September 04, 2025

Empire Metals Limited (LON:EEE)(OTCQX:EPMLF), the resource exploration and development company, is pleased to announce its interim results for the six-month period ended 30 June 2025.

Highlights:

- Pitfield confirmed as the world's most significant new titanium discovery, with unparalled scale, consistency of high-grade and purity.

- Largest drilling campaign to date launched at the Thomas Prospect delivered outstanding results and identified a large high-grade near-surface core, averaging ~6% TiO₂ over a continuous 3.6km strike.

- Metallurgical testwork achieved a 99.25% TiO₂ product, demonstrating a highly efficient and potentially lower-cost processing route.

- Process development work has confirmed that Pitfield's weathered ore is ideally suited to conventional mineral separation and refining, differentiating it from ilmenite-based projects which typically face lower recoveries, higher costs, and significant environmental challenges.

- Maiden Mineral Resource Estimate ("MRE") on track for release in the coming weeks.

- £4.5m raised in May 2025 to accelerate Pitfield development, with strong institutional support.

- Further strengthening of board and technicial team with appointment of Phil Brumit as Non-Executive Director, Alan Rubio as Study Manager and Pocholo Aviso as Hydro-metallurgist.

- Commenced US trading on the OTCQX in the US, broadening international investor access.

Shaun Bunn, Managing Director, commented:"The first half of 2025 has been a period of remarkable activity and momentum for Empire. Pitfield is no longer just a discovery story - it is fast becoming recognised as a project of global importance, with results that continue to exceed expectations. Our drilling campaigns have delivered some of the highest TiO₂ grades we've seen to date, confirming not only the exceptional quality of the deposit but also its scale consistency and simplicity.

"Metallurgical testwork has shown that we can achieve a product of extraordinary purity using straightforward, conventional processing methods.This rare combination of scale, grade and simplicity underpins our confidence that Pitfield can emerge as one of the world's leading titanium projects, capable of supplying high-value sectors such as aerospace and defence for decades to come.

"From an operational standpoint, we are now on the cusp of delivering our maiden MRE, which we believe will firmly establish Pitfield among the world's leading titanium assets. Beyond that, the pathway is clear: complete our expanded testwork, progress to pilot-scale operations, and begin engaging directly with end-users - particularly in high-value markets such as aerospace and defence, where titanium's strategic importance is growing rapidly.

"It is also encouraging to see the strength of market support for what we are building and I am confident that Empire can bring this once-in-a-lifetime discovery to commercial fruition in an expedient manner. With a world-class asset, a strengthened technical team, and strong financial backing, we are exceptionally well positioned for the next phase of growth."

Market Abuse Regulation (MAR) Disclosure

Certain information contained in this announcement would have been deemed inside information for the purposes of Article 7 of Regulation (EU) No 596/2014, as incorporated into UK law by the European Union (Withdrawal) Act 2018, until the release of this announcement.

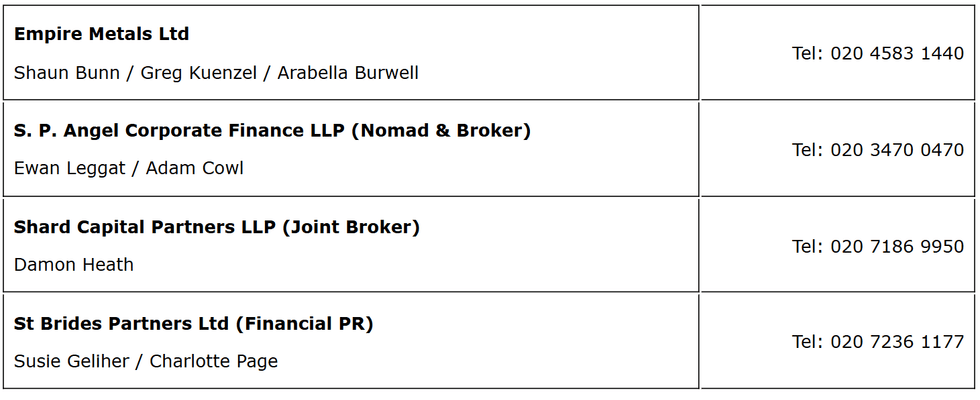

For further information please visit www.empiremetals.com or contact:

CHAIRMAN'S STATEMENT

The progress we have made during 2025 at our flagship Pitfield Project in Western Australia has been nothing short of transformational, positioning the Company at the forefront of what we believe is the most significant titanium discovery globally. This represents a generational opportunity rapidly moving from exploration success toward commercial reality.

