November 22, 2023

Magnetic Resources’ (ASX:MAU) Lady Julie North 4 (LJN4) project in Western Australia could be a sleeping giant after recent drilling revealed significant discoveries unfolding, according to a report released by advisory, stockbroking, research and investment house Argonaut Research.

The report included a potential inventory of 778Koz at 2.34g/t (1.0g/t Cut-off) for LJN4.

“Extensional drilling at depth for LJN4 is currently underway so we anticipate the next LJN4 resource update will exceed our estimates and likely turn into a +1Moz deposit captured within a large 1000m x 600m single open pit,” the report stated.

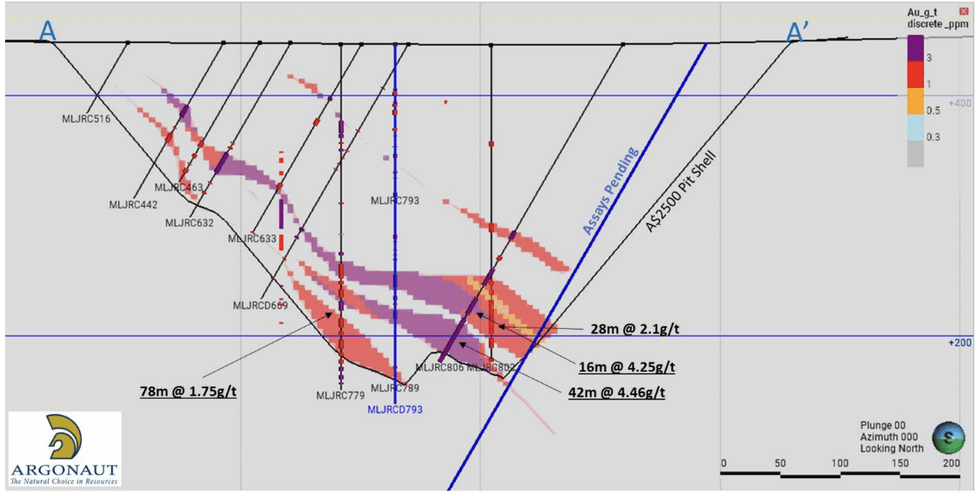

Figure 1: Cross section of Argonaut’s completed Leapfrog model for LJN4 with recent significant intercepts

Argonaut recommended a “speculative buy” for MAU with a price target of $1.80/share on the back of a pending LJN4 resource upgrade and further exploration drill results.

Highlights of the report include:

- Using currently reported drilling by MAU, Argonaut models a potential inventory of 778Koz at 2.34g/t (1.0g/t Cut-off) for LJN4.

- LJN4 resource update will exceed Argonaut estimates and likely turn into a +1Moz deposit captured within a large 1000m x 600m single open pit.

- Growing deposit in an active M&A region: The LJN4 deposit location is ideal - only 15km from two existing mills (Mt Morgans (ASX:GMD) & Granny Smith (JSE:GFI).

- Consolidation of the Leonora region by Genesis first focused on securing milling capacity. With two mills now under GMD ownership, consolidating ounces in the ground may be the next step before other producers in the area start making their own moves.

- The Granny Smith Mill is running under capacity - treating 1.58Mt in 2022, less than 50 percent of its 3.5Mtpa

Click here for the full report

This content is intended only for persons who reside or access the website in jurisdictions with securities and other applicable laws which permit the distribution and consumption of this content and whose local law recognizes the scope and effect of this Disclaimer, its limitation of liability, and the legal effect of its exclusive jurisdiction and governing law provisions [link to Governing Law section of the Disclaimer page].

Any investment information contained on this website, including third party research reports, are provided strictly for informational purposes, are general in nature and not tailored for the specific needs of any person, and are not a solicitation or recommendation to purchase or sell a security or intended to provide investment advice. Readers are cautioned to seek the advice of a registered investment advisor regarding the appropriateness of investing in any securities or investment strategies mentioned in this website.

The Conversation (0)

13 December 2023

Magnetic Resources NL

An Exciting Gold Development Play in Western Australia

An Exciting Gold Development Play in Western Australia Keep Reading...

1h

Venezuela Gold Set for US Market in Brokered Deal

A new US-Venezuela gold deal could soon channel hundreds of kilograms of bullion from the South American nation into American refineries.Venezuela’s state-owned mining company, Minerven, has agreed to sell between 650 and 1,000 kilograms of gold dore bars to commodities trading house Trafigura... Keep Reading...

22h

Rick Rule: Gold Price During War, Silver Strategy, Oil Stock Game Plan

Rick Rule, proprietor at Rule Investment Media, shares updates on his current strategy in the resource space, mentioning gold, silver, oil and agriculture. He also reminds investors to pay more attention to gold's underlying drivers than to current events.Click here to register for the Rule... Keep Reading...

22h

Lobo Tiggre: Gold, Oil in Times of War, Plus My Shopping List Now

Lobo Tiggre of IndependentSpeculator.com shares his thoughts on how gold, silver and oil could be impacted by the developing situation in the Middle East. He cautioned investors not to chase these commodities if prices run. Don't forget to follow us @INN_Resource for real-time updates!Securities... Keep Reading...

23h

TomaGold: New High-grade Deep Discovery at Berrigan Mine

TomaGold (TSXV:LOT) President, CEO and Director David Grondin said the company is focusing on its flagship Berrigan mine in Chibougamau, Québec, following a large, significant discovery at depth.Berrigan is 4 kilometers northwest of the city of Chibougamau and has existed for about 50 years.... Keep Reading...

23h

Oreterra Metals Fully Financed for Maiden Discovery Drilling at Trek South

Oreterra Metals (TSXV:OTMC) is set to launch its first-ever discovery drill program at the Trek South porphyry copper-gold prospect in BC, Canada, a pivotal moment following a corporate restructuring that culminated in the company emerging under its new name on February 2.Speaking at the... Keep Reading...

05 March

Oreterra Metals

Get access to more exclusive Gold Investing Stock profiles here Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00