October 22, 2024

IsoEnergy Ltd. (TSX: ISO) (OTCQX: ISENF) ("IsoEnergy") and Purepoint Uranium Group Inc. (TSXV: PTU) (OTCQB: PTUUF) ("Purepoint") are pleased to announce that they have entered into a contribution agreement in connection with the creation of a joint venture (the "Joint Venture") for the exploration and development of a portfolio of uranium properties in northern Saskatchewan's Athabasca Basin. Both companies will contribute assets from their respective portfolios to the Joint Venture, which will consist of 10 projects covering more than 98,000 hectares in the east side of the Athabasca Basin and will leverage their respective expertise to capitalize on the significant potential of these properties.

Transaction Highlights

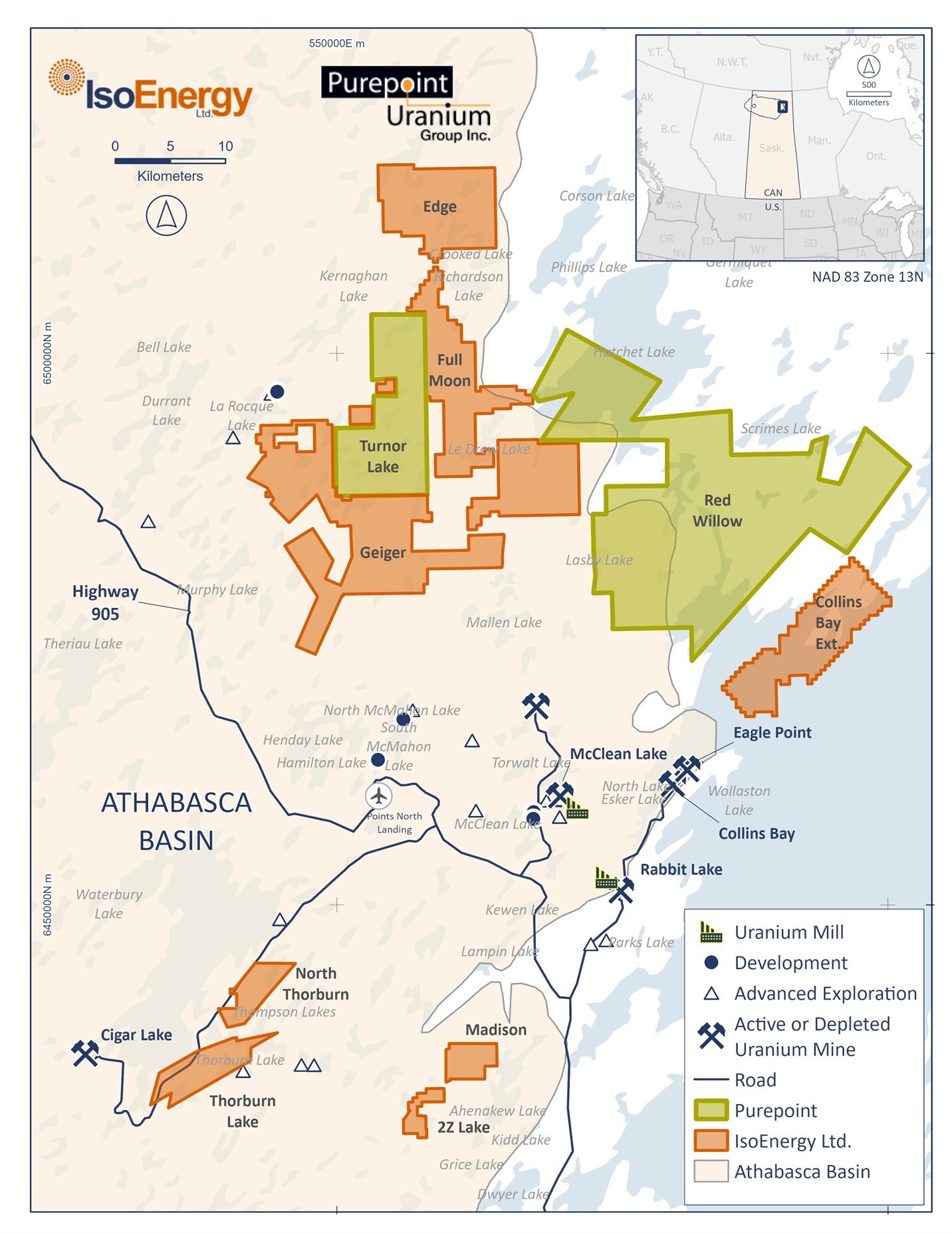

- Joint Venture Portfolio – The Joint Venture will be comprised of 10 projects within the eastern Athabasca Basin (Figure 1) including:

- IsoEnergy's Geiger, Thorburn Lake, Full Moon, Edge, Collins Bay Extension, North Thorburn, 2Z Lake, and Madison Projects.

