June 05, 2024

Iceni Gold Limited (ASX: ICL) (Iceni or the Company) is pleased to provide an exploration update on further work conducted on the 14 Mile Well Gold Project.

Highlights

- Further fieldwork at the Christmas Gift prospect in the priority Everleigh Well target area has extended the host shear structure, as well as returning additional gold bearing quartz veinlets and high-grade gold rock chip results.

- Additional high-grade rock chip assay results returned from the newly exposed sample trenches include:

- 158.00g/t Au, 93.50g/t Au and 43.20g/t Au

- These results continue on from previously announced ultra high-grade rock chip assay results, including;

- 18,207g/t Au, 18,179g/t Au, 16,776g/t Au, 16,659g/t Au, 14,780g/t Au

- Multiple shallow surface excavations along the trend have now exposed and extended the shear structure over an approximately 50m strike length that is open.

- Diamond Drilling contractors are in the process of being secured and a further announcement will be made soon in relation to mobilisation.

Commenting on the sampling results, Managing Director Wade Johnson said:

“The recent field activities and assay results at our Christmas Gift prospect provide further support to the prospectivity of this new high-grade discovery within our large 14 Mile Well Project. We are excited by the further high-grade rock chip results and shallow surface activities that now demonstrates a strike length of at least 50m to the structure that is open. The geological characteristics of the Christmas Gift structure does provide key information and a target style to explore the greater Everleigh area for additional gold mineralisation and further develop the geological model in this area. A diamond drill rig is in the process of being secured, the drill sites prepared, and we are poised to commence our maiden drill program at Christmas Gift.”

Christmas Gift Prospect

Christmas Gift is located within the priority Everleigh Well Target area (“Everleigh”), that is central to the 14 Mile Well Project. The Everleigh area forms part of the historic Redcastle gold mining centre, renowned for its prolific gold nugget finds, which was discovered in 1894. Everleigh also contains a number of historical prospecting pits, shafts and shallow workings in additional numerous alluvial gold workings distributed over a wide area. The largest historical workings in this Everleigh area are the Castlemaine Gold workings location to the south of the Christmas Gift (see Figure 5). Alluvial gold nuggets continue to be found in the area.

The Christmas Gift Prospect is located at one of the historical workings and where sampling by the Company during 2023 confirmed the presence of the narrow high-grade quartz veinlets with abundant visible gold (ASX release 8 June 2023).

Further exploration work by the Company consisted of extending the original sample pit previously exposed (ASX release 8 June 2024) and excavation of five shallow sample pits (costeans) along strike to expose the Christmas Gift shear beneath the shallow (0.5m) cover. This work has demonstrated the shear now extends to approximately 50m along strike and is open. In addition, the shear structure maintains a consistent 1m true width which trends approximately northwest and dips 55 degrees to the northeast (Figure 4).

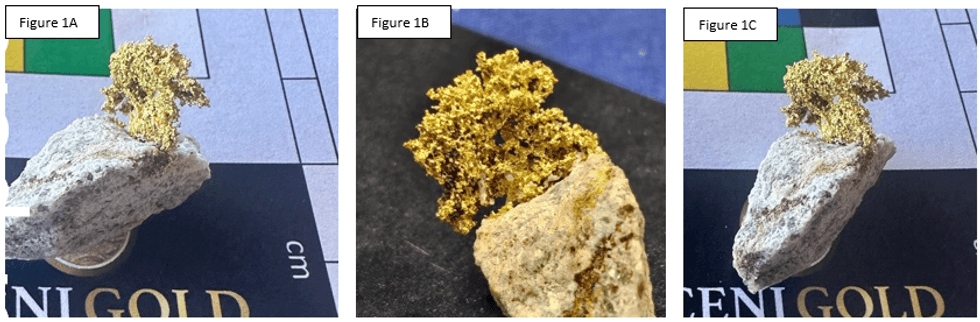

The original trench (ASX release 8 May 2024) was also extended to the south, toward and adjacent to the historical shaft. This work further exposed the gold bearing lithological unit (shear) and exposed additional spectacular narrow quartz veinlets containing visible gold (Figure 1 & Table 1) that has provided additional important geological information to the characteristics of the gold bearing structure. The Christmas Gift shear is interpreted to be a sheared interflow sediment -basalt contact bounded by massive basalt.

The combination of the previous and recent work by the Company has now confirmed the Christmas Gift shear has a strike length of at least 50m, is open, maintains a width of approximately 1m and has further enhanced the prospectivity of the target.

Results from multiple rock chip samples (Appendix 1) collected from the sample pits to test the different lithologies, including the quartz veinlets within the main Christmas Gift shear zone and the surrounding massive basalt host, support the high-grade character of the structure. Significant high-grade gold results (Table 1) include 158g/t Au and 93.5g/t Au returned from rock samples (including quartz veining collected from the shear).

Click here for the full ASX Release

This article includes content from Iceni Gold, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

ICL:AU

The Conversation (0)

8h

Editor's Picks: Is Gold and Silver's Price Correction Over?

It's been a wild couple of weeks for gold and silver. After surging to record highs at the end of January, prices for both precious metals saw significant corrections, creating turmoil for market participants.This week brought some relief, with gold bouncing back from its low point and even... Keep Reading...

19h

Blackrock Silver to Present at the Precious Metals and Critical Minerals Virtual Investor Conference on February 10th 2026

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce that Andrew Pollard, President & Chief Executive Officer of the Company, will present live at the Precious Metals & Critical Minerals Virtual Investor Conference hosted... Keep Reading...

05 February

Experts: Gold's Fundamentals Intact, Price Could Hit US$7,000 in 2026

Gold took center stage at this year's Vancouver Resource Investment Conference (VRIC), coming to the fore in a slew of discussions as the price surged past US$5,000 per ounce. Held from January 25 to 26, the conference brought together diverse experts, with a focus point being the "Gold... Keep Reading...

05 February

Barrick Advances North American Gold Spinoff After Record 2025 Results

Barrick Mining (TSX:ABX,NYSE:B) said it will move ahead with plans to spin off its North American gold assets after a strong finish to 2025.The Toronto-based miner said its board has authorized preparations for an IPO of a new entity that would house its premier North American gold operations,... Keep Reading...

05 February

Peruvian Metals Secures 6 Year Agreement with Community at Mercedes Project

Peruvian Metals Corp. (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals or the "Company") is pleased to announce that the agreement between San Maurizo Mines Ltd. ("San Maurizo"), a private Manitoba company which holds a 100% direct interest in the Mercedes Property, and Comunidades... Keep Reading...

05 February

TomaGold Borehole EM Survey Confirms Berrigan Deep Zone

Survey also validates significant mineralization and unlocks new targets Highlights Direct correlation with mineralization : The modeled geophysical plates explain the presence of semi-massive to massive sulfides intersected in holes TOM-25-009 to TOM-25-015. Priority target BER-14C :... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00