May 12, 2022

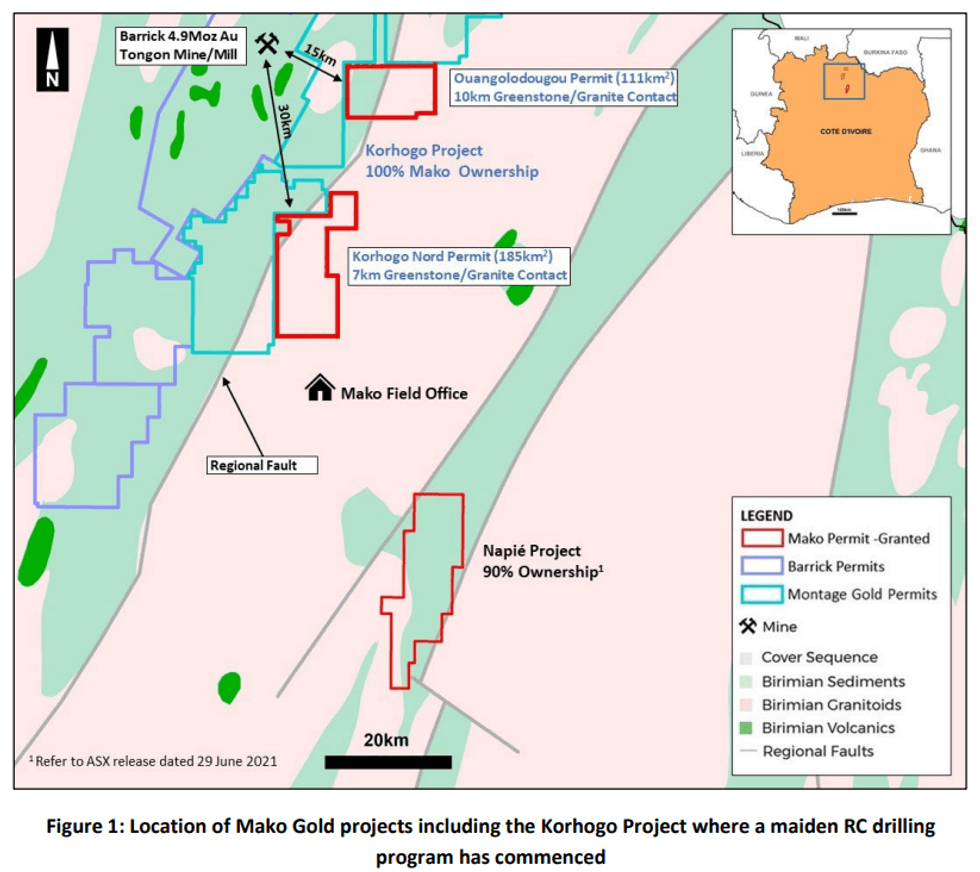

Mako Gold Limited (“Mako” or “the Company”; ASX:MKG) is pleased to advise that it has commenced a 2,000m maiden RC drilling program at the Korhogo Nord Permit which, with the Ouangolodougou Permit constitute the Korhogo Project1 . The permits collectively cover 296km2 hosting 17km of faulted greenstone granite contact as shown in Figure 1. Both permits are 100% owned by Mako and are readily accessible from the Mako Field Office.

HIGHLIGHTS

- 2,000m maiden Reverse Circulation (RC) drill program commenced on first high-priority target at Korhogo – Mako’s second project, in a previously undrilled land package

- Primary target is a 2km-long +20ppb gold anomaly with high-grade cores over 60ppb gold coincident with faulted greenstone-granite contact

- Additional targets identified for further exploration including auger and follow up RC drill testing

- The 100% Mako owned Korhogo Project has no previously recorded drilling and covers 296km2 of prospective tenure located within 15-30 km of Barrick’s 4.9Moz Tongon Gold Mine

- Exploration at Korhogo is on strategy for Mako -ensuring the Company continues to target discoveries on greenfield exploration projects, whilst moving its flagship Napié Project towards a Mineral Resource Estimate (MRE).

