- NORTH AMERICA EDITIONAustraliaNorth AmericaWorld

December 17, 2024

Iceni Gold Limited (ASX: ICL) (Iceni or the Company) is pleased to advise of a binding Farm-in Agreement and share placement transaction with Gold Road Resources Limited (ASX: GOR) over tenements around and containing the Company’s Guyer Gold Trend, within the 14 Mile Well Gold Project (14MWGP or Project) located between Leonora and Laverton in Western Australia.

Highlights

- A$35 million exploration farm-in agreement signed with GOR over 154km2 of Iceni’s 100%-owned tenements containing the Guyer Gold Trend within the 14 Mile Well Project in Western Australia, key terms of which include:

- Initial A$5 million minimum exploration expenditure, to be managed by Iceni, with the opportunity for GOR to take management upon reaching a key success milestone.

- A further A$10 million exploration expenditure within 2 years from meeting the minimum A$5 million exploration expenditure to earn a 50% Joint Venture interest (50 / 50 JV).

- Upon Joint Venture formation GOR, can earn an additional 20% to take its Joint Venture interest to 70% by free carrying Iceni to the completion of a Pre-Feasibility Study (PFS) (70 /30 JV).

- At the completion of the PFS, GOR can acquire an additional 10% Joint Venture interest (totaling 80%) by paying $20 million to Iceni (80/20 JV).

- In addition to the Farm-in, GOR is to acquire a 9.9% interest in Iceni by subscribing for A$3.05 million in shares at a price of 10 cents per share, representing a 59% premium to the 5-day VWAP prior to execution of the Farm-in Agreement.

- GOR to be issued 19,218,819 options exercisable at $0.15 on or before 31 December 2025.

- GOR to be issued 13,847,016 options exercisable at $0.20 on or before 31 December 2026.

- Should GOR exercise all options, and inclusive of the placement, Iceni will receive a total of $8.7m in cash.

- Exploration activity on the GOR farm-in tenements is expected to commence in January 2025 under Iceni management.

- Iceni retains 100% ownership of the remainder of the highly prospective 14 Mile Well Gold Project, where exploration can now be accelerated on other high priority targets within the portfolio.

- Following completion of the GOR share placement Iceni will have in excess of $3.8 million cash at bank and will be well-funded to continue exploration and development activities on its remaining highly prospective 100%-owned ground.

Iceni Gold Managing Director, Wade Johnson, said:

“We are very pleased to be partnering with Gold Road, a company that needs no introduction to gold exploration, discovery and mining in Western Australia. The Farm-in Agreement and share placement with Gold Road is an excellent result for Iceni Gold and its shareholders that provides the opportunity to accelerate and advance exploration along the exciting Guyer Gold Trend at our 14 Mile Well Gold Project.

“The commitment by Gold Road reaffirms our belief that the Guyer Gold Trend has potential to host a significant gold deposit and reinforces the prospectivity of the entire tenement package. The planned significant investment by GOR at Guyer will now also allow for the concurrent evaluation of multiple high prospectivity targets to be accelerated on the remainder of the Iceni ground in which we retain 100% ownership. The farm in agreement will see Gold Road potentially spending up to A$35 million to earn up to an 80% interest in the Farm-in tenements that include the Guyer trend.

“The largely unexplored 11.5km long granite-greenstone contact hosting the Guyer trend, hidden beneath transported cover, combined with recent success from aircore drilling and the proximity of the nearby gold nugget field has provided us with the initial indications of a corridor that has the potential to deliver a new large gold discovery. The Iceni and Gold Road teams are very keen to get underway with the next phase of exploration that is expected to commence in January.”

Overview

Iceni Gold Limited (ASX: ICL) (Iceni or the Company) is pleased to announce it has entered into a $35 million farm- in agreement (Farm-in) with Gold Road Resources Limited (ASX:GOR) (Gold Road or GOR) in respect of 154km² of tenements (Farm-In Area), that form part of the Company’s 100%-owned 14 Mile Well Gold Project between Leonora and Laverton in Western Australia (Figure 5).

