September 04, 2023

Blackstone Minerals Limited (“Blackstone” or the “Company”) is pleased to provide an update on the development of a Rare Earth project in the north of Vietnam.

Further to the signing of the Memorandum of Understanding (“MOU”) with Vietnam Rare Earths Joint Stock Company (“VTRE”), the Company is pleased to advise that the Parties have now entered into a 12 month Binding Exclusivity Agreement in which the Parties agree to work exclusively on advancing the initiatives as outlined in the MOU.

Immediate Focus

The following items will be the immediate focus for the partnership;

- Negotiate and finalise binding termsheets on the commercial model and structuring for the business in Vietnam;

- Secure mining concession(s) that are available in the Dong Pao region. The concession(s) will be made available through a process conducted by the Ministry of Natural Resources and Energy (“MONRE”). To be invited into the process, companies will need to demonstrate capability and experience across the full value chain from geology through to refining. The Parties are well positioned to demonstrate this in-country capability and expertise;

- Blackstone will make the Company’s concentrator and testing facilities available to undertake flotation testwork on the Dong Pao ores. Laboratory scale testwork undertaken by VTRE has indicated that the Ban Phuc Nickel Mine (“BPNM”) concentrator could be suitable for concentrating the Dong Pao rare earths;

- In addition to focusing on Dong Pao, the Parties will also investigate the option to secure ionic clay deposits in Yen Bai Province, with an immediate focus on Van Yen. The Parties are committed to investigating current-sustainable leaching technology that adheres to the Parties’ high ESG standards. It is our collective vision to demonstrate to Vietnam, and the larger region, a more sustainable approach to extracting rare earth elements (“REE”) from ionic clay deposits. VTRE has confirmed that precipitates from the leaching process can be refined through the VTRE Refinery located outside of Hanoi.

Well positioned to develop a world class Rare Earth Supply Chain

Confirmed by recent reports1 “Vietnam aims to raise raw rare earths output to 2 million tonnes a year by 2023” and Reuters article dated 22 August 2023: “Rare earths magnet firms turn to Vietnam in China hedge”, Vietnam is firming as a creditable, meaningful and alternative supplier of rare earths into the International Market.

Footnote 1: Reuters article dated 25 July 2023 and 22 August 2023, accessed 4 September 2023 from https://www.reuters.com/markets/commodities/vietnam-aims-raise-annual-raw-rare-earths-output-2-mln-tyr-by-2030-2023-07-25/ and https://www.reuters.com/markets/commodities/rare-earths-magnet-firms-turn-vietnam-china-hedge-2023-08- 22/