- Drilling completed at the Gogbala Prospect on the Napié Project where a MRE is on-track for June 2022

Mako’s Managing Director, Peter Ledwidge commented:

“Mako is in the privileged position to be able to commence a maiden drilling campaign on its second project, whilst finalising its MRE on its flagship Napié Project. This leverages the core skillset of the management team; namely making discoveries on highly prospective greenfield projects in West Africa. The commencement of drilling at Korhogo marks an important milestone in the growth of the Company as we progress to the drilling phase on the project. Our previous work at Korhogo has culminated in the identification of several high-priority targets. We are pleased to commence drilling on the first target, a 2km-long +20ppb gold auger anomaly with high grade cores over 60ppb Au, coincident with a faulted greenstone/ granite contact. We look forward to announcing results from drilling at Korhogo as well as Napié, where we have completed our drilling ahead of the upcoming MRE

Korhogo is located in a fertile greenstone belt that hosts Barrick Gold’s 4.9Moz Tongon gold mine and Montage Gold’s 4.5Moz Kone gold deposit, both in Côte d’Ivoire, as well as Endeavour’s 2.7Moz Wahgnion gold mine just across the border in Burkina Faso (Figure 5).

Previous work completed by Mako includes airborne magnetics/ radiometric geophysics, soil geochemical sampling, and the recent 11,000m auger drilling program1 . Interpretation of the results on these previous programs has identified several high-priority targets. The maiden drilling program will focus on the first target, a 2km-long +20ppb gold auger anomaly with high grade cores over 60ppb gold, coincident with the faulted greenstone/ granite contact shown in Figure 2.

Drilling has commenced on the first of four fences of heel to toe RC holes (where the bottom of one hole when projected to surface is the collar of the next hole), covering approximately 900m of the highest auger anomalies (Figure 3).

Click here for the full ASX Release

This article includes content from Mako Gold, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

MKG:AU

The Conversation (0)

24 August 2021

Mako Gold

Exploring High-Grade Gold Deposits in Côte d'Ivoire

Exploring High-Grade Gold Deposits in Côte d'Ivoire Keep Reading...

4h

Rick Rule: Gold Price During War, Silver Strategy, Oil Stock Game Plan

Rick Rule, proprietor at Rule Investment Media, shares updates on his current strategy in the resource space, mentioning gold, silver, oil and agriculture. He also reminds investors to pay more attention to gold's underlying drivers than to current events.Click here to register for the Rule... Keep Reading...

4h

Lobo Tiggre: Gold, Oil in Times of War, Plus My Shopping List Now

Lobo Tiggre of IndependentSpeculator.com shares his thoughts on how gold, silver and oil could be impacted by the developing situation in the Middle East. He cautioned investors not to chase these commodities if prices run. Don't forget to follow us @INN_Resource for real-time updates!Securities... Keep Reading...

04 March

Aurum Hits High-Grade Gold at Napie, Cote d'Ivoire

Aurum Resources (AUE:AU) has announced Aurum Hits High-Grade Gold at Napie, Cote d'IvoireDownload the PDF here. Keep Reading...

04 March

Precious Metals Price Update: Gold, Silver, PGMs Fall on Escalating US-Iran War

Precious metals prices are down on potential for economic fallout from escalating US-Iran War.Volatility has returned to the precious metals market this past week. All eyes are on the breakout of a full-scale war across the Middle East prompted by a coordinated assault on Iran by the United... Keep Reading...

04 March

SSR Mining to Sell Çöpler Gold Mine Stake in US$1.5 Billion Deal

SSR Mining (NASDAQ:SSRM,TSX:SSRM,OTCPL:SSRGF) has agreed to sell its majority stake in the Çöpler gold mine in Turkey for US$1.5 billion in cash, shifting the company’s portfolio towards the Americas as the yellow metal continues to surge amid rising geopolitical tensions.The Denver-based miner... Keep Reading...

04 March

Blackrock Silver Announces the Appointment of Bernard Poznanski and Susan Mathieu to the Board of Directors

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce the appointment of Bernard Poznanski and Susan Mathieu as independent directors to the Board of Directors of the Company (the "Board of Directors").In conjunction with... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00