North America Moves to Gain Ground in Electric Vehicle Race

Learn about the current state of the electric vehicle industry in the US, plus carmakers’ plans and the outlook for the region.

North America’s leadership in the automotive industry is entering a new chapter as the move from internal combustion engines (ICEs) to electric vehicles (EVs) continues to accelerate.

The new US administration has made clear that it doesn’t want to fall behind in the EV race, with President Joe Biden making a flurry of announcements to push the industry forward since taking office — including a potential partnership with Canada for essential raw materials.

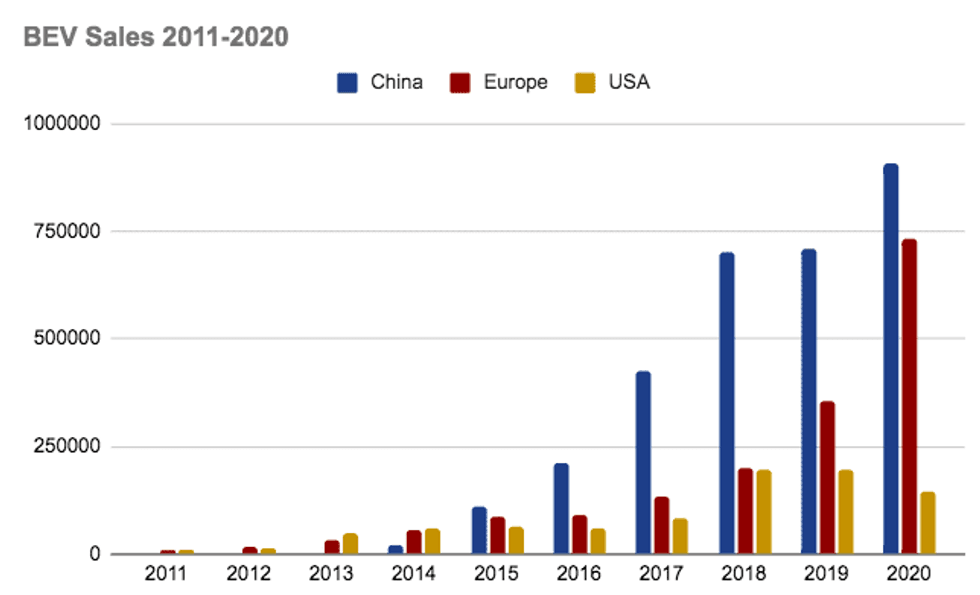

China has been at the forefront of the EV revolution, taking control over key aspects of its supply chain, and Europe is moving ahead as well, with the continent passing the Asian country as the fastest-growing region for EV sales in 2020.

But what’s next for the EV space in North America? Read on to learn more about what’s been happening in the area, including automakers’ plans and the government’s green agenda push.

Shifting from ICE vehicles to EVs

In the past year, EV sales and global government efforts to electrify transportation have taken over news headlines. Potential demand has become a reality for places outside of China, such as Europe.

But North America is a very different market than the rest of the world. US and Canadian consumers are more addicted to petrol than any others, Felipe Munoz of JATO told the Investing News Network (INN).

“Changing this mentality is more difficult, more challenging than in Europe or China,” he said. “There is certainly a big gap between North America and Europe because of this, and also because most of the growth we see in China and Europe has been boosted by the government, which is not really the case in the US, where the previous administration’s focus was not on green cars.”

Srinath Rengarajan, global head of automotive research at Oliver Wyman, agreed, saying that the biggest driver of electrification so far has been regulation.

“Wherever there have been strict regulations, there has been a lot more impulse and impetus for companies to push how much they are electrifying their fleets,” he said. “Related to these regulations there are also the incentives, which play a role in making sure that customers are willing to buy and spend money on EVs.”

The urgency to push EVs has been missing in the US in the last few years, Rengarajan added.

“But when we look at the new administration and how much impetus they’re putting on the topic of electrification of vehicles, there’s definitely going to be some acceleration which results from this.”

In the first four months of 2021, passenger and light-duty EV sales totaled 180,000 in the US and Canada — 166,000 in the US and 14,000 in Canada — compared with 677,000 in China, as per Rho Motion.

