- WORLD EDITIONAustraliaNorth AmericaWorld

November 22, 2023

Magnetic Resources’ (ASX:MAU) Lady Julie North 4 (LJN4) project in Western Australia could be a sleeping giant after recent drilling revealed significant discoveries unfolding, according to a report released by advisory, stockbroking, research and investment house Argonaut Research.

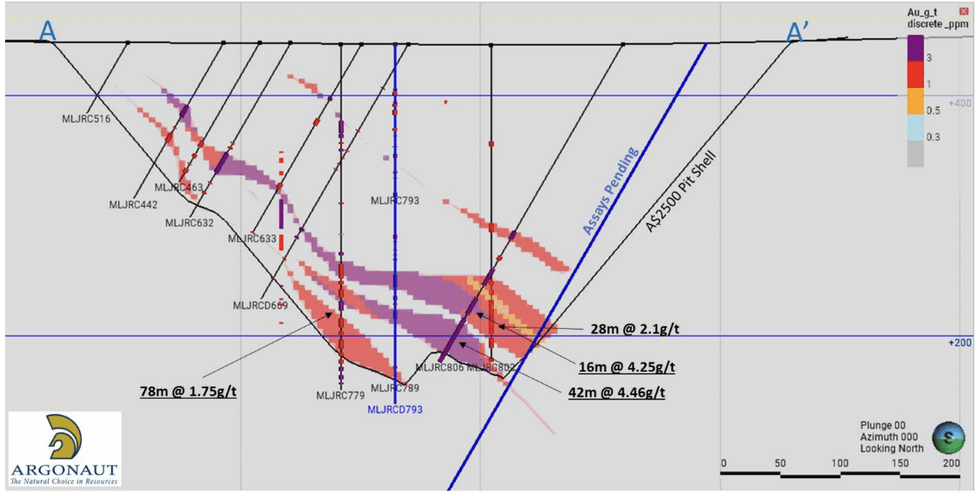

The report included a potential inventory of 778Koz at 2.34g/t (1.0g/t Cut-off) for LJN4.

“Extensional drilling at depth for LJN4 is currently underway so we anticipate the next LJN4 resource update will exceed our estimates and likely turn into a +1Moz deposit captured within a large 1000m x 600m single open pit,” the report stated.

Figure 1: Cross section of Argonaut’s completed Leapfrog model for LJN4 with recent significant intercepts

Argonaut recommended a “speculative buy” for MAU with a price target of $1.80/share on the back of a pending LJN4 resource upgrade and further exploration drill results.

Highlights of the report include:

- Using currently reported drilling by MAU, Argonaut models a potential inventory of 778Koz at 2.34g/t (1.0g/t Cut-off) for LJN4.

- LJN4 resource update will exceed Argonaut estimates and likely turn into a +1Moz deposit captured within a large 1000m x 600m single open pit.

- Growing deposit in an active M&A region: The LJN4 deposit location is ideal - only 15km from two existing mills (Mt Morgans (ASX:GMD) & Granny Smith (JSE:GFI).

- Consolidation of the Leonora region by Genesis first focused on securing milling capacity. With two mills now under GMD ownership, consolidating ounces in the ground may be the next step before other producers in the area start making their own moves.

- The Granny Smith Mill is running under capacity - treating 1.58Mt in 2022, less than 50 percent of its 3.5Mtpa

Click here for the full report

This content is intended only for persons who reside or access the website in jurisdictions with securities and other applicable laws which permit the distribution and consumption of this content and whose local law recognizes the scope and effect of this Disclaimer, its limitation of liability, and the legal effect of its exclusive jurisdiction and governing law provisions [link to Governing Law section of the Disclaimer page].

Any investment information contained on this website, including third party research reports, are provided strictly for informational purposes, are general in nature and not tailored for the specific needs of any person, and are not a solicitation or recommendation to purchase or sell a security or intended to provide investment advice. Readers are cautioned to seek the advice of a registered investment advisor regarding the appropriateness of investing in any securities or investment strategies mentioned in this website.

The Conversation (0)

13 December 2023

Magnetic Resources NL

An Exciting Gold Development Play in Western Australia

An Exciting Gold Development Play in Western Australia Keep Reading...

12h

Lion One Acknowledges Receipt of Shareholder Requisition and Reiterates Constructive Dialogue and Engagement with All Shareholders

Lion One is committed to transparency and keeping its Shareholders informed No need for Shareholders to take actionLion One Metals Limited (TSXV: LIO,OTC:LOMLF) (OTCQX: LOMLF) ("Lion One" or the "Company") acknowledges receipt of a shareholder meeting requisition notice pursuant to section 167... Keep Reading...

13h

Joe Cavatoni: Gold Volatility Picking Up, Price Setting New Floors

Joe Cavatoni, senior market strategist, Americas, at the World Gold Council, discusses gold's recent price activity, weighing in on its safe-haven status as volatility rises. "We should probably just be accepting of these higher levels of vol and understand that you still see the same type of... Keep Reading...

13h

Joe Mazumdar: Bullish on Copper, but Time to Hold Gold is Now

Joe Mazumdar, editor of Exploration Insights, explains his strategy for picking stocks in a bull market, saying good companies are getting pricier. "When you find deposits that don't have that fatal flaw ... you will have to pay up for it," he said. "And I'm not worried about paying up for it,... Keep Reading...

13h

Top 7 ASX Gold ETFs for Australian Investors in 2026

The price of gold reached record highs in 2026, driven by global economic uncertainty stemming from shifting US trade policy and escalating geopolitical tensions in the Middle East.For many investors, gold is a tool for diversification. The precious metal is known for its ability to act as a... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00