September 30, 2024

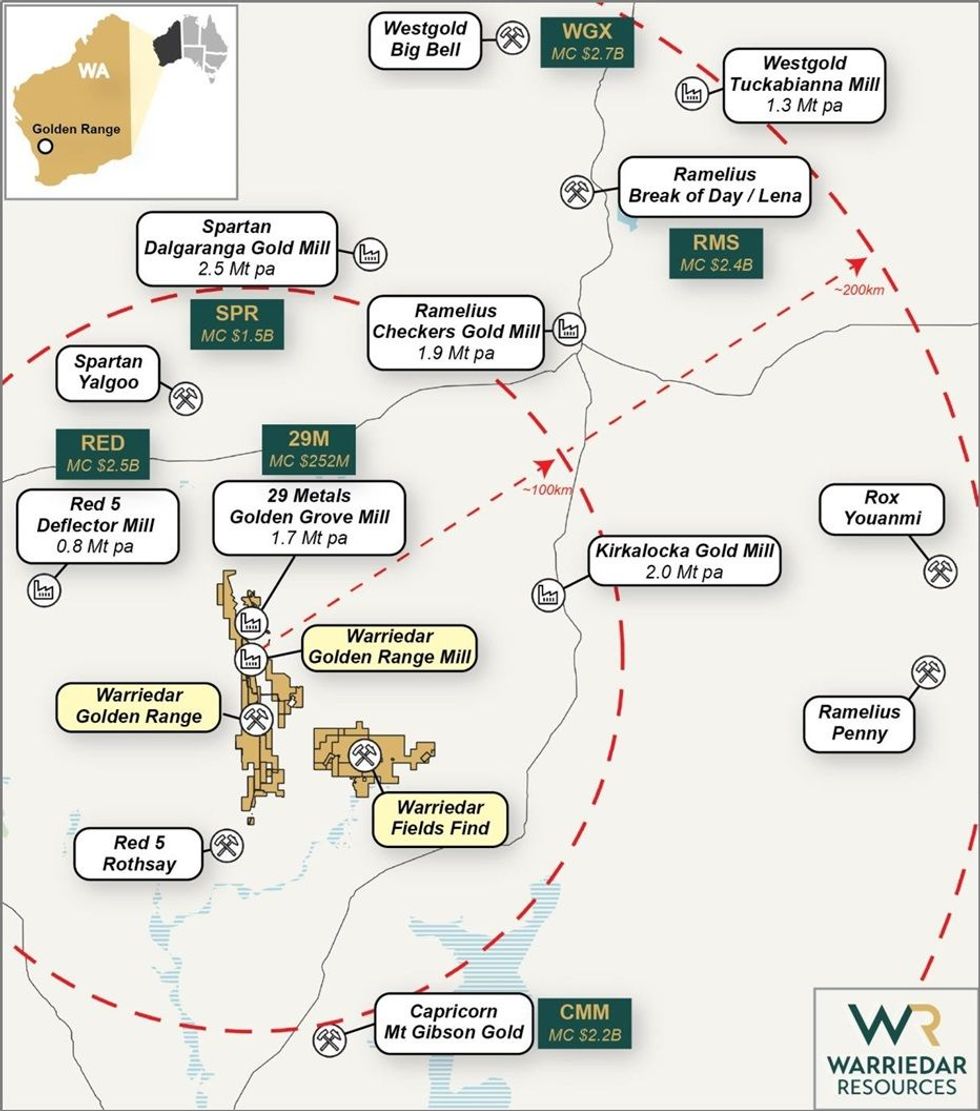

Warriedar Resources Limited (ASX: WA8) (Warriedar or the Company) provides an update on its initial review of the antimony (Sb) potential at the Ricciardo deposit, located within its Golden Range Project in the Murchison region of Western Australia.

HIGHLIGHTS:

- Review of the antimony (Sb) potential at Ricciardo is complete with drillhole assay data confirming Sb mineralisation of significant thickness and grade exists below both the Ardmore pit (previously identified) and the Copse-Silverstone pits (newly identified), representing a potential combined strike length of approx. 1km.

