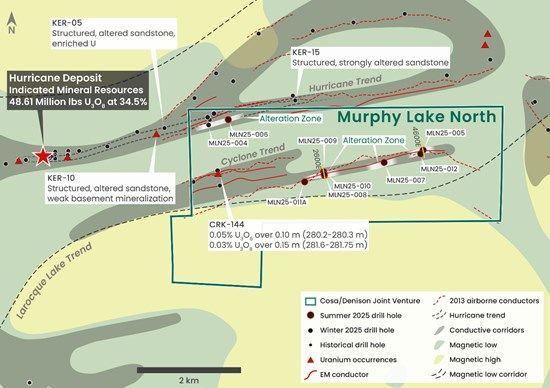

Cosa Resources Corp. (TSXV: COSA) (OTCQB: COSAF) (FSE: SSKU) ("Cosa" or the "Company") is pleased to report summer drilling has successfully identified two kilometres of highly prospective strike length characterized by strong sandstone alteration and graphitic faulting at the Cyclone Trend on the Murphy Lake North Project ("MLN" or the "Project"). MLN is a joint venture (the "Joint Venture") between Cosa and Denison Mines Corp. (TSX: DML) (NYSE American: DNN) ("Denison") and is located in the eastern Athabasca Basin, Saskatchewan. Cosa is the project operator and holds a 70% interest with Denison holding a 30% interest.

Highlights

Two kilometres of strong sandstone structure and alteration identified at the Cyclone trend underlain by large scale graphitic faulting

Up to 30 metres of unconformity relief identified at Cyclone

Alteration and structure at Cyclone remain open in both directions and follow up drill targets exist along multiple trends

Cosa has met its sole-fund obligation and now owns an irrevocable 70% interest in Murphy Lake North

Keith Bodnarchuk, President and CEO of Cosa, commented: "The results of the Murphy Lake North summer drill program, specifically those at the Cyclone trend, are the most significant to date for Cosa, and further support our thesis that ample search space remains for the next uranium discovery in the infrastructure rich eastern Athabasca Basin. I want to thank Andy Carmichael and our field team for executing a successful program in a safe and timely manner. We would also like to thank our largest shareholder and Joint Venture partner, Denison Mines, for their continued support and enthusiasm for exploration at Murphy Lake North."

Andy Carmichael, VP Exploration of Cosa, commented: "Summer drilling at Cyclone identified over two kilometres of highly prospective strike length and potentially identified an additional unexplored parallel trend to the south. The intensity and continuity of sandstone alteration and structure, both vertically and along strike, is an encouraging indicator of the trend's prospectivity. Basement structures intersected two kilometres apart are textbook examples of major graphitic faults critical to the formation of eastern Athabasca uranium deposits. With an average depth to the unconformity of roughly 250 metres, the Cyclone trend is incredibly well situated for the discovery of relatively shallow mineralization. Cosa and Denison have again elected to leave much of the drill equipment on site to minimize the time and cost to resume work in 2026."

Chad Sorba, VP Technical Services & Project Evaluation of Denison and Technical Advisor to Cosa, commented: "We congratulate Cosa for completing a safe and successful drill program on behalf of the Murphy Lake North Joint Venture. The structure and alteration observed at the Cyclone trend are encouraging and could represent early indicators of an eastern Athabasca uranium bearing trend. These initial results illustrate the potential benefits of Denison's strategy to advance a portion of our large exploration project portfolio through joint ventures with capable and motivated partners. We are excited to continue working with Cosa to plan and execute a follow up drill program at Murphy Lake North in early 2026."

Drilling Program

Summer drilling at Murphy Lake North totaled 3,323 metres in eight holes completed as initial reconnaissance of the Cyclone trend and to follow up winter 2025 drilling results on the Hurricane trend (Figure 2). Positive results and greater exploration space led to a focus on Cyclone during the program.

Cyclone Trend Summary

Cyclone was drilled on four sections over 2.4 kilometres of strike length. Six of seven drill holes intersected positive results; the seventh is interpreted as an overshot of the optimal target. Drilling identified geology considered highly prospective for an eastern Athabasca style uranium deposit including significant unconformity relief associated with major structures hosted within graphitic basement rocks. Faulting controls broad zones of alteration in the sandstone and basement which are comparable to those associated with the region's uranium deposits. Weakly elevated radioactivity was intersected at the unconformity and in the basement and is typically associated with hematite and/or clay alteration.

