August 25, 2024

Poseidon Nickel (ASX: POS, the Company) is pleased to provide an update on gold exploration programs at Black Swan and Lake Johnston.

- Gold bearing bedrock confirmed at Black Swan

- Multiple anomalous gold rock chip samples (grading up to 1.25g/t Au) returned from highly weathered quartz bearing shears exposed at surface

- Soil sampling program completed as well as additional rock chip samples collected across the tenement portfolio

- Assay results expected early next quarter with any defined anomalies to be followed up with high priority drilling programs

- Geological setting shown to be very similar to nearby gold mines including Kanowna Belle and Gordon Sirdar

- Lake Johnston copper-gold anomaly extended

- Initial soil results have successfully extended the Billy Ray Cu-Au soil anomaly into the largely untested Mantis tenement and the anomaly remains open to the North-East

- High priority soil sampling program to continue with completion expected this quarter

- Billy Ray Cu-Au soil anomaly and likely link to the mineralised Cu-Au drill intersection nearby supports the prospectivity of a larger Cu-Au system

- Planning for Flora and Heritage Surveys for drill testing at Billy Ray has commenced

CEO, Brendan Shalders, commented, “Ongoing exploration works focused on gold prospectivity at Black Swan and Lake Johnston continue to generate positive results.

Rock chip samples collected on a recent site visit to Black Swan have returned anomalous gold from quartz bearing shear zones that are located in the same area as the recovered gold nuggets.

Today’s rock chip assay results are an important step forward given the potential source of the recovered gold nuggets has now been identified and these auriferous shear zones are located well within our tenement package.

To progress the gold targeting along these prospective shear corridors, the Company completed a wide spaced reconnaissance soil sampling program last week across the entire landholding at Black Swan which will be assayed for the full suite of elements. We look forward to receiving the assay results early next quarter and will commence planning drilling programs for any defined gold anomalies.

Recently received soil sample assay results testing the extension of the Billy Ray Prospect at Lake Johnston have confirmed the continuation of the large Cu-Au anomaly. The anomaly remains open to the North-East, with geological structures suggesting the potential for further Cu-Au anomalism over the newly acquired Mantis tenement.

The Company intends to extend soil sampling across the Mantis tenement and will use the assay results and any Cu-Au anomalies identified to plan drilling programs to test the Billy Ray Prospect.

The Company is pleased with the recent series of exploration results as they continue to enhance the prospectivity for gold at both Black Swan and Lake Johnston. The low-cost exploration programs that are underway are important to defining drill targets to efficiently test the gold potential in these areas.”