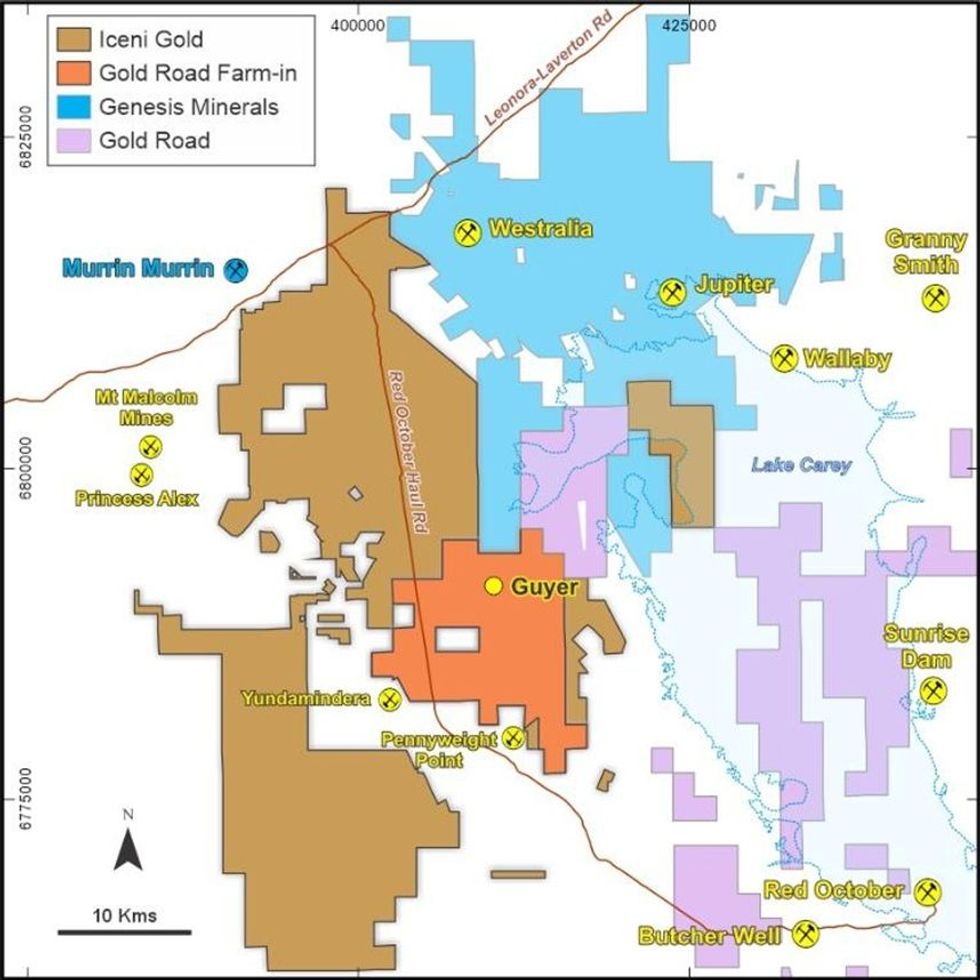

The Farm-in Area, which is to be called the Guyer Project, is shown in Figure 1. In addition, Iceni has entered into a subscription agreement with GOR pursuant to which GOR will immediately acquire a 9.9% shareholding in Iceni through a placement of new shares at 10 cents per share to raise A$3.05 million (Placement).Together, the Farm - in and Placement will strengthen the Company’s finances to accelerate exploration on its 100% non-JV tenements covering 733km2 whilst partnering with Gold Road to advance exploration at its flagship Guyer Gold Trend (Figures 2 & 3).

Details

Subscription Agreement

The Company has entered into a subscription agreement (Subscription Agreement) with Renaissance Resources Pty Limited (Subscriber), a wholly owned subsidiary of GOR. Under the Subscription Agreement, the Subscriber has subscribed for the following securities:

- 30,480,662 fully paid ordinary shares in the capital of Iceni (Shares) at an issue price of $0.10 per Share to raise $3.05m.

- 19,218,819 options to acquire Shares exercisable at $0.15 on or before 31 December 2025 for $2.8m.

- 13,847,016 options to acquire Shares exercisable at $0.20 on or before 31 December 2026 for $2.7m.

