Golden Independence Mining Corp. (CSE: IGLD) (OTCQB: GIDMF) (FSE: 6NN) ("Golden Independence") or (the "Company") is pleased to announce an updated National Instrument 43-101 (NI 43-101) compliant Mineral Resource Estimate ("MRE") for the Company's flagship Independence project located adjacent to Nevada Gold Mines' Phoenix-Fortitude mining operations in the Battle Mountain-Cortez trend of Nevada.

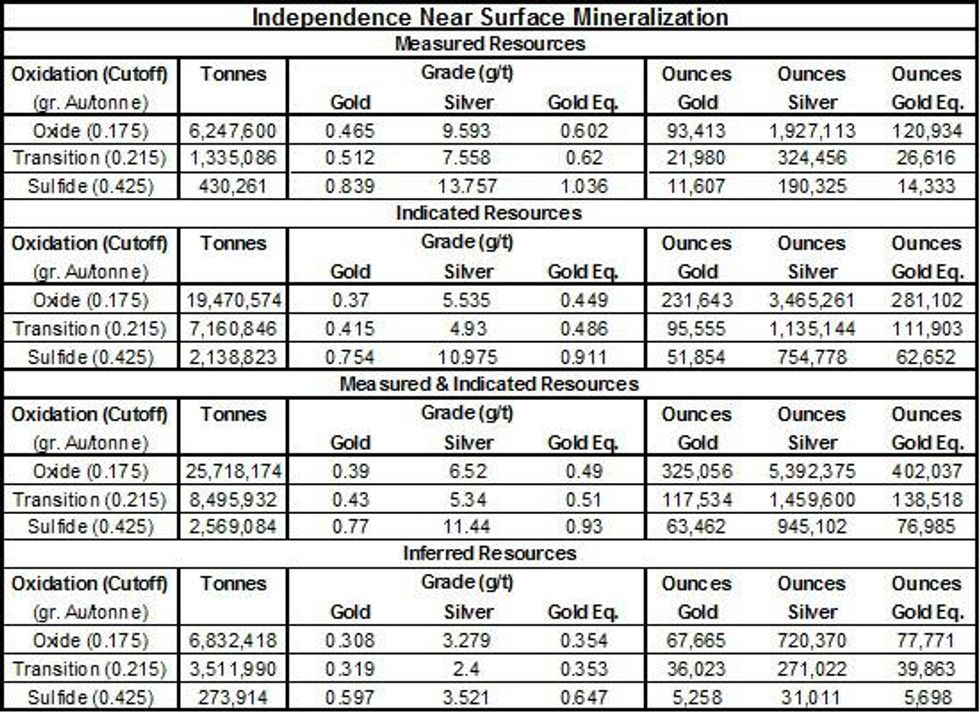

The MRE incorporates over 132,000 feet of RC and core drilling in 246 holes, outlining both a near surface and an underground resource and now incorporates a lower cut-off grade for oxide material and higher cut-off grades for transitional and sulphide material based on recent metallurgical and economic analysis for the near surface resource. The resource represents the total modelled mineralization as interpolated by the exploration drilling to date. No constraining economics have been applied to the resource. The Company is actively advancing the near surface portion of the MRE towards a Preliminary Economic Assessment anticipated by year-end 2021. Highlights of the MRE include:

- Near Surface Resource: Measured & Indicated Total Resource of 506,052 ounces of gold and 7.8 million ounces of silver plus an Inferred Total Resource of 108,946 ounces of gold and 1 million ounces of silver.

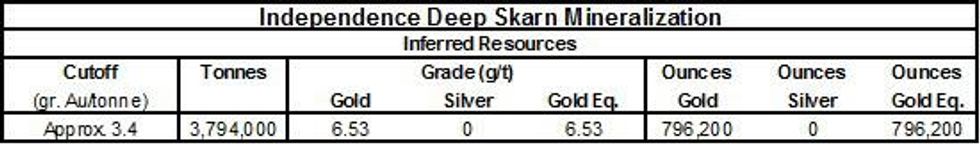

- Underground Resource: Inferred Resource of 796,200 ounces of gold.

