February 20, 2025

Targeting high-demand copper-gold projects, Metal Bank (ASX:MBK) offers a compelling investment opportunity by exploring assets in Australia, Saudi Arabia and Jordan. The company focuses on optimizing and divesting the Livingstone gold project to generate capital for expanding its copper projects in the Middle East. Metal Bank's strong regional presence, particularly in Saudi Arabia and Jordan, is underpinned by deep industry relationships and extensive operating experience.

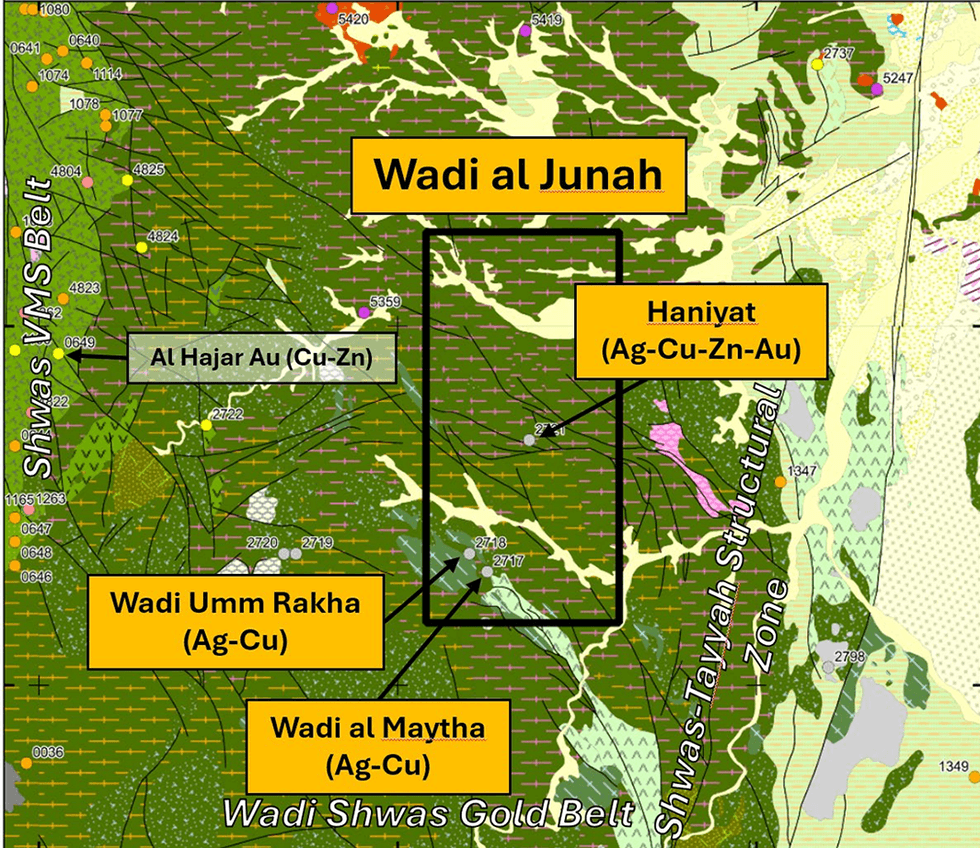

The company is securing copper and other critical minerals projects in Saudi Arabia, through its joint venture company, Consolidated Mining Company (CMC). CMC is 60 percent owned by MBK and 40 percent by Central Mining Holding Company. Its first project, Wadi Al Junah, has been awarded exploration licences in November 2024.

Wadi Al Junah is a joint venture through Consolidated Mining Company (CMC, MBK 60 percent). Exploration activities include regional geochemical surveys, surface mapping, and shear-zone anomaly identification. Phase 1 drilling is planned for Q2 2025.

Company Highlights

- Strategically focused on copper exploration and development, leveraging extensive experience and partnerships in the MENA region. Aiming for long-term growth from copper assets.

- Focused on the Livingstone gold project divestment, with ongoing JORC resource optimization, and strong corporate acquisition interest. If divested, proceeds are earmarked to fast-track exploration on the company’s copper projects.