Over the past six months, our team has demonstrated not only technical excellence but also the ability to deliver results that have redefined the perception of the Company in the market. We have moved from exploration to successfully establishing Pitfield's potential to support long-term, large-scale, and high-value titanium supply. This achievement is reflected in the strong support we continue to receive from institutional investors, with £4.5 million raised in May 2025, and in the remarkable performance of our share price, which has risen more than 500% since the beginning of the year in response to a series of consequential milestone achievements.

What sets Pitfield apart is not just its extraordinary scale, but the exceptional quality of its titanium mineralisation. Unlike many other titanium projects around the world, Pitfield benefits from high-grade mineralisation from surface which has been proven to be of exceptional purity, being very low in deleterious contaminants but also amenable to simple, conventional mining methods due to its unique geological profile. Equally important, our metallurgical work has confirmed that simple, conventional processing can deliver an exceptionally pure titanium dioxide product, grading 99.25% TiO₂.

This combination of scale, grade, purity, and processing simplicity puts Pitfield in a league of its own. The Project is also located in Western Australia - a Tier One mining jurisdiction with world-class infrastructure, stable governance, a skilled workforce and a deeply rooted mining culture. Together, these advantages create a foundation for Pitfield to become a globally significant source of titanium supply.

During the first half of 2025, we advanced Pitfield across multiple fronts. A major drilling campaign was launched in February that provided not only the bulk metallurgical samples that enabled a significant scale-up of our metallurgical test work programme during the period, but also represented the next step towards defining a Mineral Resource Estimate ("MRE") for Pitfield.

A further drill campaign was launched in June 2025, the largest at Pitfield to date. The programme covered more than 11 square kilometres and targeted high-grade titanium mineralisation within the in-situ weathered cap at the Thomas Prospect, with the objective of delivering the MRE. This programme delivered some of the highest titanium dioxide grades recorded to date, with selected intercepts including: 44m @ 7.87% TiO2 from surface (AC25TOM159); 50m @ 7.84% TiO2 from 4m (AC25TOM130); 54m @ 7.41% TiO2 from surface (AC25TOM118); 98m @ 7.05% TiO2 from 2m (RC25TOM062); and 98m @ 7.05% TiO2 from 2m (RC25TOM068). A large, high-grade central core was identified from this drilling which averaged ~6% TiO2 across a continuous 3.6km strike length. In addition, nearly two thirds of all drillholes averaged > 4% TiO2, with over 90% exceeding a 2% TiO2 cut-off grade.

We are now on the cusp of delivering our maiden MRE, which is expected in the coming weeks. Based on the results to date, we expect the MRE to be world-class and to serve as a foundation for the next phase of project development including mine scoping studies.

Following the process development breakthrough announced post period end in August 2025, we are progressing through the bench-scale and large-scale batch metallurgical testwork programme, which we expect to complete by early 2026. This work will feed into the design of a continuous pilot plant, enabling us to refine the commercial flowsheet and to produce bulk samples for evaluation by prospective end-users.

While most of the world's titanium feedstock is used to produce titanium dioxide for pigments in paints, coatings, and plastics, Pitfield's unique quality opens doors to higher-value markets. In particular, titanium sponge (for use in titanium metal production) stands out as a strategic growth opportunity. Titanium metal is essential in defence and aerospace applications due to its remarkable strength-to-weight ratio and resistance to extreme conditions. These attributes make it critical for fighter jets, naval vessels, spacecraft, and next-generation technologies.

