March 03, 2024

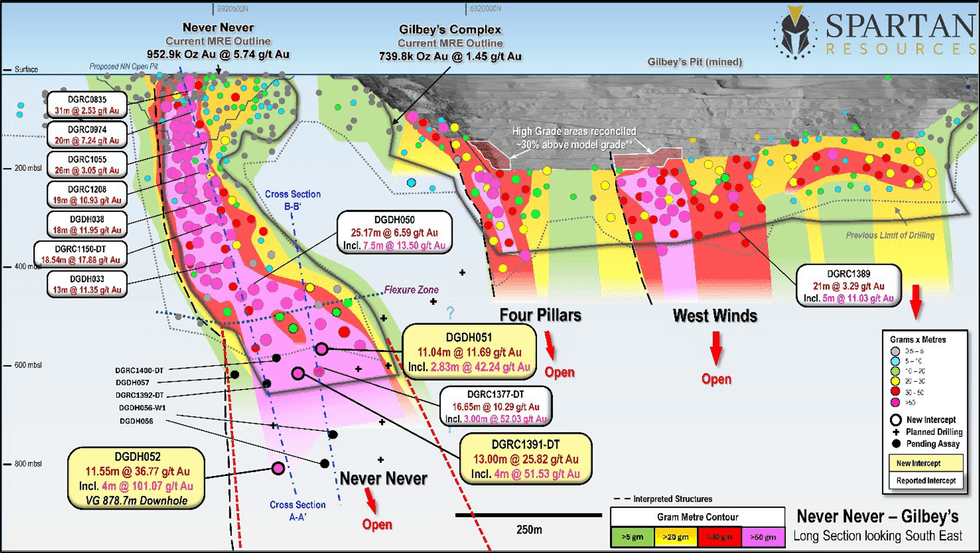

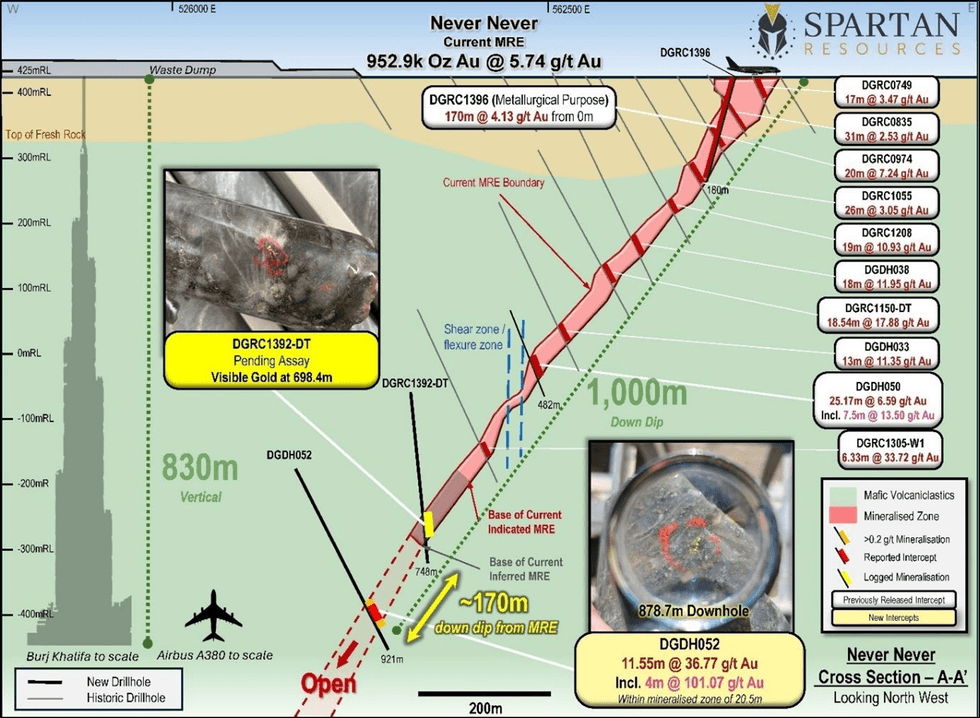

Multiple double-digit widths at double-digit grades including one of the best- ever Never Never assays from the deepest intercept to date

Spartan Resources Limited (“Spartan” or “Company”) (ASX: SPR) is pleased to report updated drilling and assay information from recent drilling at its 100%-owned Dalgaranga Gold Project (“DGP”) in the Murchison region of Western Australia.