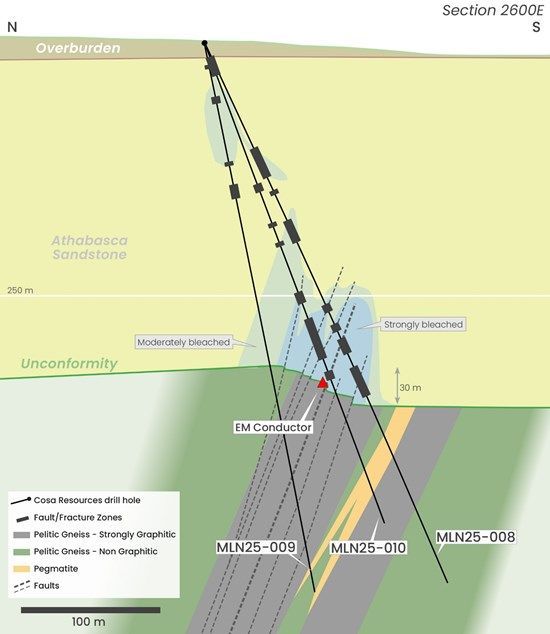

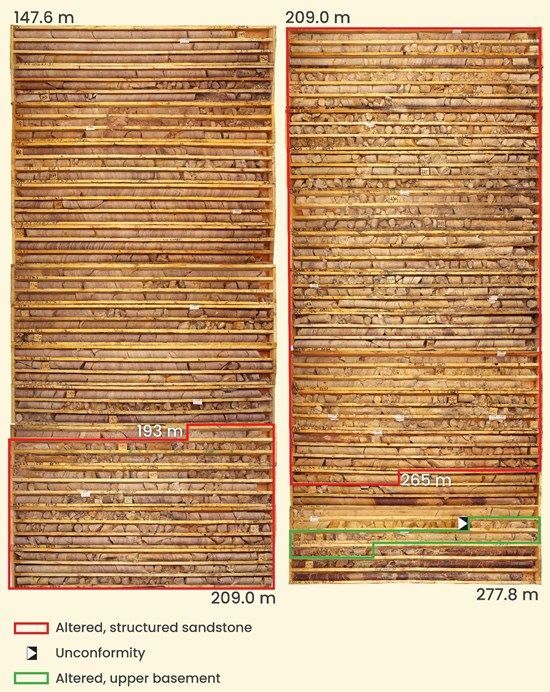

Results at Cyclone are exemplified by Section 2600E where the broadest and strongest alteration and structure were intersected (Figure 3). Three drill holes on 2600E define a significant graphitic basement fault zone within a broader package of graphitic rocks associated with 30 metres of unconformity relief (Figures 3 and 4). Basement-rooted faulting is interpreted to extend through the entire 220 metre thickness of the sandstone as faulting is evident beginning at the top of bedrock. These vertically extensive structures control broad zones of hydrothermal alteration. In MLN25-010, nearly half of the sandstone is structured including a 70-metre interval with strong fracturing, faulting, fault gouges, increased clay content and sections of near-massive clay, rotated sandstone bedding, strong bleaching, desilicification, and decimeter-scale zones of increased radioactivity (Figures 3 and 5).

The continuity and intensity of alteration and structure are considered highly encouraging. The Cyclone alteration zone remains open in multiple directions and includes untested sections of up to 1.2 kilometres strike length (Figure 2). With continued support from its Joint Venture partner and largest shareholder Denison Mines, Cosa will use pending geochemical results to guide follow up drilling in early 2026.

Hurricane Trend Summary

MLN25-006 was completed as a 400 metre step out from winter drill hole MLN25-004 (Figure 2). MLN25-004 intersected a broad zone of alteration and structure in the lower sandstone (see Cosa's News Release dated 20 March 2025). In MLN25-006, the lower 93 metres of sandstone displays strong bleaching, local clay alteration, and structure underlain by fault-controlled clay and chlorite alteration in the upper basement. MLN25-006 intersected improved alteration compared to MLN25-004 and additional follow-up to the east may be warranted pending geochemical results.

Figure 1 - Cosa's Eastern Athabasca Uranium Projects with Joint Venture Projects

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/9865/263721_77962ff864de0958_003full.jpg

Figure 2 - Murphy Lake North Drilling Results

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/9865/263721_77962ff864de0958_004full.jpg

Figure 3 - Cyclone Section 2600E

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/9865/263721_77962ff864de0958_005full.jpg

