Drill Tracker Weekly: Peel Adds High-grade to Previously ‘Blind’ Zinc Stockwork Zone at Mallee Bull

Peel Mining announced follow-up drilling at its recent discovery of near-surface zinc stockwork mineralization on its 50-percen- owned Mallee Bull copper project in New South Wales. JOGMEC may earn up to 40 percent in any project in the Cobar Superbasin project by spending an initial AU$4 million and an additional 10 percent by spending a further $3 million.

Drill Tracker Weekly is not exclusive to Resource Investing News and is published with permission from Mackie Research Capital Corporation. It highlights drilling results in context with our database of over 10,000 drilling and trenching results. The purpose of this report is to highlight drilling and trenching results that stand out from the pack and compare them to their peer group. This report does not constitute initiation of coverage or a recommendation.

Peel Mining (ASX:PEX)

Price: $0.30

Market cap: $40 million

Cash estimate: $2 million (Dec)

Project: Mallee Bull

Country: Australia

Ownership: 100 percent

Resources: 3.9 million tonnes at 2.3 percent copper, 32 g/t silver, 0.3 g/t gold

Project status: Exploration (up dip of Cu resource)

- Peel Mining announced follow-up drilling to its recent (May 25, 2015) discovery of near surface zinc stockwork mineralization on its 50% owned Mallee Bull copper project in New South Wales Australia. Japanese government backed JOGMEC may earn up to 40% in any project in the Cobar Superbasin Project by spending an initial AUS$ 4 million and an additional 10% by spending a further $3 million.

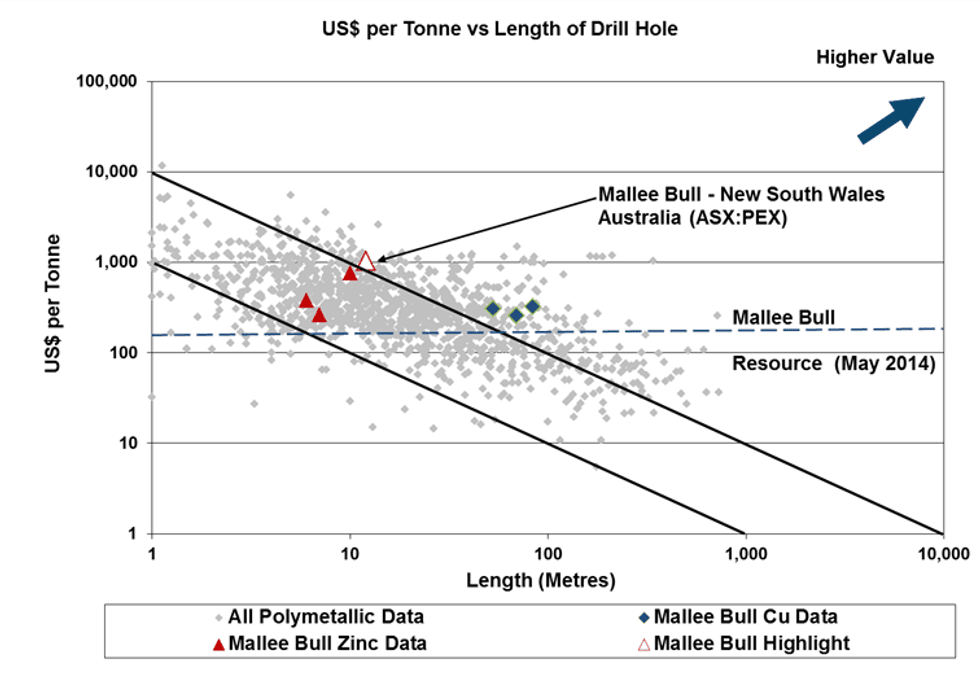

- The new discovery was originally “blind” to the EM survey as the dominant sphalerite and galena mineralization are generally poor conductors and would have been overshadowed by the deeper copper mineralization. The T1 target was identified in a Orion 3D DCIP survey chargeability high and resistivity low. The May 25, 2015 discovery hole returned 10 metres grading 15.8% Zn, 7.6% Pb, 322 g/t Ag, 1.28 g/t Au starting at a depth of 106 metres. The Company has identified additional high-priority Orion targets on the property.

- Highlights from the current drilling include 12 metres grading 20.30% Zn, 14.81% Pb, 0.54% Cu, 308 g/t Ag and 1.59 g/t Au starting at 83 metres and 6 metres of 10.57% Zn, 4.81% Pb, 53 g/t Ag and 0.39 g/t Au from 121 metres. The mineralization is expected to be dipping at approximately 45 degrees within an anticlinal fold and thus the Company believes the intervals are close to true width.

- The Mallee Bull deposit hosts a total JORC inferred and inferred resource estimate of 3.9 million tonnes grading 2.32% Cu, 32 g/t Ag and 0.3 g/t Au. The indicated portion of the steeply dipping shear hosted mineralization has been outlined with 20 by 20 metres spacing while the larger inferred resource is drilled at greater than 80 by 80 metre centres.

- The mineralization is categorized as “Cobar-style” polymetallic shear hosted. The most significant deposit is the Cobar basin is the Endeavour Mine which hosted a pre-mining resource of 45 million tonnes grading 8.5% Zn, 5.3% Zn and 9 g/t Ag.’

Discovery Shear Hosted Mineralization (Aug 2011): 48 metres @ 0.74% Cu, 24 g/t Ag, 0.21 g/t Au, 0.48% Zn, 0.49% Pb

Discovery – Zinc Stockwork (May 25, 2015): 10 metres @ 15.8% Zn, 7.6% Pb, 322 g/t Ag, 1.2 g/t Au

Current holes: 12 metres @ 20.30% Zn, 14.81% Pb, 0.54% Cu, 308 g/t Ag, 1.59 g/t Au

Risk Analysis

Data contained in DRILL TRACKER WEEKLY is based on early stage exploration activity. The results are obtained at the very early stages of exploration and therefore, individual results may not be reproducible with additional trenching or drilling, nor may the results ultimately lead to the discovery of an economic deposit. Delineation of a resource body requires an extensive data gathering exercise according to guidelines set out in National Instrument 43-101 before investors can be reliably assured of a competent body of mineralization that may be of economic interest. DRILL TRACKER WEEKLY is designed to highlight individual trench or drill results, which stand out as being materially anomalous and are particularly worth of note – a type of early warning flag for a particular property that warrants further attention. Hence, DRILL TRACKER WEEKLY does not provide a recommendation to buy, sell or hold a specific equity – it is an information reference source to help quantify the meaning and relevance of early stage exploration results.

Relevant Disclosures Applicable to: Drill Tracker Weekly

- The research analyst or a member of the research analyst’s household owns and/or has options to acquire shares of the subject issuer. At the date of this release the author, Wayne Hewgill, owns shares in the following company: Balmoral Resources Ltd. (TSX.BAR).

- Balmoral Resources (TSX.BAR) is currently covered at Mackie Research Capital Corp. by analyst Peter Campbell

Analyst Certification

I, Wayne Hewgill certify that the information in this report is sourced through public documents that are believed to be reliable but accuracy and completeness as represented in this report cannot be guaranteed. The author has not received payment from any of the companies covered in this report. This report makes no recommendations to buy, sell or hold. Each analyst of Mackie Research Capital Corporation whose name appears in this report hereby certifies that (i) the recommendations and opinions expressed in this research report accurately reflect the analyst’s personal views and (ii) no part of the research analyst’s compensation was or will be directly or indirectly related to the specific conclusions or recommendations expressed in this research report.