May 27, 2025

Greenvale Energy (ASX:GRV) provides investors with a compelling entry point into the high-growth nuclear energy sector through its highly prospective uranium exploration projects. These are complemented by strategic assets with significant bitumen and renewable geothermal energy potential—all backed by a seasoned management team with a strong track record of delivering shareholder value.

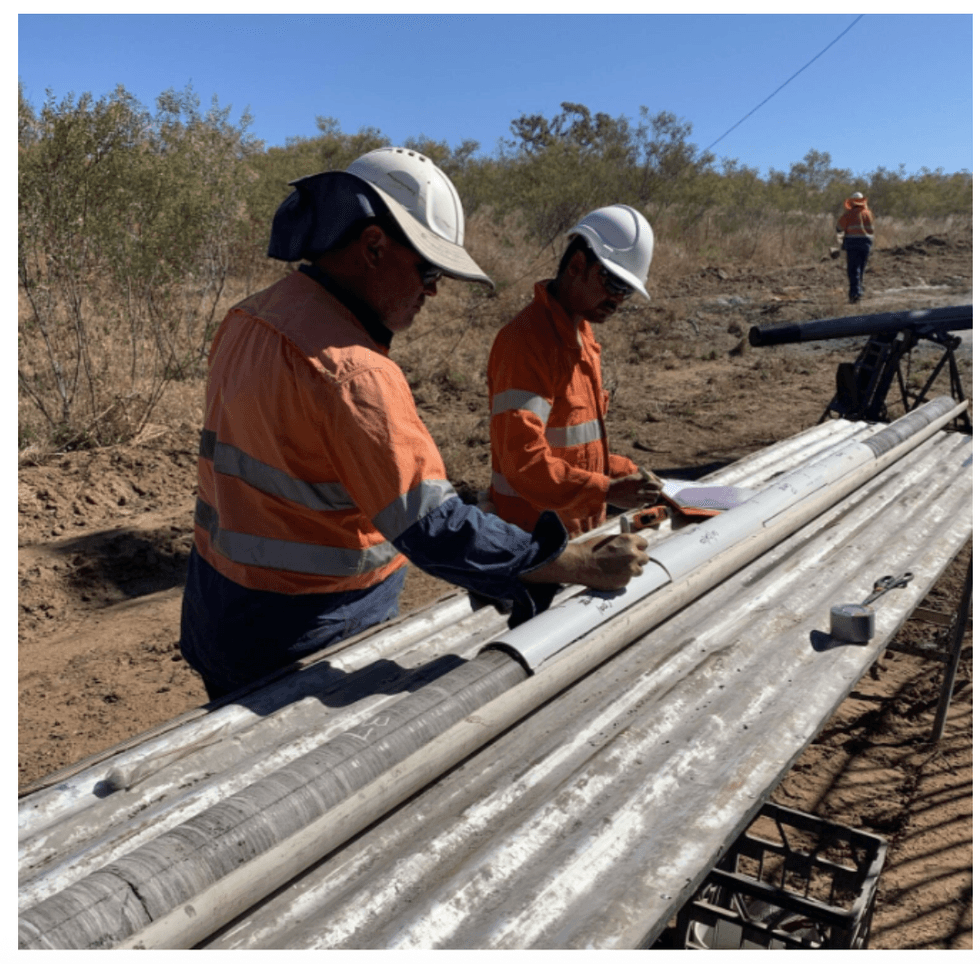

Greenvale is building a diversified portfolio of projects aimed at advancing a sustainable, low-carbon energy future. The company’s assets include early-stage uranium projects in the Northern Territory, the advanced-stage Oasis uranium project in Queensland, and the Alpha Torbanite and Millungera Basin geothermal projects, also in Queensland.

The Alpha Torbanite Project presents a strategic opportunity for Greenvale Energy to support Australia’s infrastructure sector by providing a domestic source of bitumen—a critical material currently supplied entirely through imports. The project hosts a significant Inferred Resource of 28 million tonnes of torbanite and cannel coal, positioning Greenvale to potentially secure a meaningful share of the national bitumen market, which is estimated at around 1 million tonnes annually.

