July 22, 2024

Aggressive drilling at the flagship Never Never Deposit and the new Pepper discovery outlines 1.87Moz @ 8.65g/t within 2km of the plant

Spartan Resources Limited (“Spartan” or the “Company”) (ASX: Spartan) is pleased to announce the Updated Mineral Resource Estimate (“MRE”) for its 100%-owned Dalgaranga Gold Project “DGP”, located in the Murchison region of Western Australia.

HIGHLIGHTS

- Updated Mineral Resource Estimate (“MRE”) completed for the Dalgaranga Gold Project, located on granted Mining Leases and within 2km of the 2.5Mtpa processing plant:

- 16.1Mt @ 4.79g/t gold for 2,482,200 ounces, comprising:

- 5.72Mt @ 8.07g/t gold for 1,485,200 ounces – Never Never Gold Deposit

- 1.78Mt @ 7.66g/t gold for 438,100 ounces – Pepper Gold Deposit

- 8.63Mt @ 2.01g/t gold for 558,900 ounces – “Other” Underground MRE

- 16.1Mt @ 4.79g/t gold for 2,482,200 ounces, comprising:

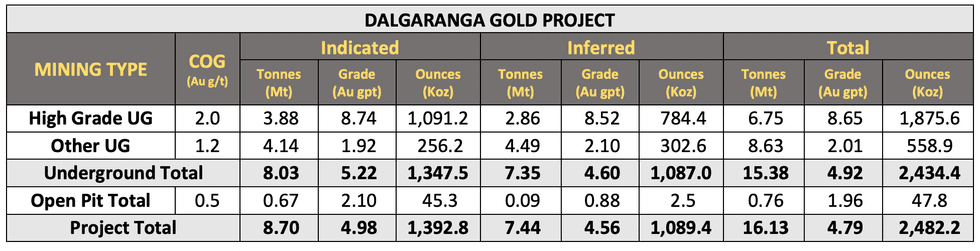

- Resource Classification breakdown for the updated Dalgaranga Gold Project MRE:

- 8.70Mt @ 4.98g/t gold for 1,392,800 ounces (56%) classified as Indicated;

- 7.44Mt @ 4.56g/t gold for 1,089,400 ounces (44%) classified as Inferred.

- Resource Classification breakdown for the Underground Never Never Gold Deposit MRE:

- 3.88Mt @ 8.74g/t gold for 1,091,200 ounces (76%) classified as Indicated;

- 1.08Mt @ 9.95g/t gold for 346,200 ounces (24%) classified as Inferred.

- Maiden Mineral Resource Estimate for the Underground Pepper Gold Deposit:

- 1.78Mt @ 7.66g/t gold for 438,100 ounces (100%) classified as Inferred.

- Combined high-grade underground MRE for the Never Never and Pepper Gold Deposits:

- 6.75Mt @ 8.65g/t gold for 1,875,600 ounces (58%) classified as Indicated.

- The ounces per vertical metre (“ozpvm”) for the updated high-grade underground MRE has increased 24% to 2,284ozpvm, from 1,690ozpvm. Between 450mbsl and 650mbsl, through both Never Never and Pepper, the ozpvm averages 3,796ozpm.

- A focus on delineating higher grade underground Mineral Resources for the Four Pillars and West Winds gold prospects, as well as the nearby Sly Fox and Plymouth gold deposits has underpinned the “Other” Underground MRE of:

- 8.63Mt @ 2.01g/t gold for 558,900 ounces:

- Updated Spartan Group Mineral Resources for the Dalgaranga and Yalgoo (“Murchison”) and Glenburgh and Egerton (“Gascoyne”) Projects now stand at:

- 39.15Mt @ 2.62g/t gold for 3,302,000 ounces (61% or 2.01Moz Indicated)

This latest MRE update is a pivot towards Dalgaranga as an emerging high-grade underground gold mining operation, and comprises Never Never, Pepper, Four Pillar, West Winds, Applewood, Plymouth and Sly Fox deposits. MRE details are shown in Tables 1 to 4:

Table 1. Dalgaranga Gold Project Combined Resources at 30 June 2024*

Click here for the full ASX Release

This article includes content from Spartan Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

SPR:AU

The Conversation (0)

03 April 2024

Spartan Resources

Focused on Growing High-grade Gold Ounces in front of established infrastructure in Prolific Western Australia

Focused on Growing High-grade Gold Ounces in front of established infrastructure in Prolific Western Australia Keep Reading...

5h

Flow Metals to Acquire the Monster IOCG Project in Yukon

Flow Metals Corp. (CSE: FWM) ("Flow Metals" or the "Company") is pleased to report that it has entered into an option agreement dated February 9, 2026 (the "Option Agreement") with Go Metals Corp. ("Go Metals") to acquire the Monster IOCG project (the "Monster Project"), located approximately 90... Keep Reading...

17h

Investor Presentation

Aurum Resources (AUE:AU) has announced Investor PresentationDownload the PDF here. Keep Reading...

18h

Dr. Adam Trexler: Physical Gold Market Broken, Crisis Unfolding Now

Dr. Adam Trexler, founder and president of Valaurum, shares his thoughts on gold, identifying a key issue he sees developing in the physical market. "There's a crisis in the physical gold market," he said, explaining that sector participants need to figure out how to serve investors who want to... Keep Reading...

18h

Trevor Hall: Bull Markets Don’t Always Mean Big Returns

Clear Commodity Network CEO and Mining Stock Daily host Trevor Hall opened his talk at the Vancouver Resource Investment Conference (VRIC) with a strong message: It is still possible to go broke in a bull market.“I want to start with the simple but uncomfortable truth: most investors don't lose... Keep Reading...

19h

How Near-term Production is Changing the Junior Gold Exploration Model

Junior gold companies have traditionally been defined by exploration: identifying prospective ground, drilling to delineate a resource and, ideally, monetising that discovery through a sale or joint venture with a larger producer. While this model has delivered success in the past, changing... Keep Reading...

19h

Gold Exploration in Guinea: An Emerging Opportunity in West Africa

While much of West Africa’s gold exploration spotlight has historically fallen on countries like Ghana and Mali, Guinea is increasingly emerging as a quiet outlier — a country with proven gold endowment, expansive underexplored terrain and a growing number of active exploration programs. Despite... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00