June 27, 2023

Ora Gold Limited (“Ora” or the “Company”, ASX: OAU) is pleased to announce exceptional high-grade gold intercepts from recent slim reverse circulation (RC) drilling at the Crown Prince Gold Prospect (M51/886).

Highlights:

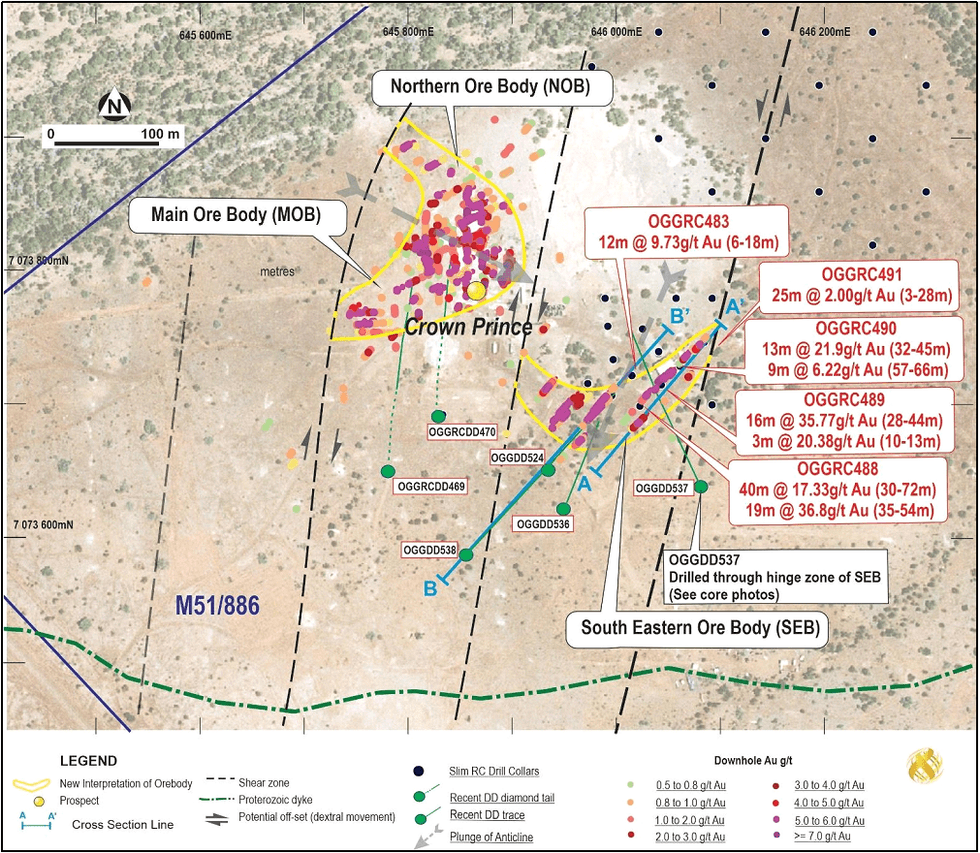

- High-grade gold results returned from drilling at the South-Eastern Ore Body (SEB) of Crown Prince Gold Prospect. High grades returned from the hinge zone of the newly delineated SEB anticline.

- These results come from along strike to the north-east of the SEB structure and indicate the lode is folded with a northern limb showing exceptional mineralisation. Best intercepts include:

40m @ 17.53g/t Au from 30m incl. 19m @ 36.8g/t Au from 35m in OGGRC488

16m @ 35.77g/t Au from 28m and 3m @ 20.38g/t Au from 10m in OGGRC489

13m @ 21.9g/t Au from 32m and 9m @ 6.22g/t Au from 57m in OGGRC490

12m @ 9.73g/t Au from 6m in OGGRC483

21m @ 2.53g/t Au from surface in OGGRC502 and

25m @ 2.00g/t Au from 3m in OGGRC491

- Following earlier high-grade results (8 May & 22 May ASX releases) the Company has undertaken a diamond program to test SEB mineralisation at depth. Four diamond drill holes targeting SEB mineralisation below 100m vertical depth have been drilled from surface and all have intersected sheared and potentially mineralised zones with assays pending.

- From geological logging, the down dip extension of the CVX lode within SEB was intersected at 212m by the deepest diamond hole drilled in this area, with sample results (assays) pending.

Drill holes in the current program have successfully delineated extensions to mineralised zones along strike of known mineralisation (to the north-west) and in down-dip positions. In several areas new zones of gold mineralisation are indicated to be present in the footwall to previously drilled lodes.

