October 28, 2024

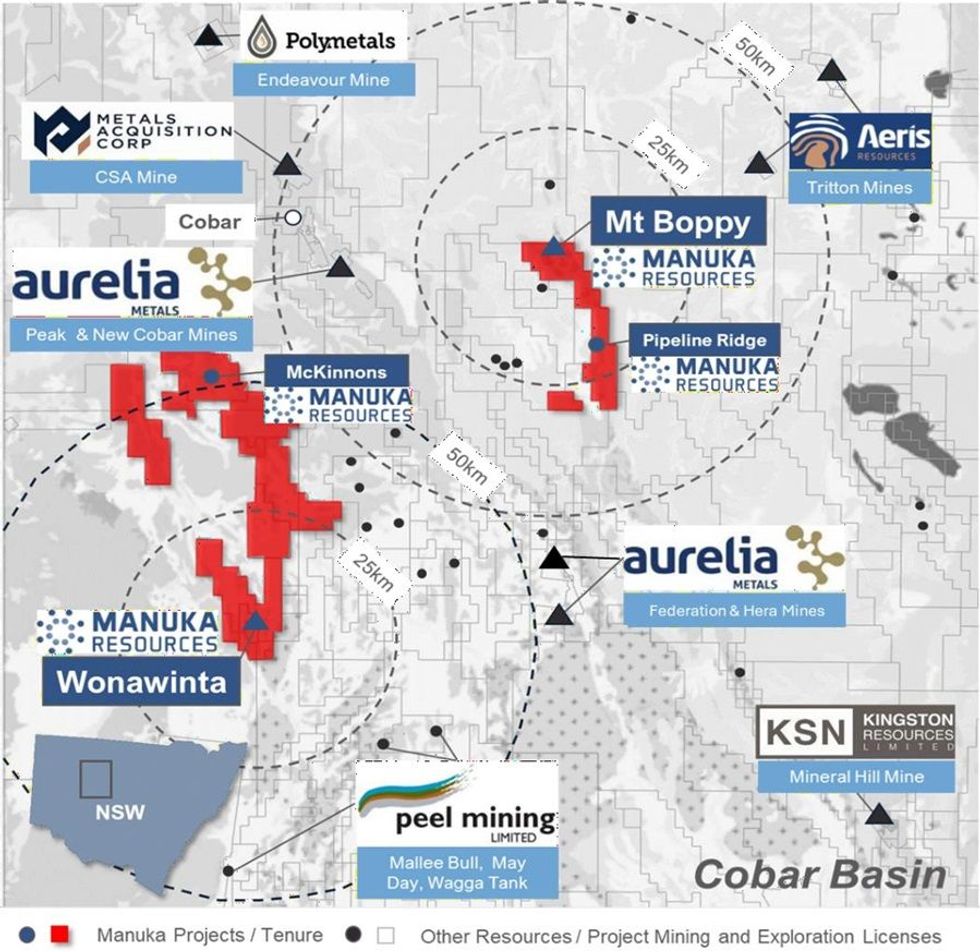

Manuka Resources Limited (“Manuka” or the “Company”) is pleased to announce a Maiden Ore Reserve (under its ownership) of the Wonawinta Silver Mine (“Wonawinta” or the “Project”), located 80km due south of Cobar in New South Wales (Figure 1). The Ore Reserve and associated Implementation Plan provides the Company with a clear production pipeline and pathway toward a dual precious metals revenue stream from two operating assets in the Cobar basin, namely Mt Boppy Gold Mine and Wonawinta.

Highlights

- The Wonawinta Silver Mine and Processing plant is a highly strategic asset located within the prolific Cobar Basin, NSW, and owned 100% by Manuka Resources Limited.

- Wonawinta is the only primary silver Reserve in Australia with all mining approvals current and intact, and process plant fully constructed - Wonawinta was producing silver for Manuka as recently as late 2022.

- Ore Reserve of 4.8Mt1 at 53.8g/t Ag containing 8.4Moz of silver comprising:

- Proved Ore Reserves of 0.8Mt at 50.8g/t Ag; and

- Probable Ore Reserves of 4.1Mt at 54.3g/t Ag.

- Ore Reserve is based solely on shallow (<40m deep) oxide material.

- Total Wonawinta Resource comprises 38.3Mt at 41.3g/t Ag for 51Moz of silver (ASX release 1 April 2021).

- The Ore Reserve and associated Implementation Plan will be used to assess the potential to take Wonawinta out of active care & maintenance and recommence silver production.

- Manuka is currently focused on the restart of a high-margin operation at its 100% owned Mt Boppy Gold Project located 50km east of Cobar and progressing approvals for its world-class vanadium rich irons sand project located in the Southern Taranaki Bight, New Zealand.

