April 10, 2023

JORC 2012 Resource of 96,000oz highlights outstanding potential for further growth with mineralisation open in all directions and numerous under-explored gold trends

Labyrinth Resources Limited (Labyrinth or the Company) (ASX: LRL) is pleased to announce the completion of the first stage of its growth strategy at the Comet Vale Gold Project in WA.

Key Points

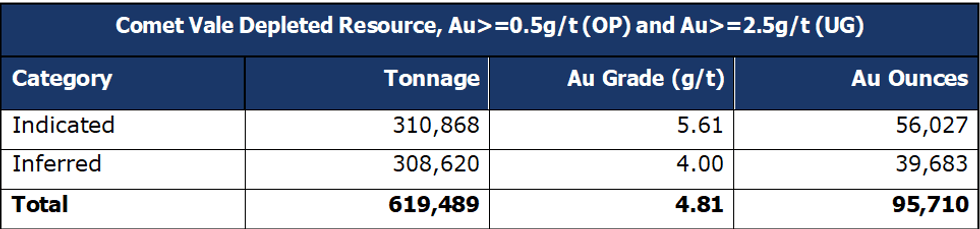

- Combined open pit and underground Indicated and Inferred Mineral Resource of 619,000t @ 4.8 g/t Au for 95,710oz

- Underground Resource of 56,233oz @ 7g/t (2.5g/t cut-off) shows high grade nature of the mineralisation

- Open pit Resource of 39,477oz @ 3.3g/t (0.5g/t cut-off) highlights the potential to establish significant high-grade, shallow inventory; This would open the door to near-term mining and cashflow options

- Notable high-grade Indicated Mineral Resource component of 42,000oz @ 10g/t Au (above 5g/t Au cut-off)

- Resource is open in all directions, demonstrating substantial growth potential through both the near-mine and regional drilling across other known gold trends

- Previous mining conducted at the property showed recoveries of 95% through conventional CIL processing at nearby toll treatment facilities1

- Mineral Resource prepared by an independent Competent Person and classified and reported in accordance with the JORC Code (2012)

- Resource is based on an extensive drilling database and rigorous modelling by independent consultants Right Solutions Australia

Next Steps:

- Receipt of assays from recently completed RC drill program targeting near-surface resource growth

- Planning of deeper drilling targeting down dip high grade mineralisation identified during the Resource estimate

- Regional exploration drilling targeting additional known gold and copper/gold trends

- Regional exploration drilling for other known commodities present on the property including nickel laterite

As part of this first stage, Labyrinth has completed an updated Indicated and Inferred Mineral Resource of 619,489t @ 4.81 g/t Au for 95,710oz and identified numerous opportunities to grow the inventory.

The Mineral Resource was prepared by a Competent Person and classified and reported in accordance with the JORC Code (2012).

The Comet Vale project is situated within the Ora Banda Domain within the Yilgarn Craton and has been mined periodically over many decades, most recently between 2018 and 2020.

The Company has undertaken a review and compilation of all available historic data to facilitate the production of a Mineral Resource reported in accordance with the JORC Code (2012).

The Indicated and Inferred Mineral Resource includes mineralisation within 10 lodes: 2 lodes (Domains 1-2) in the Sand Queen trend and 8 lodes (Domains 3-10) in the Princess Grace and Sand George trend (Table 9). Collectively these 10 domains make up the Sovereign Trend. In addition to the known mineralisation, there is also immense potential to grow the Mineral Resource given that the key lodes remain open along strike and at depth (Figures 12 and 13).

Labyrinth Chief Executive Matt Nixon said: “This is a robust Mineral Resource which lays the foundations for ongoing resource growth.

“We have defined a significant resource at consistent high grade across the historically mined areas for both open pit and underground scenarios to reinvigorate the Comet Vale Project at an exciting period for the gold market.

“The underground resource grade of 7g/t shows the high-grade nature and genuine potential of this deposit in a world class gold belt.

“Importantly, the estimate shows high grade mineralisation continues at depth and along strike. This provides immediate high priority drill targets to further grow the Resource.

“This Mineral Resource covers only the Sovereign Trend of lodes to a maximum depth of 400m below surface. With 7 other known mineralised gold trends as well as the potential for parallel systems to be discovered, there is significant growth potential across the Project.

“Following on from the success of this Mineral Resource, the Company looks forward to conducting drilling both for future resource growth as well as exploration to bring new discoveries into the pipeline”.

Note: Estimates are rounded to reflect the level of confidence in the Mineral Resource at present. All resource tonnages have been rounded to the first significant figure. Differences may occur in totals due to rounding.

Click here for the full ASX Release

This article includes content from Labyrinth Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

LRL:AU

The Conversation (0)

31 August 2023

Labyrinth Resources

Developing underexplored gold assets in the prolific Canadian Abitibi Gold Belt and the Yilgarn Craton of Western Australia.

Developing underexplored gold assets in the prolific Canadian Abitibi Gold Belt and the Yilgarn Craton of Western Australia. Keep Reading...

06 March

Adrian Day: Gold Dips Bought Quickly, Price Run Not Over Yet

Adrian Day, president of Adrian Day Asset Management, shares his latest thoughts on what's moving the gold price, emphasizing that its bull run isn't over yet. "It's monetary factors that are driving gold — that's what's fundamentally driving gold," he said. "Monetary factors, lack of trust in... Keep Reading...

06 March

Brien Lundin: Gold, Silver Stock Run Just Starting, Get in Now

Brien Lundin, editor of Gold Newsletter and New Orleans Investment Conference host, shares his stock-picking strategy at a time when high metals prices are beginning to lift all boats. In his view, gold and silver equities may still only be in the second inning. Don't forget to follow us... Keep Reading...

06 March

Venezuela Gold Set for US Market in Brokered Deal

A new US-Venezuela gold deal could soon channel hundreds of kilograms of bullion from the South American nation into American refineries.Venezuela’s state-owned mining company, Minerven, has agreed to sell between 650 and 1,000 kilograms of gold dore bars to commodities trading house Trafigura... Keep Reading...

05 March

Rick Rule: Gold Price During War, Silver Strategy, Oil Stock Game Plan

Rick Rule, proprietor at Rule Investment Media, shares updates on his current strategy in the resource space, mentioning gold, silver, oil and agriculture. He also reminds investors to pay more attention to gold's underlying drivers than to current events.Click here to register for the Rule... Keep Reading...

05 March

Lobo Tiggre: Gold, Oil in Times of War, Plus My Shopping List Now

Lobo Tiggre of IndependentSpeculator.com shares his thoughts on how gold, silver and oil could be impacted by the developing situation in the Middle East. He cautioned investors not to chase these commodities if prices run. Don't forget to follow us @INN_Resource for real-time updates!Securities... Keep Reading...

05 March

TomaGold: New High-grade Deep Discovery at Berrigan Mine

TomaGold (TSXV:LOT) President, CEO and Director David Grondin said the company is focusing on its flagship Berrigan mine in Chibougamau, Québec, following a large, significant discovery at depth.Berrigan is 4 kilometers northwest of the city of Chibougamau and has existed for about 50 years.... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00