October 08, 2024

- 4,500m drilling program to test priority targets on prospective greenstone-splay faults along strike from major gold deposits in one of Australia’s most prolific gold provinces

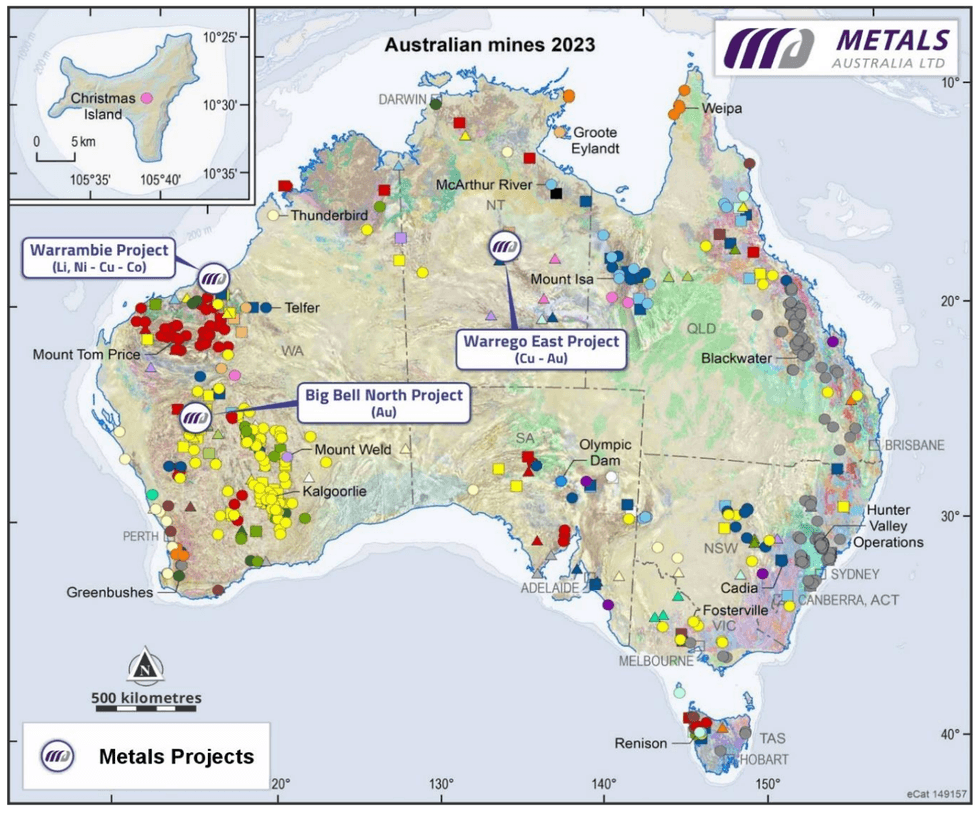

Metals Australia Ltd (ASX: MLS) (“Metals Australia” or “the Company”) is pleased to announce that drilling is set to commence to test priority targets identified at the Company’s Big Bell North tenements (EL51/2058 and EL51/2059) in Western Australia’s world-class Murchison Gold Province. The tenements lie within the regional structural corridor which hosts major gold deposits including the Meekatharra and Mt Magnet gold mining centres (Figure 2).

HIGHLIGHTS

- Up to 4,500m aircore drilling program set to commence testing priority greenstone-splay, fault-hosted gold targets interpreted under cover at Big Bell North, along strike from the 5Moz Big Bell Mine and Garden Gully Projects in Western Australia’s world-class Murchison Gold Province.

- The Big Bell North tenements cover an extensive 337km2 area where little previous exploration has been carried out due to extensive regional soil cover and the historic lack of recognition of greenstone lithologies.

- Interpretation of recently completed aeromagnetic and gravity surveys has defined greenstone-splay fault priority drilling targets on both the eastern and western zones of the Big Bell North tenements.

- Drilling will initially focus on the Eastern Zone over a 9km north-south trend interpreted to be a faulted greenstone corridor (interpreted to be 700-1,400m wide) splaying from the regional scale Chunderloo Shear Zone. This setting is identical to the Garden Gully highgrade gold project, immediately along strike to the northeast, held by Ora Gold Ltd (OAU).

- The Eastern Zone drill targets have been further refined to align magnetic lows from the aeromagnetic survey with strong positive gravity survey responses, indicative of denser greenstones (dominated by prospective mafic rocks) in the interpreted shear zone. Shear zones associated with magnetic lows commonly coincide with quartz veining/alteration2.

- Soil sampling is also underway across the Western Zone target. Subject to results, a drilling program will follow to test bedrock targets for buried gold deposits at the Western Zone, where shallower cover exists.

- Anomalous gold results in the aircore drilling programs will be followed up with deeper RC drilling to test across the gold-anomalous structures.

Metals Australia Ltd CEO Paul Ferguson commented:

“The drilling program we are set to commence at our highly prospective Big Bell North gold project in Western Australia’s prolific Murchison Gold Province is the latest step in the Company’s aggressive push to unlock value from our suite of gold and critical mineral projects, which are all located in wellestablished mining regions in Australia and Canada.”