The Crown Prince south-east extension (SEB) continues to develop as a key growth area for gold resources at the prospect.

Ora Gold’s CEO Alex Passmore commented: “We are pleased to report very high-grade extensions to known mineralisation at the SEB ore body, part of the Crown Prince Prospect. These results indicate that the SEB mineralisation is folded in a steeply south westerly plunging anticline with the north-eastern limb being strongly mineralised. With recent results returned from the primary zone showing good continuity to mineralisation, these results have great impact for mineralisation modelling at Crown Prince Prospect. Further encouragement comes from our diamond drilling which has targeted deeper zones and is interpreted to have intersected the mineralised structure at depth. These results will be used in an upcoming resource estimation. All data received so far suggests the SEB zone mineralisation commences at surface, is high-grade over good widths and hence is likely to show robust economic outcomes in any conceptual mining scenario.”

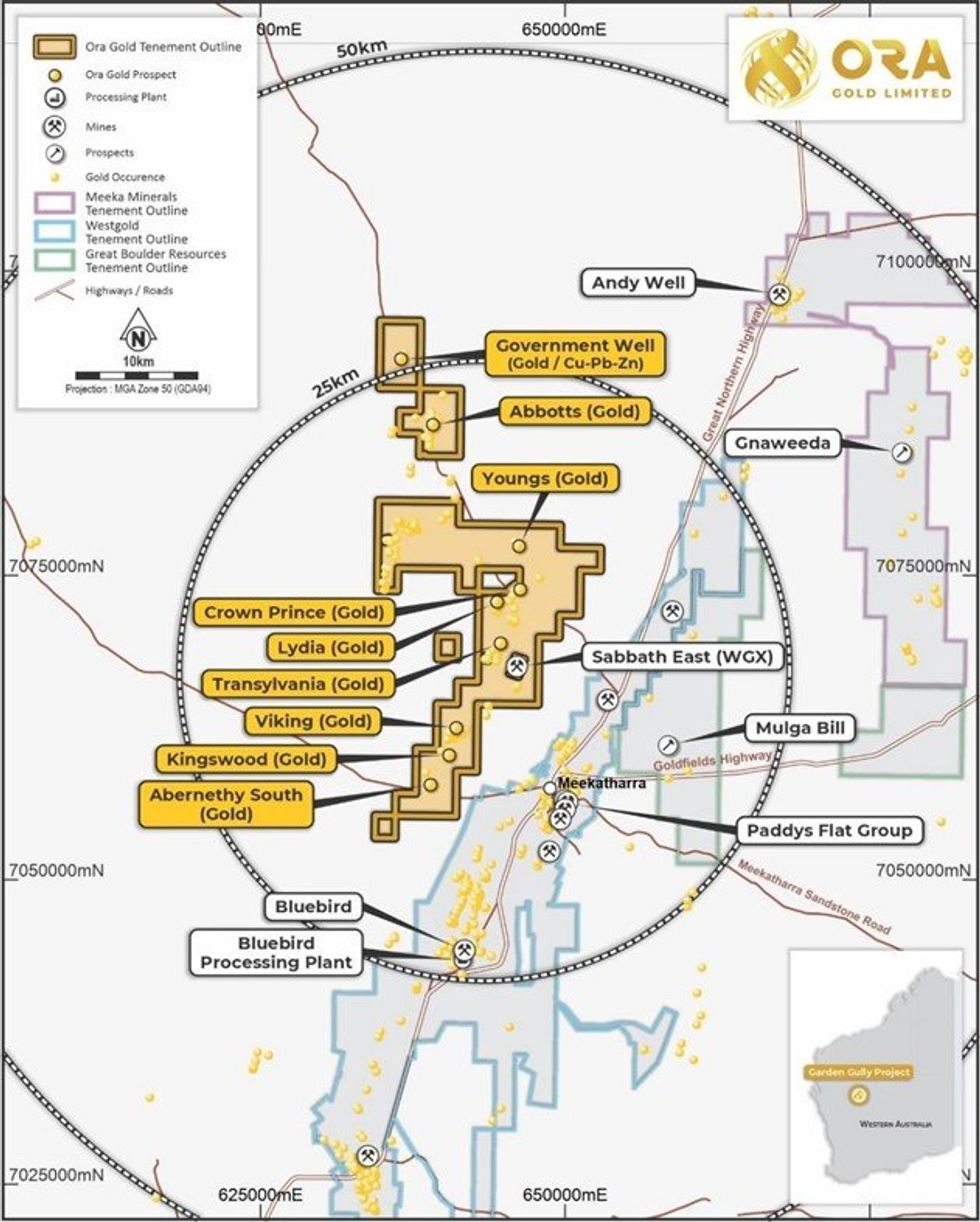

The Crown Prince Prospect is a high-grade gold deposit within Ora Gold’s Garden Gully Project. Crown Prince is located 22km north-west of Meekatharra in Western Australia via the Great Northern Highway and the Mt Clere Road (Figure 1).