Black Swan - Located in Geological Setting Prospective for Gold

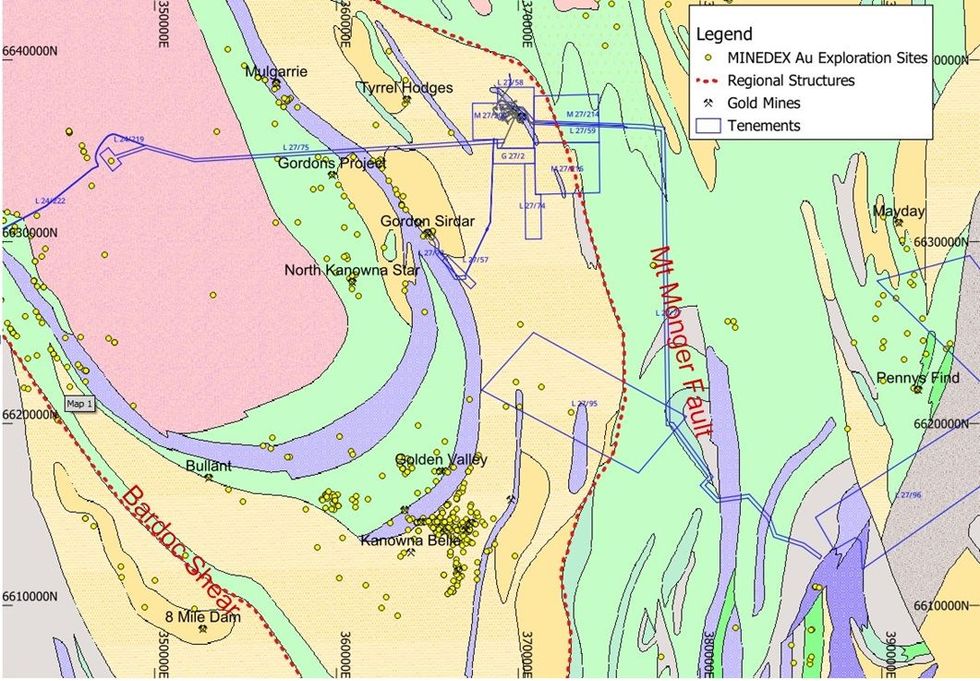

The Black Swan project is situated within the Boorara Geological Domain which hosts a number of gold mines including the nearby Kanowna Belle, Mungarra and Gordon Sirdar projects, refer Figure 1, as recently announced in ASX announcement “Gold Prospectivity Enhanced at Black Swan and Lake Johnston” re-released 16 August 2024.

Bedrock Gold Confirmed

Results from 17 rock chip samples recently collected from Black Swan have confirmed gold mineralisation in bedrock units located close to some of the recently announced gold nugget discoveries. The best rock chip returned 1.25g/t Au from a gossanous quartz vein hosted within felsic volcanic, see Figure 2. Additional rock chips with anomalous gold (>0.5g/t Au) were returned from ferrous quartz veining and within felsic volcanics (refer Table 1).

Click here for the full ASX Release

This article includes content from Poseidon Nickel Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

9h

How to Invest in Gold Royalty and Streaming Stocks

Gold royalty companies offer investors exposure to gold and silver with the benefits of diversification, lower risk and a steady income stream. Royalty companies operating in the resource sector will typically agree to provide funding for the exploration or development of a resource in exchange... Keep Reading...

9h

How Would a New BRICS Currency Affect the US Dollar?

The BRICS nations, originally composed of Brazil, Russia, India, China and South Africa, have had many discussions about establishing a new reserve currency backed by a basket of their respective currencies. The creation of a potentially gold-backed currency, known as the "Unit," as a US dollar... Keep Reading...

13h

Toronto to Host Global Mineral Sector for PDAC 2026, March 1 – 4

The Prospectors & Developers Association of Canada (PDAC) will bring together the mineral exploration and mining community in Toronto for its 94th annual Convention, taking place March 1 – 4, 2026, at the Metro Toronto Convention Centre (MTCC).As the World’s Premier Mineral Exploration & Mining... Keep Reading...

16h

THE SIGNAL ARCHITECTURE: 5 Stocks Calibrating the 2026 Infrastructure Cycle

USANewsGroup.com Market Intelligence Brief — WHAT'S HAPPENING: The infrastructure holding the global economy together is being stress-tested in real time: Gold at $5,552 per ounce as central banks loaded another 755 tonnes into reserves [1]The G7 issued formal guidance treating the quantum... Keep Reading...

23 February

Mining’s New Reality: Strategic Nationalism, Gold Records and a Fractured Cost Curve

The era of “smooth globalization” is over, and mining is entering a more fragmented, politically charged phase defined by strategic nationalism, according to speakers at S&P Global’s latest webinar.Jason Holden, who opened the “State of the Market: Mining Q4 2025” session with a macro overview,... Keep Reading...

23 February

Brazilian State Firm Seeks Injunction to Block Equinox Gold-CMOC Asset Sale

A Brazilian state-run mining company is seeking an emergency court injunction to block the sale of one of Equinox Gold's (TSX:EQX,NYSEAMERICAN:EQX) Brazilian assets. Bloomberg reported that Companhia Baiana de Produção Mineral (CBPM) has asked the Bahia State Court of Justice to immediately... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00