November 06, 2024

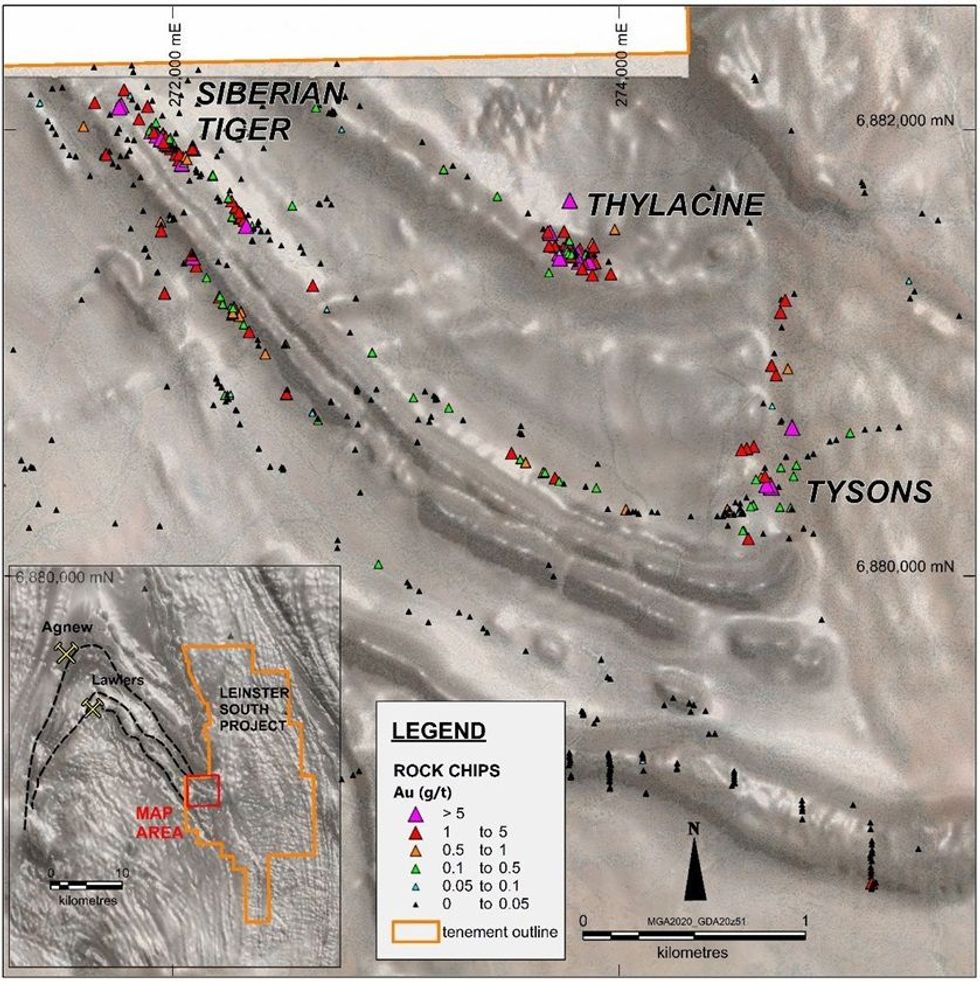

Metal Hawk Limited (ASX: MHK, “Metal Hawk” or the “Company”) is pleased to provide an exploration update relating to its 100% owned Leinster South Project, located 30km south of Leinster, in the world-class Agnew-Lawlers region of the eastern goldfields in Western Australia.

- Gold assays up to 62 g/t Au returned from first batch of rock chip samples at the Thylacine Prospect, located 1.5km ESE from Siberian Tiger.

- Several rock chip samples at Thylacine return high-grade gold from multiple sub-parallel quartz veins over a broad area, including:

- 24DR611: 62.3 g/t Au

- 24DR617: 30.4 g/t Au

- 24DR627: 27.0 g/t Au

- 24DR633: 20.2 g/t Au

- 24DR715: 27.3g/t Au

- 24DR613: 12.1 g/t Au

- 24DR627: 10.5 g/t Au

- 24DR616: 9.6 g/t Au

- 24DR602: 8.0 g/t Au

- Follow-up sampling at Tysons prospect returns high-grade gold in numerous samples of quartz veining, including:

- 24DR537: 84.0 g/t Au

- 24DR535: 21.5 g/t Au

- 24DR564: 10.9 g/t Au

- 24DR536: 6.2 g/t Au

- No historical drilling at Siberian Tiger, Thylacine or Tysons.

