March 26, 2025

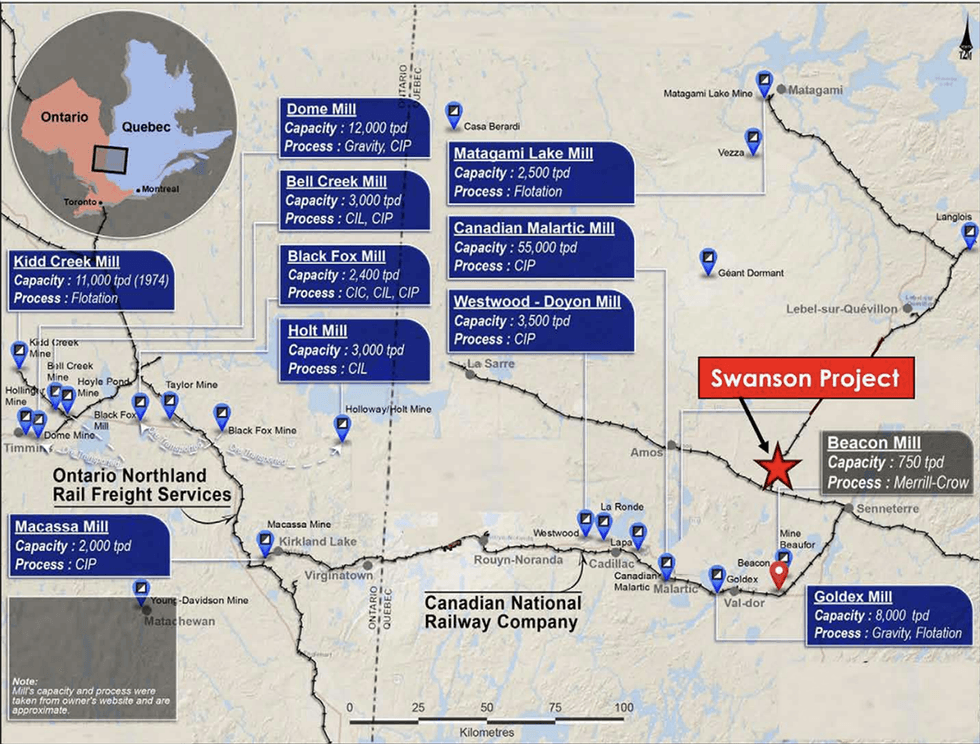

LaFleur Minerals (CSE:LFLR,OTCQB:LFLRF) is a gold exploration and development company with assets in Québec’s Abitibi Gold Belt, one of the world’s most prolific gold regions. The company is advancing the Swanson Gold Project, a well-located, resource-rich deposit with strong expansion potential, while preparing for a production restart at Beacon Mill.

With a market cap yet to reflect its asset value, LaFleur presents a compelling entry opportunity, backed by solid fundamentals, strong growth catalysts, and significant upside potential from its low-cost, near-term gold mill restart.

The Swanson Gold Project is located in Québec, Canada, the fifth-best mining jurisdiction globally (Fraser Institute’s 2023 survey). The region offers a stable, resource-friendly environment with strong access to flow-through capital. With over 36,000 metres of historical drilling, Swanson demonstrates significant exploration and development potential, featuring multiple gold-bearing regional structures and deformation corridors across the property.

Company Highlights

- Focused on developing high-potential gold projects in the Abitibi Gold Belt in Québec, a top-tier mining jurisdiction with strong government support and flow-through financing incentives, and Canada’s largest gold producing region.

- Successfully assembled over 150 square kilometers of mineral claims and a mining lease, anchored by the Swanson gold deposit and complemented by recent acquisitions from Abcourt Mines.

- The Swanson gold project hosts an NI 43-101-compliant mineral resource of 123 koz indicated and 64 koz inferred, with significant exploration upside.

- LaFleur owns the fully permitted and refurbished 750 tpd Beacon Gold Mill, which previously underwent ~$20 million in upgrades, providing a clear pathway to near-term gold production from Swanson and other potential regional sources.

- The company has launched an extensive exploration program, including geophysics, geochemistry and a planned 10,000-meter drill campaign for 2025, targeting a resource expansion to over 1 Moz.

- Led by CEO Paul Ténière, a highly experienced geologist and mining executive, supported by a team with extensive expertise in gold exploration, project development and corporate finance.

This LaFleur Minerals profile is part of a paid investor education campaign.*

LFLR:CNX

Sign up to get your FREE

LaFleur Minerals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

20 July 2025

LaFleur Minerals

Advancing a district-scale gold asset and near-term production mill in Quebec’s Abitibi Gold Belt

Advancing a district-scale gold asset and near-term production mill in Quebec’s Abitibi Gold Belt Keep Reading...

10 February

Flow Metals to Acquire the Monster IOCG Project in Yukon

Flow Metals Corp. (CSE: FWM) ("Flow Metals" or the "Company") is pleased to report that it has entered into an option agreement dated February 9, 2026 (the "Option Agreement") with Go Metals Corp. ("Go Metals") to acquire the Monster IOCG project (the "Monster Project"), located approximately 90... Keep Reading...

09 February

Investor Presentation

Aurum Resources (AUE:AU) has announced Investor PresentationDownload the PDF here. Keep Reading...

09 February

Dr. Adam Trexler: Physical Gold Market Broken, Crisis Unfolding Now

Dr. Adam Trexler, founder and president of Valaurum, shares his thoughts on gold, identifying a key issue he sees developing in the physical market. "There's a crisis in the physical gold market," he said, explaining that sector participants need to figure out how to serve investors who want to... Keep Reading...

09 February

Trevor Hall: Bull Markets Don’t Always Mean Big Returns

Clear Commodity Network CEO and Mining Stock Daily host Trevor Hall opened his talk at the Vancouver Resource Investment Conference (VRIC) with a strong message: It is still possible to go broke in a bull market.“I want to start with the simple but uncomfortable truth: most investors don't lose... Keep Reading...

09 February

How Near-term Production is Changing the Junior Gold Exploration Model

Junior gold companies have traditionally been defined by exploration: identifying prospective ground, drilling to delineate a resource and, ideally, monetising that discovery through a sale or joint venture with a larger producer. While this model has delivered success in the past, changing... Keep Reading...

09 February

Gold Exploration in Guinea: An Emerging Opportunity in West Africa

While much of West Africa’s gold exploration spotlight has historically fallen on countries like Ghana and Mali, Guinea is increasingly emerging as a quiet outlier — a country with proven gold endowment, expansive underexplored terrain and a growing number of active exploration programs. Despite... Keep Reading...

Latest News

Sign up to get your FREE

LaFleur Minerals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00