December 03, 2024

With a strong foothold in the manufacturing and distribution of copper-insulated cables, Australia-based Energy Technologies (ASX:EGY) is poised to capitalize on the growing renewable energy sector through strategic global partnerships presenting a compelling investment opportunity. The company''s wholly owned subsidiary, Bambach Wires and Cables, is the oldest cable manufacturer in Australia, and its extensive history underpins a reputation for reliability and quality.

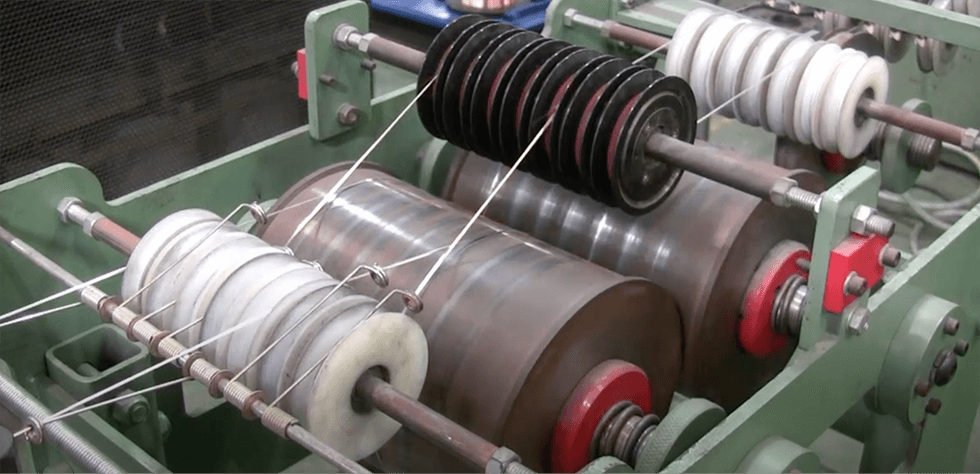

Energy Technologies focuses its factory operations on higher-margin product lines while employing a balanced strategy of manufacturing and purchasing cables for sale. Its Rosedale facility is a significant upgrade in its manufacturing capabilities equipped with a high level of automation that supports production efficiency, processing up to 250 tonnes of copper monthly, with room for additional capacity if demand rises.

Energy Technologies also engages in purchased sales by sourcing lower-margin products from rigorously vetted suppliers throughout the globe. This approach ensures Energy Technologies can meet market demand without overextending its manufacturing resources. Purchased sales for FY25 are projected to contribute an additional AU$6.7 million to the company’s revenue.

Company Highlights

- Energy Technologies produces low-, medium-, and high-voltage cables, with over 90 percent of its materials sourced locally in Australia.

- The company is strategically aligned with electrification and renewable energy trends, catering to infrastructure, solar, wind and mining industries.

- Key partnerships with Gantner Instruments and Tratos Group expand its product offerings for solar farms, wind turbines and subsea transmission lines.

- The company’s partnerships position it as a comprehensive supplier for large-scale renewable energy projects, projected to grow to AU$6 billion annually by 2034.

This Energy Technologies profile is part of a paid investor education campaign.*

Click here to connect with Energy Technologies (ASX:EGY) to receive an Investor Presentation

EGY:AU

Sign up to get your FREE

Energy Technologies Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

02 December 2024

Energy Technologies

High-quality cable manufacturer and re-seller for the expanding energy and infrastructure markets

High-quality cable manufacturer and re-seller for the expanding energy and infrastructure markets Keep Reading...

27 February

EGY Appendix 4D and HY Financial Report 31 December 2025

Energy Technologies (EGY:AU) has announced EGY Appendix 4D and HY Financial Report 31 December 2025Download the PDF here. Keep Reading...

29 January

Appendix 4C and Cover Ltr qtr ending 31 December 2025

Energy Technologies (EGY:AU) has announced Appendix 4C and Cover Ltr qtr ending 31 December 2025Download the PDF here. Keep Reading...

30 October 2025

Appendix 4C and Cover Ltr qtr ending 30 Sep 2025

Energy Technologies (EGY:AU) has announced Appendix 4C and Cover Ltr qtr ending 30 Sep 2025Download the PDF here. Keep Reading...

28 August 2025

EGY Appendix 4E

Energy Technologies (EGY:AU) has announced EGY Appendix 4EDownload the PDF here. Keep Reading...

31 July 2025

Appendix 4C and Cover Ltr qtr ending 30 June 2025

Energy Technologies (EGY:AU) has announced Appendix 4C and Cover Ltr qtr ending 30 June 2025Download the PDF here. Keep Reading...

23h

CHARBONE to Present at the Hydrogen East Conference and Announce the Development of a Supply Hub in the Atlantic Market through its Subsidiary

(TheNewswire) Brossard, Quebec TheNewswire - March 12, 2026 Charbone CORPORATION (TSXV: CH,OTC:CHHYF; OTCQB: CHHYF; FSE: K47) ("Charbone" or the "Company"), a North American producer and distributor specializing in clean Ultra High Purity ("UHP") hydrogen and strategic industrial gases, is... Keep Reading...

23h

CHARBONE presentera a la conference Hydrogen East et annonce le developpement d'un hub d'approvisionnement dans le marche de l'Atlantique via sa filiale

(TheNewswire) Brossard, Quebec TheNewswire - le 12 mars 2026 CORPORATION Charbone (TSXV: CH,OTC:CHHYF; OTCQB: CHHYF; FSE: K47) (« Charbone » ou la « Société »), un producteur et distributeur nord-américain spécialisé dans l'hydrogène propre Ultra Haute Pureté (« UHP ») et les gaz industriels... Keep Reading...

12 March

Syntholene Selects Papadakis Engineering as Integration Partner for Novel Thermal-Hybrid Synthetic Fuel Demonstration Facility Heat Exchanger System

Experienced Thermal Integration Specialist Team Adds Depth to Syntholene's Construction and Operational RosterSyntholene Energy CORP (TSXV: ESAF,OTC:SYNTF) (FSE: 3DD0) (OTCQB: SYNTF) ("Syntholene" or the "Company") announces that it has selected Papadakis Engineering ("Papadakis"), the advanced... Keep Reading...

04 March

Funding to Advance 2026 Development Milestones

Provaris Energy (PV1:AU) has announced Funding to Advance 2026 Development MilestonesDownload the PDF here. Keep Reading...

02 March

Trading Halt

Provaris Energy (PV1:AU) has announced Trading HaltDownload the PDF here. Keep Reading...

25 February

Acquisition of Critical Infrastructure Services Platform

European Green Transition plc (AIM: EGT) announces that in line with its strategy set out at IPO, EGT has entered into a share purchase agreement ("SPA") to acquire an established, EBITDA profitable onshore wind turbine operating, maintenance, repairing, and remote monitoring business (the "O&M... Keep Reading...

Latest News

Sign up to get your FREE

Energy Technologies Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00