October 03, 2024

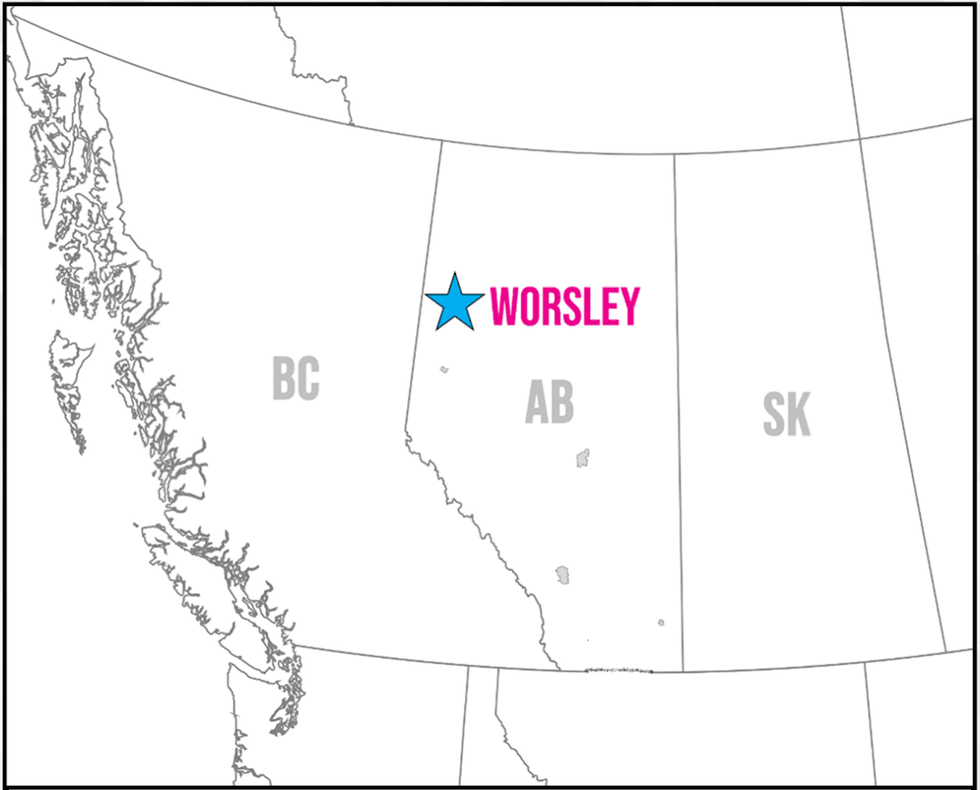

First Helium (TSXV:HELI,OTCQB:FHELF,FRA:2MC) is a Canadian company developing helium resources in Alberta, Canada. The company’s primary asset is the Worsley project spanning 53,000 acres, including helium-enriched natural gas, oil and other natural resources. First Helium has made significant progress with multiple discoveries, including a helium discovery well and successful oil wells. The company aims to grow its production and cash flow through ongoing exploration and drilling activities.

First Helium targets over $100 million in annual revenue within the next three to five years. Based on current projections, vertical drilling alone could generate over $100 million in annual revenue, with cash flow estimated to reach $70 million annually.

The Worsley project is distinguished by its significant helium resources and multi-zone drilling potential for helium, natural gas and oil. Worsley area has produced over 1 Bcf of helium, which was not recovered in previous natural gas operations, highlighting the untapped potential of the region for helium extraction.

The Worsley project area benefits from an existing natural gas gathering infrastructure, expediting the timeline to bring helium to market. First Helium expects the first production to begin in the fourth quarter of 2025, positioning it to become a key supplier in the growing North American helium market.

Company Highlights

- Helium is a critical mineral with steady growth in demand. Major companies like Google, Amazon, SpaceX, Samsung, NVIDIA and Intel rely on it.

- Helium prices have increased by over 50 percent in the last three years and the market is expected to grow 300 percent by 2030.

- First Helium’s indicative cash netbacks are three to four times higher than typical Canadian natural gas producers.

- First Helium offers exposure to helium, natural gas and oil revenue streams, which diversifies risk and increases value.

This First Helium profile is part of a paid investor education campaign.*

HELI:CA

The Conversation (0)

10 February 2025

First Helium

Advanced stage, high-value oil, and helium-enriched natural gas project in Alberta, Canada

Advanced stage, high-value oil, and helium-enriched natural gas project in Alberta, Canada Keep Reading...

1h

Oil Tops US$100 as Iran Conflict Threatens Strait of Hormuz Supply Route

Global oil and gas prices rallied sharply over the weekend as escalating geopolitical tensions in the Middle East rattled energy markets and triggered fears of a major supply disruption. Benchmark crude prices surged to their highest levels in years, with traders pricing in the possibility of... Keep Reading...

06 March

Syntholene Energy Corp. Announces Completion of Conceptual Design Report and Technoeconomic Analysis

Report Validates Pathway to Industrial Scale Synthetic Fuel Production Targeting Cost Competitiveness with Fossil FuelsSyntholene Energy Corp. (TSXV: ESAF,OTC:SYNTF) (OTCQB: SYNTF) ("Syntholene" or the "Company") announces the completion of its Conceptual Design Report ("CDR") and integrated... Keep Reading...

06 March

Angkor Resources Announces Closing of Evesham Oil and Gas Sale

(TheNewswire) GRANDE PRAIRIE, ALBERTA TheNewswire - March 6, 2026 - Angkor Resources Corp. (TSXV: ANK,OTC:ANKOF) ("ANGKOR" OR "THE COMPANY") announces the completion of all final payments and closing of the sale of its 40% participating interest (the "Assets") in the Evesham Macklin oil and gas... Keep Reading...

05 March

Oil Prices Surge as Iran Conflict Halts Tanker Traffic Through Hormuz

Oil and gas prices extended their sharp climb this week as the escalating conflict between the US, Israel and Iran disrupts shipping through one of the world’s most critical energy chokepoints.Crude oil futures surged again on Thursday (March 5), with the US benchmark climbing roughly 3.5... Keep Reading...

03 March

Syntholene Energy Corp. Closes Oversubscribed $3.75 Million Non-Brokered Private Placement

Proceeds to be used to Accelerate Procurement and Component Assembly for Demonstration Facility Deployment in IcelandSyntholene Energy CORP. (TSXV: ESAF,OTC:SYNTF) (FSE: 3DD0) (OTCQB: SYNTF) (the "Company" or "Syntholene") is pleased to announce that it has closed its previously announced... Keep Reading...

02 March

Oil, LNG Prices Climb on Fears of Prolonged Hormuz Shutdown

Oil and gas prices surged Monday (March 2) after fresh military strikes between the US, Israel, and Iran rattled energy markets and brought shipping through the Strait of Hormuz close to a halt, raising fears of a wider supply shock.Brent crude, the global oil benchmark, jumped as much as 10... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00