- Plans for drilling advanced with heritage survey scheduled for early 2025.

- Field mapping continues to discover new zones of outcropping gold mineralisation, including the new untested Bengal Tiger prospect.

Following the discovery of gold at Siberian Tiger only three months ago (see ASX announcement 5 August 2024), Metal Hawk’s field activities at Leinster South continue to encounter more significant outcropping high grade gold mineralisation at new prospects. As well as expanding the mineralised footprint of Siberian Tiger, the latest round of assay results successfully followed up the recent high grade rock chip result (22 g/t Au) at Tysons prospect, with several additional sites of quartz vein hosted gold mineralisation recorded (up to 84g/t Au) along the north-south trending granite-greenstone contact. Additionally, spectacular new gold assay results (up to 62 g/t Au) have confirmed the Thylacine prospect, located 1.5km to the ESE of Siberian Tiger, as another high-grade vein system at Leinster South.

Metal Hawk’s Managing Director Will Belbin commented: “In addition to the high-grade gold rock chips at Siberian Tiger, these outstanding new assay results from Thylacine and Tysons suggest that we are on the verge of multiple significant gold discoveries at Leinster South. It is incredible that there has not been any previous gold exploration, sampling or drilling at any these prospects. This is a huge opportunity for Metal Hawk and I believe there is potential for a new high-grade gold camp at Leinster South.”

