June 06, 2023

Global Oil & Gas Limited (ASX: GLV) (Company) is pleased to announce that is has been offered a Technical Evaluation Agreement (TEA) for a 4,858km2 oil and gas exploration block offshore Peru. The Company will hold 80% of the TEA with project partner, US based oil and gas exploration company Jaguar Exploration, Inc. (Jaguar), holding the remaining 20%.

Highlights

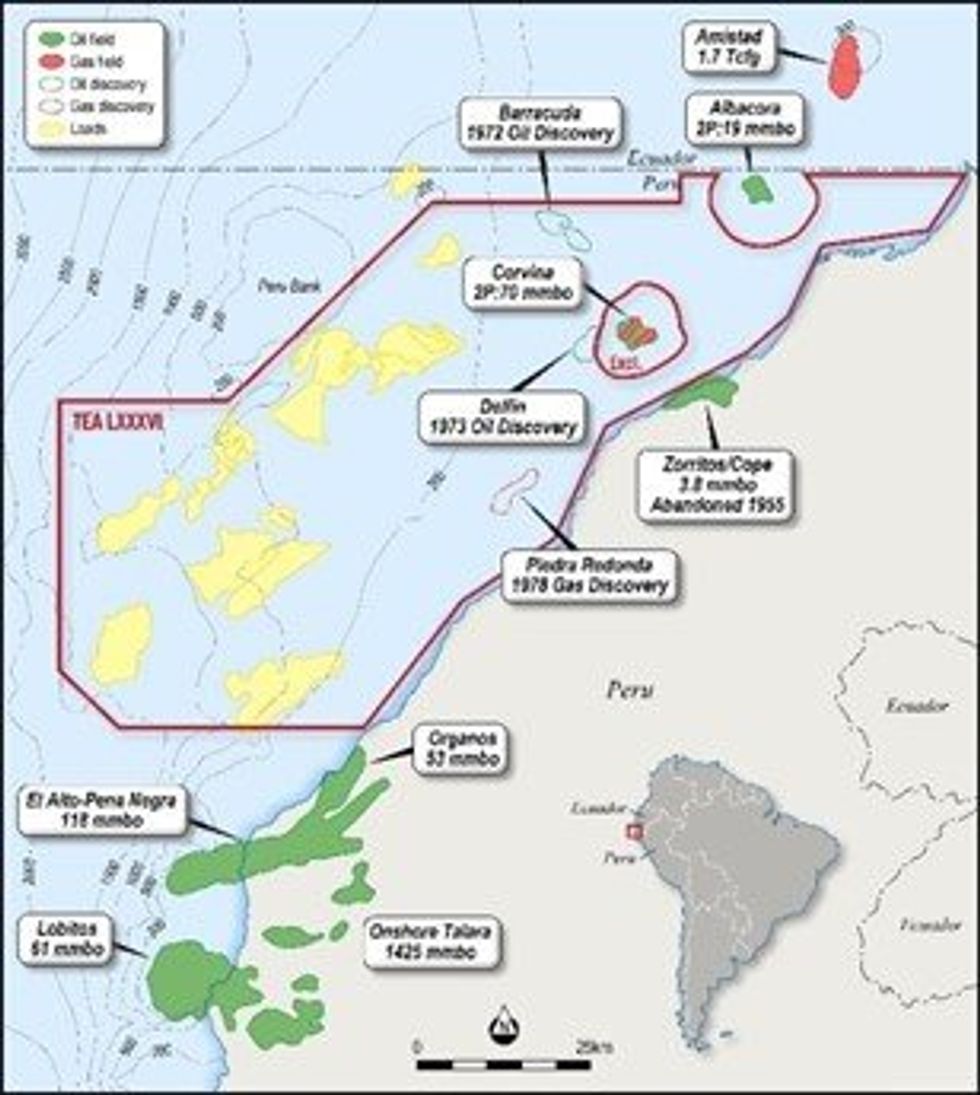

- Global has been offered the rights to a 4,858km2 oil and gas block in proven hydrocarbon bearing basins offshore Peru, boarding the prolific (+1.6 Billion Barrels produced) Talara basin (TEA LXXXVI previously Z-70)

- The Company and Jaguar Exploration, Inc (US based partner) will now move to finalise formal agreements with Perupetro (the Peruvian national oil regulator) for its 100% interest in the block (80% Global and 20% Jaguar)

- Previous production of 4,000 bopd at the excised Corvina field incorporated within the block

- Located immediately south of the block is the Alto- Pena Negra oil field, one of Peru’s most productive fields, currently producing around 3,000 bopd with total historical production of more than 143 million barrels of oil

- Historical corporate transactions in the region of up to US$900 million Dollars

- Data from 7 historical 2D seismic campaigns and more than 3,800km2 of historical 3D seismic has been secured

- No significant expenditure commitments for the TEA

- Global aim to generate Prospective Resources to facilitate potential third-party investment and/or farmin

Managing Director Patric Glovac commented:

“Being offered this globally significant 4,858km2 (over 1.1 million acres) offshore oil and gas opportunity in Peru has the potential to be transformational for the Company.

