- NORTH AMERICA EDITIONAustraliaNorth AmericaWorld

January 24, 2024

Antilles Gold Limited (“Antilles Gold” or the “Company”) (ASX: AAU, OTCQB: ANTMF) is pleased to advise positive results from the 21 diamond drill holes into the El Pilar oxide deposit in central Cuba, which completed the 10,600m 2023 campaign.

HIGHLIGHTS

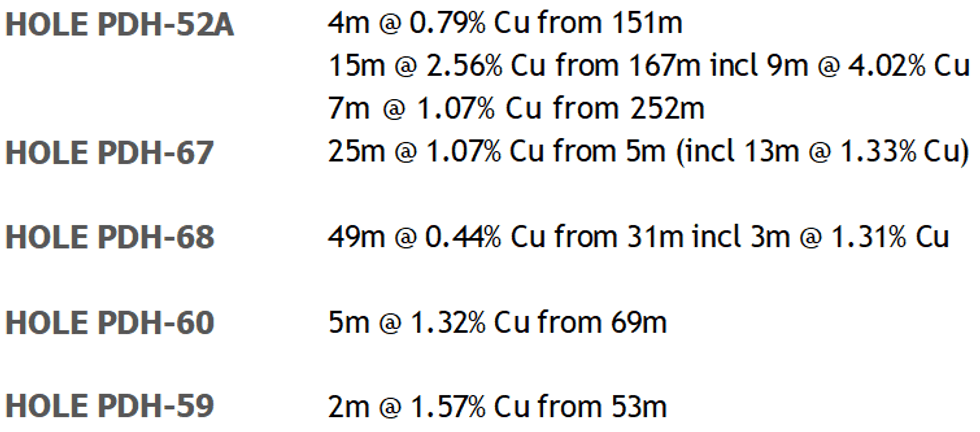

Copper Domain – El Pilar

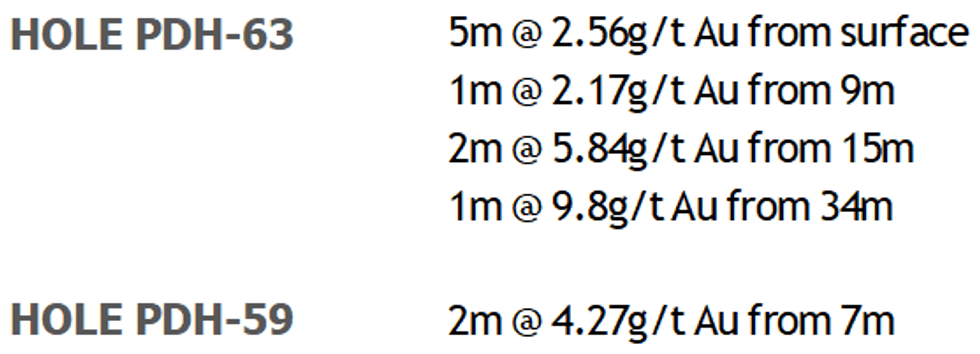

Gold Domain – El Pilar

Sampling Techniques and Data are set out in the JORC Code 2012 Edition Template attached.

EL PILAR OXIDE DEPOSIT

- The results continue excellent grades for both gold and copper in the oxide deposit that have previously been advised to ASX (4, 17, 27 July 2023, 8 August 2023, 21 September 2023, 23 October 2023, and 2 November 2023).

- These results plus those from 1,800m undertaken in 2022 and selected results from 24,000m of historic drilling reinforce the prospect of near term development of the low CAPEX Nueva Sabana mine at El Pilar.

- The outstanding grades in the gold domain extend from surface to a depth of 40m to 50m, and robust grades in the underlying copper domain continue for a further 50m to 70m.

- The gold zone within the oxide deposit is well defined, and the copper domain has increased in volume both laterally and vertically with continuing exploration, and projects into the underlying sulphide zone.

- A Mineral Resource Estimate (“MRE”) for the proposed Nueva Sabana mine is expected to be established within 3 or 4 weeks, and will be followed by a Scoping Study for the project around April 2024.

- The El Pilar oxide deposit is metallurgically simple, and the Nueva Sabana mine is being planned as a copper project which would benefit from the high grade gold cap during initial operations.