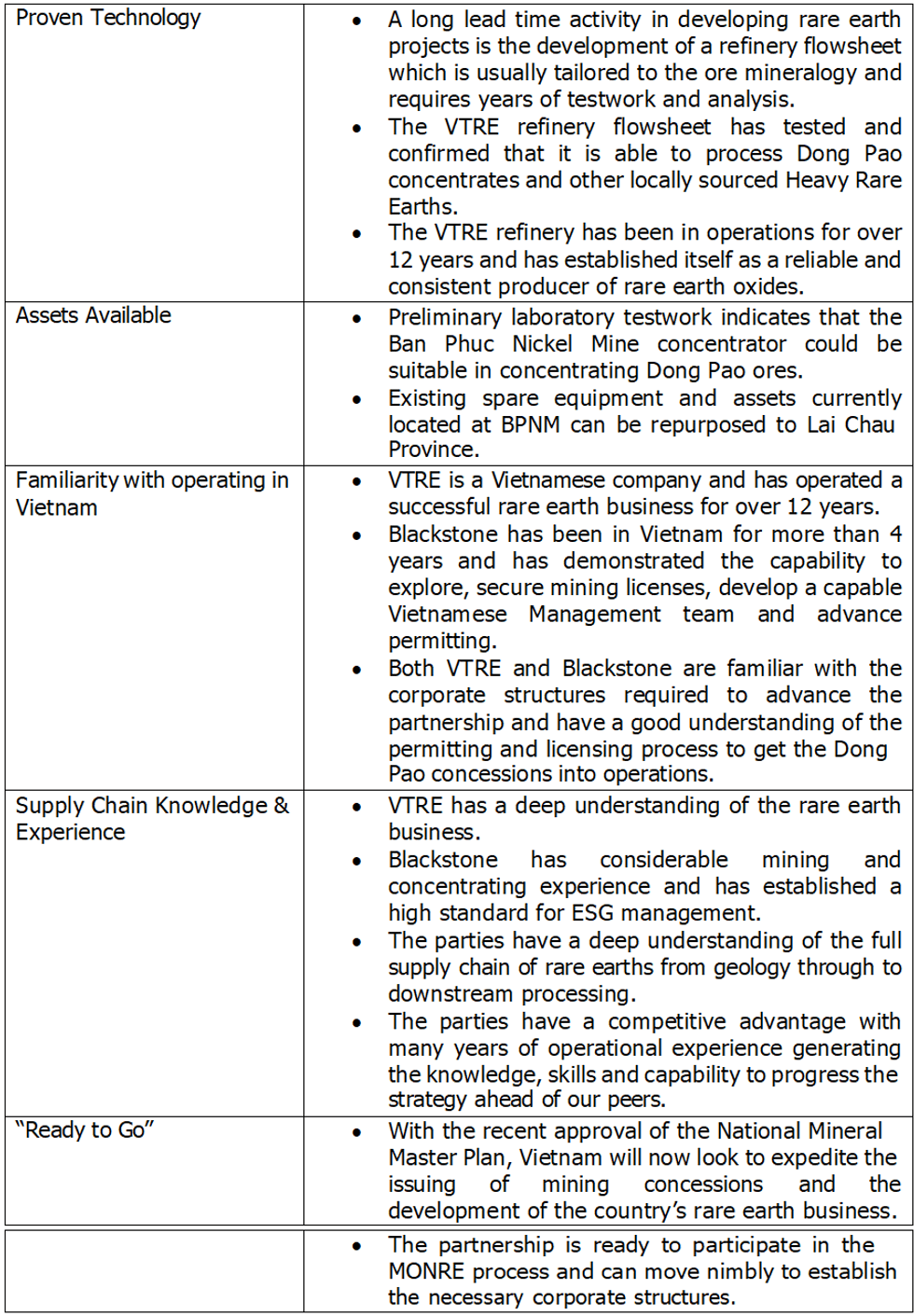

Blackstone believes that the partnership has strategic advantages that can help expedite the development of the REE supply chain in Vietnam which would otherwise take many years to develop, these strategic advantages include;

Additional Details on the Dong Pao Rare Earths Region

The Dong Pao REE deposits were initially discovered in 1959 and exploratory activities between 1965 and 1969 resulted in the identification of 60 individual high grade REE mineralised bodies up to 1 km long and 500 m wide within a 15 km2 syenite (alkali) intrusion. The main REE minerals at Dong Pao are bastnaesite and parisite, additionally significant amounts of fluorite and barite. Despite significant historic geological and resource definition work, as well as the confirmation that the REE mineralogy (bastnaesite and parisite) is suitable for conventional processing methods, the Dong Pao deposits remain unexploited. In 1990 the United Nations issued a publication reporting up to ~7 million tonnes of total rare earth oxide (TREO) for the Dong Pao region with reported grades of up to 30% TREO^. There has been a considerable amount of additional exploration since the United Nations publication and the potential of Dong Pao may be significantly higher than reported in 1990.

Click here for the full ASX Release

This article includes content from Blackstone Minerals Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

BSX:AU

Sign up to get your FREE

Blackstone Minerals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

25 July 2025

Blackstone Minerals

A diversified developer of battery-grade nickel and copper-gold assets in Southeast Asia

A diversified developer of battery-grade nickel and copper-gold assets in Southeast Asia Keep Reading...

27 January

Quarterly Activities/Appendix 5B Cash Flow Report

Blackstone Minerals (BSX:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

28 December 2025

Managing Director Resignation and Board Changes

Blackstone Minerals (BSX:AU) has announced Managing Director Resignation and Board ChangesDownload the PDF here. Keep Reading...

24 October 2025

Quarterly Activities/Appendix 5B Cash Flow Report

Blackstone Minerals (BSX:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

27 August 2025

BSX Secures JV Partner & Funding for Ta Khoa Nickel Project

Blackstone Minerals (BSX:AU) has announced BSX Secures JV Partner & Funding for Ta Khoa Nickel ProjectDownload the PDF here. Keep Reading...

25 August 2025

Trading Halt

Blackstone Minerals (BSX:AU) has announced Trading HaltDownload the PDF here. Keep Reading...

12h

FPX Nickel Reports Confirmatory Results from Geotechnical Drilling at the Baptiste Nickel Project

FPX Nickel Corp. (TSX-V: FPX, OTCQX: FPOCF) ("FPX" or the "Company") is pleased to report assay results from select drill holes completed during its 2025 engineering field investigation program at the Baptiste Nickel Project ("Baptiste" or the "Project") in central British Columbia.As previously... Keep Reading...

08 January

Nickel Market Recalibrates After Explosive Trading Week

Nickel prices stabilized on Thursday (January 8) after a turbulent week that saw the market swing sharply higher before retreating as traders reassessed the balance between existing supply risks and a growing overhang of inventory.Three-month nickel on the London Metal Exchange (LME) hovered... Keep Reading...

05 January

Nusa Nickel Corp. Provides 2025 Year-End Corporate Update and 2026 Outlook

Nusa Nickel Corp. is pleased to provide a year-end update highlighting key achievements in 2025 and outlining strategic priorities for 2026 as the Company continues to build a vertically integrated nickel business in Indonesia.2025 Year-End Highlights-Successfully advanced into production during... Keep Reading...

22 December 2025

Nickel Price Forecast: Top Trends for Nickel in 2026

Nickel prices were stagnant in 2025, trading around US$15,000 per metric ton (MT) for much of the year.Weighing heavily on the metal was persistent oversupply from Indonesian operations. Meanwhile, sentiment remained weak amid soft demand growth from the construction and manufacturing sectors,... Keep Reading...

Latest News

Sign up to get your FREE

Blackstone Minerals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00