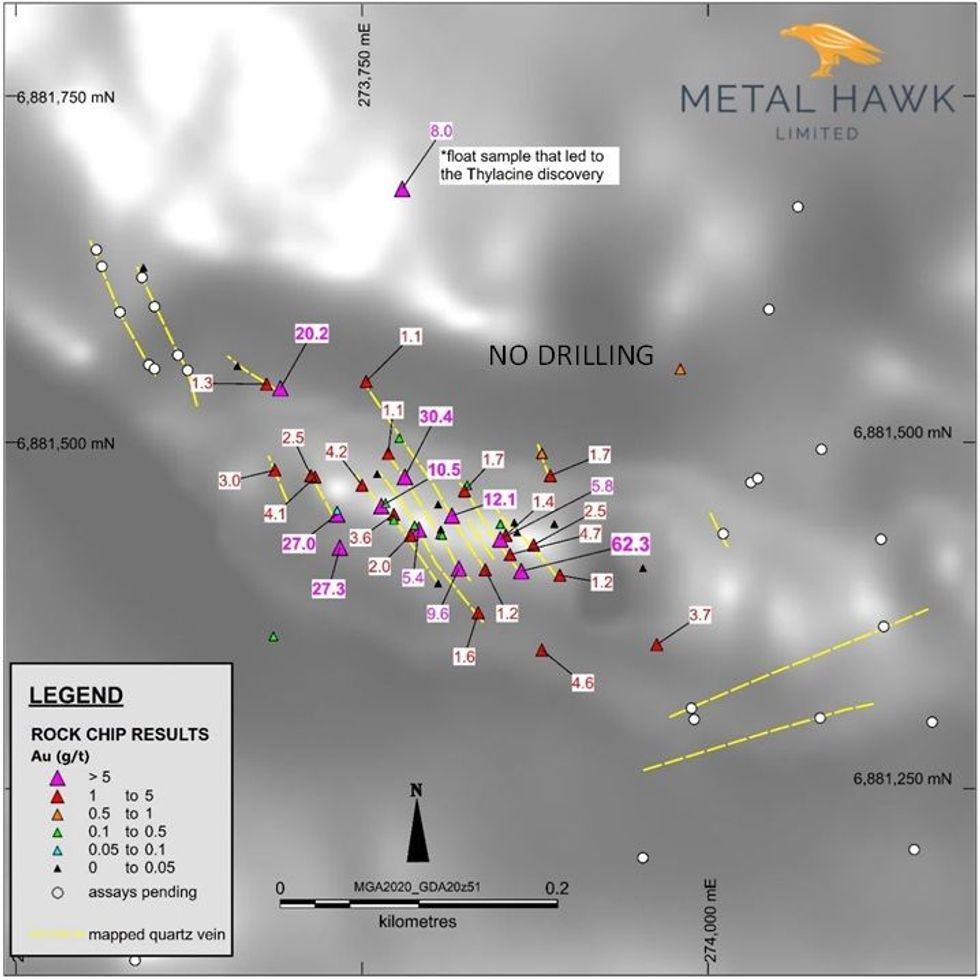

THYLACINE

The Thylacine prospect is located approximately 1.5km ESE of Siberian Tiger on the parallel northern ESE trending greenstone belt. Initial rock chip samples from Thylacine have returned several high grade gold assays in multiple sub-parallel NW trending quartz veins. A total of 12 mineralised quartz veins have been mapped and broadly sampled, with seven samples grading greater than 10 g/t Au. The average grade of the 38 available quartz vein sample assays is 7 g/t Au. Additionally, ten rock chip assay results are pending that cover the northwestern two veins at the prospect. The mineralisation at Thylacine is very similar to Siberian Tiger, with abundant iron oxides often forming sheets or banding (stripes) and local zones of brecciation. High grade results from initial sampling at Thylacine are shown on Figure 2 below (for a full list of results see Table 1).

Click here for the full ASX Release

This article includes content from Metal Hawk Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

MHK:AU

The Conversation (0)

02 October 2024

Metal Hawk Limited

Gold-focused exploration in Western Australia’s prolific Eastern Goldfields region

Gold-focused exploration in Western Australia’s prolific Eastern Goldfields region Keep Reading...

05 May 2025

MHK Presentation RIU Sydney - May 2025

Metal Hawk Limited (MHK:AU) has announced MHK Presentation RIU Sydney - May 2025Download the PDF here. Keep Reading...

23 April 2025

Quarterly Activities/Appendix 5B Cash Flow Report

Metal Hawk Limited (MHK:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

31 March 2025

Heritage Survey Completed at Leinster South

Metal Hawk Limited (MHK:AU) has announced Heritage Survey Completed at Leinster SouthDownload the PDF here. Keep Reading...

23 March 2025

$2.5m Placement to Fund Extensive Gold Drilling

Metal Hawk Limited (MHK:AU) has announced $2.5m Placement to Fund Extensive Gold DrillingDownload the PDF here. Keep Reading...

20 March 2025

Trading Halt

Metal Hawk Limited (MHK:AU) has announced Trading HaltDownload the PDF here. Keep Reading...

10h

Matthew Piepenburg: Gold, Silver Going Higher, but Expect Volatility

Matthew Piepenburg, partner at Von Greyerz, breaks down what's really driving the gold price, going beyond headlines to the ongoing debasement of the US dollar. He also discusses silver market dynamics. Don't forget to follow us @INN_Resource for real-time updates!Securities Disclosure: I,... Keep Reading...

31 January

Jeff Clark: Gold, Silver Price Drop — Cash is Key in Corrections

Jeff Clark, founder of Paydirt Prospector, remains bullish on the outlook for gold and silver, emphasizing that cash is key when prices correct. "Even though I'm very long, and even though I haven't taken profits on a lot of things, the number one antidote to a crash or a correction is your cash... Keep Reading...

31 January

Chris Vermeulen: Gold, Silver to Go "Dramatically Higher," This is When

Speaking ahead of this week's gold and silver price correction, Chris Vermeulen, chief market strategist at TheTechnicalTraders.com, said the metals were due for a "significant pullback." After that, they'll be positioned for a new leg up."There will be a time definitely to get back into metals,... Keep Reading...

30 January

Editor's Picks: Gold and Silver Prices Hit New Highs, Then Drop — What's Next?

Gold and silver are wrapping up a record-setting week once again. Starting with gold, the yellow metal left market participants hanging last week after finishing just shy of US$5,000 per ounce. However, it made up for it in spades this week, breaking through that level and continuing on up to... Keep Reading...

30 January

Lobo Tiggre: Gold, Silver Hit Record Highs, Next "Buy Low" Sector

Did gold and silver just experience a blow-off top, or do they have more room to run? Lobo Tiggre, CEO of IndependentSpeculator.com, shares his thoughts on what's going on with the precious metals, and how investors may want to position.Don't forget to follow us @INN_Resource for real-time... Keep Reading...

30 January

Ross Beaty: Gold, Silver in "Bubble Territory," What Happens Next?

Ross Beaty of Equinox Gold (TSX:EQX,NYSEAMERICAN:EQX) and Pan American Silver (TSX:PAAS,NASDAQ:PAAS) shares his thoughts on gold and silver's record-setting runs. While high prices are exciting, he noted that even US$50 per ounce silver is good for miners. "At the end of the day, there's still... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00