“In the US and Canada, this is roughly a 3.1 percent penetration rate of EVs in the total sales mix. Meanwhile, China had a penetration rate of 8.6 percent in the opening four months,” Charles Lester of Rho Motion told INN.

An interesting dynamic in North America compared to other regions is the split between battery electric vehicles (BEVs) and plug-in hybrid EV sales, Lester pointed out.

“In the US, the majority of EV sales are BEVs — roughly 80 percent — whereas in Europe the split is currently closer to 50/50,” he said.

Rho Motion expects EV demand for the US and Canada to remain within similar levels for the coming months, at between 40,000 to 60,000 per month, until the US government starts its EV stimulus package.

Carmakers’ moves in North America

The latest forecasts suggest that the EV market could quadruple from 2020 to 2025, and again double from 2025 to 2030 in terms of the number of EVs sold, Rengarajan pointed out.

“But this really depends on all regulations and incentives catching up,” he said. “Also acceleration from the original equipment manufacturers (OEMs), as well in terms of offering more models, ecosystems for charging infrastructure being developed, etc.”

Chart via JATO.

The US is the birthplace of California-based Tesla (NASDAQ:TSLA), which is the biggest EV maker with the best technology so far for EVs.

“The country has a good base, the problem is that the demand is not yet responding as fast as in the rest of the world,” Munoz said, adding that he expects this trend to continue in 2021. “Of course, this gap will reduce because Tesla has a bigger offer, there are more models and in general other carmakers, such as Ford (NYSE:F) and General Motors (NYSE:GM), are also investing and launching EVs.”

By 2035, General Motors is aiming to produce only EVs, with 30 new plug-in models arriving by 2025, while Ford has announced that 40 percent of its vehicles will be electrified by 2030.

European carmakers have also pledged to electrify their fleets and expand their EV offerings, from Volkswagen (OTC Pink:VLKAF,ETR:VOW3) to BMW (OTC Pink:BAMXF,ETR:BMW).

American government pushes for EVs

On March 31, details were released for the American Jobs Plan, also recognized as the Biden administration’s infrastructure plan; it outlines U$2 trillion in spending.

“The plan stated it would invest US$174 billion to ‘win the EV market,’ although full details on how and where this investment will be targeted are still coming through,” Lester said.

He added that the administration was quick to look into these issues, but the timing of when any changes are implemented is key to watch out for.

“There has also been an increase in US states announcing targets. California had already committed to all passenger cars to be zero emission by 2035, but in April 2021 New York also committed to 2035, plus Washington State committed to 2030,” he added.

For Rengarajan, ideas similar to those being implemented by the Biden administration have been tried and tested in the last five to 10 years in countries like China. “It’s similar to the levies that the European Union adapted for its local context in the last few years,” he said.

When asked about whether North America could catch up with other regions, Munoz said this could happen if governments can keep a steady hand and not flip flop from one political term to the next.

“We need a long-term perspective,” he said. “The American industry and its stakeholders, investors and consumers … will do the rest to close the gap, but first we need some clear rules of where to go.”

For Munoz, the current US administration is moving in the right direction, as EVs are not a taboo topic anymore. “But we cannot treat the North American car market in the same way as in Europe or China. It’s a different thing,” he said. “It has proved to take longer for adoption, because this is not only a matter of this administration, it’s a matter of cultural issues.”

Munoz added that the Biden administration can do many things, including increasing incentives and penalizing gasoline cars.

“However if consumers are still afraid of this technology, if consumers are still in love with these big trucks, it is difficult to change it,” he said. “To change, it takes time, it takes resources and it takes people to understand the benefits of this, but so far the current administration is going in the right direction.”

Challenges for consumer adoption

Commenting on the current barriers for EV adoption in the region, Lester said one aspect is incentives.

“In China, and most major European markets, there are generous subsidies and incentives,” he said. “In the US, the current tax credits are phased out after an automaker sells 200,000 EVs, which both Tesla and GM have reached.”

Another aspect highlighted by Lester were emission standards. Corporate Average Fuel Economy standards are a federal rule to increase the efficiency of vehicles.

“OEMs were initially expected to increase the fuel efficiency of their fleets by 5 percent per year between 2021 to 2026, but this was reduced by 1.5 percent under the Trump administration,” he said. “This may change under the Biden administration as there is a review underway.”

