- WORLD EDITIONAustraliaNorth AmericaWorld

Overview

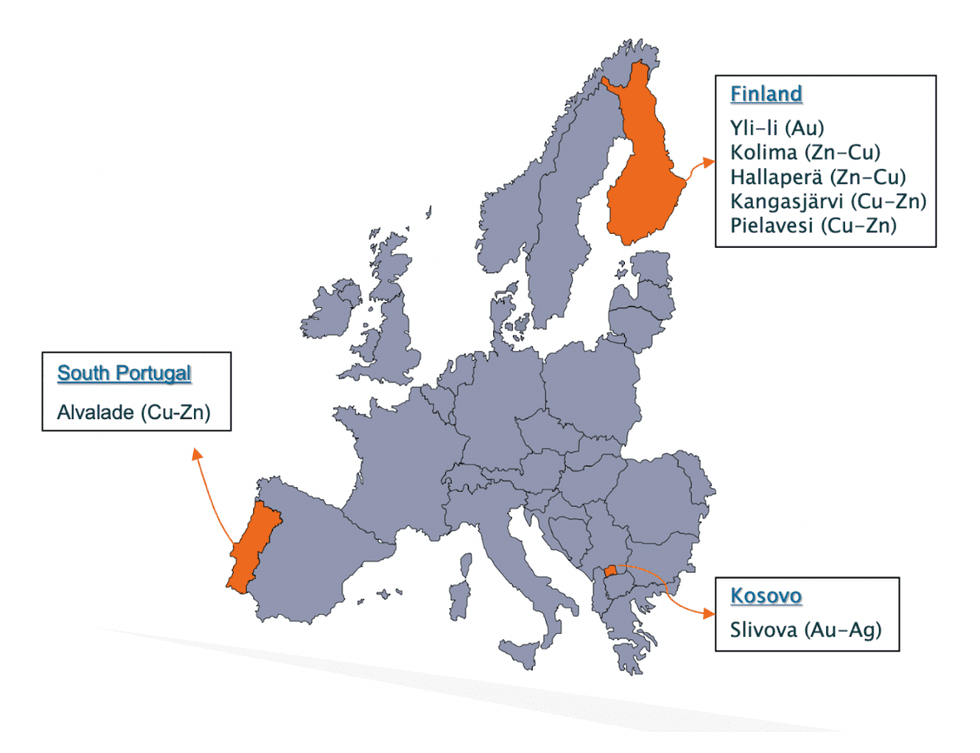

Avrupa Minerals (TSXV:AVU) is a junior exploration and development company based in Vancouver, British Columbia. The company follows a unique prospect generator model focused on aggressive modern exploration for world-class mineral deposits in politically-stable jurisdictions across Europe, including Portugal, Kosovo and more recently, Finland.

Avrupa’s hybrid prospect generator model is designed to create shareholder value by building an extensive portfolio of projects suitable for exploration to be funded by joint venture or sold to larger mining companies. The company leverages new techniques and technologies to improve exploration efforts and facilitate new discoveries. In some cases, companies following the prospect generator model have become royalty companies by allowing partners to dilute them to a valuable royalty, and Avrupa has significant exposure to this route to liquidity.

Avrupa’s goal is to have one flagship, 100-percent-owned project, that it advances with its own funds instead of through partner funding. The Finland projects, some of which have historical base metal resources, are being assessed to identify flagship potential for one of the assets.

The company's projects are all located in areas with existing mines and strong geological potential for the discovery of further economic metal deposits. For example, the company’s flagship Alvalade JV project is located in the Iberian Pyrite Belt (IPB) of southern Portugal, a hotspot for mining with over 80 historic mines in the Belt. Presently, there are seven active mining operations in the IPB of Portugal and Spain.

Company Highlights

- Operates in mining-friendly jurisdictions that are also prospective for large deposits

- Europe offers established mining districts, pro-mining policies and a variety of metals including gold, silver, copper, lead, zinc and tungsten

- Seeking partners for strategic alliances and/or project-specific JVs to fund large drill programs.

- Owns the Alvalade JV (VMS-copper-zinc), located in the Pyrite Belt of southern Portugal.

- JV earn-in agreement with Sandfire-MATSA on the Alvalade copper project

- Sandfire-MATSA currently funding drilling at the Alvalade copper-zinc project

- Slivova Gold Project in the Vardar Mineral Belt in Kosovo. Discovery made in 2012. Initial gold resource estimate completed in April 2016.

- Made two significant discoveries: the Slivova gold target and the Sesmarias VMS at Alvalade.

- Four Finland projects acquired in 2021, some with historical copper and/or zinc resources.