Our Big Bell North project, where there has been no modern-day exploration, has advanced rapidly during 2024 on the back of a methodical, phased exploration approach from our geological team. This started with an extensive fixed wing aeromagnetic survey covering over 5,200-line km which yielded two interpreted shear zones of significance.

We followed this up with detailed gravity survey work, which revealed the likelihood of greenstones within the shear zones. This is significant because gold mineralisation within the Murchison domain is often concentrated within such greenstone belts and is structurally controlled, thus enhancing the potential of the targets we are now set to drill.

In addition to Big Bell North, we continue to advance plans for an extensive soil survey and follow-on drilling program at the Warrego East copper-gold project in the Northern Territory, which is on track to commence later this year, ahead of the wet season, once permitting and land access arrangements are finalised.

We are also awaiting results and interpretation from two other recently completed exploration programs at Warrambie in the Pilbara, where our aircore drilling program has been completed; and our Corvette River project in Quebec’s James Bay region in Canada, where assay results from the phase one field program are imminent. Exploration at Corvette River is extensively focused on gold, silver, base metals (Cu-Pb-Zn) and lithium.

At our flagship Lac Carheil high-grade flake graphite project in Quebec, positive dialogue continues as we seek to build alignment on the project’s benefits with all stakeholders. Our significant cash reserves leave us well-placed to accelerate our various exploration programs as we continue striving to unlock the true value of our suite of projects in Australia and Canada.”

Click here for the full ASX Release

This article includes content from Metals Australia, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

MLS:AU

Sign up to get your FREE

Metals Australia Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

02 July 2025

Metals Australia

High-quality graphite development project with an accelerated pathway to production, complemented by a diversified portfolio of critical, precious and base metals assets in tier-1 jurisdictions across Canada and Australia.

High-quality graphite development project with an accelerated pathway to production, complemented by a diversified portfolio of critical, precious and base metals assets in tier-1 jurisdictions across Canada and Australia. Keep Reading...

17 February

High Grade Assays Verify the Emerging Manindi VTM Project

Metals Australia (MLS:AU) has announced High Grade Assays Verify the Emerging Manindi VTM ProjectDownload the PDF here. Keep Reading...

29 January

Quarterly Activities/Appendix 5B Cash Flow Report

Metals Australia (MLS:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

27 January

Graphite Project Links to Quebec's Critical Minerals Plan

Metals Australia (MLS:AU) has announced Graphite Project Links to Quebec's Critical Minerals PlanDownload the PDF here. Keep Reading...

18 December 2025

High Copper Anomalies Show Deeper Potential at Warrego East

Metals Australia (MLS:AU) has announced High Copper Anomalies Show Deeper Potential at Warrego EastDownload the PDF here. Keep Reading...

16 December 2025

Titanium-Vanadium-Magnetite Discovery Extended over 1km

Metals Australia (MLS:AU) has announced Titanium-Vanadium-Magnetite Discovery Extended over 1kmDownload the PDF here. Keep Reading...

27 February

UK Enters Commercial Lithium Production with Geothermal Plant Launch

The UK has entered commercial lithium production for the first time as Geothermal Engineering Ltd (GEL) began operations in its plant at Cornwall, anchoring the government's hopes of a domestic battery metals supply chain.The Redruth-based facility marks the country’s first commercial-scale... Keep Reading...

26 February

Zimbabwe Imposes Immediate Ban on Raw Mineral and Lithium Exports

Zimbabwe has imposed an immediate ban on exports of all raw minerals and lithium concentrates, halting shipments already in transit as the government tightens control over the country’s mining sector.Mines and Mining Development Minister Polite Kambamura announced Wednesday that the suspension... Keep Reading...

19 February

Top Australian Mining Stocks This Week: Lithium Valley Results Boost Gold Mountain

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.Mining giant BHP (ASX:BHP,NYSE:BHP,LSE:BHP) reported strong half-year copper results, saying that its copper operations accounted for... Keep Reading...

17 February

Howard Klein Doubles Down on Strategic Lithium Reserve as Project Vault Takes Shape

Before the Trump administration revealed plans for Project Vault, Howard Klein, co-founder and partner at RK Equity, proposed the idea of a strategic lithium reserve. “The goal of a strategic lithium reserve is to stabilize prices and allow the industry to develop,” he told the Investing News... Keep Reading...

17 February

Sigma Lithium Makes New Lithium Fines Sale, Unlocks US$96 Million Credit Facility

Sigma Lithium (TSXV:SGML,NASDAQ:SGML) has secured another large-scale sale of high-purity lithium fines and activated a production-backed revolving credit facility as it ramps up operations in Brazil.The lithium producer announced it has agreed to sell 150,000 metric tons (MT) of high-purity... Keep Reading...

12 February

Albemarle Lifts Lithium Demand Forecast as Energy Storage Surges

Albemarle (NYSE:ALB) is raising its long-term lithium demand outlook after a breakout year for stationary energy storage, underscoring a shift in the battery materials market that is no longer driven solely by electric vehicles.The US-based lithium major reported fourth quarter 2025 net sales of... Keep Reading...

Latest News

Sign up to get your FREE

Metals Australia Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00