Lester also pointed to the lack of choice for consumers in the US, where preference for cars tilts towards larger vehicles.

“There is currently a lack of electric pickup trucks or SUVs in the US,” he said. “In terms of upcoming model releases, there is the Rivian pickup, expected to be released in a couple of months, as well as the Ford F-150, expected to be sold in Q1 2022.”

Ford sells roughly 900,000 thousand F-series ICE pickup trucks per year in the US.

Munoz agreed, saying one of the main barriers to adoption is the cultural aspect, as in the US consumers are used to big cars, which is related to education.

“I think (governments, manufacturers) can do more to educate people on range anxiety, for example. EV reliability, how to apply for EV incentives and transportation effects on climate change,” he said.

Another aspect to consider is a barrier that is also a problem in the rest of the world: EV affordability.

“We still don’t see these competitive affordable EVs, especially in the US, where Tesla has a dominant position but is perceived as a luxury brand,” Munoz said.

North America’s EV supply chain

Looking at current proposals from the Biden administration, it is clear the US aims to bring as much of the EV manufacturing and supply chain to the country as possible.

“The infrastructure plan specified some specific goals: Targeted grants to retool factories and support American workers, US$50 billion for research and manufacturing of semiconductors, spur domestic supply chains from raw materials to parts — an executive order has launched a 100 day review into the battery supply chain to ‘address vulnerabilities,'” Lester commented.

For Munoz, a clear risk in the American EV supply chain is supply of critical minerals.

“It appears that raw materials may be a risk, as China has a stronghold on many of the world’s mines,” he said, adding that tensions between the US and China could also become a challenge for the supply chain.

“We are already seeing the risk in the supply chain with this chip problem around the world, with carmakers having production issues because of the lack of these,” he said. “This could also be the case for EVs in the future.”

In terms of raw materials, the question is not only about availability in the US — “it’s also a question of whether it’s commercially viable to scale up a mine and produce at a scale which can cater to the industry for X particular materials,” Rengarajan said.

Another area where the supply chain in the US should be looking to catch up is the midstream sector.

“What we see in the US quite often is that there are a lot of really good startups with very good ideas and very innovative ideas, but it’s not really at an industrial scale yet,” he said. “There are very few companies which are already today in a stage where they’re able to industrialize their technology at a massive scale, which is necessary for battery production and for the automotive industry.”

For the expert, generally there is a lot more movement and dynamics in terms of local players getting into battery manufacturing ecosystems and supply chains in Europe than what is seen in the US.

EV outlook in North America

The EV market in the US is expected to reach 6.9 million unit sales by 2025, up from 1.4 million unit sales forecast for 2020, due to government incentives that are driving EV ownership, Frost & Sullivan said at the end of last year.

When asked about what North America can learn from China’s approach, Lester pointed to EV subsidies. In China, the EV subsidy is currently being phased out. It was reduced by 20 percent in 2021, and it will be reduced by a further 30 percent in 2022.

“China initially planned to eliminate all subsidies by 2020, however, this reduced EV sales significantly. Therefore, China extended the subsidy scheme for two years,” he said. “Even though there has been a reduction in the EV subsidy, EV sales have still been strong in China.”

Another point to take into account is that there is a lot more choice in China — over 200 different models sold in 2021 alone, as well as many different price points for consumers.

“Also, the Chinese battery supply chain is much more comprehensive and robust than anywhere else in the world,” he added.

For Munoz, some recipes from China could be applied to North America, but in a different way.

“I think they will rely mostly on their industrial competitive (advantage) to support the EV space. In the US, the role of the government is not as important as in Europe or China,” he said. “That’s why I think also the role of the carmakers and suppliers will be a key element here in this story too.”

For Rengarajan, the number of new models or the number of new EVs being sold is probably not the most interesting thing about this space in 2021, but rather the strategic moves that the companies in the space are making today with an eye on 2025 or 2030.

“One big shift that we have seen this year is that unlike last year, when there was a reluctance to invest in dedicated platforms for EVs, this year we’re seeing the OEMs coming out and saying, ‘Yes, we see that there is enough volume in the future and we see enough customers are going to be interested in it,’ and that justifies the decision to put X billion dollars into developing a new platform dedicated for EVs from a technology point of view.”

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Priscila Barrera, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.