- WORLD EDITIONAustraliaNorth AmericaWorld

Overview

Hydralyte International (ASX:HPC) is an ASX-listed rapid hydration solutions business focused on the lucrative North American market. With an established supply chain in Canada and the United States, the company consolidated its market position in FY23 with a 10 percent increase in net sales to $10 million. The impressive increase in group sales was achieved with a disciplined cost focus which flowed through to a significant US$5.7 million in cash savings. And there was ongoing momentum in the first quarter of FY24, with consistent growth in net sales to US$2.17 million on strong gross margins of 56 percent.

Hydralyte’s multi-channel distribution strategy includes a targeted growth through ecommerce. Its rapid rehydration product has been the number one SKU in the hydration category on Amazon Prime Day in Canada, where it's the number two hydration brand overall with a 21 percent market share. Starting on Prime Day, Hydralyte delivered ~US$140,000 in gross sales over 48 hours.

It's also worth noting that all this revenue growth – alongside a partnership with Shay Mitchell – occurred with an ongoing reduction in marketing expenditure. In 2024, marketing costs as a percentage of net revenue decreased to 37 percent from 48 percent in Q1 2023. This is due in part to the company's solid leadership team, featuring professionals with decades of expertise in health and wellness, as well as heavy brand investments which have been made throughout 2022.

In Australia, New Zealand and parts of Southeast Asia, Prestige Consumer Healthcare (NYSE:PBH) holds the exclusive sales and distribution rights to Hydralyte products. PBH is an American over-the-counter healthcare marketing and distribution company, dating back more than 100 years.

Hydralyte International's robust supply chain, sales trajectory, manufacturing approach and product strategy are far from the only reasons it shows such promise as an investment. Current market trends also significantly favor the company's core value proposition. Valued at US$1.68 billion in 2023, the global electrolyte hydration drinks market is expected to reach US$2.78 billion by 2033 as consumers turn away from high-sugar, low-electrolyte drinks and towards more clinical hydration products.

Roughly 75 percent of Americans are dehydrated at any given time. The reasons are many and varied, ranging from travel and exercise to alcohol and illness. Its symptoms are something many of us have simply learned to live with – irritability, brain fog, dizziness, increased thirst, dry mouth and fatigue, to name just a few.

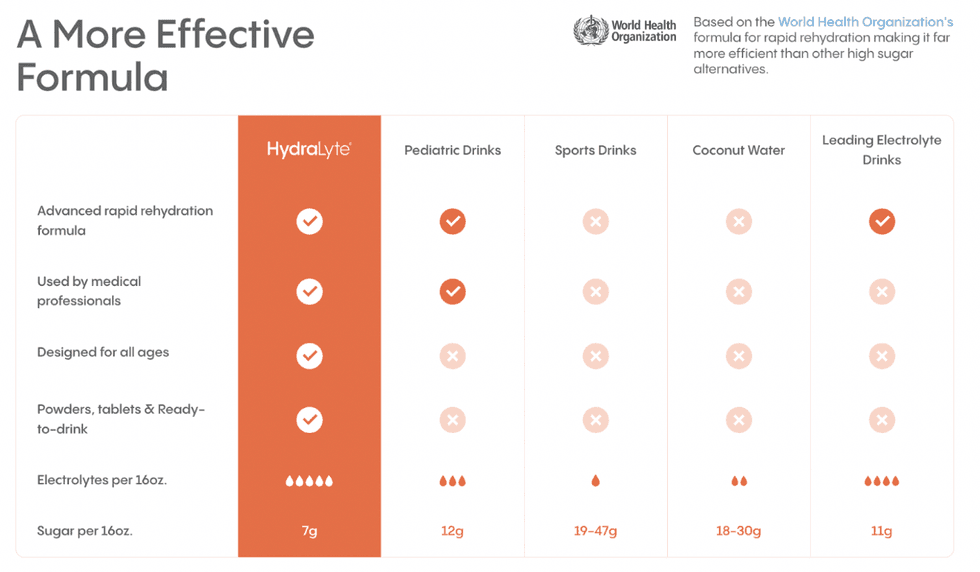

Hydralyte fits the bill perfectly for these consumers. Founded with the goal of making a difference through better hydration, Hydralyte is able to treat dehydration more effectively than the majority of sports drinks on the market. Thanks to its proprietary formula – which uses a precise ratio of water, electrolytes and glucose based on the World Health Organization's recommended formula for rapid rehydration.

Hydralyte is available in three forms: ready-to-drink, tablet and dissolvable powder stick. All three are widely accepted in the medical community. Hydralyte is also frequently used by professional athletes as an alternative to sports drinks.

In short, thanks to its market position, strong leadership and science-based formula, Hydralyte represents the perfect opportunity for investors to enter the lifestyle sports market.

Get access to more exclusive Biotech Investing Stock profiles here