- Purepoint's Turnor Lake and Red Willow Projects.

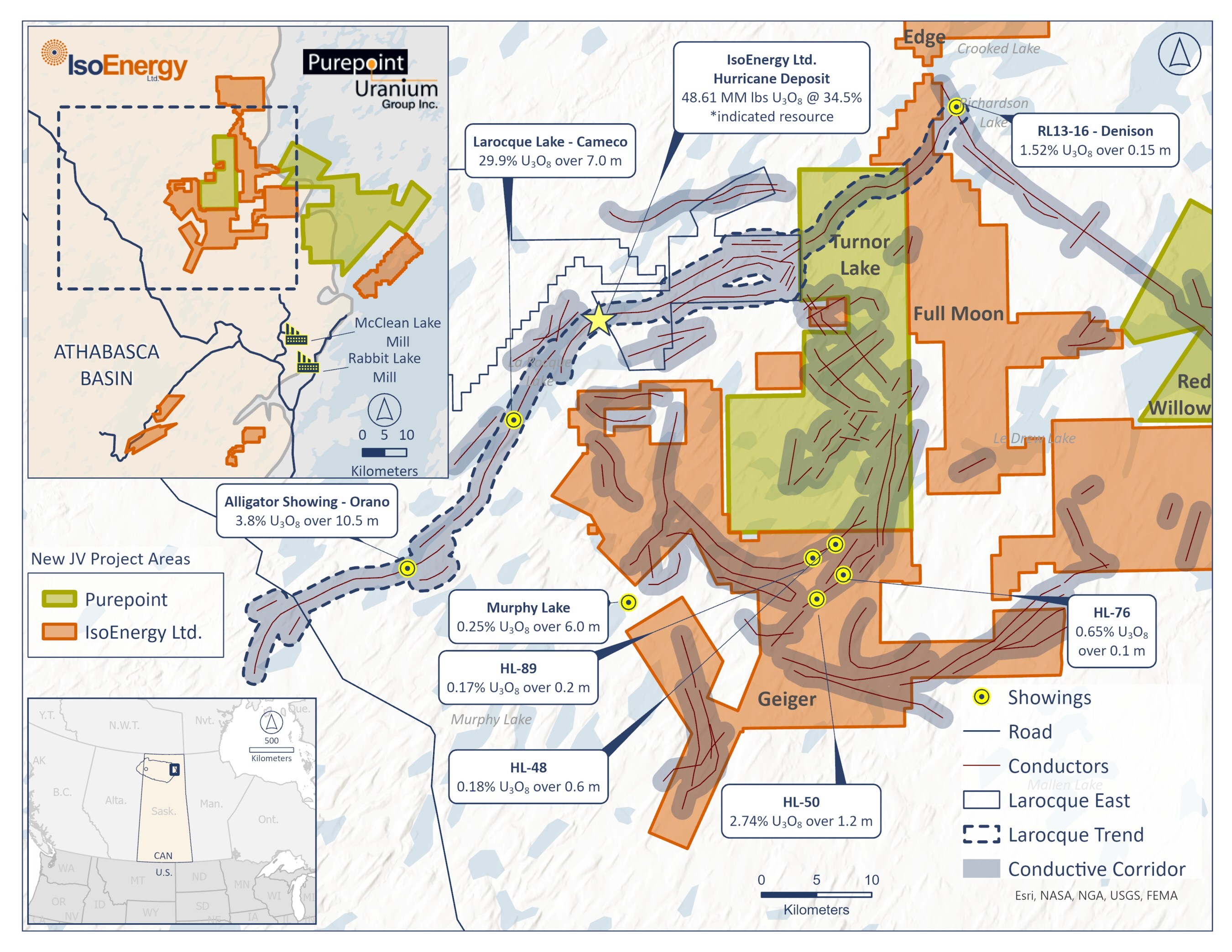

- Complementary and Prospective Ground Covering the Larocque Trend with Strong Discovery Potential – The Larocque Trend ("Larocque Trend"), is an important regional structure that hosts the world-class Hurricane deposit and other notable high-grade occurrences, including those on Cameco/Orano's Dawn Lake joint venture. The trend extends onto the Turnor Lake and Full Moon Projects, positioning the Joint Venture along a proven corridor for uranium mineralization, where further discoveries could be expedited (Figure 2).