Highlights:

Never Never Gold Deposit:

- 11.55m @ 36.77g/t gold (424.7 g x m) from 875.0m, incl. 4.0m @ 101.07g/t (DGDH052)

- Top-3 all-time Never Never gram x metre intercept located 170m below the current MRE and the deepest Never Never intercept to date.

- 13.00m @ 25.82g/t gold (335.7g x m) from 624.0m, incl. 4.0m @ 51.53g/t (DGRC1391-DT)

- Top 5 all-time Never Never gram x metre intercept in-fills and strengthens lowest extent of the current 0.95Moz Never Never Mineral Resource Estimate.

- 11.04m @ 11.69g/t gold (129.1g x m) from 567.0m, incl. 2.83m @ 42.24g/t (DGDH051)

- Intercept in-fills and strengthens the central area of the Inferred Resource.

The assays in this release includes significant intercepts from resource in-fill and exploration drilling at the high-grade Never Never Gold Deposit, as well as a highly significant assay result that has extended the known mineralisation to nearly 1km below surface – highlighting the growing strategic significance of this exceptional high-grade deposit.

Note: Visual estimates of mineral abundance should never be considered a proxy or substitute for laboratory analyses where concentrations or grades are the factor of principal economic interest. Visual estimates also potentially provide no information regarding impurities or deleterious physical properties relevant to valuations. Core processing is currently underway, with assay results expected by mid- March.

Click here for the full ASX Release

This article includes content from Spartan Resources Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

SPR:AU

The Conversation (0)

03 April 2024

Spartan Resources

Focused on Growing High-grade Gold Ounces in front of established infrastructure in Prolific Western Australia

Focused on Growing High-grade Gold Ounces in front of established infrastructure in Prolific Western Australia Keep Reading...

13h

Rick Rule: Gold Price During War, Silver Strategy, Oil Stock Game Plan

Rick Rule, proprietor at Rule Investment Media, shares updates on his current strategy in the resource space, mentioning gold, silver, oil and agriculture. He also reminds investors to pay more attention to gold's underlying drivers than to current events.Click here to register for the Rule... Keep Reading...

13h

Lobo Tiggre: Gold, Oil in Times of War, Plus My Shopping List Now

Lobo Tiggre of IndependentSpeculator.com shares his thoughts on how gold, silver and oil could be impacted by the developing situation in the Middle East. He cautioned investors not to chase these commodities if prices run. Don't forget to follow us @INN_Resource for real-time updates!Securities... Keep Reading...

14h

TomaGold: New High-grade Deep Discovery at Berrigan Mine

TomaGold (TSXV:LOT) President, CEO and Director David Grondin said the company is focusing on its flagship Berrigan mine in Chibougamau, Québec, following a large, significant discovery at depth.Berrigan is 4 kilometers northwest of the city of Chibougamau and has existed for about 50 years.... Keep Reading...

14h

Oreterra Metals Fully Financed for Maiden Discovery Drilling at Trek South

Oreterra Metals (TSXV:OTMC) is set to launch its first-ever discovery drill program at the Trek South porphyry copper-gold prospect in BC, Canada, a pivotal moment following a corporate restructuring that culminated in the company emerging under its new name on February 2.Speaking at the... Keep Reading...

04 March

Aurum Hits High-Grade Gold at Napie, Cote d'Ivoire

Aurum Resources (AUE:AU) has announced Aurum Hits High-Grade Gold at Napie, Cote d'IvoireDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00