October 03, 2024

Metal Hawk (ASX:MHK) has a solid strategy to increase shareholder value through early-stage exploration success. The company explores for gold and nickel driven by a technically proficient team with a proven track record of identifying high-potential mineral exploration projects and executing early-stage discoveries.

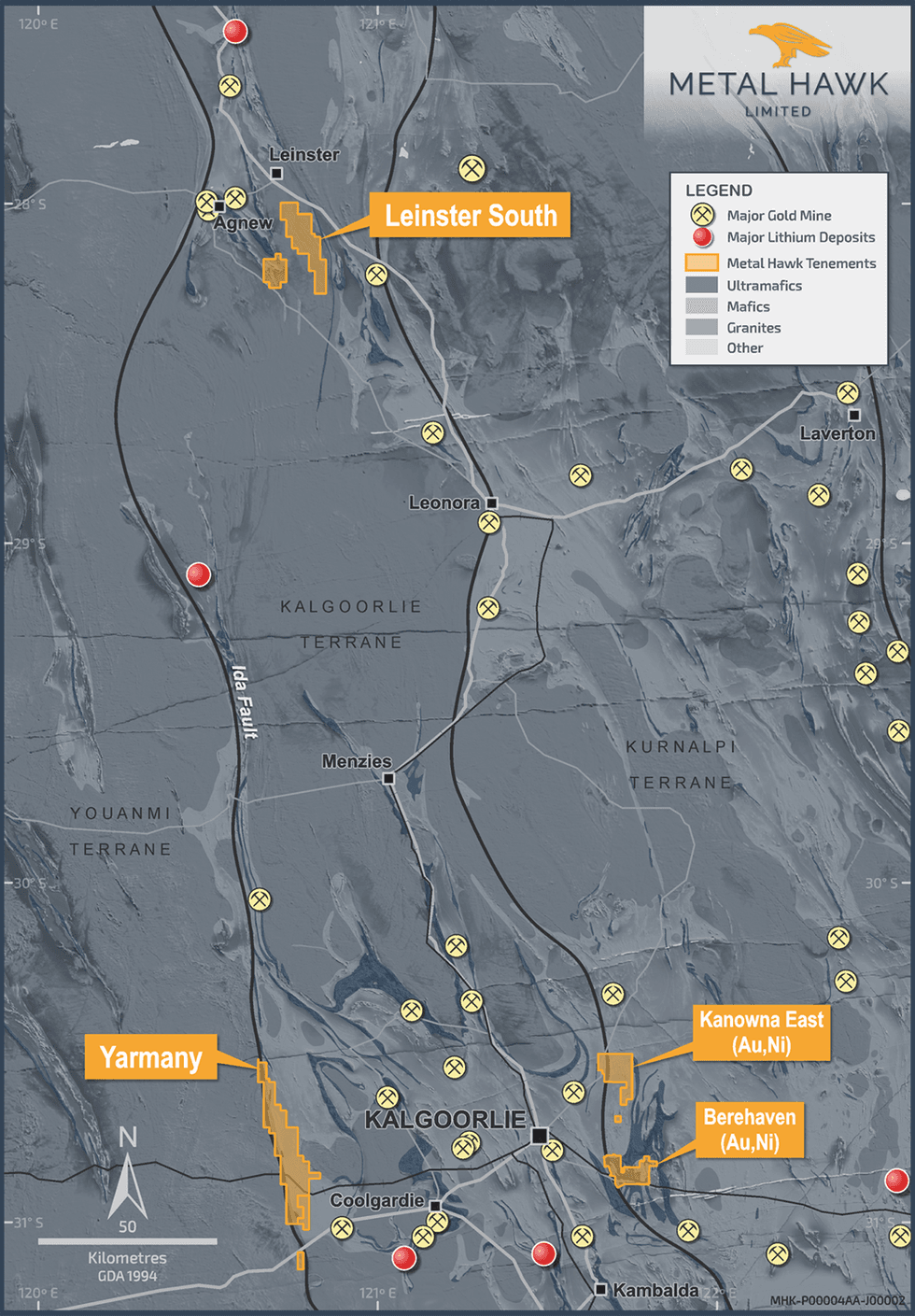

Metal Hawk’s portfolio is primarily concentrated in the prolific Eastern Goldfields of Western Australia. The company’s exploration strategy combines traditional geological methods with innovative technologies to unlock the full potential of its tenements.