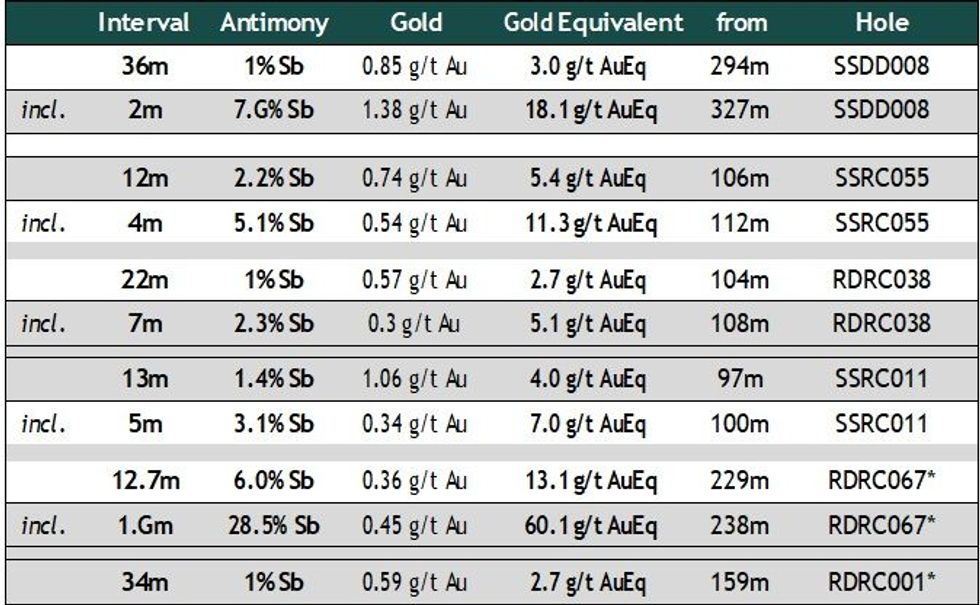

- Multiple significant Sb intervals have been identified (reviewing both historic and WA8 drill hole assays), in addition to results recently released (* indicated below):

- Most of the Sb mineralisation appears to be located above the main gold zone, a distinct metallurgical positive for future processing and economic potential. Similarly to the gold mineralisation, the Sb zones remain wide open at depth.

- Only 11% of historical drill samples at Ricciardo were assayed for Sb. Retained pulp samples from historical holes are currently being tested with pXRF, with those favourable for significant Sb set to undergo laboratory multi element assay.

- An approx. 100kg high-grade sample of antimony mineralisation from Ricciardo has also been dispatched for scoping-level metallurgical testwork.

Warriedar Managing Director and CEO, Amanda Buckingham, commented:

“Following the recent high grade antimony intersections at Ricciardo, our initial review of the broader antimony potential has delivered further promise. An exceptionally high-grade antimony interval, as well as a much wider intersection, are now able to be placed in greater context. This context is a broader volume of antimony, not yet well-defined but with existing drilling showing serious scale and grade potential.

“Importantly, the high-grade antimony appears relatively discrete from higher-grade gold mineralisation, an excellent metallurgical outcome. While it remains early days, we are cautiously optimistic and have commenced initial metallurgical testing for potential processing and antimony recovery.

“While we are excited about this emerging opportunity at Ricciardo, I want to emphasise however that pursuit of this opportunity will be in parallel with our growth-focussed gold drilling at Golden Range, which remains our current core focus.”

Key Ricciardo context

The Ricciardo gold system spans a strike length of approximately 2.3km, with very limited drilling having been undertaken below 100m depth. Ricciardo possesses a current Mineral Resource Estimate (MRE) of 8.7 Mt @ 1.7 g/t Au for 476 koz gold.1

Historical gold mining operations at Ricciardo were primarily focused on the oxide material, with the transition and primary sulphides mineralisation not systematically explored. Antimony was not a focus of previous exploration, with only about 11% of historic drill holes assayed for antimony.

