N-S trending Mundine Well dolerite dykes, along strike from Dreadnought’s Mangaroon Ni-Cu-PGE prospect, and contains the “Chain Pool” uranium occurrence and the historic “Joy Helen” copper-lead-silver mine.

Miramar’s Executive Chairman, Mr Allan Kelly, said the Gascoyne region provided the opportunity for the discovery of multiple commodities and deposit types.

“This new application is prospective for base metal mineralisation hosted in sediments of the Edmund Basin, uranium and/or REE mineralisation associated with the Durlacher Supersuite granitoid, and potentially also Ni-Cu-PGE mineralisation associated with Mundine Well dolerite dykes,” Mr Kelly said.

“We look forward to progressing the tenement to grant and getting out on the ground,” he added.

Chain Pool Uranium occurrence

The Chain Pool occurrence is located within the “Telfer Batholith”, part of the Durlacher Supersuite and the same geological unit that hosts the REE deposits at Yangibana and YIN (Figure 2).

The batholith was first identified as being prospective for uranium mineralisation hosted within veins within the granites, similar to the Rössing and/or Phalaborwa deposits, in the 1970’s.

In the period 2009-2011, Raisama Limited conducted exploration targeting uranium mineralisation associated with the granitoid including a detailed airborne magnetic and radiometric survey across the entire granitoid batholith, followed by limited reconnaissance rock chip sampling and RC drilling.

The highest rock chip result of 1,898ppm U (i.e. 2,248ppm U3O8) came from a sample in what is now known as the “Chain Pool” prospect. Only two rock chip samples, approximately 1.4km apart, were ever taken within the 5km long radiometric anomaly (Figure 3).

A single RC drill hole, CP_RC05, was drilled to 80m and tested the radiometric anomaly beneath the highest rock chip result but failed to intersect significant uranium mineralisation.

The hole encountered granite intruded by thin pegmatites but the samples were only assayed for Rubidium, Thorium, Uranium and Zircon (WAMEX Reports a087098, a088661 and a089842).

Given the areal extent of the uranium anomalism, the similarities in geology to Yangibana, and the lack of any systematic sampling or drilling, the area remains prospective for uranium and/or REE mineralisation.

In addition, the Mundine Well dolerite dykes have apparently never been investigated for Ni-Cu-PGE mineralisation.

Click here for the full ASX Release

This article includes content from Miramar Resources Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

copper-stocksasx-m2rresource-stocksasx-stocksgold-explorationgold-stocksnickel-stockscopper-investingcopper-explorationnickel-exploration

M2R:AU

The Conversation (0)

06 February 2024

Miramar Resources

Aiming to create shareholder value through the discovery of world-class mineral deposits

Aiming to create shareholder value through the discovery of world-class mineral deposits Keep Reading...

19 February

Northern Dynasty Shares Plunge as DOJ Backs EPA Veto of Alaska’s Pebble Mine

Northern Dynasty Minerals (TSX:NDM,NYSEAMERICAN:NAK) shares plunged on Wednesday (February 18) after the US Department of Justice (DOJ) filed a court brief backing the Environmental Protection Agency’s (EPA) January 2023 veto of the company’s long-contested Pebble project in Alaska.The brief... Keep Reading...

18 February

BHP Reports Strong Half-Year Copper Results, Boosts Guidance for 2026

BHP (ASX:BHP,NYSE:BHP,LSE:BHP) has published its financial results for the half-year ended December 31, 2025.The mining giant said its copper operations, which span multiple continents, accounted for the largest share of its overall earnings for the first time, coming in at 51 percent of... Keep Reading...

17 February

Nine Mile Metals Announces Certified Assays from DDH-WD-25-02 of 2.78% CUEQ over 32.10 METERS, Including 4.78% CUEQ over 11.52 Meters and 5.64% CUEQ over 6.02 Meters

Nine Mile Metals LTD. (CSE: NINE,OTC:VMSXF) (OTC Pink: VMSXF) (FSE: KQ9) (the "Company" or "Nine Mile") is pleased to announce it has received certified assays for drill hole WD-25-02 at the Wedge Mine situated in the renowned Bathurst Mining Camp, New Brunswick (BMC). WD-25-02 HIGHLIGHTS: DDH... Keep Reading...

17 February

Nine Mile Metals Announces Certified Assays from DDH-WD-25-02 of 2.78% CUEQ over 32.10 METERS, Including 4.78% CUEQ over 11.52 Meters and 5.64% CUEQ over 6.02 Meters

Nine Mile Metals LTD. (CSE: NINE,OTC:VMSXF) (OTC Pink: VMSXF) (FSE: KQ9) (the "Company" or "Nine Mile") is pleased to announce it has received certified assays for drill hole WD-25-02 at the Wedge Mine situated in the renowned Bathurst Mining Camp, New Brunswick (BMC). WD-25-02 HIGHLIGHTS: DDH... Keep Reading...

17 February

Nine Mile Metals Announces Certified Assays from DDH-WD-25-02 of 2.78% CUEQ over 32.10 METERS, Including 4.78% CUEQ over 11.52 Meters and 5.64% CUEQ over 6.02 Meters

Nine Mile Metals LTD. (CSE: NINE,OTC:VMSXF) (OTC Pink: VMSXF) (FSE: KQ9) (the "Company" or "Nine Mile") is pleased to announce it has received certified assays for drill hole WD-25-02 at the Wedge Mine situated in the renowned Bathurst Mining Camp, New Brunswick (BMC). WD-25-02 HIGHLIGHTS: DDH... Keep Reading...

17 February

Nine Mile Metals Announces Certified Assays from DDH-WD-25-02 of 2.78% CUEQ over 32.10 METERS, Including 4.78% CUEQ over 11.52 Meters and 5.64% CUEQ over 6.02 Meters

Nine Mile Metals LTD. (CSE: NINE,OTC:VMSXF) (OTC Pink: VMSXF) (FSE: KQ9) (the "Company" or "Nine Mile") is pleased to announce it has received certified assays for drill hole WD-25-02 at the Wedge Mine situated in the renowned Bathurst Mining Camp, New Brunswick (BMC). WD-25-02 HIGHLIGHTS: DDH... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00