At a time when the geopolitical landscape is shifting rapidly, the security of titanium supply has never been more important. China has tripled its titanium sponge output since 2018 and now controls nearly 70% of global supply. The United States is 95% reliant on imports of titanium sponge and 86% reliant on imports of mineral concentrates. Similarly, the European Union is exposed to supply risks, with no meaningful domestic production. Pitfield therefore represents a unique opportunity for Empire to establish itself as a secure, Western-aligned generational supplier of titanium. This strategic positioning is already resonating strongly with investors and potential industry partners.

Corporate

As Pitfield advances toward development, we have made strategic additions to our team to ensure we have the right expertise in place. In January 2025, we were delighted to welcome Phil Brumit to the Board as a Non-Executive Director and Chair of our Technical Committee. Phil brings more than 40 years of operational and project management experience across leading global mining companies, including Freeport-McMoRan, Lundin Mining, and Newmont Corporation. His proven track record in overseeing large-scale projects from development through to production will continue to be invaluable as we pursue an expeditious development of Pitfield.

Following the period end, we further strengthened our technical leadership with the appointments of Alan Rubio as Study Manager and Pocholo Aviso as Hydrometallurgist. Alan brings nearly three decades of experience in project evaluation and development, and will play a central role in assessing mining and infrastructure scenarios, as well as overseeing key economic studies. Pocholo, with his background in the TiO₂ pigment industry and metallurgical expertise, will lead the product development programme, optimising process flowsheets and assessing market pathways. Together, these appointments significantly enhance our ability to quickly advance Pitfield toward feasibility study stage with confidence and precision.

Alongside our operational and corporate progress, we have also been proactive in broadening awareness of the Empire investment proposition to a wider international audience. A key part of this strategy was our decision to commence trading of our shares on the OTCQB Market in the United States in March 2025. We were particularly pleased to be upgraded to the OTCQX Market only a few months later, which is a significant step forward in providing US investors with greater visibility of, and access to, Empire.

Trading on OTCQX opens the Company to a deep and diverse pool of new shareholders, many of whom are actively seeking exposure to strategic metals. Titanium is formally recognised as a critical mineral in numerous jurisdictions, including the United States, and our marketing initiatives across North America have confirmed the strong appetite for high-quality investment opportunities in this sector. Empire is therefore exceptionally well positioned to capture growing international investor interest as Pitfield advances toward commercialisation.

Financial

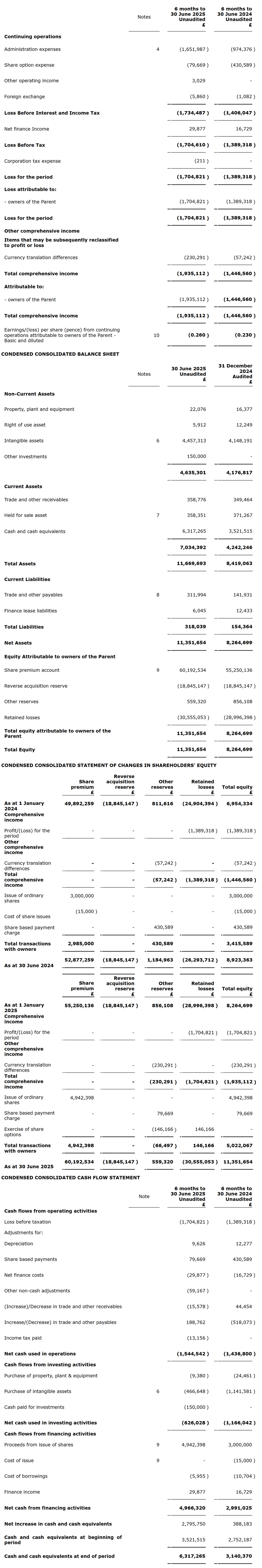

As an exploration and development group which has no revenue, we are reporting a loss for the six months ended 30 June 2025 of £1,704,821 (30 June 2024: loss of £1,389,318).