The nearby oil discoveries and petroleum refinery close to the offshore block make this an enviable address for global oil and gas players. Seven 2D seismic surveys and more than 3,800km2 of 3D seismic has been received and is now being processed to identify leads, prospects and Certified Prospective Resources.

The Company is in the process of creating a comprehensive data room to facilitate the process of marketing this opportunity to prospective project investors and/or joint venture partners.

This world-class asset is an incredible opportunity for the Company to comprehensively collate all existing information, generate certified Prospective Resources and generate compelling drill targets

We look forward to finalising the formal agreements over the coming weeks with both Jaguar & Perupetro”.

The Company and Jaguar have been considered as a “Qualified Subjects” by Perupetro (the Peruvian national oil regulator) and can now assume obligations for one hundred percent (100%) participation in a Technical Evaluation Agreement (CET) on area LXXXVI, subject to formal contracts being entered into between the parties and Perupetro which is expected to occur over the coming weeks.

The oil and gas block is located in the gulf of Guayaquil in water depths that range from 100m to 1,500m, straddling the Tumbes-Progreso and Talara basins. Both basins host historical producing oil and gas fields, with the latter incorporating one of Peru’s most productive hydrocarbon plays.

The block is surrounded by, and incorporates, multiple historic and currently producing oil and gas fields. The southeast of the block borders the Alto-Pena Negra oil field which is one of Peru’s most productive fields, currently producing around 3,000 barrels of oil per day (bopd) and with total historical production of more than 143 million barrels of oil.

In the northeast, the block incorporates the excised Corvina oil field which generated past production rates of up to 4,000 barrels of light oil per day (28.45⁰ API).

The southern border of the TEA is also only 70km from the Talara crude oil refinery which received production from the Corvina field.

Exploration Opportunity

Historical exploration over the TEA has been intermittent with a clear misalignment between seismic and the drilling of the exploration wells. Three early 1970s wildcat wells, drilled before the running of any seismic, encountered oil and gas followed by only one more exploratory well three decades later after the running of seven 2D and four 3D (3,800km2) seismic campaigns.

Click here for the full ASX Release

This article includes content from Global Oil and Gas Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

GLV:AU

The Conversation (0)

4h

Syntholene Energy Corp. Closes Oversubscribed $3.75 Million Non-Brokered Private Placement

Proceeds to be used to Accelerate Procurement and Component Assembly for Demonstration Facility Deployment in IcelandSyntholene Energy CORP. (TSXV: ESAF,OTC:SYNTF) (FSE: 3DD0) (OTCQB: SYNTF) (the "Company" or "Syntholene") is pleased to announce that it has closed its previously announced... Keep Reading...

14h

Oil, LNG Prices Climb on Fears of Prolonged Hormuz Shutdown

Oil and gas prices surged Monday (March 2) after fresh military strikes between the US, Israel, and Iran rattled energy markets and brought shipping through the Strait of Hormuz close to a halt, raising fears of a wider supply shock.Brent crude, the global oil benchmark, jumped as much as 10... Keep Reading...

23h

Angkor Resources Announces Stock Option Grant

(TheNewswire) GRANDE PRAIRIE, ALBERTA TheNewswire - March 2, 2026 - Angkor Resources Corp. (TSXV: ANK,OTC:ANKOF) ("ANGKOR" OR "THE COMPANY") wishes to announce that it has granted, effective today, an aggregate of 4,275,000 stock options (each an "Option) to certain Directors, management and... Keep Reading...

27 February

US-Iran Tensions Put Europe’s Gas Storage Plans at Risk

Escalating tensions between the United States and Iran are reviving a risk energy markets have long feared: a potential closure of the Strait of Hormuz, the narrow Gulf passage that carries roughly 20 percent of global LNG trade and 25 percent of seaborne oil.New modelling from energy analytics... Keep Reading...

25 February

QIMC Intersects Major Subsurface Fault Corridor with Elevated H2 Readings at 142m Depth

Pressurized Formation Water and Visible Gas Bubbling Confirm Active Structural System in First of Five-Hole Systematic Drill Program

Quebec Innovative Materials Corp. (CSE: QIMC) (OTCQB: QIMCF) (FSE: 7FJ) ("QIMC" or the "Company") is pleased to report significant initial results from the first 300 metres of its planned 650-metre diamond drill hole DDH-26-01 at its West Advocate Eatonville Project, Nova Scotia. Drilling... Keep Reading...

24 February

Angkor Resources Commences Trenching Program At CZ Gold Prospect, Ratanakiri Province, Cambodia

(TheNewswire) GRANDE PRAIRIE, ALBERTA (February 24, 2026) TheNewswire - Angkor Resources Corp. (TSXV: ANK,OTC:ANKOF) ("ANGKOR" OR "THE COMPANY") announces the completion of a trenching and sampling program at the CZ Gold Prospect in Ratanakiri Province, Cambodia. As previously announced (see... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00