- Expanding in Saudi Arabia by progressing the Wadi Al Junah copper project through a joint venture with Central Mining Holding Company.

- Disciplined capital allocation approach focused on low overheads and in-ground exploration investment.

- The company’s leadership team brings a proven track record in Saudi Arabia and Australia of exploration success and project execution, positioning the company for long-term value creation in the critical minerals market.

This Metal Bank profile is part of a paid investor education campaign.*

Click here to connect with Metal Bank (ASX:MBK) to receive an Investor Presentation

MBK:AU

Sign up to get your FREE

Metal Bank Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

19 February 2025

Metal Bank

Copper and gold-focused exploration in Australia and the Middle East

Copper and gold-focused exploration in Australia and the Middle East Keep Reading...

22 February

High-Grade Near-Surface Graphite Intersected at Millennium

Metal Bank (MBK:AU) has announced High-Grade Near-Surface Graphite Intersected at MillenniumDownload the PDF here. Keep Reading...

27 January

Quarterly Cash Flow Report

Metal Bank (MBK:AU) has announced Quarterly Cash Flow ReportDownload the PDF here. Keep Reading...

27 January

Quarterly Activities Report

Metal Bank (MBK:AU) has announced Quarterly Activities ReportDownload the PDF here. Keep Reading...

15 December 2025

Maiden Gold Resource for Seven Leaders Starter Pit

Metal Bank (MBK:AU) has announced Maiden Gold Resource for Seven Leaders Starter PitDownload the PDF here. Keep Reading...

26 November 2025

Millennium Drilling Commenced

Metal Bank (MBK:AU) has announced Millennium Drilling CommencedDownload the PDF here. Keep Reading...

27 February

Lahontan Gold Eyes Resource Update as Production Nears

Lahontan Gold (TSXV: LG,OTCQB:LGCXF) is drawing investor attention as it advances toward renewed production at its historic Santa Fe Mine in Nevada. A revised mineral resource estimate is expected soon, offering a potential catalyst, according to a recent report by News Financial.... Keep Reading...

27 February

Peruvian Metals Invites Shareholders and Investment Community to Visit Them at Booth 2624B at PDAC 2026 in Toronto, March 3-4

Peruvian Metals Corp (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals" or the "Company") is pleased to invite investors and shareholders to Booth #2624B at the Prospectors & Developers Association of Canada's (PDAC) Convention at the Metro Toronto Convention Centre (MTCC) from Tuesday,... Keep Reading...

27 February

OTC Markets Group Welcomes RUA GOLD INC. to OTCQX

OTC Markets Group Inc. (OTCQX: OTCM), operator of regulated markets for trading 12,000 U.S. and international securities, today announced Rua Gold INC. (TSX: RUA,OTC:NZAUF; OTCQX: NZAUF), an exploration company, has qualified to trade on the OTCQX® Best Market. Rua Gold INC. upgraded to OTCQX... Keep Reading...

27 February

RUA GOLD Begins Trading on the OTCQX Best Market in the United States

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZ: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce that that its common shares have begun trading today on the OTCQX® Best Market under the symbol 'NZAUF'. U.S. investors can find current financial disclosure and Real-Time Level 2... Keep Reading...

27 February

American Eagle Expands South Zone 750 Metres to the East and Further Demonstrates Continuity Within High-Grade Core, Intersecting 618 Metres of 0.77% CuEq from Surface

Highlights: 618 m of 0.77% CuEq from surface in NAK25-80, linking high grade, at-surface gold rich mineralization to high-grade core at depth. Continuity from surface to depth: NAK25-80 builds on prior long-intervals, including NAK25-78: 802 m of 0.71% CuEq from surface, and strengthens... Keep Reading...

26 February

Pause in Trading

Zeus Resources Limited (ZEU:AU) has announced Pause in TradingDownload the PDF here. Keep Reading...

Latest News

Sign up to get your FREE

Metal Bank Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Obonga Project: Wishbone VMS Update

27 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00