- Strategic Synergy and Strengthened Positioning through Equity Participation – IsoEnergy will subscribe for $1.0 million in concurrent equity financing of Purepoint. Through this equity stake, IsoEnergy will gain exposure to Purepoint's other highly prospective exploration projects in the Athabasca Basin, including Hook Lake, which previously intersected an impressive 10 meters at 10.3% U₃O₈. In turn, Purepoint will benefit from IsoEnergy's financial and technical support, enabling both companies to work collaboratively to accelerate project development and drive long-term success.

- Initial Ownership Structure and Operating Terms – IsoEnergy will initially hold a 60% interest in the Joint Venture, while Purepoint will hold a 40% interest. Each party has the option to adjust this ownership to 50/50 within six months through the exercise of mutually exclusive put/call options. Purepoint will serve as the operator during the exploration phase of the Joint Venture properties. Upon the advancement into the pre-development phase, IsoEnergy will assume operational control of the Joint Venture properties.

Philip Williams, CEO and Director of IsoEnergy, commented: "We are excited to announce formation of this Joint Venture with Purepoint and see many advantages for both companies. Together, the Joint Venture projects consolidate a large land position immediately to the east of the Larocque East project, which includes several kilometres of the highly prospective Larocque trend. Purepoint has proven itself an exceedingly capable operator and the Joint Venture will allow us to have several of our highly prospective projects advanced, while remaining focused on dual priorities of exploring and advancing the Larocque East project, host to the high-grade Hurricane Deposit, and restarting our past producing uranium mines in Utah. By combining our complementary project portfolios and leveraging our collective expertise, we believe we are well-positioned to accelerate discoveries and create value for our shareholders."

Chris Frostad, President and CEO of Purepoint, added: "With this Joint Venture, the majority of Purepoint's most significant projects are now being advanced within partnerships alongside some of the uranium sector's strongest players. This collaboration underscores the confidence our partners, including Cameco, Orano, Foran Mining and now IsoEnergy, have in the potential of these projects, and it further solidifies Purepoint's position at the forefront of uranium exploration in the Athabasca Basin. By combining forces and pooling resources, we are accelerating exploration efforts and setting the stage for potential large-scale discoveries that can meet the growing demand for clean energy. We look forward to leveraging the technical and financial strengths of our partners as we continue to operate these district-scale projects and drive them towards success."

Figure 1: Joint Venture Portfolio, including 10 Projects Covering More Than 98,000 Hectares in the Athabasca Basin.

Figure 2: Complementary and Prospective Ground Covering the Larocque Trend with Strong Discovery Potential

Figure 2: Complementary and Prospective Ground Covering the Larocque Trend with Strong Discovery Potential

Joint Venture Terms

The Joint Venture will be governed by a formal joint venture agreement to be entered into between the companies concurrently with the effective formation of the Joint Venture. Under the agreement:

- IsoEnergy will contribute its Geiger, Thorburn Lake, Full Moon, Edge, Collins Bay, North Thorburn, 2Z Lake, and Madison Projects in exchange for an initial 60% participation interest in the Joint Venture.

- Purepoint will contribute its Turnor Lake and Red Willow Projects in exchange for an initial 40% participation interest in the Joint Venture.

- IsoEnergy will have a put option to sell, and Purepoint will have a call option to acquire, 10% of IsoEnergy's initial participation interest, increasing Purepoint's stake to 50% in exchange for 4,000,000 post-Consolidation Purepoint shares (as defined below). This option is exercisable within six months of the Joint Venture's formation, with the exercise of one option resulting in the expiry of the other. If exercised, both parties will hold equal 50/50 participation interests in the Joint Venture.

- After the put/call option period, IsoEnergy will hold a further option to purchase an additional 1% interest from Purepoint for $2 million, giving IsoEnergy a 51% participation interest and Purepoint a 49% participation interest. This option expires on the earlier of February 28, 2026, or 60 days after a material uranium discovery.

- The ownership interests of each company are subject to standard dilution if a party fails to contribute to approved Joint Venture programs or expenditures. If either party's interest is reduced to 10% or less, that party will relinquish its entire interest in the Joint Venture in exchange for a 2% net smelter royalty (NSR) on the Joint Venture properties. The remaining party can purchase 1% of the NSR for $2 million.

- If one of the parties seeks to sell its participation interest in the Joint Venture, such party may force the other party to sell its participation interest in the Joint Venture so long as the selling party's participation interest is equal to 60% or greater.

