June 29, 2023

Klimat X (TSXV:KLX) generates long-term (30+ years) recurring revenue streams and unprecedented returns in carbon markets by taking project development risk on restoration and conservation projects and pre-selling directly to large corporate buyers of carbon credits to meet their net-zero goals.

Klimat X is an industrial-scale carbon exploration and development company diversified across multiple jurisdictions. Having been founded in 2021 by James Tansey, the company was built to become a leader in protecting and restoring natural systems.

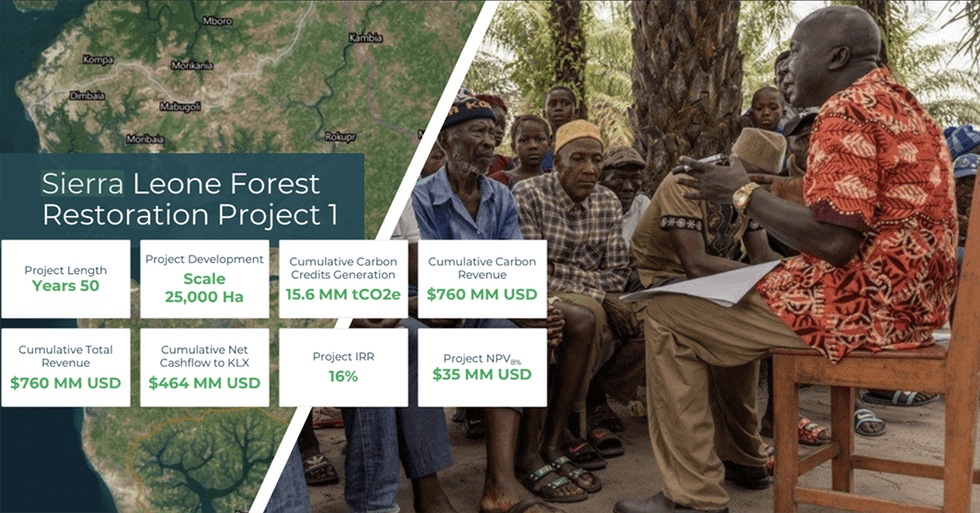

Klimat X's flagship project in Sierra Leone seeks to reforest and rewild land previously cleared for mining and palm plantations. As of September 2022, the company has restored roughly 400 hectares and plans to reach 1,200 hectares by the end of summer 2023. Klimat X has also secured an additional 57,000 hectares of land degraded by agricultural activity, which it intends to restore through collaboration with local communities.

Company Highlights

- Klimat X is an industrial-scale carbon credit project developer focused on natural solutions such as conservation, reforestation and mangrove restoration.

- Through collaboration with both the national government and its network of partners and developers, Klimat X is focused on developing low-cost carbon offset projects in highly productive jurisdictions.

- The company already maintains between 40 and 100 percent ownership of three initial assets alongside a development pipeline of 3 million tons of carbon credits diversified across Asia, Latin America and Africa.

- In addition to rewilding and reforestation in Sierra Leone, agroforestry in Guyana and mangrove restoration in Mexico, Klimat X is assessing the following regions for additional natural carbon projects:

- Suriname

- Kurdistan (Iraq)

- Balochistan (Pakistan)

- Mongolia

- Colombia

- Democratic Republic of Congo

- The existing Yucatan and Sierra Leone projects alone will result in roughly 44 million tons of carbon credit production. That supply stands to exponentially increase as the other projects in the pipeline are developed.

- The company works with some of the largest buyers in the world including Fortune 100 companies.

- Klimat X currently maintains a 60-percent interest in sustainable coconut and spice producer and processor Pomeroon.

This Klimat X profile is part of a paid investor education campaign.*

Click here to connect with Klimat X (TSXV:KLX) to receive an Investor Presentation

KLX:CC

The Conversation (0)

15 January 2024

Carbon Done Right

Embracing the Carbon Credit Economy to Address Climate Change

Embracing the Carbon Credit Economy to Address Climate Change Keep Reading...

25 February

Acquisition of Critical Infrastructure Services Platform

European Green Transition plc (AIM: EGT) announces that in line with its strategy set out at IPO, EGT has entered into a share purchase agreement ("SPA") to acquire an established, EBITDA profitable onshore wind turbine operating, maintenance, repairing, and remote monitoring business (the "O&M... Keep Reading...

25 February

CHARBONE confirme de nouvelles commandes en hydrogene UHP et une premiere commande en oxygene UHP aux Etats-Unis

(TheNewswire) Brossard, Quebec, le 25 février 2026 TheNewswire - CORPORATION Charbone (TSXV: CH,OTC:CHHYF; OTCQB: CHHYF; FSE: K47) (« Charbone » ou la « Société »), un producteur et distributeur nord-américain spécialisé dans l'hydrogène propre Ultra Haute Pureté (« UHP ») et les gaz industriels... Keep Reading...

25 February

CHARBONE Confirms New UHP Hydrogen Orders and its First UHP Oxygen Order in the United States

(TheNewswire) Brossard, Quebec, February 25, 2026 TheNewswire - Charbone CORPORATION (TSXV: CH,OTC:CHHYF; OTCQB: CHHYF; FSE: K47) ("Charbone" or the "Company"), a North American producer and distributor specializing in clean Ultra High Purity ("UHP") hydrogen and strategic industrial gases, is... Keep Reading...

24 February

Carbonxt Secures $500,000 Convertible Note Funding

Carbonxt Group (CG1:AU) has announced Carbonxt Secures $500,000 Convertible Note FundingDownload the PDF here. Keep Reading...

23 February

CHARBONE Presente a la Conference Emerging Growth le 25 fevrier 2026

(TheNewswire) Brossard, Quebec TheNewswire - le 23 février 2026 CORPORATION Charbone (TSXV: CH,OTC:CHHYF; OTCQB: CHHYF; FSE: K47) (« Charbone » ou la « Société »), un producteur et distributeur nord-américain spécialisé dans l'hydrogène propre Ultra Haute Pureté (« UHP ») et les gaz industriels... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Obonga Project: Wishbone VMS Update

27 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00