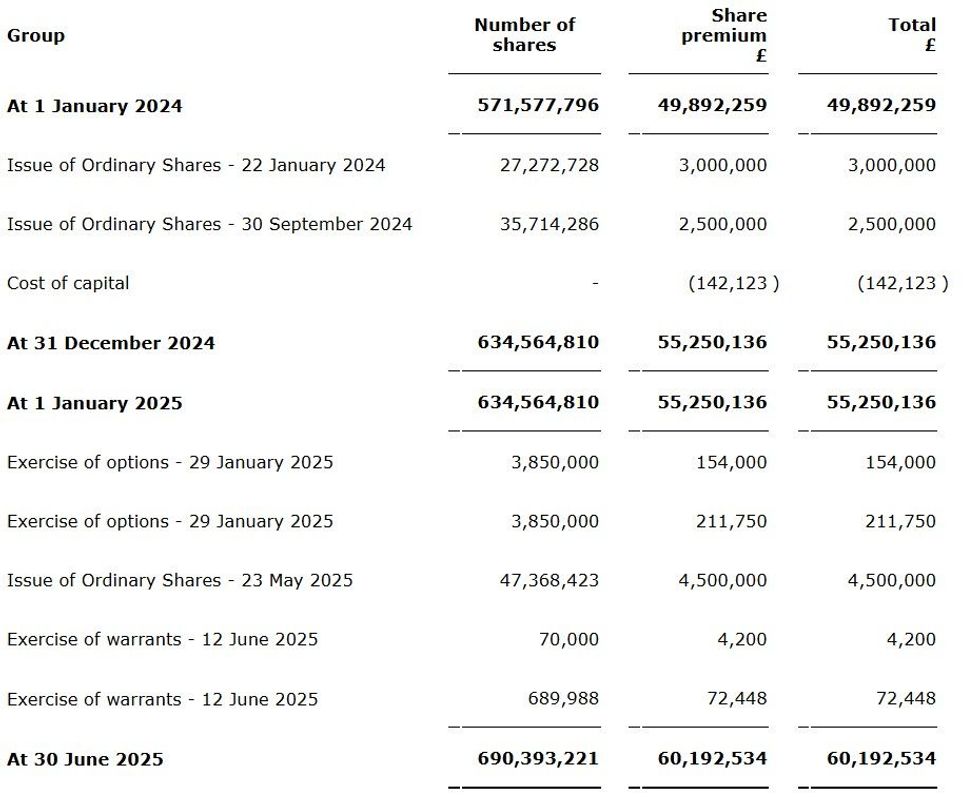

In May 2025, the Company announced that it had raised £4.5 million before expenses by way of a placing of 47,368,423 new ordinary shares of no par value to new and existing investors at 9.5p per share.

The Group's cash position as at 30 June 2025 was £6.3 million.

Outlook

The months ahead will be a busy and exciting time for Empire Metals. The maiden MRE will provide a foundation for detailed project evaluation, while ongoing metallurgical testwork will further optimise our flowsheet and advance our understanding of Pitfield's product potential. As we transition into the pilot testing phase, we will be engaging more closely with potential customers, including those in the titanium metal supply chain, to position Pitfield as a long-term, strategic source of secure supply.

At the same time, we will continue to strengthen our team and capabilities to match the scale of the opportunity before us. With a world-class asset, a highly experienced team, strong financial backing, and a supportive market, we are exceptionally well placed to deliver on the unprecendented opportunity Pitfield presents.

I would like to thank our shareholders for their continued support and confidence in Empire. The progress we have made in such a short time has been extraordinary, and I firmly believe we are only at the beginning of a highly rewarding journey that will see Pitfield become established as one of the most important titanium projects globally.

With Pitfield, we are building the foundations of a secure, generational-scale titanium supply business that has the potential to reshape the global titanium industry. The coming months promise to be both exciting and defining, and I look forward to updating you on our continued progress.

