- NORTH AMERICA EDITIONAustraliaNorth AmericaWorld

March 16, 2023

Gold Port (CSE:GPO, OTCQB:GPOTF), OTCQB:GPOTF) is now preparing for its upcoming drill campaign at its 100 percent owned gold asset in Guyana. The company’s Groete gold-copper project has an NI 43-101 AuCuEq resource estimate with an inferred 1.57 million ounces of gold equivalent. The asset is in close proximity to deep water and road access to support potential future production development.

Guyana consistently has a gold mining history and is one of the best places to work in South America. This mining-friendly jurisdiction allows new operations to receive permits and license projects relatively quickly to support exploration and development. Gold Port holds, through a common law agreement, three mining permits that comprise the Groete project’s 1,384-hectare area.

Groete Gold Deposit Inferred Resource Calculation based on 2012 Drilling

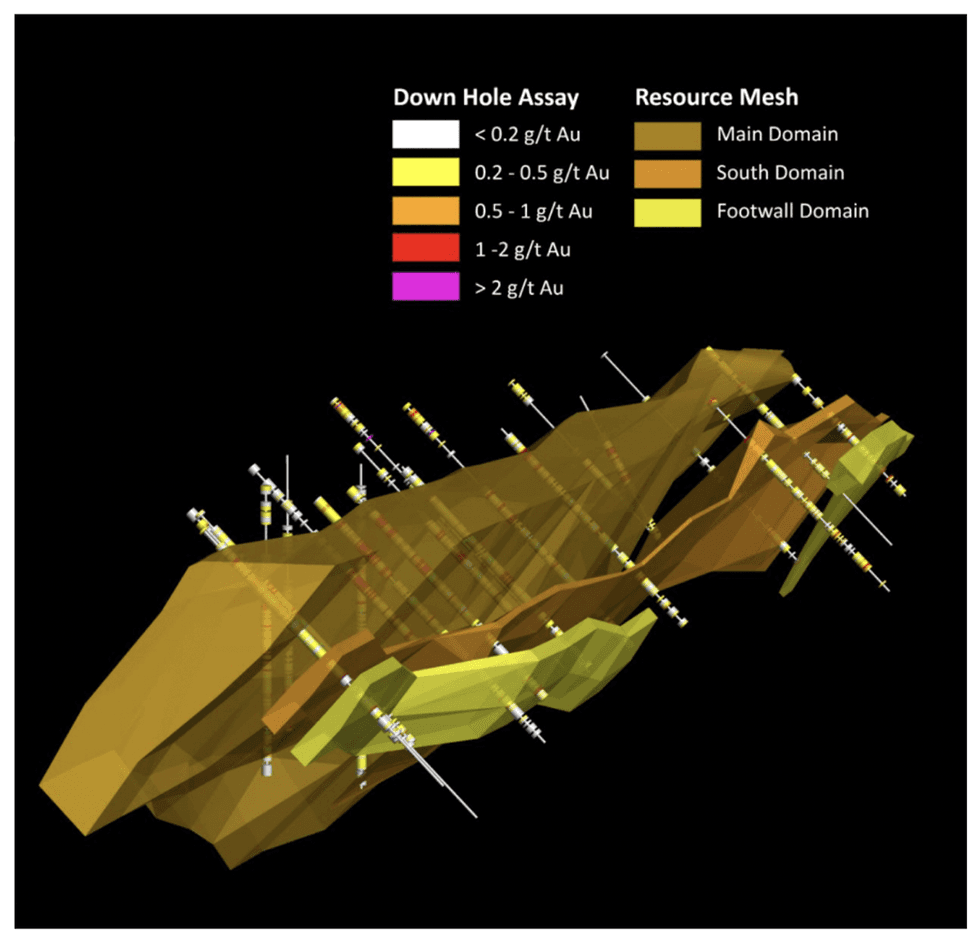

Groete Gold Deposit Inferred Resource Calculation based on 2012 DrillingThe upcoming drill program includes 35 targets totaling 8,102 meters, with depths ranging from 60 to 370 meters. These priority targets were chosen to confirm the continuity of the known higher-grade zone. In addition, the drill program aims to establish an indicated mineral resource estimate for the zone. Exploration upside to the east identified by surface work in 2012 will also likely be drill-tested. Gold Port designed a brand new tracked rig specifically for this program. Upon road access completion, the unit and support equipment will be moved to site to initiate the program.

Company Highlights

- Gold Port is a gold exploration company with a 100 percent owned gold asset in Guyana.

- The company’s Groete asset has an inferred resource estimate of 1.57 million ounces of gold equivalent. Details of the Mineral Resource Estimate are contained in a National Instrument 43-101 report titled, Technical Report and Updated Mineral Resource Estimate on the Groete Gold Copper Deposit, Groete Property, Guyana, South America by P & E Mining Consultants Ltd., dated April 16, 2019.

- Guyana is a highly ranked South American mining jurisdiction with a mining-friendly government.

- Gold Port’s Groete project has three mining permits covering 1,384 hectares of relatively unexplored land.

- The company is embarking on its 2023 35-hole drill program. The campaign aims to follow up on priority targets and to increase the quality of the historic resource.

- Gold Port’s upcoming drill campaign targets 35 priority locations totaling 8,102 meters.

- A highly competent management team, with experience operating within Guyana, leads the company toward fully realizing the potential of its asset.

This Gold Port profile is part of a paid investor education campaign.*

GPO:CC

The Conversation (0)

06 February

Editor's Picks: Is Gold and Silver's Price Correction Over?

It's been a wild couple of weeks for gold and silver. After surging to record highs at the end of January, prices for both precious metals saw significant corrections, creating turmoil for market participants.This week brought some relief, with gold bouncing back from its low point and even... Keep Reading...

06 February

Blackrock Silver to Present at the Precious Metals and Critical Minerals Virtual Investor Conference on February 10th 2026

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce that Andrew Pollard, President & Chief Executive Officer of the Company, will present live at the Precious Metals & Critical Minerals Virtual Investor Conference hosted... Keep Reading...

05 February

Experts: Gold's Fundamentals Intact, Price Could Hit US$7,000 in 2026

Gold took center stage at this year's Vancouver Resource Investment Conference (VRIC), coming to the fore in a slew of discussions as the price surged past US$5,000 per ounce. Held from January 25 to 26, the conference brought together diverse experts, with a focus point being the "Gold... Keep Reading...

05 February

Barrick Advances North American Gold Spinoff After Record 2025 Results

Barrick Mining (TSX:ABX,NYSE:B) said it will move ahead with plans to spin off its North American gold assets after a strong finish to 2025.The Toronto-based miner said its board has authorized preparations for an IPO of a new entity that would house its premier North American gold operations,... Keep Reading...

05 February

Peruvian Metals Secures 6 Year Agreement with Community at Mercedes Project

Peruvian Metals Corp. (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals or the "Company") is pleased to announce that the agreement between San Maurizo Mines Ltd. ("San Maurizo"), a private Manitoba company which holds a 100% direct interest in the Mercedes Property, and Comunidades... Keep Reading...

05 February

TomaGold Borehole EM Survey Confirms Berrigan Deep Zone

Survey also validates significant mineralization and unlocks new targets Highlights Direct correlation with mineralization : The modeled geophysical plates explain the presence of semi-massive to massive sulfides intersected in holes TOM-25-009 to TOM-25-015. Priority target BER-14C :... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Equity Metals Exhibiting at the 2026 PDAC

06 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00