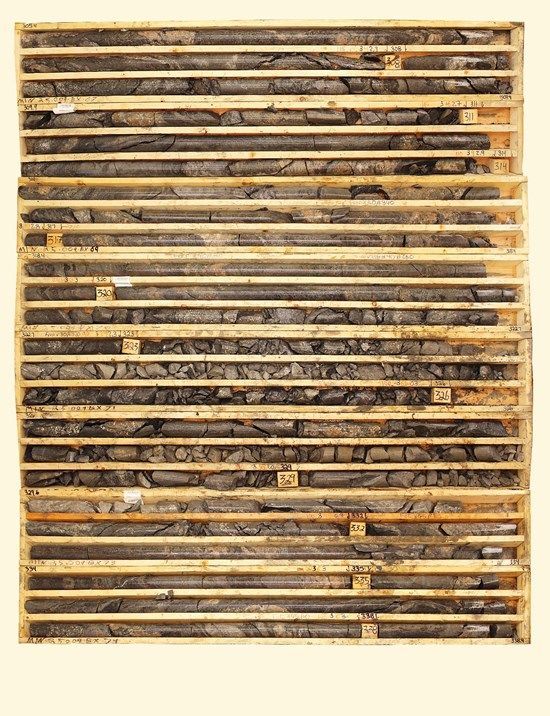

Figure 4 - MLN25-009 Altered Graphitic Basement Fault Zone

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/9865/263721_77962ff864de0958_006full.jpg

Figure 5 - MLN25-010 Sandstone Alteration and Structure

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/9865/263721_77962ff864de0958_007full.jpg

About Murphy Lake North

Murphy Lake North covers a portion of the Larocque Lake trend and is located 2.7 kilometres east of the Hurricane deposit (Figures 1 & 2). Hurricane is the world's highest-grade Indicated Uranium Resource and was discovered and delineated for IsoEnergy Ltd. by current members of Cosa's management, board of directors, and advisors from 2018 through 2022. The Larocque Lake trend also hosts the high-grade Larocque Lake Zone, Yelka Prospect, and Alligator Lake Zone.

Per the completed Acquisition Agreement between Cosa and Denison (see Cosa's news release dated January 14, 2025), Cosa has met its obligation to sole-fund C$1.5 million of exploration expenditures at the Project during the summer drill program and now owns an irrevocable 70% interest in Murphy Lake North.

About Cosa Resources Corp.

Cosa Resources is a Canadian uranium exploration company operating in northern Saskatchewan. The portfolio comprises roughly 237,000 ha across multiple underexplored 100% owned and Cosa-operated Joint Venture projects in the Athabasca Basin region, the majority of which reside within or adjacent to established uranium corridors.

In January of 2025, the Company entered a transformative strategic collaboration with Denison that has secured Cosa access into several additional highly prospective eastern Athabasca uranium exploration projects. As Cosa's largest shareholder, Denison gains exposure to Cosa's potential for exploration success and its pipeline of uranium projects.

Cosa's award-winning management team has a long track record of success in Saskatchewan. In 2022, members of the Cosa team were awarded the AME Colin Spence Award for their previous involvement in discovering IsoEnergy's Hurricane deposit. Prior to Hurricane, Cosa personnel led teams or had integral roles in the discovery of Denison's Gryphon deposit and 92 Energy's GMZ zone and held key roles in the founding of both NexGen and IsoEnergy.

The Company's core focus throughout 2025 is drilling at the Murphy Lake North Joint Venture. Murphy Lake North is a 70/30 Joint Venture between Cosa and Denison respectively and is located at the northern end of the Larocque Lake trend. The Project is within three kilometres of and on trend with the Hurricane deposit. Drilling completed by Cosa in 2025 identified multiple zones of strong sandstone structure and alteration and weakly elevated radioactivity underlain by large graphitic structures rooted in basement rocks. The Company is planning additional follow up work in 2026.

Technical Disclosure

Drilling completed by Cosa and reported in this news release was completed with oriented NQ diameter drill core which was logged and sampled to capture geological information including alteration, structure, and radioactivity. All drill core was systematically scanned for total gamma radioactivity using an RS-125 hand-held spectrometer and the average cps recorded for each 3-metre drill run. Intervals measuring over 1.5 times background levels were broken out and recorded. For intervals with elevated (>300 cps) radioactivity (RS-125), total gamma radioactivity was measured by removing sequential 0.1 metre lengths of drill core to an area with background radioactivity and scanned with an RS-125.

Following completion of each drill hole, down-hole total gamma logging was completed using a Reflex EZ-Gamma system lowered inside the drill rods using the drill wireline. Measurements of total gamma were collected every 0.1 metres in both the down and up directions. Down-hole gamma logs were plotted alongside RS-125 total gamma measurements to confirm depths, handheld spectrometer readings, and assess total gamma radioactivity through intervals of unrecovered core.