Neil O'Brien

Non-Executive Chairman

3 September 2025

CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

NOTES TO THE INTERIM FINANCIAL STATEMENTS

1. General Information

The principal activity of Empire Metals Limited ('the Company') and its subsidiaries (together 'the Group') is the exploration and development of precious and base metals. The Company's shares are quoted on the AIM Market of the London Stock Exchange. The Company is incorporated in the British Virgin Islands and domiciled in the United Kingdom. The Company was incorporated on 10 February 2010 under the name Gold Mining Company Limited. On 10 October 2016 the Company changed its name from Noricum Gold Limited to Georgian Mining Corporation and subsequently on 10 February 2020 changed its name from Georgian Mining Corporation to Empire Metals Limited.

The address of the Company's registered office is Craigmuir Chambers, PO Box 71, Road Town, Tortola BVI.

2. Basis of Preparation

The condensed consolidated interim financial statements have been prepared in accordance with the requirements of the AIM Rules for Companies. As permitted, the Company has chosen not to adopt IAS 34 "Interim Financial Statements" in preparing this interim financial information. The condensed interim financial statements should be read in conjunction with the annual financial statements for the year ended 31 December 2024, which have been prepared in accordance with International Financial Reporting Standards (IFRS) as adopted by the European Union.

The interim financial information set out above does not constitute statutory accounts. They have been prepared on a going concern basis in accordance with the recognition and measurement criteria of International Financial Reporting Standards (IFRS) as adopted by the European Union. Statutory financial statements for the year ended 31 December 2024 were approved by the Board of Directors on 5 June 2025. The report of the auditors on those financial statements was unqualified.

Going concern

The Directors, having made appropriate enquiries, consider that adequate resources exist for the Group to continue in operational existence for the foreseeable future and that, therefore, it is appropriate to adopt the going concern basis in preparing the condensed interim financial statements for the period ended 30 June 2025.

The factors that were extant in the 31 December 2024 Annual Report are still relevant to this report and as such reference should be made to the going concern note and disclosures in the 2024 Annual Report.

Risks and uncertainties

The Board continuously assesses and monitors the key risks of the business. The key risks that could affect the Group's medium-term performance and the factors that mitigate those risks have not substantially changed from those set out in the Group's 31 December 2024 Annual Report and Financial Statements, a copy of which is available on the Group's website: https://www.empiremetals.co.uk. The key financial risks are liquidity risk, foreign exchange risk, credit risk, price risk and interest rate risk.

Critical accounting estimates

The preparation of condensed interim financial statements requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, income and expenses, and disclosure of contingent assets and liabilities at the end of the reporting period. Significant items subject to such estimates are set out in note 4 of the Group's 31 December 2024 Annual Report and Financial Statements. Actual amounts may differ from these estimates. The nature and amounts of such estimates have not changed significantly during the interim period.

3. Accounting Policies

The same accounting policies, presentation and methods of computation have been followed in these condensed interim financial statements as were applied in the preparation of the Group's annual financial statements for the year ended 31 December 2024.

3.1 Changes in accounting policy and disclosures

(a) New and amended standards mandatory for the first time for the financial periods beginning on or after 1 January 2025.

The International Accounting Standards Board (IASB) issued various amendments and revisions to International Financial Reporting Standards and IFRIC interpretations. The amendments and revisions were applicable for the period ended 30 June 2025 but did not result in any material changes to the Financial Statements of the Group.

b) New standards, amendments and interpretations in issue but not yet effective or not yet endorsed and not early adopted.

There are a number of standards, amendments to standards, and interpretations which have been issued by the IASB that are effective in future accounting periods and which have not been adopted early.

