- NORTH AMERICA EDITIONAustraliaNorth AmericaWorld

March 26, 2025

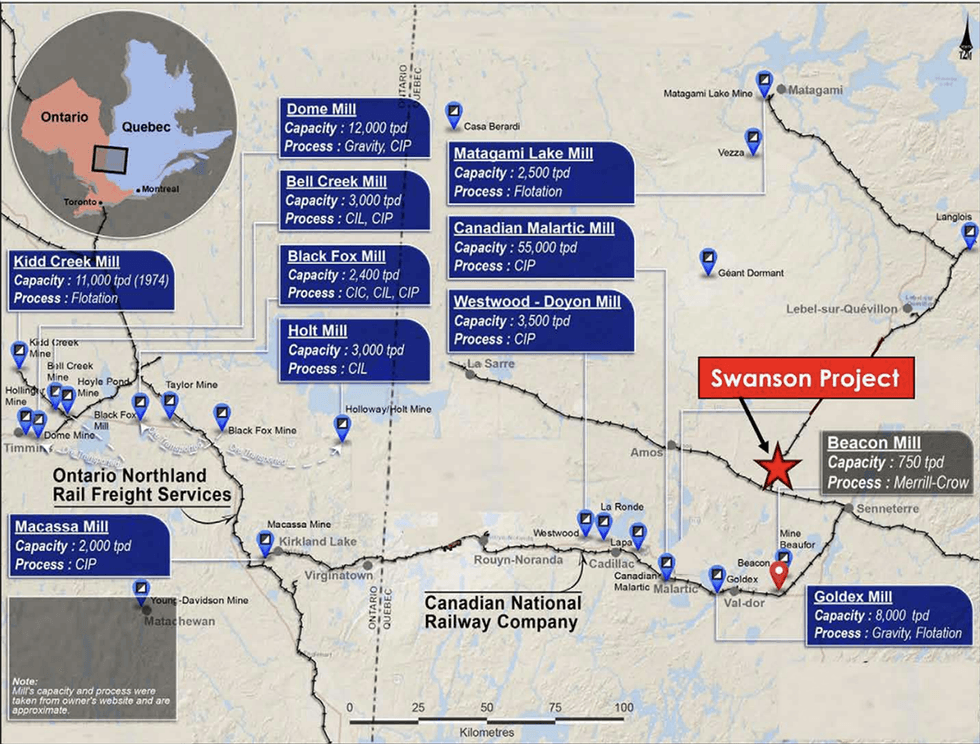

LaFleur Minerals (CSE:LFLR,OTCQB:LFLRF) is a gold exploration and development company with assets in Québec’s Abitibi Gold Belt, one of the world’s most prolific gold regions. The company is advancing the Swanson Gold Project, a well-located, resource-rich deposit with strong expansion potential, while preparing for a production restart at Beacon Mill.

With a market cap yet to reflect its asset value, LaFleur presents a compelling entry opportunity, backed by solid fundamentals, strong growth catalysts, and significant upside potential from its low-cost, near-term gold mill restart.

The Swanson Gold Project is located in Québec, Canada, the fifth-best mining jurisdiction globally (Fraser Institute’s 2023 survey). The region offers a stable, resource-friendly environment with strong access to flow-through capital. With over 36,000 metres of historical drilling, Swanson demonstrates significant exploration and development potential, featuring multiple gold-bearing regional structures and deformation corridors across the property.

Company Highlights

- Focused on developing high-potential gold projects in the Abitibi Gold Belt in Québec, a top-tier mining jurisdiction with strong government support and flow-through financing incentives, and Canada’s largest gold producing region.

- Successfully assembled over 150 square kilometers of mineral claims and a mining lease, anchored by the Swanson gold deposit and complemented by recent acquisitions from Abcourt Mines.

- The Swanson gold project hosts an NI 43-101-compliant mineral resource of 123 koz indicated and 64 koz inferred, with significant exploration upside.

- LaFleur owns the fully permitted and refurbished 750 tpd Beacon Gold Mill, which previously underwent ~$20 million in upgrades, providing a clear pathway to near-term gold production from Swanson and other potential regional sources.

- The company has launched an extensive exploration program, including geophysics, geochemistry and a planned 10,000-meter drill campaign for 2025, targeting a resource expansion to over 1 Moz.

- Led by CEO Paul Ténière, a highly experienced geologist and mining executive, supported by a team with extensive expertise in gold exploration, project development and corporate finance.