- Purepoint will act as operator for all Joint Venture properties in the exploration phase, leveraging its extensive expertise and deep understanding of the Athabasca Basin. Once the Joint Venture properties advance to the pre-development stage, IsoEnergy will assume the role of operator.

Purepoint Share Consolidation and Concurrent Financing

In connection with the transaction, Purepoint will consolidate its shares on a 10:1 basis (the "Consolidation"). Purepoint currently has 500,772,765 common shares issued and outstanding. After giving effect to the Consolidation, Purepoint will have approximately 50,077,277 issued and outstanding post-consolidation common shares. The Consolidation has been approved by the Purepoint Board of Directors and was approved by Purepoint's shareholders at its Annual General and Special Meeting held on June 4, 2024. The Consolidation remains subject to approval by the TSX Venture Exchange (the "TSXV").

In conjunction with the Consolidation, Purepoint plans to complete a non-brokered private placement offering of up to 6,666,667 units at a price of $0.30 per unit, for gross proceeds of up to $2,000,000 (the "Concurrent Financing"). Each unit will consist of one post-Consolidation share and one warrant exercisable at $0.40 to acquire one post-Consolidation share for a period of three years. IsoEnergy will subscribe for $1.0 million of this financing, underscoring its commitment to the Joint Venture's exploration plans. IsoEnergy will be granted the right, for so long as it owns at least 10% of the post-Consolidation shares of Purepoint (on a partially diluted basis), to participate in any future equity financing of Purepoint in order to maintain its pro rata interest in Purepoint. The net proceeds of the Concurrent Financing will be used by Purepoint for general working capital purposes

The transactions, including the formation of the Joint Venture, the Consolidation, and Concurrent Financing (together the "Transactions"), remains subject to approval by the TSXV. The Joint Venture will take effect following the satisfaction of certain conditions, including but not limited to the completion of the Consolidation, closing of the Concurrent Financing, and receipt of all necessary regulatory approvals, including approval of the TSXV.

About IsoEnergy Ltd.

IsoEnergy is a leading, globally diversified uranium company with substantial current and historical mineral resources in top uranium mining jurisdictions of Canada, the U.S. and Australia at varying stages of development, providing near-, medium- and long-term leverage to rising uranium prices. IsoEnergy is currently advancing its Larocque East project in Canada's Athabasca basin, which is home to the Hurricane deposit, boasting the world's highest-grade indicated uranium mineral resource.

IsoEnergy also holds a portfolio of permitted past-producing, conventional uranium and vanadium mines in Utah with a toll milling arrangement in place with Energy Fuels. These mines are currently on standby, ready for rapid restart as market conditions permit, positioning IsoEnergy as a near-term uranium producer.

About Purepoint Uranium Group Inc.

Purepoint Uranium Group Inc. (TSXV: PTU) (OTCQB: PTUUF) is a focused explorer with a dynamic portfolio of advanced projects within the renowned Athabasca Basin in Canada. The most prospective projects are actively operated on behalf of partnerships with industry leaders including Cameco Corporation, Orano Canada Inc. and IsoEnergy Ltd.

Additionally, the Company holds a promising VHMS project currently optioned to and strategically positioned adjacent to and on trend with Foran Corporation's McIlvena Bay project. Through a robust and proactive exploration strategy, Purepoint is solidifying its position as a leading explorer in one of the globe's most significant uranium districts.

Neither the Exchange nor its Regulation Services Provider (as that term is defined in the policies of the Exchange) accepts responsibility for the adequacy or accuracy of this Press release.

Disclosure regarding forward-looking statements

This press release contains "forward-looking information" within the meaning of applicable Canadian securities legislation. Generally, forward-looking information can be identified by the use of forward-looking terminology such as "plans", "expects" or "does not expect", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates" or "does not anticipate", or "believes", or variations of such words and phrases or state that certain actions, events or results "may", "could", "would", "might" or "will be taken", "occur" or "be achieved". This forward-looking information may relate to the Transactions, including statements with respect to the completion of the Transactions; the anticipated benefits of the Joint Venture to the parties and their respective shareholders; the expected receipt of regulatory and other approvals relating to the Transactions; the expected ownership interests of and Purepoint in the Joint Venture; the prospects of each company's respective projects, including mineralization of each project; the potential for, success of and anticipated timing of commencement of future exploration and development of the Joint Venture projects; the expected gross proceeds of the Concurrent Financing and the anticipated use thereof; and any other activities, events or developments that the companies expect or anticipate will or may occur in the future.