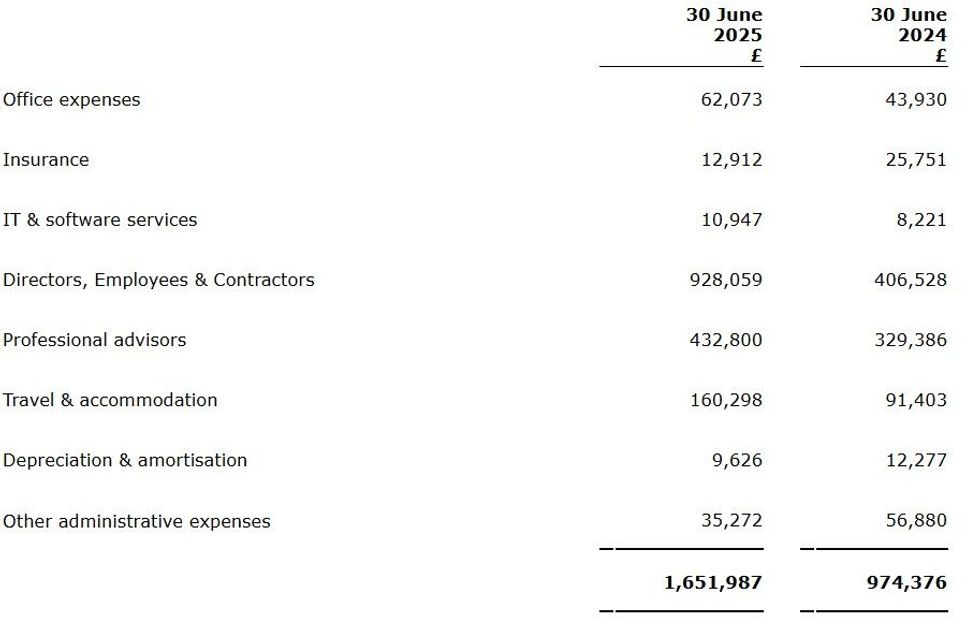

4. Administrative expenses

5. Dividends

No dividend has been declared or paid by the Company during the six months ended 30 June 2025 (2024: nil).

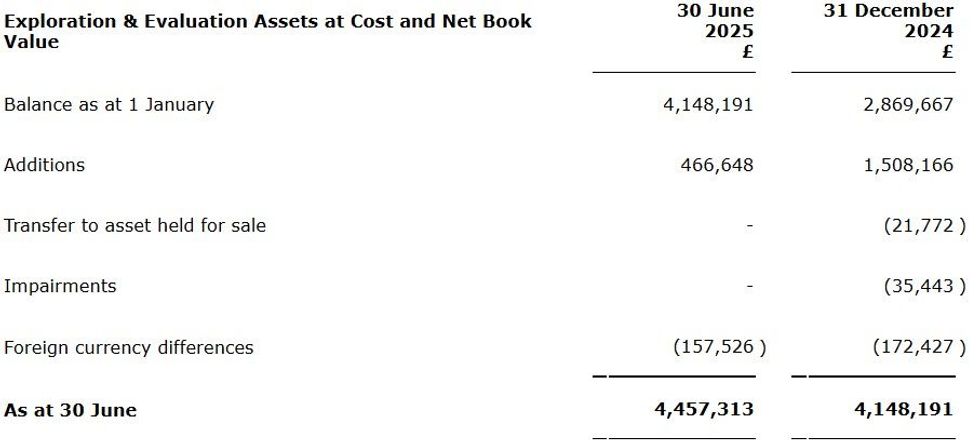

6. Intangible Assets

The Exploration & Evaluation additions in the current period primarily relates to work performed at the Company's Pitfield project.

The Directors do not consider the asset to be impaired.