Manuka’s Executive Chairman, Dennis Karp, commented:

“Manuka’s Maiden Silver Ore Reserve and the preparation of an Implementation Plan for Wonawinta represents a major milestone for the Company and supports a potential of restarting silver mining and processing operations in the future. Our process plant at Wonawinta has been kept in excellent condition and on active care & maintenance since the processing of gold from stockpiles hauled from Mt Boppy, ceased in February 2024 and therefore stands ready to come back online at short notice.

The prospect of restarting Wonawinta provides the Company with excellent optionality on silver and the potential to take advantage of the very buoyant precious metals prices and broader strategic opportunities within the Cobar Basin. We look forward to providing further updates to the market as our strategy progresses.

Summary

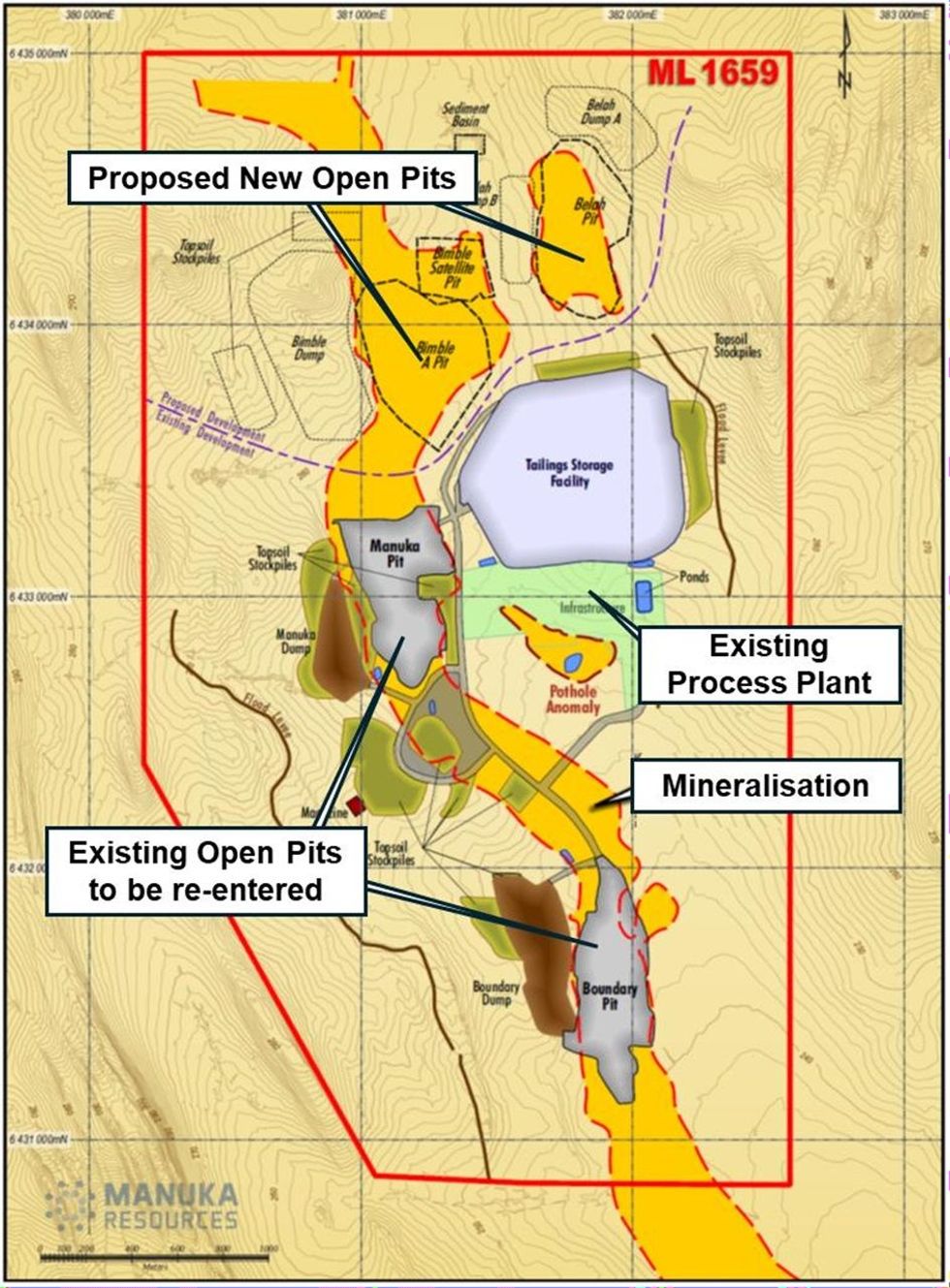

Wonawinta was built by Cobar Consolidated Resources (“CCR”) in 2011 and acquired by Manuka in 2016. The Project comprises a granted mining lease, existing open pits mines, an existing 1Mtpa CIL process plant and associated infrastructure including approved tailings dams and accommodation facilities (Figures 2 – 4). Whilst limited silver production was undertaken by Manuka in 2022, the Wonawinta plant has primarily, and as recently as December 2023, been used by Manuka to produce gold doré from ore hauled from the Mt Boppy gold mine.