Forward-looking statements are necessarily based upon a number of assumptions that, while considered reasonable by management at the time, are inherently subject to business, market and economic risks, uncertainties and contingencies that may cause actual results, performance or achievements to be materially different from those expressed or implied by forward-looking statements. Such assumptions include, but are not limited to, assumptions that IsoEnergy and Purepoint will complete the Transactions in accordance with the terms and conditions of the relevant agreements; that the parties will receive the required regulatory approvals and will satisfy, in a timely manner, the other conditions to completion of the Transactions; the accuracy of management's assessment of the effects of the successful completion of the Joint Venture and that the anticipated benefits of the Joint Venture will be realized; the anticipated mineralization of IsoEnergy's and Purepoint's projects being consistent with expectations and the potential benefits from such projects and any upside from such projects; the price of uranium; that general business and economic conditions will not change in a materially adverse manner; that financing will be available if and when needed and on reasonable terms; and that third party contractors, equipment and supplies and governmental and other approvals required to conduct the Joint Venture's planned activities will be available on reasonable terms and in a timely manner. Although each of IsoEnergy and Purepoint have attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking information.

Such statements represent the current views of IsoEnergy and Purepoint with respect to future events and are necessarily based upon a number of assumptions and estimates that, while considered reasonable by IsoEnergy and Purepoint, are inherently subject to significant business, economic, competitive, political and social risks, contingencies and uncertainties. Risks and uncertainties include, but are not limited to the following: the inability of IsoEnergy and Purepoint to complete the Transactions; a material adverse change in the timing of and the terms and conditions upon which the Transactions are completed; the inability to satisfy or waive all conditions to completion of the Transactions; the failure to obtain regulatory approvals in connection with the Transactions; the inability of the Joint Venture to realize the benefits anticipated from the Joint Venture and the timing to realize such benefits; changes to IsoEnergy's and/or Purepoint's current and future business plans and the strategic alternatives available thereto; growth prospects and outlook of Purepoint's business; regulatory determinations and delays; stock market conditions generally; demand, supply and pricing for uranium; and general economic and political conditions in Canada, the United States and other jurisdictions where the applicable party conducts business. Other factors which could materially affect such forward-looking information are described in the risk factors in each of IsoEnergy's and Purepoint's most recent annual management's discussion and analyses or annual information forms and IsoEnergy's and Purepoint's other filings with the Canadian securities regulators which are available, respectively, on each company's profile on SEDAR+ at www.sedarplus.ca. IsoEnergy and Purepoint do not undertake to update any forward-looking information, except in accordance with applicable securities laws.

PTU:CA

The Conversation (0)

27 January

Basin Energy Eyes Uranium Growth in Europe After Sweden Policy Shift

Basin Energy (ASX:BSN) is positioning for growth following Sweden’s significant shift in uranium policy, a move the company’s managing director, Pete Moorhouse, says has major implications not only for the company, but also for Europe’s broader energy strategy. In an interview with the Investing... Keep Reading...

27 January

American Uranium Exec Outlines Lo Herma ISR Progress, Resource Update

American Uranium (ASX:AMU,OTCID:AMUIF) Executive Director Bruce Lane says recent test work at the company’s Lo Herma uranium project in Wyoming has delivered an important proof of concept for its in situ recovery (ISR) development plans. The testing focused on validating aquifer performance, a... Keep Reading...

27 January

Standard Uranium CEO Outlines Athabasca Exploration Plans and Uranium Market Outlook

Standard Uranium (TSXV:STND,OTCQB:STTDF) is advancing an ambitious exploration strategy in Saskatchewan’s Athabasca Basin, according to CEO and Chairman John Bey, who spoke with the Investing News Network at the 2026 Vancouver Resource Investment Conference.The company is preparing for a... Keep Reading...

23 January

Investment establishes valuation of C$50M for the polymetallic Häggån project

Aura Energy Limited (ASX: AEE, AIM: AURA) (“Aura” or “the Company”) is pleased to announce that MMCAP International Inc. SPC (‘MMCAP’) and certain other strategic investors (together the ‘Strategic Investors’) will provide funding of C$10 million for a 19.7% interest in the Company’s... Keep Reading...

21 January

Laramide Exits Kazakhstan Uranium Project After Government Policy Shifts

Laramide Resources (TSX:LAM,OTCQX:LMRXF) has pulled out of a greenfield uranium exploration venture in Kazakhstan, citing policy changes that it says have effectively shut the door on economically viable foreign investment in the country’s uranium sector.The Toronto-based company announced on... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00