Company Highlights

- Uranium exploration portfolio across the Northern Territory and Queensland

- Advanced-exploration, high-grade Oasis project with intercepts up to 0.72 percent U3O8 (15.8 lbs/ton)

- Strategic coverage of the Northern Territory, with four uranium projects targeting sandstone hosted and unconformity style deposits

- Alpha Torbanite project with 28 Mt inferred resource, positioned to be the only local producer that can supply Australia’s bitumen market (consuming ~1 Mt annually through 100% imported material)

- Millungera Basin geothermal project with potential for 3.4 GW continuous power generation

- Experienced board and management team, Chaired by Neil Biddle, founding director of Pilbara Minerals

- Substantial R&D grant support for the Alpha Torbanite project, having successfully secured over $3 million in non-dilutive grant funding

- Projects aligned to the long-term zero-carbon energy transition

This Greenvale Energy's profile is part of a paid investor education campaign.*

Click here to connect with Greenvale Energy (ASX:GRV) to receive an Investor Presentation

GRV:AU

Sign up to get your FREE

Greenvale Energy Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

27 May

Greenvale Energy

Strategic exploration of prospective uranium assets in Queensland and the Northern Territory

Strategic exploration of prospective uranium assets in Queensland and the Northern Territory Keep Reading...

01 October

Oasis Uranium Propsectivity Report

Greenvale Energy (GRV:AU) has announced Oasis Uranium Propsectivity ReportDownload the PDF here. Keep Reading...

16 September

Chemical assay confirms high-grade uranium

Greenvale Energy (GRV:AU) has announced Chemical assay confirms high-grade uraniumDownload the PDF here. Keep Reading...

04 September

High-Grade Uranium from drilling at Oasis

Greenvale Energy (GRV:AU) has announced High-Grade Uranium from drilling at OasisDownload the PDF here. Keep Reading...

31 August

Commencement of Henbury Field Program

Greenvale Energy (GRV:AU) has announced Commencement of Henbury Field ProgramDownload the PDF here. Keep Reading...

26 August

Strong Start to Maiden Drill Program at Oasis

Greenvale Energy (GRV:AU) has announced Strong Start to Maiden Drill Program at OasisDownload the PDF here. Keep Reading...

06 November

Real-World Uranium Markets Meet DeFi with the Launch of xU3O8-Based Lending on Oku, Powered by Morpho

Uranium has fully landed in decentralized finance (DeFi), following the launch of xU3O8-based lending on DeFi aggregator Oku and powered by Morpho, the universal network that connects lenders and borrowers to the best possible opportunities worldwide. In a watershed moment for the DeFi sector,... Keep Reading...

06 November

China Achieves World’s First Thorium-to-Uranium Conversion

China has confirmed a major milestone in nuclear science after achieving the world’s first successful conversion of thorium into uranium fuel inside a working molten salt reactor.The experimental thorium molten salt reactor (TMSR), developed by the Chinese Academy of Sciences’ Shanghai Institute... Keep Reading...

29 October

US, Brookfield and Cameco Strike US$80 Billion Nuclear Reactor Deal

The US government has entered into an US$80 billion partnership with Brookfield Asset Management (TSX:BAM,NYSE:BAM) and Cameco (TSX:CCO,NYSE:CCJ) to construct new Westinghouse nuclear reactors.The initiative aims to accelerate the revival of the US nuclear industry, while powering the rapid... Keep Reading...

29 October

Top 3 ASX Uranium Stocks of 2025

After a volatile year defined by tightening supply, bullish investor sentiment and persistent structural challenges, the uranium market is entering the final quarter of 2025 with renewed momentum. Spot U3O8 prices have climbed from a March low of US$63.25 per pound to a year-to-date high of... Keep Reading...

28 October

5 Best-performing Canadian Uranium Stocks of 2025

The uranium market is entering the final quarter of 2025 with renewed momentum after a volatile year marked by tightening supply, bullish investor sentiment and lingering structural challenges. Spot U3O8 prices have surged from a March low of US$63.25 per pound to a year-to-date high of US$83.18... Keep Reading...

Latest News

Sign up to get your FREE

Greenvale Energy Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00