- Together, the Subscription Securities will be issued utilising the Company’s placement capacity under ASX Listing Rules 7.1 and 7.1A and will be subject to a voluntary escrow period of 24 months from the date of issue.

- A summary of the material terms and condition of the Subscription Agreement is set out in the Schedule.

Funds raised under the Subscription Agreement will be used to on the exploration of existing projects and for working capital purposes.

Farm-in Agreement

The Company’s wholly owned subsidiary, Guyer Well Pty Ltd (Owner) has entered into a Farm-in agreement (Farm- in Agreement) with Gold Alpha Pty Ltd (Acquirer), a wholly owned subsidiary of GOR. The Farm-in Agreement will commence immediately upon signing. The Acquirer must expend a minimum of $5 million (Minimum Obligation) as soon as reasonably practicable.

Under the Farm-in Agreement, GOR may earn and acquire up to an 80% joint venture interest in the Company’s tenements which form the Guyer Project (see Figure 1) as follows:

- Stage 1: Following satisfaction of the Minimum Obligation, the Acquirer can earn an initial 50% interest (Stage 1 Interest) in the Guyer Project by expending $15 million (inclusive of the Minimum Obligation) within 2 years following satisfaction of the Minimum Obligation.

- Stage 2: Following completion of Stage 1, the Acquirer can earn an additional 20% interest (Stage 2 Interest) through completion of a publicly announced Preliminary Feasibility Study in respect of the Guyer Project, which may include such items as a preferred technically viable solution to mine and process the mineralisation to extract metals or minerals, provide estimates of capital and operating costs for a project with sufficient financial returns to attract capital, and that provides a recommendation to progress to a feasibility level of evaluation, with recommendations on the scope of the feasibility studies.

- Stage 3: The Acquirer can acquire an additional 10% interest through a cash payment of $20 million to Iceni within 60 business days following completion of Stage 2.

Click here for the full ASX Release

This article includes content from Iceni Gold, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

ICL:AU

The Conversation (0)

15h

Adrian Day: Gold Dips Bought Quickly, Price Run Not Over Yet

Adrian Day, president of Adrian Day Asset Management, shares his latest thoughts on what's moving the gold price, emphasizing that its bull run isn't over yet. "It's monetary factors that are driving gold — that's what's fundamentally driving gold," he said. "Monetary factors, lack of trust in... Keep Reading...

15h

Brien Lundin: Gold, Silver Stock Run Just Starting, Get in Now

Brien Lundin, editor of Gold Newsletter and New Orleans Investment Conference host, shares his stock-picking strategy at a time when high metals prices are beginning to lift all boats. In his view, gold and silver equities may still only be in the second inning. Don't forget to follow us... Keep Reading...

18h

Venezuela Gold Set for US Market in Brokered Deal

A new US-Venezuela gold deal could soon channel hundreds of kilograms of bullion from the South American nation into American refineries.Venezuela’s state-owned mining company, Minerven, has agreed to sell between 650 and 1,000 kilograms of gold dore bars to commodities trading house Trafigura... Keep Reading...

05 March

Rick Rule: Gold Price During War, Silver Strategy, Oil Stock Game Plan

Rick Rule, proprietor at Rule Investment Media, shares updates on his current strategy in the resource space, mentioning gold, silver, oil and agriculture. He also reminds investors to pay more attention to gold's underlying drivers than to current events.Click here to register for the Rule... Keep Reading...

05 March

Lobo Tiggre: Gold, Oil in Times of War, Plus My Shopping List Now

Lobo Tiggre of IndependentSpeculator.com shares his thoughts on how gold, silver and oil could be impacted by the developing situation in the Middle East. He cautioned investors not to chase these commodities if prices run. Don't forget to follow us @INN_Resource for real-time updates!Securities... Keep Reading...

05 March

TomaGold: New High-grade Deep Discovery at Berrigan Mine

TomaGold (TSXV:LOT) President, CEO and Director David Grondin said the company is focusing on its flagship Berrigan mine in Chibougamau, Québec, following a large, significant discovery at depth.Berrigan is 4 kilometers northwest of the city of Chibougamau and has existed for about 50 years.... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00