About one third of the assay results from the recent slim RC drill program undertaken in June targeting the SEB have been received (Table 1, Appendix 1 & Figure 2). The program consisted of 44 holes totaling 3,213m.

A diamond drill program was also concurrently undertaken and consisted of two diamond tails on Main Ore Body (MOB) and four holes with coring from surface over the SEB (see Photo 1 below). All assay results are pending.

The results in this release include a new high-grade extension to the SEB and a new structural interpretation for mineralised shoots at Crown Prince (Figure 2). Mineralised envelopes are contorted and folded between northerly trending sheers. MOB mineralisation occurs in a steep south-east plunging anticline. SEB mineralisation is hosted within a steep south westerly plunging anticline. The two zones are separated by a northerly trending shear zone (Figure 2).

This structural interpretation is based on high grade envelopes encountered in recent RC drilling and also core logging from recent diamond drilling.

All hole details and sampling information are included in Tables 1 and 2. Assay results received to date with more than 0.1ppm Au are included in Appendix 1.

South-Eastern Ore Body (SEB)

Exceptional high-grade gold intercepts have been returned and are reported in this release (Table 1, Appendix 1 & Figure 2). They are located over the eastern flank of the newly interpreted anticline structure of SEB (Figures 2, 3 and 4). Assays from two more RC holes are still pending (OGGRC534-535) and both are expected to return gold grades (Figure 4).

The new interpreted structural model shows that the exceptional grades are located on the hinge of the anticline plunging south-westerly and a series of saddle reefs appear to be well preserved (Figure 3). A diamond hole OGGDD537 was drilled north-westerly under the anticlinal structure and a wide sheared (+/- mineralised) zone was intersected between 128-147m down hole (Assays pending, see Photo 2, Figure 2).

Three diamond holes have targeted the down-dip mineralisation of the previously announced intersections at CVX Lode (Figure 4). All have intersected sheared (+/- mineralised) zones confirming the prospectivity and down dip continuity of the hinge zone of the anticlinal structure at SEB (Figure 4). Assay results are pending on both DD and RC holes displayed in blue color.

Click here for the full ASX Release

This article includes content from Ora Gold Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

6h

RUA GOLD Files 43-101 Technical Reports for the Reefton and Glamorgan Projects in New Zealand

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZX: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce the filing on SEDAR+ of independent Technical Reports for its Reefton Project ("Reefton Technical Report") on the South Island and Glamorgan Project ("Glamorgan Technical Report") on... Keep Reading...

8h

Blackrock Silver Receives First of Three Key Permits for the Tonopah West Project

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce the issuance by the Nevada Department of Environmental Protection (NDEP), through the Bureau of Air Pollution Control, the Class II Air Quality and Surface Disturbance... Keep Reading...

02 March

As Gold Investment Surges, Fake Platforms and AI Drive New Fraud Wave

As gold prices continue to soar past record highs, investors are pouring billions into bars, coins, and digital tokens. However, regulators and analysts warn that the same rally is fueling a surge in scams that are quietly draining retirement accounts and life savings.Gold has long been marketed... Keep Reading...

02 March

Peruvian Metals Announces the 10-Year Renewal of the Use of Surface Rights at the Aguila Norte Processing Plant

Peruvian Metals Corp (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals" or the "Company") is pleased to announce that the Company has renewed the lease on the use of the surface rights at its 80-per-cent-owned Aguila Norte processing plant ("Aguila Norte" or the "Plant") located in... Keep Reading...

27 February

American Eagle Announces $23 Million Strategic Investment Backed by Eric Sprott

Highlights:The investment adds a third strategic investor, when combined with investments by mining companies South32 Group Operations PTY Ltd. and Teck Resources LimitedThe Offering funds significantly expanded drill programs for 2026 and 2027 at the Company's NAK copper-gold porphyry project... Keep Reading...

27 February

Lahontan Gold Eyes Resource Update as Production Nears

Lahontan Gold (TSXV: LG,OTCQB:LGCXF) is drawing investor attention as it advances toward renewed production at its historic Santa Fe Mine in Nevada. A revised mineral resource estimate is expected soon, offering a potential catalyst, according to a recent report by News Financial.... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00