"This updated resource incorporates ongoing work associated with the PEA and an additional 12 RC holes drilled after the May 2021 initial resource was released," commented Christos Doulis, CEO. "The near surface component of this updated MRE provides the foundation for a Preliminary Economic Assessment anticipated imminently. With the recent formation of a formal Joint Venture with our partner AGEI we look forward to continuing to advance the Independence project towards a production decision," he concluded.

The resource estimate was completed by James Ashton of Dyer Engineering with an effective date of November 15, 2021 and complies with National Instrument 43-101 and guidelines developed in 2014 by the Canadian Institute of Mining and Metallurgy ("CIM"). In accordance with NI 43-101, a Technical Report will be filed on SEDAR within 45-days of this release.

Independence Project NI 43-101 Resource - November 15, 2021

To view an enhanced version of this graphic, please visit:

https://orders.newsfilecorp.com/files/7273/108082_8d1384ce44082bd5_001full.jpg

To view an enhanced version of this graphic, please visit:

https://orders.newsfilecorp.com/files/7273/108082_8d1384ce44082bd5_002full.jpg

Notes to Mineral Resource Estimate:

- Mineral Resources which are not Mineral Reserves do not have demonstrated economic viability. The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, sociopolitical, marketing, changes in global gold markets or other relevant issues. The CIM definitions (2014) were followed for classification of Mineral Resources. The quantity and grade of reported inferred Mineral Resources in this estimation are uncertain in nature and there has been insufficient exploration to define these inferred Mineral Resources as indicated Mineral Resource. It is probable that further exploration drilling will result in upgrading them to the indicated or measured Mineral Resource category.

- The Mineral Resource Estimate incorporates over 132,000 feet of reverse circulation and core drilling in 246 holes, and outlines both a near surface and a deep skarn resource. The near surface mineralization is primarily based on the reverse circulation drilling, while the deep skarn mineralization is based entirely on core drilling.

- The resource was prepared by James Ashton, P.E., an independent QP, with an effective date of November 15, 2021.

- The mineral resources are unconstrained and presented at variable undiluted gold cutoff grades, which represent mineralization that is potentially available for open-pit mining and heap-leach processing.

- The Deep Skarn mineralization resources were quantified based on deep tabular solids representing potentially underground mineable lenses.

- Gold equivalent values are based on silver to gold ratio of 70:1.

- Rounding may result in apparent discrepancies between tonnes, grade, and contained metal content.

Qualified Person

The technical content of this news release has been reviewed and approved by R. Tim Henneberry, PGeo (B.C.), a director and president of Golden Independence Mining and a qualified person under National Instrument 43-101.

About Golden Independence Mining Corp.

Golden Independence Mining Corp. is a development company currently focused on the advanced-stage Independence project located adjacent to Nevada Gold Mine's Phoenix-Fortitude mine in the Battle Mountain-Cortez Trend of Nevada. The Independence project hosts an M&I resource of 506,052 ounces of gold and an Inferred resource of 905,146 ounces of gold with a substantial silver credit. The Company is actively advancing the near-surface resource towards a production decision with a PEA anticipated in late 2021.

FOR FURTHER INFORMATION PLEASE CONTACT:

Christos Doulis, Chief Executive Officer

Telephone: 1.647.924.1083 Email: christos@goldenindependence.co

This press release contains forward-looking information (within the meaning of applicable Canadian securities legislation) that involves various risks and uncertainties regarding future events. Such forward-looking information includes statements based on current expectations involving a number of risks and uncertainties and such forward-looking statements are not guarantees of future performance of the Company, and include, without limitation, statements regarding completion of the Private Placement. There are numerous risks and uncertainties that could cause actual results and the Company's plans and objectives to differ materially from those expressed in the forward-looking information in this news release, including without limitation, the following risks and uncertainties: (i) the risk that the Canadian Securities Exchange will not accept the terms of the Private Placement; (ii) the risk that the Company will not be able to locate suitable purchasers for the Private Placement; and (iii) management's discretion regarding the use of proceeds. Actual results and future events could differ materially from those anticipated in such information. This forward-looking information is based on estimates and opinions of management on the date hereof and is expressly qualified by this notice. Risks and uncertainties about the Company's business are more fully discussed in the Company's disclosure materials filed with the securities regulatory authorities in Canada at www.sedar.com. The Company assumes no obligation to update any forward-looking information or to update the reasons why actual results could differ from such information unless required by applicable law.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/108082