This LaFleur Minerals profile is part of a paid investor education campaign.*

LFLR:CNX

Sign up to get your FREE

LaFleur Minerals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

20 July

LaFleur Minerals

Advancing a district-scale gold asset and near-term production mill in Quebec’s Abitibi Gold Belt

Advancing a district-scale gold asset and near-term production mill in Quebec’s Abitibi Gold Belt Keep Reading...

05 November

LaFleur Minerals Advances Swanson Confirmation Drilling to Support Beacon Mill Restart and PEA

LaFleur Minerals Inc. (CSE: LFLR,OTC:LFLRF) (OTCQB: LFLRF) (FSE: 3WK0) is moving closer to near-term gold production with the launch of a confirmation drilling program at its Swanson Gold Deposit in Val-d'Or, Québec. The program will support a Preliminary Economic Assessment (PEA) for the... Keep Reading...

05 November

LaFleur Minerals Announces Brokered Private Placement of Gold-Linked Convertible Notes to Finance Restart of Gold Production at Beacon Gold Mill

LaFleur Minerals Inc. (CSE: LFLR,OTC:LFLRF) (OTCQB: LFLRF) (FSE: 3WK0) ("LaFleur Minerals" or the "Company") is pleased to announce the launch of a brokered private placement of gold-linked convertible notes with a minimum principal amount of $4,000,000 and up to a maximum principal amount of... Keep Reading...

04 November

LaFleur Minerals Provides Update on Confirmation Drilling for PEA at Swanson Gold Deposit and Beacon Gold Mill, Val-d'Or, Québec

LaFleur Minerals Inc. (CSE: LFLR,OTC:LFLRF) (OTCQB: LFLRF) (FSE: 3WK0) ("LaFleur Minerals" or the "Company") is pleased to provide an update on the twinned-hole drilling program launched at its Swanson Gold Deposit ("Swanson"). The Company announced, in its October 6, 2025 news release, that it... Keep Reading...

31 October

LaFleur Minerals Closes $1.66 Million Flow-Through Offering to Advance Drilling and PEA-Related Work at its Swanson Gold Deposit

LaFleur Minerals Inc. (CSE: LFLR,OTC:LFLRF) (OTCQB: LFLRF) (FSE: 3WK0) ("LaFleur Minerals" or the "Company" or "Issuer") is pleased to announce that, further to its news releases dated July 30, 2025, and September 10, 2025, the Company has closed its non-brokered flow-through private placement... Keep Reading...

31 October

LaFleur Minerals Inc. Emerging Among Peers as Attractive, Resilient Investment Play

This article has been disseminated on behalf of LaFleur Minerals and may include paid advertising. Via InvestorWire — LaFleur Minerals Inc. (CSE: LFLR) (OTCQB: LFLRF) (FSE: 3WK0) today announces its placement in an editorial published by NetworkNewsWire ("NNW"), one of 75+ brands within the... Keep Reading...

21h

Brien Lundin: Gold, Silver Waiting for Next Leg, What's the Catalyst?

Brien Lundin, editor of Gold Newsletter and New Orleans Investment Conference host, shares his outlook for gold and silver as prices continue to consolidate. "At the end of this cycle, I've long predicted that we're going to get to a US$6,000 to US$8,000 (per ounce) price range, whenever that... Keep Reading...

23h

Maritime Announces 2025 Annual General and Special Meeting Results

Maritime Resources Corp. (TSXV: MAE,OTC:MRTMD) ("Maritime" or the "Company") is pleased to announce that, at the annual general and special meeting (the "Company Meeting") of the holders of common shares (the "Common Shares") in the capital of the Company (the "Shareholders") and the holders of... Keep Reading...

04 November

Word Gold Council: Investment Key Driver of Gold Demand in Q3 2025

Investor appetite for safe-haven assets resulted in a record quarter for gold demand in Q3 2025, according to the World Gold Council’s (WGC) latest report.The WGC published its Gold Demand Trends Q3 report on October 30, which clearly demonstrates that investor demand for gold is exploding as... Keep Reading...

04 November

Gold Miners Ride Record Prices to Strong Q3 Results

Global gold producers reported robust third-quarter earnings on the back of record bullion prices. The yellow metal surged to its all-time high of US$4,379.13 on October 17, 2025, coming off the back of rising geopolitical and economic tensions that reignited safe-haven demand.The metal broke... Keep Reading...

Latest News

Sign up to get your FREE

LaFleur Minerals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00