The current Implementation Plan proposes the mining and processing of 4.8Mt of Ore at a grade of 54g/t Ag over 4.5 years for the recovery of 5.8Moz of silver. Capital Costs for taking the mine out of care & maintenance and recommence production are estimated to be A$3.7M plus A$12.4M in pre-strip mining. Based on the current silver forward curve and an All-In Sustaining Cost of A$40.51/oz, the mine plan would deliver operating cash flows of ~A$100M based on the Ore Reserve alone.

As the price and demand outlook for silver continues to develop, Manuka will continue to refine its economic model for the Project and look to further optimise the mining schedule and reduce pre-production mining costs ahead of a decision to commence the restart of operations.

Click here for the full ASX Release

This article includes content from Manuka Resources Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

vanadium investingsilver investingiron investinggold stocksasx stocksgold explorationgold investingasx:mkr

MKR:AU

The Conversation (0)

26 March 2025

Manuka Resources

Near-term production from both its silver and gold projects located in the Cobar Basin, Central West, New South Wales

Near-term production from both its silver and gold projects located in the Cobar Basin, Central West, New South Wales Keep Reading...

05 August 2025

Results of Fully Underwritten Entitlement Offer

Manuka Resources (MKR:AU) has announced Results of Fully Underwritten Entitlement OfferDownload the PDF here. Keep Reading...

31 July 2025

June 2025 Quarter Activities and Cashflow Reports

Manuka Resources (MKR:AU) has announced June 2025 Quarter Activities and Cashflow ReportsDownload the PDF here. Keep Reading...

29 July 2025

Maiden Mt Boppy Open Pit Ore Reserve

Manuka Resources (MKR:AU) has announced Maiden Mt Boppy Open Pit Ore ReserveDownload the PDF here. Keep Reading...

10 July 2025

Further Information to 26 June Announcement

Manuka Resources (MKR:AU) has announced Further Information to 26 June AnnouncementDownload the PDF here. Keep Reading...

08 July 2025

Reinstatement to Quotation

Manuka Resources (MKR:AU) has announced Reinstatement to QuotationDownload the PDF here. Keep Reading...

8h

Rick Rule: Gold Price During War, Silver Strategy, Oil Stock Game Plan

Rick Rule, proprietor at Rule Investment Media, shares updates on his current strategy in the resource space, mentioning gold, silver, oil and agriculture. He also reminds investors to pay more attention to gold's underlying drivers than to current events.Click here to register for the Rule... Keep Reading...

8h

Lobo Tiggre: Gold, Oil in Times of War, Plus My Shopping List Now

Lobo Tiggre of IndependentSpeculator.com shares his thoughts on how gold, silver and oil could be impacted by the developing situation in the Middle East. He cautioned investors not to chase these commodities if prices run. Don't forget to follow us @INN_Resource for real-time updates!Securities... Keep Reading...

9h

TomaGold: New High-grade Deep Discovery at Berrigan Mine

TomaGold (TSXV:LOT) President, CEO and Director David Grondin said the company is focusing on its flagship Berrigan mine in Chibougamau, Québec, following a large, significant discovery at depth.Berrigan is 4 kilometers northwest of the city of Chibougamau and has existed for about 50 years.... Keep Reading...

9h

Oreterra Metals Fully Financed for Maiden Discovery Drilling at Trek South

Oreterra Metals (TSXV:OTMC) is set to launch its first-ever discovery drill program at the Trek South porphyry copper-gold prospect in BC, Canada, a pivotal moment following a corporate restructuring that culminated in the company emerging under its new name on February 2.Speaking at the... Keep Reading...

04 March

Aurum Hits High-Grade Gold at Napie, Cote d'Ivoire

Aurum Resources (AUE:AU) has announced Aurum Hits High-Grade Gold at Napie, Cote d'IvoireDownload the PDF here. Keep Reading...

04 March

Precious Metals Price Update: Gold, Silver, PGMs Fall on Escalating US-Iran War

Precious metals prices are down on potential for economic fallout from escalating US-Iran War.Volatility has returned to the precious metals market this past week. All eyes are on the breakout of a full-scale war across the Middle East prompted by a coordinated assault on Iran by the United... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00