The flagship Leinster South project is located 30 kilometers south of Leinster in Western Australia’s Eastern Goldfields region. Covering approximately 127 square kilometers of granted tenure, this project is highly prospective for gold and nickel mineralization. Its proximity to the Agnew-Lawlers mining center, which has produced over 5 million ounces of gold at an average grade of 5 grams per ton (g/t), further enhances its significance. The project sits within the Agnew-Wiluna greenstone belt and along the eastern limb of the Lawlers Anticline, a key structural feature associated with major gold discoveries in the region.

Company Highlights

- A gold-focused exploration company backed by a highly experienced technical team with a track record of identifying high-potential projects and making early-stage discoveries.

- The company’s flagship project is the Leinster South project, which hosts the high-grade Siberian Tiger gold prospect.

- Recent rock chip sampling at Siberian Tiger returned assays as high as 20.2 g/t gold.

- Metal Hawk has completed a UAV magnetic survey at Leinster South to assist with drill targeting.

- The company is progressing through heritage negotiations and awaiting approval for a maiden RC drilling campaign at Siberian Tiger.

This Metal Hawk profile is part of a paid investor education campaign.*

Click here to connect with Metal Hawk (ASX:MHK) to receive an Investor Presentation

MHK:AU

The Conversation (0)

02 October 2024

Metal Hawk Limited

Gold-focused exploration in Western Australia’s prolific Eastern Goldfields region

Gold-focused exploration in Western Australia’s prolific Eastern Goldfields region Keep Reading...

05 May 2025

MHK Presentation RIU Sydney - May 2025

Metal Hawk Limited (MHK:AU) has announced MHK Presentation RIU Sydney - May 2025Download the PDF here. Keep Reading...

23 April 2025

Quarterly Activities/Appendix 5B Cash Flow Report

Metal Hawk Limited (MHK:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

31 March 2025

Heritage Survey Completed at Leinster South

Metal Hawk Limited (MHK:AU) has announced Heritage Survey Completed at Leinster SouthDownload the PDF here. Keep Reading...

23 March 2025

$2.5m Placement to Fund Extensive Gold Drilling

Metal Hawk Limited (MHK:AU) has announced $2.5m Placement to Fund Extensive Gold DrillingDownload the PDF here. Keep Reading...

20 March 2025

Trading Halt

Metal Hawk Limited (MHK:AU) has announced Trading HaltDownload the PDF here. Keep Reading...

20h

Rick Rule: Gold Price During War, Silver Strategy, Oil Stock Game Plan

Rick Rule, proprietor at Rule Investment Media, shares updates on his current strategy in the resource space, mentioning gold, silver, oil and agriculture. He also reminds investors to pay more attention to gold's underlying drivers than to current events.Click here to register for the Rule... Keep Reading...

20h

Lobo Tiggre: Gold, Oil in Times of War, Plus My Shopping List Now

Lobo Tiggre of IndependentSpeculator.com shares his thoughts on how gold, silver and oil could be impacted by the developing situation in the Middle East. He cautioned investors not to chase these commodities if prices run. Don't forget to follow us @INN_Resource for real-time updates!Securities... Keep Reading...

21h

TomaGold: New High-grade Deep Discovery at Berrigan Mine

TomaGold (TSXV:LOT) President, CEO and Director David Grondin said the company is focusing on its flagship Berrigan mine in Chibougamau, Québec, following a large, significant discovery at depth.Berrigan is 4 kilometers northwest of the city of Chibougamau and has existed for about 50 years.... Keep Reading...

21h

Oreterra Metals Fully Financed for Maiden Discovery Drilling at Trek South

Oreterra Metals (TSXV:OTMC) is set to launch its first-ever discovery drill program at the Trek South porphyry copper-gold prospect in BC, Canada, a pivotal moment following a corporate restructuring that culminated in the company emerging under its new name on February 2.Speaking at the... Keep Reading...

04 March

Aurum Hits High-Grade Gold at Napie, Cote d'Ivoire

Aurum Resources (AUE:AU) has announced Aurum Hits High-Grade Gold at Napie, Cote d'IvoireDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00