The gold and antimony mineralisation at Ricciardo is predominantly hosted within intensely altered and deformed ultramafic units. The high-grade antimony-dominant mineralisation occurred later than the main gold events and generally sits above the high-grade gold mineralisation.

Click here for the full ASX Release

This article includes content from Warriedar Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

WA8:AU

The Conversation (0)

09 April 2024

Warriedar Resources

Advanced gold and copper exploration in Western Australia and Nevada

Advanced gold and copper exploration in Western Australia and Nevada Keep Reading...

18 November 2024

Targeted Exploration Focus Delivers an Additional 471koz or 99% Increase in Ounces, and a Higher Grade for Ricciardo

Warriedar Resources Limited (ASX: WA8) (Warriedar or the Company) is pleased to report on an updated MRE for its flagship Ricciardo Gold Deposit, part of the broader Golden Range Project located in the Murchison region of Western Australia. HIGHLIGHTS:Updated Mineral Resource Estimate (MRE) for... Keep Reading...

29 September 2024

Further Strong Extensional Diamond Drill Results from Ricciardo

Warriedar Resources Limited (ASX: WA8) (Warriedar or the Company) provides further assay results from its Golden Range Project, located in the Murchison region of Western Australia. HIGHLIGHTS:All residual assay results received from the recent 2,701m (27 holes) diamond drilling program at... Keep Reading...

26 August 2024

Further Step-Out Gold Success and High-Grade Antimony Discovery

Warriedar Resources Limited (ASX: WA8) (Warriedar or the Company) provides further assay results from its Golden Range Project, located in the Murchison region of Western Australia. The results reported in this release are for a further 6 of the 27 diamond holes drilled in the current program at... Keep Reading...

01 August 2024

Infill Drilling of Ricciardo Deposit Delivers Significant Gold Mineralisation

Warriedar Resources Limited (ASX: WA8) (Warriedar or the Company) is pleased to provide an update on drilling progress and assay results from its Golden Range Project, located in the Murchison region of Western Australia (Figure 1). HIGHLIGHTS: Assay results for a further two (2) diamond tails... Keep Reading...

9h

Brazilian State Firm Seeks Injunction to Block Equinox Gold-CMOC Asset Sale

A Brazilian state-run mining company is seeking an emergency court injunction to block the sale of one of Equinox Gold's (TSX:EQX,NYSEAMERICAN:EQX) Brazilian assets. Bloomberg reported that Companhia Baiana de Produção Mineral (CBPM) has asked the Bahia State Court of Justice to immediately... Keep Reading...

11h

Silver Hammer Closes CDN$3,913,617 Non-Brokered Private Placement Pursuant to Listed Issuer Exemption

Silver Hammer Mining Corp. (CSE: HAMR,OTC:HAMRF) (the "Company" or "Silver Hammer") is pleased to announce that further to its news release dated February 2, 2026, it has closed its previously announced non-brokered private placement pursuant to the Listed Issuer Exemption ("LIFE") (the... Keep Reading...

22 February

High-Grade Near-Surface Graphite Intersected at Millennium

Metal Bank (MBK:AU) has announced High-Grade Near-Surface Graphite Intersected at MillenniumDownload the PDF here. Keep Reading...

22 February

Boundiali Resource Grows to 3Moz - Indicated Up 49%

Aurum Resources (AUE:AU) has announced Boundiali Resource Grows to 3Moz - Indicated Up 49%Download the PDF here. Keep Reading...

22 February

High-grade Assays incl 4m @ 26.7g/t Au in Sandstone Drilling

Brightstar Resources (BTR:AU) has announced High-grade assays incl 4m @ 26.7g/t Au in Sandstone drillingDownload the PDF here. Keep Reading...

22 February

High-Grade Gold in Initial White Dam Drilling Results

Pacgold (PGO:AU) has announced High-Grade Gold in Initial White Dam Drilling ResultsDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00