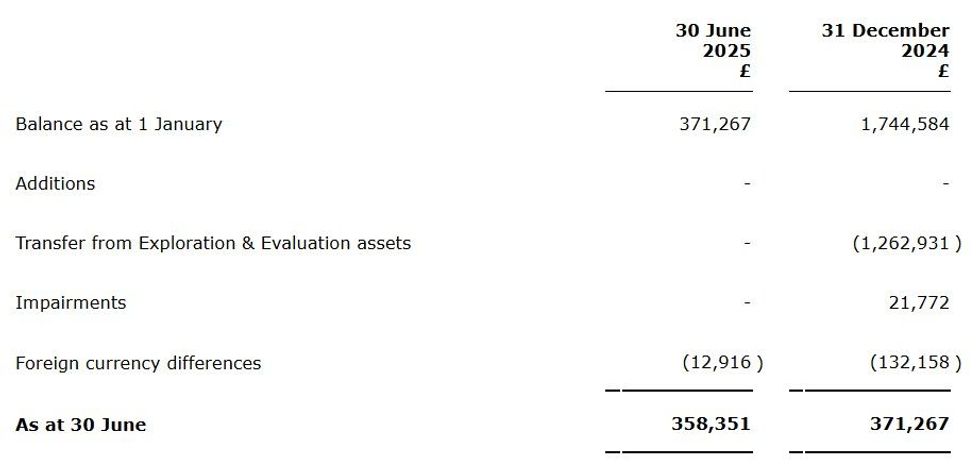

7. Held for Sale Asset

The Company continue to work on a potential divestment of the Eclipse project and are actively engaged with a number of Australian companies operating in the gold mining sector to find a buyer. Management are committed to the sale of the Eclipse licence.

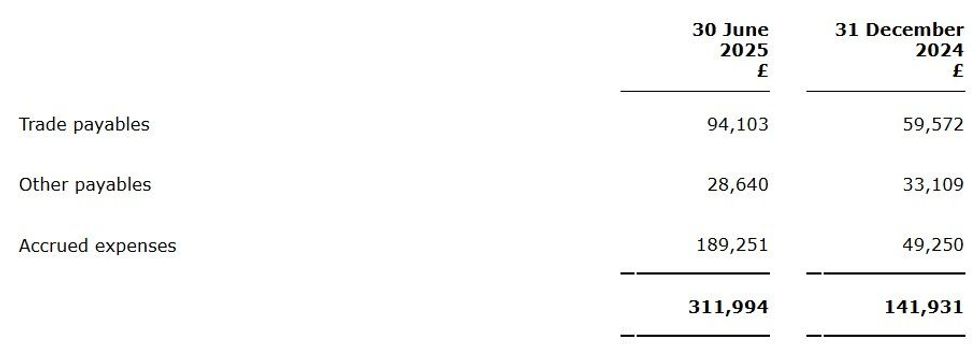

8. Trade and Other Payables

9. Share capital and share premium

10. Earnings per share

The calculation of the total basic loss per share of 0.260 pence (30 June 2024: 0.230 pence) is based on the loss attributable to equity owners of the parent company of £1,704,821 (30 June 2024: £1,389,318 ) and on the weighted average number of ordinary shares of 651,359,884 (30 June 2024: 595,703,671) in issue during the period.

Details of share options that could potentially dilute earnings per share in future periods are disclosed in the notes to the Group's Annual Report and Financial Statements for the year ended 31 December 2024.

2,000,000 options were granted during the period. The total number of options outstanding at 30 June 2025 is 67,200,000.

11. Commitments

Commitments stated in the Group's Annual Financial Statements for the year ended 31 December 2024 remain.

12. Events after the balance sheet date

There have been no events after the reporting date of a material nature.

13. Approval of interim financial statements

The condensed interim financial statements were approved by the Board of Directors on 3 September 2025.

Market Abuse Regulation (MAR) Disclosure

Certain information contained in this announcement would have been deemed inside information for the purposes of Article 7 of Regulation (EU) No 596/2014, as incorporated into UK law by the European Union (Withdrawal) Act 2018, until the release of this announcement.

This information is provided by RNS, the news service of the London Stock Exchange. RNS is approved by the Financial Conduct Authority to act as a Primary Information Provider in the United Kingdom. Terms and conditions relating to the use and distribution of this information may apply. For further information, please contact rns@lseg.com or visit www.rns.com.

EPMLF

Sign up to get your FREE

Empire Metals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

14 October 2025

Empire Metals

Advancing a game-changing, globally significant titanium project in Western Australia.

Advancing a game-changing, globally significant titanium project in Western Australia. Keep Reading...

27 January

Empire Metals Limited Announces Pitfield Project Development Update

LONDON, UNITED KINGDOM / ACCESS Newswire / January 27, 2026 / Empire Metals Limited (AIM:EEE)(OTCQX:EPMLF), the AIM-quoted and OTCQX-traded leading exploration and development company, is pleased to provide an update on the Pitfield titanium Project in Western Australia ('Pitfield' or the... Keep Reading...