- Preliminary metallurgical test work by Blue Coast Research Laboratories in Canada has indicated a gold recovery of 85% from a simple rougher flotation circuit with a concentrate of 53.1 g/t Au produced from an ore sample grading 2.11 g/t Au.

- Test work is continuing on copper recoveries and concentrate grades, and early indications are that the copper concentrate will contain around 25% Cu.

- Planning and permitting for the proposed mine is well advanced.

- The recently revised construction cost estimate of ~US$22 million for the proposed mine, was based on a mining rate of 650,000tpa of ore.

- Negotiations have commenced to arrange an advance on purchases of the gold concentrate for a similar amount by an international commodities trader, in order to fund the construction.

- The low capital cost reflects the availability of HT power, rail and highway links to a container port, water supply, and skilled labour being close to the unoccupied flat mine site, together with low pre-stripping costs, and the ability to dry-hire all necessary mining equipment rather than purchasing a new fleet.

- Antilles Gold’s 50:50 joint venture with the Cuban Government’s mining company, GeoMinera, intends to develop the Nueva Sabana mine as soon as possible, and commencement of the 10 month mine construction is planned for July 2024.

Click here for the full ASX Release

This article includes content from Antilles Gold, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

AAU:AU

The Conversation (0)

23 June 2024

Antilles Gold Limited

Developing Gold and Copper Projects in mineral‐rich Cuba

Developing Gold and Copper Projects in mineral‐rich Cuba Keep Reading...

17 February 2025

Antilles Gold to Raise $1.0M for Working Capital

Antilles Gold Limited (AAU:AU) has announced Antilles Gold to Raise $1.0M for Working CapitalDownload the PDF here. Keep Reading...

31 January 2025

Quarterly Activities/Appendix 5B Cash Flow Report

Antilles Gold Limited (AAU:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

12 January 2025

Summary of Pre-Feasibility Study for Nueva Sabana Mine

Antilles Gold Limited (AAU:AU) has announced Summary of Pre-Feasibility Study for Nueva Sabana MineDownload the PDF here. Keep Reading...

11 December 2024

Revision to Updated Scoping Study Nueva Sabana Mine, Cuba

Antilles Gold Limited (AAU:AU) has announced Revision to Updated Scoping Study Nueva Sabana Mine, CubaDownload the PDF here. Keep Reading...

14h

Armory Mining To Conduct a Series of Airborne Geophysics Surveys at the Ammo Gold-Antimony Project

(TheNewswire) Vancouver, B.C. TheNewswire - February 9, 2026 Armory Mining Corp. (CSE: ARMY) (OTC: RMRYF) (FRA: 2JS) (the "Company" or "Armory") a resource exploration company focused on the discovery and development of minerals critical to the energy, security and defense sectors, is pleased to... Keep Reading...

06 February

Editor's Picks: Is Gold and Silver's Price Correction Over?

It's been a wild couple of weeks for gold and silver. After surging to record highs at the end of January, prices for both precious metals saw significant corrections, creating turmoil for market participants.This week brought some relief, with gold bouncing back from its low point and even... Keep Reading...

06 February

Blackrock Silver to Present at the Precious Metals and Critical Minerals Virtual Investor Conference on February 10th 2026

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce that Andrew Pollard, President & Chief Executive Officer of the Company, will present live at the Precious Metals & Critical Minerals Virtual Investor Conference hosted... Keep Reading...

05 February

Experts: Gold's Fundamentals Intact, Price Could Hit US$7,000 in 2026

Gold took center stage at this year's Vancouver Resource Investment Conference (VRIC), coming to the fore in a slew of discussions as the price surged past US$5,000 per ounce. Held from January 25 to 26, the conference brought together diverse experts, with a focus point being the "Gold... Keep Reading...

05 February

Barrick Advances North American Gold Spinoff After Record 2025 Results

Toronto-based company Barrick Mining (TSX:ABX,NYSE:B) said it will move ahead with plans to spin off its North American gold assets after a strong finish to 2025.The company's board has authorized preparations for an initial public offering (IPO) of a new entity that would house its premier... Keep Reading...

05 February

Peruvian Metals Secures 6 Year Agreement with Community at Mercedes Project

Peruvian Metals Corp. (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals or the "Company") is pleased to announce that the agreement between San Maurizo Mines Ltd. ("San Maurizo"), a private Manitoba company which holds a 100% direct interest in the Mercedes Property, and Comunidades... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00