Composite sampling was completed throughout every drill hole. Composite samples are used as representative samples over varying interval lengths depending on geology, and are collected by taking half core chips, approximately one inch long, every 1.5 metres. Spot samples are collected through zones of elevated radioactivity, alteration zones, and other geological features of interest and are taken as half-core samples between 0.1 and 0.5 metres in length. Samples were transported by Company personnel or by courier to SRC Geoanalytical Laboratories (SRC) in Saskatoon, Saskatchewan (ISO/IEC 17025:2005 accredited) for multielement analysis. Certified reference material (CRM) standards and CRM blanks were inserted into both the spot and composite sample series. SRC independently conducts a QA/QC programme comprising repeat analyses and insertion of CRM standards SRC's CRM results are verified by Cosa staff.

Historical drilling and geophysical results for Murphy Lake North and adjacent projects were sourced from the Saskatchewan Mineral Assessment Database (SMAD). SMAD sources for the Murphy Lake North Project include file numbers 74I-0060, 74I09-0057, 74I09-0064, 74I09-0066, 74I09-0077, 74I09-0098, and MAW00510. Data and reports related to the 2020 ground EM survey completed by Denison are not presently available via SMAD and were supplied to Cosa by Denison.

SMAD sources for drilling and geophysical results proximal to Murphy Lake North include 64L05-0161, 64L05-0180, 74I-0066, 74I-0067, 74I01-0114, 74I08-0056, 74I09-0053, 74I09-0061, 74I09-0064, 74I09-0071, 74I09-0079, 74I09-0087, 74I09-0088, 74I09-0090, 74I09-0091, 74I09-0092, MAW01939, MAW02327, MAW02599, and MAW02395.

Historical drill hole collar locations for Murphy Lake North and relevant along-strike drill holes were verified from air photos. The collar locations of Murphy Lake North drill holes CRK-144 and CRK-145 were verified on the ground using a handheld GPS and determined to be within 20 metres of the locations derived from air photos. Segments of drill core from CRK-143 and CRK-144 were reviewed in the field; further review was hampered by the deteriorated condition of core boxes.

Verification of historical geophysical results included confirming the locations of geophysical survey grids from air photos, compiling data from geophysical surveys completed post year 2000, engaging a consultant to re-interpret historical geophysical surveys completed inside MLN and comparing to historical interpretations, and evaluating whether interpreted geophysical results could be reasonably explained by historical drilling results.

Qualified Person

The Company's disclosure of technical or scientific information in this press release has been reviewed and approved by Andy Carmichael, P.Geo., Vice President, Exploration for Cosa. Mr. Carmichael is a Qualified Person as defined under the terms of National Instrument 43-101. This news release refers to neighbouring properties in which the Company has no interest. Mineralization on those neighbouring properties does not necessarily indicate mineralization on the Company's properties.

Contact

Keith Bodnarchuk, President and CEO

info@cosaresources.ca

+1 888-899-2672 (COSA)

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statements

This press release contains forward-looking information within the meaning of Canadian securities laws (collectively "forward-looking statements"). Forward-looking statements are typically identified by words such as: believe, expect, anticipate, intend, estimate, plans, postulate and similar expressions, or are those, which, by their nature, refer to future events. All statements that are not statements of historical fact are forward-looking statements. These forward-looking statements or information may relate to anticipated exploration, development and/or expansion activities, including exploration of the Company's current Projects; the collaboration with Denison, including the Joint Venture, and the anticipated benefits thereof; and the outlook regarding Cosa's business plans and objectives.

Such forward-looking information and statements are based on numerous assumptions, including among others, that the results of planned exploration activities are as anticipated, the cost of planned exploration activities are as anticipated, that general business and economic conditions will not change in a material adverse manner, that financing will be available if and when needed and on reasonable terms, that third party contractors, equipment and supplies and governmental and other approvals required to conduct Cosa's planned exploration activities will be available on reasonable terms and in a timely manner. Although the assumptions made by Cosa in providing forward-looking information or making forward-looking statements are considered reasonable by management at the time, there can be no assurance that such assumptions will prove to be accurate.

By their nature, forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements, or other future events, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors and risks include, among others: Cosa may require additional financing from time to time in order to continue its operations which may not be available when needed or on acceptable terms and conditions acceptable; Cosa may not be able to maintain compliance with its contractual obligations with third parties; Cosa may not be able to maintain compliance with extensive government regulation applicable to its operations; domestic and foreign laws and regulations could adversely affect Cosa's business and results of operations; the stock markets have experienced volatility that often has been unrelated to the performance of companies and these fluctuations may adversely affect the price of Cosa's securities, regardless of its operating performance; the ongoing military conflict in Ukraine, and other risk factors set out in Cosa's public disclosure documents.

The forward-looking information contained in this news release represents the expectations of Cosa as of the date of this news release and, accordingly, is subject to change after such date. Readers should not place undue importance on forward-looking information and should not rely upon this information as of any other date. Cosa does not undertake any obligation to update these forward-looking statements in the event that management's beliefs, estimates or opinions, or other factors, should change.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/263721