30 December 2025

Empire Metals Limited Announces Conditional Sale of 75% of Eclipse Gold Project

LONDON, UNITED KINGDOM / ACCESS Newswire / December 30, 2025 / Empire Metals Limited (AIM:EEE)(OTCQX:EPMLF), the AIM-quoted and OTCQX-traded exploration and development company, is pleased to announce that it has entered into a conditional sale and purchase agreement for its 75% interest in the... Keep Reading...

01 December 2025

Empire to Present at the Precious Metals & Critical Minerals Virtual Investor Conference

Empire Metals Limited (AIM: EEE, OTCQX: EPMLF), announces that Greg Kuenzel (Finance Director) will present live at the Precious Metals & Critical Minerals Virtual Day Conference in partnership with OTC Markets and hosted by VirtualInvestorConferences.com, on December 4 th at 9am ET. The... Keep Reading...

13 November 2025

Empire Metals Limited Announces Appointment of Joint Corporate Broker

Empire Metals Limited, the AIM-quoted and OTCQX-traded exploration and development company, is pleased to announce the appointment of Canaccord Genuity Limited ("Canaccord") as joint corporate broker with immediate effect. Canaccord will work alongside S. P. Angel Corporate Finance LLP and Shard... Keep Reading...

13 November 2025

Empire Metals Limited Announces Appointment of Joint Corporate Broker

LONDON, UK / ACCESS Newswire / November 13, 2025 / Empire Metals Limited, the AIM-quoted and OTCQX-traded exploration and development company, is pleased to announce the appointment of Canaccord Genuity Limited ("Canaccord") as joint corporate broker with immediate effect. Canaccord will work... Keep Reading...

06 February

Top 5 Canadian Mining Stocks This Week: Giant Mining Gains 70 Percent

Welcome to the Investing News Network's weekly look at the best-performing Canadian mining stocks on the TSX, TSXV and CSE, starting with a round-up of Canadian and US news impacting the resource sector.Statistics Canada released January’s jobs report on Friday (February 6). The data shows that... Keep Reading...

05 February

Top Australian Mining Stocks This Week: Solstice Minerals Soars on Strong Copper Drill Results

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.In global news, Australia took part in a ministerial meeting hosted by the US this week. The gathering was aimed at exploring a... Keep Reading...

04 February

Glencore Signs MOU with Orion Consortium on Potential US$9 Billion DRC Asset Deal

Glencore (LSE:GLEN,OTCPL:GLCNF) has entered into preliminary talks with a US-backed investment group over the potential sale of a major stake in two of its flagship copper and cobalt operations in the Democratic Republic of Congo (DRC).In a joint statement, Glencore and the Orion Critical... Keep Reading...

03 February

Drilling Ramping-up Following Oversubscribed Fundraise

Critical Mineral Resources plc (“CMR”, “Company”) is pleased to report that following the recently completed and heavily oversubscribed fundraise, diamond drilling with two rigs is ramping-up over the coming weeks as the weather improves. Drilling during H1 is designed to produce Agadir... Keep Reading...

02 February

Rick Rule: Oil/Gas Move is Inevitable, but Copper is Next Bull Market

Rick Rule, proprietor at Rule Investment Media, is positioning in the oil and gas sector, but thinks a bull market is two or two and a half years away. In his view, copper is likely to be the next commodity to begin a bull run.Click here to register for the Rule Symposium. Don't forget to follow... Keep Reading...

02 February

BHP Expands 2026 Xplor Program with Record 10 Companies

Mining major BHP (ASX:BHP,NYSE:BHP,LSE:BHP) has named the early stage explorers selected for its 2026 Xplor program, expanding the intake to a record 10 companies.According to a Monday (February 2) press release, the latest cohort is the largest since the initiative launched in 2023, surpassing... Keep Reading...

Latest News

Sign up to get your FREE

Empire Metals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Trading Halt

3h

Equity Metals Exhibiting at the 2026 PDAC

06 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00